1. Weekly News

Egypt

Fresh Tomato Prices Declined by 50% MoM in Oct-24 Due to Oversupply

In Oct-24, fresh tomato prices in Egypt dropped by 50% month-on-month (MoM) to USD 412.37 per metric ton (mt), down from USD 824.75/mt in Sep-24. This sharp decline is due to an oversupply of tomatoes in the market.

Peru

Decline in Peruvian Tomato Exports Linked to Decreased International Demand

A decline in international demand, particularly from the United States (US), has impacted the Peruvian tomato market, which has not been as robust as in previous months. In Aug-24, Peru's tomato exports reached 2,332 mt, generating USD 2.47 million, representing a substantial year-on-year (YoY) drop of 53% in volume and 19% in value. The average export price decreased significantly, plummeting 42% YoY from USD 1.80 to USD 1.10 per kilogram (kg). Most of Peru's tomato exports were in the form of paste, accounting for 77% of the total, with 1,421 mt valued at USD 1.9 million. In comparison, fresh tomatoes comprised the remaining 23%, amounting to 911 mt valued at USD 575,000. Tomato shipments were distributed across nine markets, with Colombia being the primary destination, holding a 27% share of the total and importing 679 mt valued at USD 679,000. Following Colombia, Ecuador accounted for 23% of exports, with 911 mt valued at USD 575,000, and Brazil imported 348 mt valued at USD 535,000.

Spain

Revenue Hits USD 1.2 Billion Despite 35.56% Drop in Spanish Tomato Exports

Over the last ten campaigns, Spain's tomato exports have been steadily declining, although it has seen an overall increase in income due to higher export prices. However, during the 2023/24 campaign, export volumes and revenues declined, reversing the previous trend. Spain's tomato exports fell by 35.56% from the 2014/15 to the 2023/24 campaign, totaling 632,610 mt. Despite the reduced volume, Spain earned USD 1.2 billion from tomato exports due to higher export prices, averaging USD 1.90/kg. The United Kingdom (UK) emerged as the top-paying buyer, with an average price of USD 2.51/kg, followed by Germany at USD 2.05/kg, the Netherlands at USD 1.85/kg, Poland at USD 1.54/kg, and France at USD 1.38/kg. Several key importing countries significantly reduced their tomato purchases from Spain, with the UK leading this trend with a 59.94% reduction in imports, followed by France at 46.2%, the Netherlands at 42.86%, and Germany at 9.47%. Germany increased its tomato purchases from Spain during the 2023/24 campaign, highlighting a mixed market response among crucial buyers.

2. Weekly Pricing

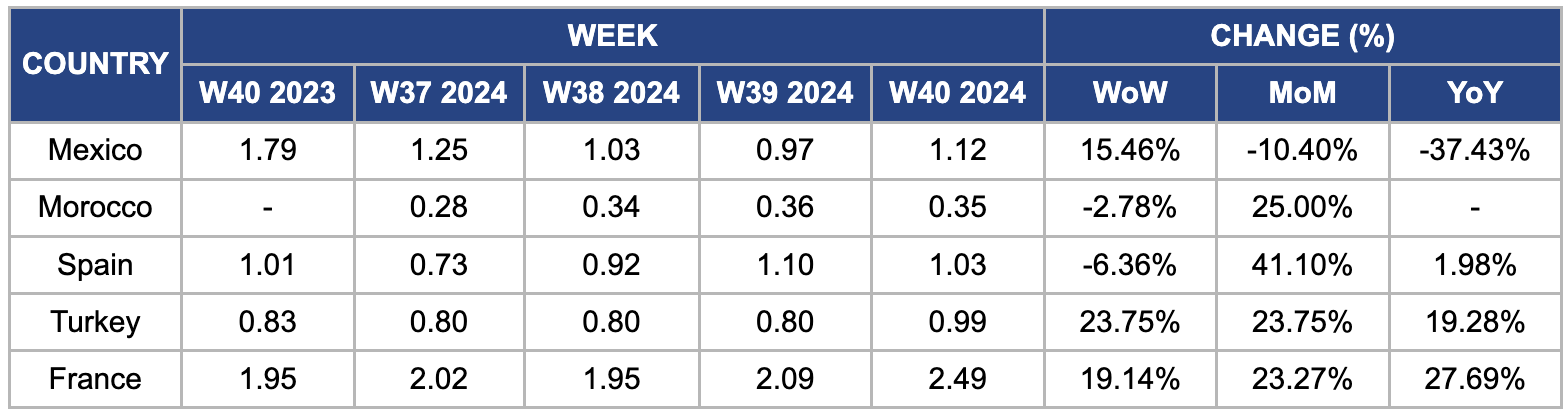

Weekly Tomato Pricing Important Exporters (USD/kg)

Yearly Change in Tomato Pricing Important Exporters (W40 2023 to W40 2024)

Mexico

In W40, wholesale tomato prices in Mexico surged by 15.46% week-on-week (WoW) to USD 1.12/kg, driven by the end of production in primary states like Sonora and Sinaloa. However, prices have declined by 10.41% MoM and 37.43% YoY. This decline is due to a forecasted 2% YoY increase in Mexico's tomato production in 2024, expected to rise from 3.22 million metric tons (mmt) in 2023 to 3.30 mmt. The anticipated production growth has contributed to market stabilization and a bearish price trend. While some producers have invested in protected cultivation to mitigate risks, much of Mexico's tomato production still relies on open-field farming, which is more vulnerable to weather fluctuations and generally results in lower yields.

Morocco

In W40, Moroccan tomato prices slightly declined by 2.78% WoW to USD 0.35/kg from USD 0.36/kg. This decline comes as the first harvest of Moroccan tomatoes is set to arrive earlier this season, attributed to more consistent planting in the Souss Massa region, in contrast to the uncertainty of the previous season. Despite this promising outlook, Morocco anticipates a decrease in overall tomato volume in 2024, according to a grower in Agadir. Consequently, prices surged by 25% MoM from USD 0.28/kg in W37 due to reduced production and rising demand. Heatwaves that affected vital growing regions such as Mohammedia, El Jadida, Oualidia, and Agadir aggravated this situation.

Spain

In W40, Spain's wholesale tomato prices fell 6.36% WoW, dropping from USD 1.10/kg to USD 1.03/kg. However, prices have risen 41.10% MoM and 1.98% YoY. The sharp monthly price increase is primarily due to seasonal fluctuations as the summer tomato production cycle ends, with early autumn varieties yet to enter the market. Additionally, extreme weather, including heatwaves and irregular rainfall, has negatively affected yields, tightening supply and adding upward pressure on prices.

Turkey

In W40, Turkey's tomato prices surged by 23.75% WoW and 23.75% MoM, reaching USD 0.99/kg. This increase is driven by ongoing drought conditions and rising production costs, particularly for diesel and transportation, which have grown disproportionately compared to stagnant product prices. This imbalance has led to dissatisfaction among producers, sparking protests in critical agricultural regions. Moreover, demand for Turkish vine tomatoes continues to grow across Europe. Turkey's more stable growing conditions offer an advantage over Spain and Morocco, which have faced extreme weather and water shortages in recent years. As retailers struggle to meet their supply needs from Spain and Morocco, the demand for Turkish vine tomatoes continues to rise.

France

In W40, tomato prices in France surged by 19.14% WoW, 23.27% MoM, and 27.69% YoY, reaching USD 2.49/kg, reaching USD 2.49/kg, the highest among top suppliers like Mexico, Morocco, Spain, and Turkey. This price spike is mainly due to a significant shortage of round tomatoes, driven by seasonal factors, especially in mid-Sept-24. Although imports from southern countries such as Spain and Morocco have been delayed, they are gradually arriving in the French market. Despite moderate demand, prices remain elevated due to a more substantial production shortfall than the previous year.

3. Actionable Recommendations

Encourage Protected Cultivation Systems

Mexico's tomato production remains vulnerable to weather fluctuations due to the heavy reliance on open-field farming. Mexican farmers should be encouraged to adopt protected cultivation systems such as greenhouses, high tunnels, and shade structures to counteract extreme weather conditions. These systems offer better control over environmental conditions, improving yield consistency and crop quality, even in unpredictable weather. Moreover, implementing training programs to educate farmers on greenhouse management, pest control, and the economic benefits of higher productivity would significantly improve adoption rates. This shift to more resilient production methods will not only safeguard crops but also help stabilize market prices in the long run.

Promote High-Value Varieties

Despite declining export volumes, Spain continues to command high prices for its tomatoes, particularly in premium markets like the UK and Germany. To capitalize on this, Spanish producers should focus on expanding the production and marketing of high-value tomato varieties, such as vine-ripened, organic, or specialty heirloom tomatoes. These varieties are in demand by consumers who prioritize quality, flavor, and sustainability. Producers could also explore expanding organic certifications or using eco-friendly packaging to appeal to environmentally-conscious buyers. The Spanish government and trade bodies should collaborate to enhance the promotion of these premium varieties through targeted marketing campaigns that highlight Spain’s expertise in producing high-quality tomatoes. Expanding promotional efforts at international food exhibitions and trade fairs can help secure more premium buyers and strengthen Spain’s position in the global tomato market.

Promote Early Harvesting Techniques

Morocco should focus on encouraging farmers to adopt early harvesting techniques and the use of heat-resistant seed varieties. Early harvesting allows farmers to bring their products to market ahead of the usual season, taking advantage of high early-season prices while avoiding potential heat waves that could harm later crops. Agricultural institutions should work together to distribute heat-tolerant seed varieties that can withstand rising temperatures and unpredictable weather better. Additionally, technical support and training on advanced farming practices, such as staggered planting schedules and crop rotation, will help farmers optimize their yields and avoid over-reliance on a single harvest period. These efforts can ensure consistent production, reduce price volatility, and strengthen Morocco’s competitive position in the international tomato market.

Sources: Tridge, Agraria, Portal Del Campo, El Heraldo de Juarez, HortiDaily