1. Weekly News

Global

Record Global Soybean Harvest Expected for 2024

The 2024/25 agricultural year will see a record global soybean harvest. The United States Department of Agriculture (USDA) forecasts 169 million metric tons (mmt), while the International Grain Council (IGC) estimates 161.5 mmt. Although final numbers will be confirmed as next year's harvest approaches, both organizations project a significant increase in soybean exports, with the USDA predicting 421.6 mmt and the IGC 415.1 mmt. Global consumption is expected to reach 401.5 mmt, and world soybean reserves will likely rise to 127.8 mmt, exceeding the long-term average. Brazil and the United States (US) will drive these increases due to strong domestic and international biofuel demand and competitive pricing compared to other crops.

Argentina

Argentina’s Soybean Cultivation Forecast for 2024/25

For the 2024/25 harvest, Argentina plans to increase its soybean cultivation area to 18.2 million hectares (ha), nearly 1 million ha more than the previous season. This expansion is due to producers shifting away from corn due to leafhopper problems, favoring soybeans, sorghum, and sunflower. If realized, this will be the largest soybean planting area since the 2015/16 harvest. Yield projections for 2024/25 are up 3% year-on-year (YoY) to 3,055 metric tons (mt) per ha, with expected production reaching 55.3 mmt, an 11% increase from 2023/24. Planting will start in late Oct-24 and extend through Jan-25, with the final area depending on weather conditions and potential impacts on early corn planting. Forecasts suggest a less intense La Niña event compared to the severe drought of 2022/23, which previously impacted soybean yields.

Brazil

Brazil’s Soybean Area and Production Forecast for 2024/25

DATAGRO Grãos' survey reveals that Brazil's soybean area is expected to increase by 1.5% YoY for the 2024/25 harvest, reaching 46.89 million ha. Preliminary estimates suggest a productivity of 3.55 mt/ha, potentially yielding 166.64 mmt, a 12% rise from 2024's revised figure. The expansion in soybean cultivation is anticipated to be distributed across Brazil, focusing on the North and Northeast regions.

Brazil’s Soybean Meal and Soybean Exports Update for Jul-24

According to data from the National Association of Grain Exporters (ANEC), Brazil's soybean meal exports in Jul-24 were estimated at 2 mmt. This figure falls short of the previous week's record forecast of 2.4 mmt and is also below the 2.17 mmt exported in Jul-23. Additionally, Brazil's soybean exports for Jul-24 are anticipated to be 9.76 mmt, below last week's expectation, but still exceed the 8.6 mmt exported in Jul-23.

Brazil’s Soybean Import Surged in the First Half of 2024

In the first half of 2024, Brazil's soybean imports surged by 58.78% compared to 2022 and 267.6% compared to 2023, totaling 665.44 thousand mt. This rise resulted from a 4.70% decrease in Brazil's internal soybean supply, mainly due to reduced production in the Central-West and Paraná states. Paraguay was the leading supplier, providing 99.00% of the imported volume. Paraná was the leading consumer state, importing 91.15% of the total, predominantly from Paraguay.

Poland

Record Soybean Planting Area in Poland

Poland’s soybean cultivation has grown significantly, becoming one of the top three legumes in the country. In 2024, the area dedicated to soybeans reached a record 79,828.20 ha, nearly doubling from the previous season, marking a substantial increase from the 20 to 25 thousand ha cultivated in 2020. The rise in soybean farming is due to benefits in crop rotation, such as improving soil quality and nitrogen addition, as well as its high feed value and expanding use in human food. The most significant increases were recorded in the Podkarpackie, Lublin, and Lesser Poland provinces, while the Lubuskie province saw a decline.

2. Weekly Pricing

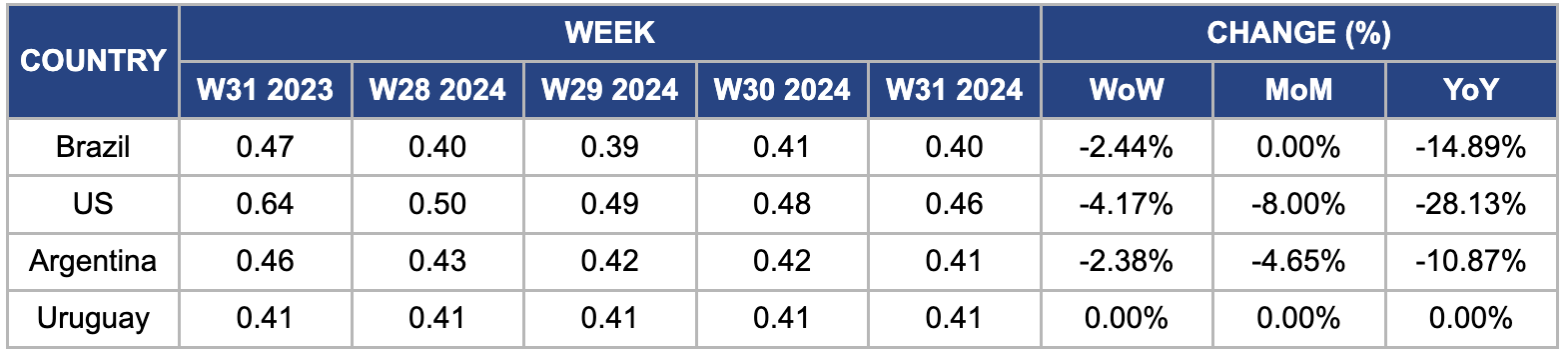

Weekly Soybean Pricing Important Exporters (USD/kg)

Yearly Change in Soybean Pricing Important Exporters (W31 2023 to W31 2024)

Brazil

In W31, Brazilian soybean prices dropped by 2.44% week-on-week (WoW) to USD 0.40 per kilogram (kg), down from USD 0.41/kg in W30, and experienced a 14.89% YoY decline from USD 0.47/kg. The decrease is due to Brazil's upcoming 2024/25 soybean harvest, set to begin in mid-Sept-24. Expectations of a record 165 mmt and export forecasts of 102 mmt are driven by anticipated productivity recovery and an expansion in the planted area, assuming favorable weather conditions.

United States

In W31, US soybean prices declined for the fourth consecutive week by 4.17% WoW to USD 0.46/kg, marking an 8% month-on-month (MoM) and 28% YoY decrease. This drop is due to favorable crop conditions and weather in the American Midwest. The USDA reported that most oilseed fields are in good or excellent condition, surpassing 2023's figures and contributing to bearish market sentiment.

Argentina

Soybean prices in Argentina decreased by 2.38% WoW to USD 0.41/kg in W31 from USD 0.42/kg in W30. Argentina's soybean harvest for the 2024/25 season is projected to reach 55.3 mmt, an 11% YoY increase from the previous season. This growth is due to an estimated expansion of soybean planting to 18.2 million ha, nearly 1 million ha more than the current season, as producers shift away from corn due to pest outbreaks, turning instead to soybeans, with some also opting for sorghum and sunflower. If confirmed, this would represent the largest soybean planting area since the 2015/16 season.

Uruguay

Uruguayan soybean prices remained steady in both WoW and MoM in W31. The 2023/24 soybean harvest has concluded with an estimated 3 mmt total production. However, excessive spring and summer rains tempered initial expectations for a record harvest, leading to yields that fell short of high projections. This outcome has disappointed farmers who had hoped to recover from previous losses. Additionally, prices remain modest, marking the lowest levels since 2020, adding to the challenges facing Uruguay's agricultural sector.

3. Actionable Recommendations

Promote Sustainable Agricultural Practices

Encouraging sustainable farming practices in soybean cultivation is crucial. Brazil and Argentina can implement water-efficient irrigation, reduce pesticide use, and adopt soil conservation techniques. Providing training and support for farmers to adopt these practices will improve long-term soil health and minimize environmental impacts. This approach will benefit local farmers and global soybean consumers, who increasingly demand environmentally friendly products. Enhanced sustainability will support long-term market stability and meet the growing demand for eco-friendly agricultural products.

Strengthen Supply Chain and Export Strategies

Brazil should optimize its soybean supply chain and diversify its export markets, including improving logistical infrastructure, streamlining export processes, and establishing long-term trade agreements with emerging markets. Enhanced storage facilities will help manage surplus production more effectively, benefiting Brazilian soybean exporters and importing countries such as China, the EU, and Indonesia. A more efficient and stable supply chain will help stabilize prices and ensure consistent availability in global markets.

Enhance Soybean Research and Development

Brazil and Argentina should invest in advancing soybean research and development to produce high-yield and disease-resistant varieties. This can be achieved by collaborating with agricultural research institutions to improve breeding programs, pest management, and climate resilience. As a result, soybean productivity and stability in these countries will be enhanced, benefiting global markets. Importing countries such as China, the EU, and others will experience more stable and reliable soybean supplies, reducing price volatility and supporting international food security.

Sources: Rosng, Notícias Agrícolas, Portal Do Agronegócio, Farmer.pl, MercoPress, Ukr AgroConsult