W29 2024: Palm Oil Weekly Update

1. Weekly News

China

China's Role in Advancing Sustainable Palm Oil Practices

The global food and agriculture system, including commodities like palm oil, significantly contributes to deforestation, particularly in Southeast Asia and Brazil. In 2022, global deforestation reached 6.6 million hectares (ha), hindering efforts to eliminate deforestation by 2030. China, a major importer of palm oil, has responded by adopting sustainable practices. The country consumes around 6 million metric tons (mmt) of palm oil annually and has shown commitment to sustainability through increased membership in the Roundtable on Sustainable Palm Oil (RSPO), with 400 members as of W29. This drives the consumption of half a mmt of Certified Sustainable Palm Oil (CSPO) in the region.

Multinational brands are pushing Chinese suppliers towards RSPO certification, aligning with global policies and increasing the share of CSPO in China's consumption. New European Union (EU) regulations will further pressure Chinese suppliers to eliminate deforestation risks, enhancing sustainability in China's supply chain management. New guidelines from China's major stock exchanges reinforce its commitment to sustainability. Starting in 2026, listed companies must disclose sustainability-related information. Leading Chinese companies are formulating zero-deforestation policies and improving supplier transparency. China's active participation in global environmental governance, including the Glasgow Leaders' Declaration on Forests and Land Use, underscores its role in combating deforestation and climate change. The country is forecasted to introduce more policies to drive corporate and market transformations towards sustainability, positioning itself as a pivotal player in the sustainable palm oil industry.

Malaysia

Malaysia Secures Over USD 49.06 Million in Palm Oil Deals During Trade Visit to China

During a recent visit to China, Malaysia secured over USD 49.06 million (MYR 230 million) in palm oil trade deals. Led by a member of the Parliament of Malaysia and lasting from July 8 to 12, the visit resulted in four memorandums of understanding (MoUs) signed between Malaysian palm oil companies and Chinese businesses at the 15th China International Bijirin and Oil Industry Summit in Nanjing on July 11, 2024.

Malaysia's Palm Oil Prices Expected to Rise Amid La Niña Threat

Malaysia's palm oil prices are forecasted to rise in the latter half of 2024 due to potential disruptions caused by the La Niña weather phenomenon, expected to bring above-normal rainfall to Southeast Asia from Sep-24 or Oct-24, which could affect fieldwork and harvesting during the peak season. Prices have increased by over 5% this year due to erratic weather, limited expansion, and aging trees. Benchmark futures in Malaysia are anticipated to reach USD 853.37 to 896.04 per metric ton (MYR 4,000 to 4,200/mt) by year-end, marking the first annual gain since 2021. The average price for 2024 is projected at USD 844.84 (MYR 3,960), up from USD 810.27 (MYR 3,798) last year. Factors such as La Niña's impact, demand fluctuations, and reduced exportable surplus from Indonesia's increased biofuel use are expected to drive prices higher.

Malaysia's Palm Oil Exports to India Expected to Increase Due to Growing Consumer Demand

Malaysia's palm oil exports to India are projected to rise, driven by India's growing consumer demand, according to the Minister of Plantation and Commodities. In 2023, Malaysia exported 3.3 mmt of palm oil and products to India, valued at nearly USD 3 billion, representing 13% of Malaysia's total palm oil exports. The minister affirmed Malaysia's commitment to being a reliable supplier of high-quality palm oil to support India's food security and address evolving market demands. India's oil consumption, such as palm oil, which accounts for 36% of its total consumption, has been rising, with per capita consumption increasing from 15.8 kilograms (kg) to 19 kg over the past decade. This trend is forecasted to continue, fueled by the expanding consumer demand, projected to grow from 31% of the population as of W29 2024 to 60% by 2047. Malaysia, the world's second-largest palm oil producer, exported over 80% of its 2023 production.

Peru

Peru's Palm Oil Exports Surge 46% in Early 2024, Boosting Non-Traditional Agricultural Exports

From Jan-24 to May-24, Peru's palm oil exports increased by 46% compared to the same period in 2023. This growth contributed to the overall rise in non-traditional agricultural exports, which totaled USD 3.467 billion, a 5.5% increase from 2023. The significant increase in palm oil and its fractions highlights the product's growing importance in Peru's agricultural export portfolio, alongside other essential products such as fresh fruits and vegetables.

2. Weekly Pricing

Weekly Potato Pricing Important Exporters (USD/kg)

Yearly Change in Potato Pricing Important Exporters (W29 2023 to W29 2024)

.png)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Indonesia

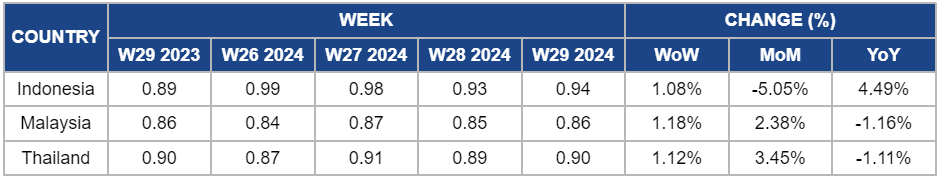

Indonesia's crude palm oil prices increased to USD 0.93/kg in W29, a slight 1.08% week-on-week (WoW) rise from USD 0.93/kg in W28. Despite the slight increase, Indonesia's palm oil industry is grappling with the dual challenges of rising demand and declining productivity, potentially leading to future shortages in both export and domestic markets. The Indonesian government urges smallholders to adopt superior seed varieties and employ better-pollinating insects to boost productivity and ensure a stable supply.

Malaysia

Malaysia's palm oil prices increased to 0.86/kg, in W29, marking a 1.18% WoW rise from USD 0.85/kg in W28 and a 2.38% month-on-month (MoM) increase from 0.84/kg in W26.This increase is due to erratic weather, limited expansion, and aging trees. Malaysia's palm oil prices are forecasted to rise in the latter half of 2024 due to potential disruptions from the La Niña weather phenomenon, which is anticipated to bring above-normal rainfall to Southeast Asia from Sep-24 or Oct-24, which could affect fieldwork and harvesting during the peak season.

Thailand

Palm oil prices in Thailand increased to 0.90/kg in W29, marking an increase of 1.12% WoW from USD 0.89 in W28, and a 3.45% MoM in W26 at USD 0.87/kg. Thailand plans to export 800 thousand mt of crude palm oil in 2024 to address local oversupply and stabilize domestic fresh palm nut prices. Despite a price drop earlier in the year, prices have improved as of W29. Continued exports are expected to reduce excess supply and support price stability.

3. Actionable Recommendations

Enhance Global Sustainability Efforts

Southeast Asian palm oil producers, including Malaysia, Indonesia, and Thailand, should increase participation in the Roundtable on Sustainable Palm Oil (RSPO) to align with global sustainability standards and improve market access, particularly in the EU and China. Supporting initiatives that lead to adopting zero-deforestation policies will further enhance sustainability in the supply chain and align with global environmental commitments.

Strategic Trade Agreements

Building on recent successful trade deals, such as Malaysia's agreements with China, is crucial for securing new partnerships and expanding market reach. To increase export opportunities for Malaysia, particular focus should be placed on markets with growing demand, such as India. In addition, developing flexible pricing strategies and enhancing supply chain resilience will help manage potential disruptions, like those from La Niña, and stabilize prices.

Enhance Market Transparency

Promoting sustainability reporting among palm oil companies will align with China's new guidelines on sustainability and strengthen corporate credibility and market trust. Monitoring and adapting to evolving market regulations will help maintain compliance and competitive advantage.

Sources: Tridge, Portal Fruticola, Astro Awani, The Edge Malaysia, UkrAgroConsult