1. Weekly News

Cameroon

Cameroon’s Banana Exports Reach 68.8 Thousand Tons in Early 2024

In Q1-24, Cameroon exported 68.8 thousand tons of bananas. Leading these exports were the French agro-industrial subsidiaries Plantations du Haut Penja (PHP) and Compagnie des Bananes de Mondoni (CDBM). CDBM, which began operations in Jun-23, contributed 79.7% of the total exports. Compagnie Fruitière also provided technical support and oversaw production and export logistics for local producers, including the state-owned CDC and private entity Boh Plantations Plc. Bananas have consistently been an essential export commodity for Cameroon, with a 1.6% year-over-year (YoY) increase in export revenues in 2023.

Europe

Banana Wholesale Prices in Europe and Latin America During W23

In W23, average wholesale prices of bananas from Latin America were as follows: USD 120.25/100 kg (EUR 112/100 kg) in the Netherlands, USD 103.07/100 kg (EUR 96/100 kg) in Belgium, USD 122.40/100 kg (EUR 114/100 kg) in Spain, and USD 125.62/100 kg (EUR 117/100 kg) in France. Conversely, European banana prices were notably higher, with Spain at USD 343.57/100 kg (EUR 320/100 kg) and France at USD 137.43/100 kg (EUR 128/100 kg).

Japan

Japan and Philippines Collaborate on Disease Management for Bananas and Cacao

The Japanese and Philippine governments are partnering to develop novel disease management systems for bananas and cacao. The project, part of JICA's Science and Technology Research Partnership for Sustainable Development (SATREPS), aims to improve food sufficiency through enhanced production and stakeholder partnerships. The Bureau of Plant Industry (BPI) facilitated the project's Memorandum of Agreement (MOA), which focuses on plant quarantine regulations, clearance, and permits.

Spain

Canary Islands' Banana Prices Rebound to Pre-Eruption Levels in Three Months

Following a period of overproduction, decreased demand from external markets, and intense competition from other producing countries, banana prices in the Canary Islands have returned to their pre-eruptive levels in just three months. The Association of Banana Producers of the Canary Islands (ASPROCAN) reported a market withdrawal of 26.5 million kg of fruit in 2023, resulting in a record annual production of 467 million kg.

Vietnam

Vietnam Surpasses Philippines as Top Banana Exporter to China

In Q1-24, Vietnam emerged as the leading country in banana exports to China, surpassing the Philippines. Vietnam's banana export volume was 2.4 times higher than the Philippines, accounting for 48.6% of the total banana imports into China. However, banana export prices from 10 countries to China experienced a drop of 2 to 39%, with Vietnamese goods decreasing by 16%. This resulted in a 3% increase in Vietnam's banana export value in the same period.

Vietnam has faced challenges such as decreasing banana production due to climate change, reduced quality, and increased logistics costs from Vietnam to China, making their goods 33% more expensive than Vietnamese bananas. Despite these challenges, Vietnam also exports bananas to Malaysia, Singapore, Korea, Japan, and Qatar, with the export value of fruits and vegetables estimated to reach nearly USD 2.6 billion in Jan-24 to May-24.

2. Weekly Pricing

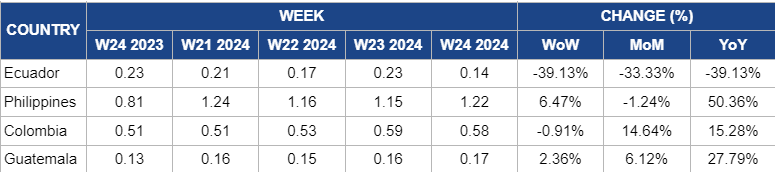

Weekly Banana Pricing Important Exporters (USD/kg)

Yearly Change in Banana Pricing Important Exporters (W24 2023 to W24 2024)

Ecuador

Despite the low season of bananas in Ecuador, prices dropped significantly in W24 by 39.14% week-over-week (WoW) to USD 0.14/kg compared to USD 0.23/kg in W23. This decline is due to oversupply and market dynamics despite recent benefits from a trade agreement with China. The agreement, effective from May 1, led to a 1% reduction in tariffs for Ecuadorian bananas. However, rising spot prices have hindered further export growth, despite bananas being China's second most exported product in Q1-24, generating USD 37 million.

Philippines

The increase in banana prices in the Philippines in W24, rising by 6.47% WoW to USD 1.22/kg compared to USD 1.15/kg in W23, despite a 1.24% month-on-month (MoM) decrease, is due to the ongoing effects of heatwaves and rainfalls that caused widespread destruction in banana plantations. The YoY increase of 50.36% further underscores the impact of these environmental factors on banana production and supply, leading to the observed price increase in W24.

Colombia

Banana prices in Colombia slightly decreased by 0.91% WoW to USD 0.59/kg in W24, compared to USD 0.60/kg in W23. However, there is a 14.64% MoM increase and a 15.28% YoY increase. This is due to the ongoing low season and the impact of Fusarium TR4, which has reduced yields by up to 50%. Despite Fair Trade initiatives improving productivity, extreme weather continues to stress plants and limit supply, driving overall prices higher MoM and YoY.

Guatemala

Banana prices in Guatemala slightly increased by 2.36% WoW to USD 0.17/kg in W24. This rise is due to the ongoing low season, which limits supply. Additionally, there is a 6.12% MoM and a 27.79% YoY increase, reflecting sustained demand and reduced availability.

3. Actionable Recommendations

Optimizing Banana Export Strategies for Competitive Pricing in European Markets

Given the price disparities between bananas from Latin America and Europe, exporters from Latin America should focus on competitive pricing strategies to maintain market share in Europe. This could include negotiating better transportation rates, optimizing supply chain efficiency, and exploring value-added options to justify higher prices. Additionally, efforts should be made to ensure consistent quality and supply to meet European market demands.

Sustainable Strategies for Canary Islands Banana Producers

To sustain their regained profitability, Canary Islands' banana producers should focus on a few key strategies. They should carefully manage production levels to match market demand, avoiding overproduction. Additionally, investing in marketing to highlight the unique qualities of Canarian bananas can help attract more consumers. Building strong partnerships with retailers and wholesalers for stable market access is crucial. Lastly, continuous efforts to improve production efficiency and reduce costs will enhance competitiveness.

Japan-Philippines Partnership Enhances Banana and Cacao Disease Management

The collaboration between Japan and the Philippines, under JICA's SATREPS program, should prioritize developing disease-resistant banana and cacao varieties suitable for local conditions. Capacity-building programs are crucial to educate farmers on disease prevention and management, while stakeholder engagement will promote awareness and collaboration. Innovative disease monitoring and management technologies supported by favorable policies will be key to achieving sustainable agriculture and food sufficiency goals.

Sources: Tridge, Freshplaza, Fructidor, Portal Fruticola