.jpg)

In W6 in the wheat landscape, some of the most relevant trends included

- Australia's wheat production exceeded initial estimates by 2 mmt, alleviating global supply concerns and putting downward pressure on prices. However, China's postponement of 600 thousand mt of Australian wheat imports further dampens market sentiment.

- Kazakhstan resumed wheat exports to Georgia, expecting 80 thousand mt in 2025, with subsidies helping maintain competitiveness amid lower global wheat prices.

- Due to tightening supply, Russia expects wheat exports to drop 50% YoY in Feb-25. Russia’s wheat production forecast has also been lowered to 83 mmt, while government export restrictions further limit market availability.

- Wheat prices showed mixed trends: Russia remained stable, the US saw an uptick due to frost damage, France experienced gains driven by lower production and weak exports, and Ukraine recorded YoY increases despite drought-related declines in sowing.

1. Weekly News

Australia

Australia’s 2024/25 Wheat Output Exceeds Estimates by 2 MMT, Pressuring Prices

Australia’s 2024/25 wheat production surpassed initial harvest estimates by approximately 2 million metric tons (mmt), easing concerns over global supply shortages and lowering prices. As the world’s fourth-largest wheat exporter, Australia’s higher output has helped Chicago wheat futures recover from their four-year low in 2024.

China

China Delays Australian Wheat Imports Due to Ample Domestic Supply

China has postponed imports of up to 600 thousand metric tons (mt) of mostly Australian wheat and has offered some of these cargoes to other buyers, as ample domestic supplies reduced demand. According to the United States Department of Agriculture (USDA), the country accounted for 6% of global wheat imports in the year ending Jun-24. With China’s lower wheat intake, benchmark Chicago wheat prices could face further pressure. Following bumper corn and wheat harvests, China seeks to support local prices by delaying new wheat arrivals until at least Apr-25.

Kazakhstan

Kazakhstan to Export 80 Thousand MT of Wheat to Georgia in 2025

Kazakhstan will export 80 thousand mt of wheat to Georgia in 2025 as part of the expansion of their bilateral trade relations. In 2023, Kazakhstan did not export wheat to Georgia, but trade resumed in 2024, bringing total exports to USD 71 million. The Kazakh Agriculture Minister stated that wheat exports would continue growing based on Georgia’s demand.

Russia

Russian Wheat Exports to Halve YoY in Feb-25 as Prices Rise

Russian wheat exporters are set to ship 50% less wheat year-on-year (YoY) in Feb-25, with volumes expected between 2.2 to 2.3 mmt, the lowest since Feb-20. This decline follows when exporters shipped 2.54 mmt in Jan-25, down from 4.08 mmt a year ago, including deliveries to Eurasian Economic Union (EAEU) countries. Rising export prices have contributed to the drop. Russian wheat (12.5% protein) for Feb-25 to Mar-25 delivery increased by USD 4/mt week-on-week (WoW) to USD 242/mt free-on-board (FOB). For the first time in the 2024/25 season, prices have matched last season’s levels as reduced shipments and tightening supply drive the market upward.

2. Weekly Pricing

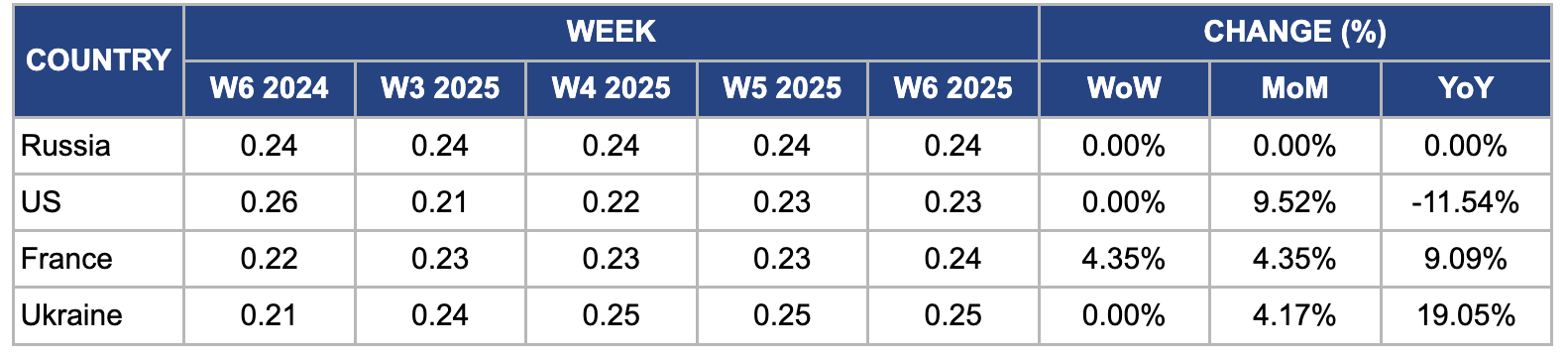

Weekly Wheat Pricing Important Exporters (USD/kg)

Yearly Change in Wheat Pricing Important Exporters (W6 2024 to W6 2025)

Russia

In W6, Russian wheat prices remained stable WoW and month-on-month (MoM) at USD 0.24 per kilogram (kg). However, concerns persist over a potential supply decline due to unfavorable weather conditions, including droughts that have lowered production forecasts. The USDA revised its 2024/25 marketing year (MY) wheat production estimate for Russia downward to 83 mmt. Moreover, the Russian government's export restrictions to stabilize domestic food prices and ensure sufficient local supply have further limited export volumes, tightening the global wheat market.

United States

In W6, United States (US) wheat prices remained unchanged WoW but increased by 9.52% MoM, reaching USD 0.23/kg. This rise followed severe frosts between January 20 and 22, with temperatures dropping to -21°C in parts of the Plains and Midwest, potentially damaging up to 15% of winter wheat crops that lacked snow cover. Reports of poor crop conditions have renewed price support, while concerns over cold weather damage to the US winter wheat crop continue to influence market sentiment.

France

In W6, French wheat prices rose by 4.35% WoW, MoM, and 9.09% YoY to USD 0.24/kg due to a downward revision in 2024/25 production forecasts. France’s wheat export sector experienced challenges from diplomatic tensions with Algeria, reduced Chinese demand, and a poor harvest, leading to a loss of market share to more competitive producers like Russia. The country’s soft wheat harvest has reached its lowest level since the 1980s, while competition from Eastern Europe continues to intensify. Exports to Algeria and China have declined sharply, and sales to Morocco have more than halved, forcing some companies to place staff on unpaid leave. In response, France is working to diversify its export markets by strengthening its presence in the Middle East.

Ukraine

In W6, Ukrainian wheat prices remained unchanged WoW but rose 4.17% MoM and 19.05% YoY, reaching USD 0.25/kg. The wheat harvest forecast for 2024/25 remains steady at 22.9 mmt, but the export forecast has been revised downward to 16 mmt. As of early Dec-24, operational data shows that Ukraine has sown 4.38 million hectares (ha) of winter wheat, nearly 2% below the planned area and reflecting a 9% YoY decline. This shortfall in winter sowing is due to persistent drought conditions impacting key growing regions.

3. Actionable Recommendations

Diversify Export Markets for French Wheat

France’s wheat export sector faces challenges due to declining demand from Algeria and China, alongside a poor harvest and increased competition from Eastern Europe. To counter this, French exporters should strengthen trade relations with alternative markets such as the Middle East, where demand remains stable. Expanding sales to countries like Saudi Arabia and the United Arab Emirates (UAE), with high import dependence, could help mitigate revenue losses. Moreover, offering competitive pricing or bundled contracts with feed wheat and barley could improve market penetration in regions currently dominated by Russian suppliers.

Mitigate Supply Risks Through Alternative Sourcing

Russia’s wheat exports are expected to decline in Feb-25 due to rising export prices, government restrictions, and reduced supply. Meanwhile, due to drought, Ukraine’s wheat sowing area has dropped 9% YoY, impacting future availability. Given these constraints, wheat importers, especially in North Africa and South Asia, should diversify sourcing strategies by increasing purchases from Australia, the US, and Argentina. Establishing long-term contracts with alternative suppliers and securing freight logistics ahead of potential market tightness in mid-2025 could prevent supply disruptions and price volatility.

Leverage Forward Contracts to Hedge Against Wheat Price Volatility

To mitigate the risks of Russian wheat price volatility, importers should secure forward contracts with Russian suppliers at current FOB prices, ensuring stable costs amid tightening supply. Moreover, diversifying sourcing to alternatives like France and Kazakhstan can reduce dependency on Russian wheat, particularly as France seeks new markets following export declines to Algeria and China. Traders should also hedge price risks using Chicago Board of Trade (CBOT) or Euronext futures and options, allowing them to lock in prices or benefit from market fluctuations. These strategies collectively safeguard against supply disruptions and price surges while optimizing procurement costs.

Sources: Tridge, Food Mate, NoticiasAgricolas, UkrAgroConsult