W31 2024: Tomato Weekly Update

1. Weekly News

Greece

Rising Tomato Imports Impact Greek Domestic Market

Despite a decrease in tomato exports and peppers, imports of these products have been rising in Greece, pushing local produce out of the market. The Greek government has primarily remained passive in addressing this trend, which undermines domestic production. Tomato exports from January 1 to July 26, 2024, reached approximately 28,300 metric tons (mt), a 7.4% year-on-year (YoY) decrease from the 30,900 mt exported during the same period in 2023. During this timeframe, around 1,400 mt of tomatoes have been imported, primarily from Turkey, Serbia, Poland, and Kosovo, with the pace of imports accelerating recently.

India

Delhi Launches Subsidized Tomato Sale Initiative to Stabilize Prices

The Ministry of Consumer Affairs, Food and Public Distribution announced the launch of a subsidized tomato sale initiative in Delhi, which aims to stabilize rising tomato prices and offer relief to consumers. The National Cooperative Consumers' Federation of India Ltd (NCCF) will operate vans selling tomatoes at a subsidized rate of USD 0.71 per kilogram (kg) in Delhi, Noida, and Gurugram. The government has implemented this market intervention to counter the surge in retail tomato prices, which range from USD 0.83 to 1.19/kg depending on quality and location.

Russia

Russia's Vegetable Harvest Exceeds 1.4 MMT in Early 2024

According to the Ministry of Agriculture, Russia has harvested over 1.4 million metric tons (mmt) of vegetables in the organized sector as of early 2024. This includes 438.8 thousand mt of open-ground vegetables, representing a 28% YoY increase. Additionally, 991.3 thousand mt of greenhouse vegetables have been collected, up 2.2% YoY. This greenhouse includes 410 thousand mt of tomatoes and 570 thousand mt of cucumbers.

Ukraine

Diseases and Pests Affect Tomato Crops

High temperatures and insufficient precipitation negatively impacted melons and vegetable harvests in Ukraine. Potato and tomato crops are particularly affected by late blight and Alternaria leaf blight, which impacted 3 to 24% of plants. Additionally, up to 12% of tomato fruits are suffering from Alternaria and apical rot. Cabbage, carrot, and onion crops are also facing challenges, with larvae from flies damaging these vegetables.

Quarantine Imposed in Ukraine's Mykolaiv Region Due to South American Tomato Moth Infestation

The Main Directorate of the State Service for Food Safety and Consumer Protection in the Mykolaiv region of Ukraine introduced a quarantine regime on July 26 due to the presence of the South American tomato moth (Tuta absoluta Meyr) in the Nechayansky village council of the Nikolaev district. The South American tomato moth is an oligophage that primarily feeds on nightshade crops, with tomatoes being the primary target. The caterpillars can damage all parts of the plant at any growth stage, creating large mines on the leaves and gnawing long passages in stems, shoots, and green fruits. This damage results in significant crop losses, ranging from 50% to 100%, as the affected fruits rot and lose their commercial quality in greenhouses and open fields.

Greenhouse Tomato Prices Drop in Ukraine Amid Stabilized Weather and Poor Demand

Greenhouse tomato prices in Ukraine have dropped from USD 0.49 to 0.97/kg in W31, a 22% decrease week-on-week (WoW). Stabilized weather conditions allowed field tomato harvesting to resume in many regions. Still, demand remains low due to poor quality caused by hot, dry weather, damaging the fruits. Despite the recent price drop, greenhouse tomatoes are still sold at prices 25% higher YoY, attributed to a general decline in tomato production.

2. Weekly Pricing

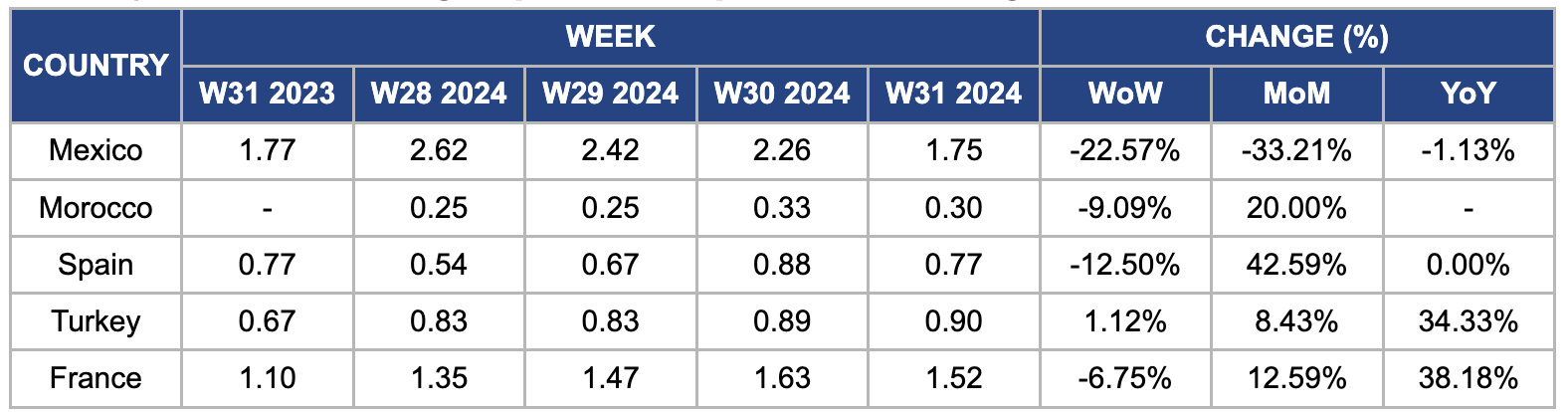

Weekly Tomato Pricing Important Exporters (USD/kg)

Yearly Change in Tomato Pricing Important Exporters (W31 2023 to W31 2024)

Mexico

In W31, Mexican wholesale tomato prices fell by 22.57% WoW to USD 1.75/kg from USD 2.26/kg amid a robust production forecast of 3.30 mmt for 2024, a 2% increase from 2023. Sinaloa, the leading producer, accounts for 22% of the national total, with the top five states contributing over 51% of production. Harvesting is ongoing in Northern Mexico. Quality remains good for Roma and round tomatoes, though grape and cherry tomato supplies are limited due to poor weather in Central Mexico, impacting yields and sustaining high prices.

Morocco

In W31, Moroccan tomato prices dropped by 9.09% WoW to USD 0.30/kg from USD 0.33/kg in W30 due to an ample supply of tomatoes. The Ministry of Agriculture successfully negotiated a reduction in the daily tomato export quota from 1,500 mt to less than 700 mt to manage supply. Despite this, the month-on-month (MoM) price increased by 20% due to adverse weather, fluctuations in supply and demand, and higher production and transportation costs. Import and export policies, limited production, and market availability also increased prices.

Spain

In W31, Spanish wholesale tomato prices dropped by 12.50% WoW to USD 0.77/kg from USD 0.88/kg. The end of the greenhouse campaign in Almería has led to expectations of an earlier start for the 2024/25 season. Additionally, increased tomato imports from Morocco, which have sparked new protests by French associations and producer organizations and supplies from other origins, have significantly reduced prices in Almería during the winter tomato campaign.

Turkey

Turkey's tomato prices increased slightly by 1.12% WoW to USD 0.90/kg in W31 from USD 0.89/kg in W30. Prices also rose 8.43% MoM and 34.33% YoY. The rise is due to drought conditions caused by climate change, which have negatively impacted agricultural output. Farmers also face higher costs due to increased diesel fuel and transport expenses. Supermarket prices reflect these challenges, with tomatoes priced at approximately USD 1.21/kg. The president of the Agriculture Engineers' Chambers (ZMO) highlights extreme heat and rising transport costs as significant factors driving up prices.

France

Tomato prices in France decreased 6.75% WoW to USD 1.52/kg in W31, reversing the previous week's increase. The price drop is due to stagnant demand amidst a global downward trend in tomato prices due to rising supply. Increased competition from Spain, Turkey, and Morocco has contributed to the surplus in the French market, where supply exceeds demand, particularly towards the end of the month, leading to downward pressure on prices.

3. Actionable Recommendations

Mitigate Production Challenges and Support Farmers in Turkey

Turkey should address the impact of drought conditions on tomato production by providing financial and technical support to farmers. This includes subsidies for production costs and investments in drought-resistant technologies. Turkey can stabilize tomato prices and support its agricultural sector by mitigating the effects of climate change and rising costs. This will benefit Turkish farmers and improve Turkish tomatoes' availability in domestic and international markets. Key global markets that import Turkish tomatoes include the European Union (EU), Russia, and the Middle East. Strengthening production and export strategies will enhance Turkey's competitive position in these markets.

Enhance Domestic Tomato Production Support in Greece

Local farmers should be encouraged to form cooperatives and collaborate directly with retailers and food processors to strengthen Greece's domestic tomato production and counteract the impact of rising imports. This collaboration can improve market access, reduce distribution costs, and increase the competitiveness of Greek-grown tomatoes. Investing in advanced agricultural practices, such as precision farming and greenhouse technology, can boost yields and quality. By focusing on innovation and collaboration, Greek tomato producers can stabilize the domestic market and enhance their presence in local and international markets.

Implement Strategic Price Stabilization Measures in India

To manage price fluctuations and stabilize the tomato market in India, stakeholders in the supply chain, including farmers, wholesalers, and retailers, should collaborate to create a voluntary reserve system. This system would involve stockpiling tomatoes during periods of surplus and releasing them during shortages to manage price volatility. Additionally, encouraging farmer cooperatives to sell to urban markets directly can reduce intermediaries and keep prices more stable. This market-driven approach can help maintain a consistent supply in key markets like Delhi and other major cities, benefiting producers and consumers.

Sources: Agrotypos, The Print, Terraevita, Eastfruit, Kvedomosti