1. Weekly News

Brazil

Brazilian Wholesale Onion Prices Declined 11% MoM in Jul-24

The prices of most vegetables and fruits in Brazil's main wholesale markets notably declined in Jul-24. According to the 8th Bulletin of the Brazilian Program for the Modernization of the Fruit and Vegetable Market (Prohort) from the National Supply Company (CONAB), prices dropped significantly compared to Jun-24. Onions experienced an average price decrease of 11.14% month-on-month (MoM), with Acre recording the most significant reduction at 28.69%. The overall price drop is due to increased supply and greater production diversity.

Netherlands

Netherlands Onion Exports Declined in W31, Lowest Volume Since 2015

Netherlands exports slowed down in W31, with shipments not exceeding 17 thousand metric tons (mt) from July 29 to August 4. This represents the smallest export volume for that week since 2015, a significant decrease compared to over 23 thousand mt in the previous two years. The decline has contributed to a growing backlog in exports. The Ivory Coast emerged as a critical buyer in 2024, importing more than 2 thousand mt in W31. Great Britain, traditionally a stable buyer, saw a decline in imports to just under 2 thousand mt. Belgium, another notable buyer, imported 1,081 mt, likely forwarding some of these onions to West Africa due to its low onion production. Over the season's first five weeks, total exports reached 65,500 mt, down 15% year-on-year (YoY). The drop is due to Senegal's early purchase last year.

Ukraine

Ukrainian Onion Prices Drop Amid Increased Supply and Sluggish Demand

Ukraine’s onion harvest has commenced across almost all farms, leading to a rapid increase in supply. Despite this surge, demand remains weak. In W34, Ukrainian farmers sell onions from USD 0.12 to 0.22 per kilogram (kg), approximately 17% week-on-week (WoW) lower and 12% lower than in 2024. This price decline reflects the oversupply in the market. However, analysts anticipate that the situation will shift starting Sep-24. Due to adverse weather conditions, a significant portion of the current crop is expected to be of poor quality and challenging to store, leading to high losses. Consequently, producers are motivated to sell off the subpar lots quickly.

2. Weekly Pricing

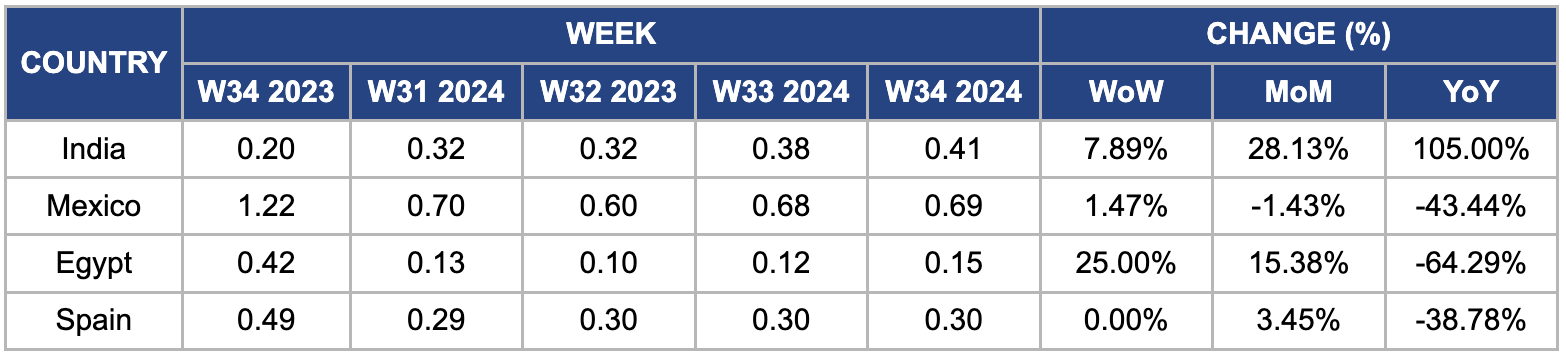

Weekly Onion Pricing Important Exporters (USD/kg)

* Varieties: Netherlands (yellow onion), Mexico (white onion), and India, Egypt and Spain (overall average)

Yearly Change in Onion Pricing Important Exporters (W34 2023 to W34 2024)

* Varieties: Netherlands (yellow onion), Mexico (white onion), and India, Egypt and Spain (overall average)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

India

In W34, onion prices in India surged significantly, rising 7.89% WoW, 28.13% MoM, and 105% YoY to USD 0.41/kg. This sharp increase is primarily due to reduced Rabi onion acreage and lower-than-usual Kharif sowing. The Rabi crop’s planted area drastically decreased, dropping to 756 thousand hectares (ha) in 2024 from 1.23 million ha in 2023. While recent rainfall in top regions like Nashik is expected to boost Kharif sowing, the reduced supply from the Rabi season has tightened the market, leading to elevated prices despite declining exports. Consequently, onions are priced between USD 0.42 and 0.54/kg in most retail markets, with limited immediate options for the government to reduce prices.

Mexico

Mexican wholesale onion prices slightly increased by 1.47% WoW to USD 0.69/kg, though they remain down 43.44% YoY. The recent price rise is due to a seasonal decrease in onion harvests, aggravated by cold weather and frost that hindered crop development and harvesting in key producing states such as Chihuahua, Guanajuato, and Zacatecas. Additionally, inflation in Mexico has been rising for five consecutive months as of Aug-24, contributing to price pressures. Despite these challenges, prices have declined over the longer term, driven by a recovery from severe weather disruptions, including Hurricane Hilary in late Aug-23, which initially reduced local supply but was later offset by increased imports, helping to stabilize the market.

Egypt

In W34, Egypt's wholesale onion prices surged by 25% WoW to USD 0.15/kg from USD 0.12/kg in W33. Despite this recent increase, prices remain the lowest compared to India, Mexico, and Spain. The current prices are still significantly below the USD 0.42/kg peak recorded in W34 2023. Moreover, YoY prices have dropped sharply by 64%, mainly due to the severe devaluation of the Egyptian pound (EGP) against the United States dollar (USD). In Sep-23, prices tripled to USD 0.74/kg, leading Egyptian officials to stop onion exports temporarily, attributing the spike to traders. However, onion growers have linked the price rise to a heat wave that reduced the harvest and increased production costs.

Spain

Spain's wholesale onion prices held steady WoW at USD 0.30/kg for the past three weeks, though it decreased 38% YoY. This substantial drop is mainly due to a surge in onion imports from China, which has put considerable downward pressure on the market despite domestic solid production. Representatives from the Agrarian Association of Young Farmers (ASAJA) in Bolaños de Campos noted that this downward trend, which started several months ago with the rise in imports, has intensified recently. The situation is further complicated by rising production costs and a critical shortage of qualified labor for harvesting, adding to the already challenging market conditions.

3. Actionable Recommendations

Utilize Export Opportunities Amidst Slowed Netherlands Shipments

Facing a slowdown in onion exports with shipments dropping significantly, the Netherlands should focus on utilizing export opportunities to manage the backlog. Targeting emerging markets with growing demand, such as East Africa and Southeast Asia, will help absorb excess supply. The Netherlands should also streamline export processes and strengthen trade agreements with essential regional buyers. Enhancing promotional efforts through international trade fairs and digital marketing campaigns will also attract new buyers and bolster export volumes. Developing partnerships with local distributors in these new markets will further facilitate entry and ensure steady demand. By focusing on these strategies, the Netherlands can mitigate the impact of the export slowdown and improve its market position.

Invest in Storage Infrastructure and Quality Management in Ukraine

In dealing with a rapid increase in onion supply and weak demand, Ukraine should invest in modern storage infrastructure and quality management to address declining prices and substandard products. Developing state-of-the-art storage facilities with climate control systems will help manage the supply more effectively and reduce spoilage. Implementing training programs for farmers and storage operators on best practices for handling and storing onions will enhance product quality. Upgrading existing storage equipment through subsidies and collaborating with international partners for technology transfer will introduce advanced solutions. Establishing stringent quality control standards for domestic and export markets will also ensure consistent, high-quality onions and stabilize prices. These measures will help improve Ukraine's reputation in international markets and support domestic price stability.

Enhance Market Strategies and Address Supply Chain Challenges

In Brazil, where the wholesale onion prices experienced notable declines in Jul-24, the focus should be on enhancing market strategies and addressing supply chain challenges. Brazil must invest in improved storage and transportation infrastructure to effectively manage the oversupply and stabilize prices. Modern storage facilities will help reduce post-harvest losses and manage supply better. Additionally, Brazil should explore new domestic and international markets to diversify demand. For instance, expanding exports to high-demand regions such as North America and Europe while strengthening distribution networks within South America could help balance the supply and demand equation. Implementing targeted marketing campaigns to promote Brazilian vegetables and fruits in these new markets will boost demand and stabilize prices. By addressing these factors, Brazil can better support its vegetable and fruit markets and enhance trade performance.

Sources: Nieuwe Oogst, Sinor, Portal Do Agronegócio, Fresh Plaza