W19 2025: Orange Weekly Update

In W19 in the orange landscape, some of the most relevant trends included:

- Global orange production is under pressure due to severe weather conditions, including droughts in Brazil, abnormal heat in Egypt, and poor weather in Spain and the US, leading to significant yield declines and reduced supply.

- Orange prices are rising in key markets like Egypt and globally for juice, driven by tight supply, increased local processing demand, and strong international demand, especially as Brazil’s output shrinks and exports contract.

- The global citrus trade is experiencing a supply chain shift, with the Middle East and others turning to South Africa as an alternative supplier amid earlier-than-usual season ends in traditional exporters like Spain and constrained shipments from Egypt.

- Market volatility persists as processors and exporters face rising input costs, reduced subsidies, and logistical disruptions, prompting cautious contract strategies and greater reliance on upcoming crop forecasts (e.g., Fundecitrus, USDA) for planning.

1. Weekly News

Brazil

Brazil Sees Decline in Orange Prices Due to Increased Supply and Mild Demand

Orange prices in Brazil declined in Apr-25 due to an increased supply of early-season varieties like Hamlin and Westing, along with Ponkan tangerines, while mild weather conditions softened consumer demand. Pear orange prices dropped by 4.58% between April 28 and May 2, averaging USD 18.80 per 40-kilogram (kg) box, while the overall monthly average fell to USD 18.52, down 1.75% from Mar-25. The processing sector also saw a sharp drop, with prices for fruit delivered to the industry averaging USD 10.52 per 40.8-kg box in Apr-25, an 18% month-on-month (MoM) decrease, and further declining to USD 9.60 in early May-25, a weekly drop of 5.95%. With market conditions shifting, growers and processors are now looking to upcoming Fundecitrus data, expected on May 9, to help guide pricing strategies and contract decisions for the 2025/26 crop.

Brazil Faces Lowest Orange Production in Over 30 Years Due to Severe Drought and Disease

Brazil’s orange production is projected to fall to its lowest level since the 1988/89 season, driven by a severe drought, its worst since 1950, and the continued spread of citrus greening disease, particularly in major growing regions such as São Paulo and Minas Gerais. Over 58% of the country is affected by drought, leading to critically low soil moisture and water availability, while record-breaking heat has further stressed crops and intensified pest pressures. As a result, the 2024/25 harvest is expected to decline by 24% to around 232 million 40.8-kg boxes, pushing domestic prices up by 78%, from USD 7.98 to 14.19/box (BRL 45 to 80/box). Given Brazil's role as the world’s largest orange juice exporter, supplying over 70% of global demand, this production drop has sent global orange juice prices soaring, and futures have nearly tripled in two years, causing the lowest juice availability in over five decades. Countries are now turning to alternative sources like South Africa, but new supply chains will take time to establish, keeping the global market highly unstable.

Egypt

Egyptian Orange Prices Surge Due to Tight Supply and Strong Global Demand

In Egypt, orange export prices have risen sharply, from USD 0.43 to 0.45/kg in mid-Apr-25 to USD 0.66/kg, driven by seasonal factors, a nearly one-third drop in harvest volumes due to abnormal heat, logistical constraints, and strong global demand. Most of the harvested fruit is medium-sized, limiting its attractiveness in premium markets such as the Gulf states and Eastern Europe. The situation has been compounded by a reduction in Egypt’s export subsidies from 8 to 10% to 2.5% in late 2024, increasing financial pressure on exporters. Simultaneously, soaring global prices for frozen orange juice concentrate, triggered by lower production in Brazil, have spurred local interest in processing, while drought-hit harvests in Spain and Italy have opened up opportunities for Egypt to fill supply gaps and command higher prices.

Middle East

Middle East Faces Orange Shortage Following Supply Gaps from Spain and Egypt

In the Middle East, orange scarcity is reshaping citrus trade dynamics as reduced supply from key exporters, Spain and Egypt, disrupts traditional sourcing patterns. Egypt's exports have declined due to increased demand from local juice processors, while Spain ended its season unusually early, at W14 instead of the typical W20, due to adverse weather and poor fruit quality. This opened a late-season opportunity for Egyptian oranges to regain market share. Looking forward, the region is shifting focus to South Africa, where early shipments of oranges are expected to perform well following a strong start with lemons. As climate change, evolving industrial demand, and logistical uncertainties continue to influence global citrus flows, the Middle East remains optimistic about stable returns from South African navels but cautious of potential oversupply risks.

United States

US Orange Production Forecast Falls Sharply Despite Minor Monthly Adjustment

In the United States (US), the United States Department of Agriculture (USDA) 2024/25 forecast for Florida’s all-orange production is expected at 11.6 million 40.8-kg boxes, slightly under 1% above the previous estimate but 36% lower than last season’s final output, highlighting the ongoing challenges facing the state’s citrus industry. This total includes 4.58 million boxes of non-Valencia oranges (early, mid-season, and Navel varieties, with Navel accounting for 100 thousand boxes) and 7.05 million boxes of Valencia oranges, with the latter reflecting a minor upward revision based on late Apr-25 harvest and processor survey data. Forecasts for other citrus fruits remain unchanged, with expectations of 1.3 million boxes of grapefruit (140 thousand white and 1.16 million red), 600 thousand boxes of lemons, and 400 thousand boxes of tangerines and mandarins. The USDA notes a 2.2% root mean square error for the May 1 orange forecast, suggesting a two-thirds likelihood that the final output will fall within this margin.

2. Weekly Pricing

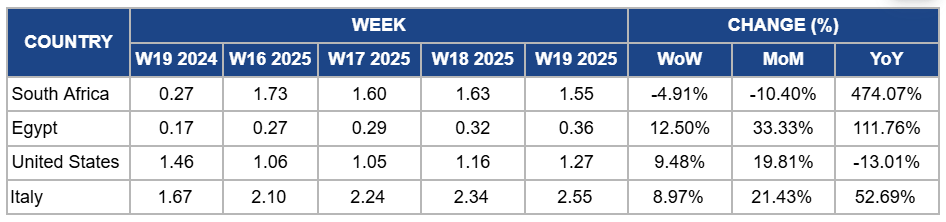

Weekly Orange Pricing Important Exporters (USD/kg)

Yearly Change in Orange Pricing Important Exporters (W19 2024 to W19 2025)

South Africa

In W19, orange prices in South Africa decreased by 4.91% WoW to USD 1.55/kg, reflecting a 10.40% MoM decline. This reduction is due to a seasonal increase in supply as the harvest season progresses, leading to greater availability in the market. Additionally, the appreciation of the South African rand against major currencies has made exports less competitive, further contributing to the price drop. However, compared to the same week in the previous year, prices have surged by 474.07% YoY. This dramatic increase is due to a significant decrease in production during the previous season, which resulted in a substantial supply shortage and a sharp rise in prices. The current higher prices reflect the recovery from that low-production period.

Egypt

Orange prices in Egypt increased by 12.50% WoW to USD 0.36/kg in W19, with a 33.33% MoM rise and a 111.76% YoY surge due to a sharp reduction in harvest caused by abnormal heat during the flowering period, which affected fruit development and led to lower yields. Around 90% of the oranges harvested were medium-sized, limiting the supply of larger fruits preferred in premium export markets. Additionally, domestic demand rose as orange concentrate factories offered better payment terms, increasing competition for available volumes. The government’s reduction of export subsidies from 8% to 10% to 2.5% also led exporters to raise prices to cover rising costs.

United States

In W19, orange prices in the US increased by 9.48% WoW to USD 1.27/kg, with a 19.81% MoM increase due to reduced domestic production caused by citrus greening disease and hurricanes in Florida, leading to lower inventories and higher prices. However, YoY prices dropped by 13.01% due to decreased consumer demand stemming from high prices and diminished juice quality, leading to reduced consumption

Italy

Orange prices in Italy increased by 8.97% WoW to USD 2.55/kg in Italy, with a 21.43% MoM rise and a 52.69% YoY surge. This price increase is due to production challenges during the 2024/25 season, including prolonged droughts and torrential rains in regions like Sicily, which led to smaller fruit sizes and reduced yields. Additionally, the growing demand for organic oranges, which now account for nearly 18% of the market, has contributed to the upward pressure on prices

3. Actionable Recommendations

Replant with Resilient Orange Varieties

Orange producers in the US, Brazil, Spain, and other key citrus-growing regions should prioritize replanting with high-yield, disease-tolerant orange varieties to counter long-term declines in output. For example, US growers facing challenges from citrus greening can shift toward tolerant Valencia strains or early-maturing hybrids like Sugar Belle. In Brazil, producers can rotate between Pera and Rubi varieties better adapted to regional conditions. Spain’s growers may adopt late-season Navelina or Salustiana to extend harvest windows and reduce climate risk exposure. These strategic varietal shifts can help stabilize supply and improve orchard longevity under mounting production pressure.

Sort by Size to Maximize Market Value

Orange producers in Egypt, Spain, Italy, and Brazil should implement size-based grading and market segmentation to boost returns amid supply disruptions and shifting demand. In Egypt, where medium-sized fruit dominates, exporters should target mid-tier markets like South Asia or Eastern Europe, where size is less critical, while reserving larger fruit for Gulf markets. Spanish and Italian growers facing drought-related losses can prioritize premium sizes for fresh export and divert undersized oranges to processing. Brazilian producers should capitalize on the surge in frozen juice prices by allocating smaller or blemished fruit to concentrate production. This approach helps producers align supply with the most profitable channels in real time.

Sources: Tridge, Cepea, EastFruit, Freshfruitportal, Freshplaza, NASA, Producereport, USDA