In W3 in the avocado landscape, some of the most relevant trends included:

- Avocado production is growing in New Zealand, South Africa, and Spain, driven by recovery from weather challenges and increased planting.

- New Zealand is expanding exports, especially to Asia, while South Africa diversifies export markets, and Spain faces competition from Morocco and imports.

- Avocado prices vary per region, with Mexico and Chile seeing price hikes due to supply tightness, while Peru faces a price decline due to increased competition and a drop in exports.

- Both local and export markets are influenced by supply challenges, with weather and harvest timing affecting availability, particularly in South Africa and Spain, where these factors have a significant impact.

- There is continued strong demand in markets like the US and Europe, although slight adjustments are being made based on economic factors and changing consumer preferences.

1. Weekly News

New Zealand

New Zealand Avocado Production Projected to Reach 7 Million Trays in 2024/25 Season

New Zealand is expected to produce approximately 7 million trays of avocados in the 2024/25 season, a significant increase from the 5 million trays harvested in the 2023/24 season. This growth follows two challenging campaigns affected by Cyclones Dovi and Gabrielle, but the industry is now seeing renewed optimism. New Zealand's emphasis on resilience and innovation has led to its avocados being recognized as premium, sustainably grown fruit both locally and globally. Half of the country's avocado production is exported, primarily to Australia, while growing opportunities in Asian markets such as Japan, South Korea, and Thailand contribute to the export expansion.

Peru

Peruvian Avocado Exports Increased in 2024 Despite Volume Decline

In 2024, Peru exported 593.8 thousand tons of avocados valued at USD 1.29 billion, marking a 7% year-on-year (YoY) decrease in volume but a 25% YoY increase in value. This revenue growth was driven by a 35% YoY rise in the average price, reaching USD 2.17 per kilogram (kg). Europe remained the leading destination, with the Netherlands receiving 33% of exports, totaling 191.1 thousand tons valued at USD 421 million, followed by Spain with 127.5 thousand tons and a 50% YoY increase in value. While the United States (US) saw a 16% YoY drop in volume, its value rose by 15% YoY.

South Africa

South Africa Faces Temporary Tightening of Avocado Supply

South Africa is currently facing a temporary tightness in avocado supplies, typical for this time of year due to the country's avocado season running from February to September, which leads to lower supplies in Jan-25. This supply issue is further exacerbated by strong global demand in 2024, driving higher exports and contributing to tighter domestic availability. However, with annual production exceeding 120 thousand metric tons (mt) and expanding plantings, South Africa is well-positioned to meet local and export market needs. The primary export markets include the Netherlands, United Kingdom (UK), and Germany, and the industry focuses on diversifying exports for long-term profitability. Despite these challenges, the local market remains a priority, and the current supply shortage is expected to be short-lived.

Spain

Spain's 2024/25 Avocado Season Faces Challenges Despite Optimism

According to the Spanish Tropical Association (AET), the 2024/25 avocado season in Spain, which began in Dec-24, is expected to yield over 70 thousand tons. Production in the Malaga region of La Axarquía and the Costa Tropical of Granada is showing signs of improvement after difficult years marked by harsh weather, water shortages, and rising production costs. Recent rains have provided some relief, though water scarcity remains a critical issue, with ongoing calls for infrastructure investments. This season, avocado prices will be influenced by both supply and competition from imports, especially from Morocco, which is expecting a strong harvest. The AET urges consumers to support local Spanish avocados, highlighting the environmental benefits and the importance of supporting local agriculture.

2. Weekly Pricing

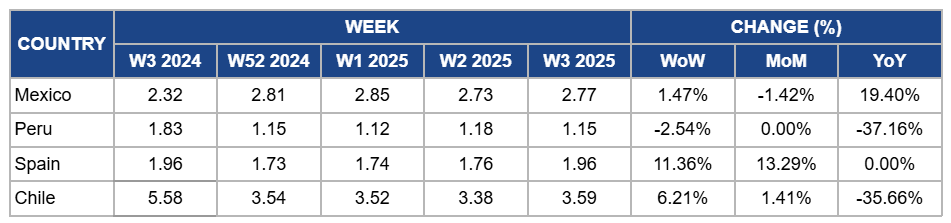

Weekly Avocado Pricing Important Exporters (USD/kg)

Yearly Change in Avocado Pricing Important Exporters (W3 2024 to W3 2025)

Mexico

In W3, avocado prices in Mexico increased by 1.47% week-on-week (WoW) to USD 2.77/kg, showing a 19.4% YoY increase due to persistent supply challenges, tight availability across all sizes, and strong export demand, particularly from major markets like the US. Additionally, quality-driven price pressure, worsened by issues such as checkerboarding, has contributed to the YoY increase. However, there is a 1.42% month-on-month (MoM) drop due to slight market adjustments following earlier price hikes, coupled with marginal shifts in demand, as some buyers turn to alternative suppliers or adjust purchasing patterns in response to elevated prices.

Peru

Peru's avocado prices dropped by 2.54% WoW to USD 1.15/kg in W3. There was no MoM change, and a 37.16% YoY decline occurred. This price drop is due to increased global competition and a higher supply of avocados from alternative-producing countries, particularly Mexico and Colombia, which have filled market gaps. Additionally, the 2024 export volume decline, despite higher prices last year, has led to some market adjustments, as buyers remain cautious about price fluctuations. Slower demand from key markets like the US and Europe, where economic pressures and shifting consumer preferences have influenced purchasing behavior, also contributed to the significant YoY price drop.

Spain

Avocado prices in Spain rose by 11.36% WoW to USD 1.96/kg in W3, with a 13.29% MoM increase. The price increase is driven by strong domestic demand, supported by the AET campaign encouraging consumers to support local avocados for their environmental and economic benefits. Moreover, avocado prices have no YoY change due to improved local production volumes in regions like La Axarquía and the Costa Tropical of Granada, following favorable rains that eased some water scarcity issues. Additionally, competition from imports, particularly from Morocco’s strong harvest, has limited price hikes, maintaining stability in YoY comparisons. However, ongoing concerns over water shortages and production costs continue to influence pricing trends.

Chile

Chile's avocado prices increased by 6.21% WoW to USD 3.59/kg in W3, with a 1.41% MoM increase due to a slight improvement in demand, both local and in export markets, as buyers adjusted to the high supply and competitive pricing. Additionally, the gradual stabilization of post-holiday demand has contributed to this uptick. However, there is a significant drop of 35.66% YoY due to the normalization of market conditions compared to last year's exceptionally high prices, which were driven by supply shortages and disruptions. The ongoing harvest season continues to maintain elevated supply levels, keeping prices significantly lower than the previous year's inflated rates.

3. Actionable Recommendations

Maintain Domestic Avocado Supply Balance

South African avocado exporters should prioritize strategic allocation by closely monitoring supply and demand trends to adjust volumes for local and export markets effectively. Producers and traders should utilize data-driven insights to align distribution strategies, ensuring sufficient domestic availability while leveraging opportunities in export markets like the Netherlands, UK, and Germany. This approach will help stabilize local market supply and support long-term profitability in global trade.

Optimize Export Market Focus

Peruvian avocado exporters should enhance their market strategies by conducting in-depth market research to identify consumer preferences, pricing trends, and growth opportunities in high-value destinations like Europe, particularly the Netherlands and Spain. Exporters should also analyze declining US volumes by evaluating trade data, identifying supply chain gaps, and implementing targeted marketing campaigns, such as emphasizing quality, sustainability, and health benefits, to regain competitiveness and strengthen brand positioning in the US market.

Sources: Tridge, Agraria, AgroPeru, Freshfruitportal, Fruitnet, MXfruit, Surinenglish