W44 2024: Tomato Weekly Update

1. Weekly News

Bulgaria

Key Markets for Bulgarian Tomato Exports in 2024

According to the Bulgarian Ministry of Agriculture, Romania was the largest destination for Bulgarian tomato exports from Jan-24 to Jul-24, receiving 37% of the shipments. Hungary followed with 25%, Poland with 19%, and the Czech Republic and Croatia with smaller shares.

Greece

Greek Farmers Call for Stricter Controls on Turkish Tomato Imports Over Chemical Use Concerns

Greek farmers are voicing concerns over the influx of Turkish tomatoes treated with chemical substances, claiming that these imports unfairly impact local producers who have adhered to European Union (EU) regulations and stopped using banned chemicals over two decades ago. To maintain compliance, Greek farmers have transitioned to more costly biological preparations, which add financial strain to their operations. Recently, a shipment of Turkish tomatoes was halted due to missing phytosanitary documentation, highlighting inconsistencies in import controls. Greek farmers argue that this lack of stringent enforcement places them at a disadvantage and could pose health risks to consumers. They have appealed to regulatory bodies to enforce stricter import inspections and reconsider the agricultural practices regulations to create a level playing field.

Egypt

Egypt's Fresh Tomato Prices Declined by 40% MoM Due to High Production and Inflation

In Oct-24, Egyptian fresh tomato prices dropped by 40% month-on-month (MoM) to USD 307.99 per ton (EGP 15,000/ton), down from USD 513.32/ton (EGP 25,000/ton) in Sep-24. This decline is due to increased production saturating the market and the impact of inflation.

Peru

Peru’s Tomato Exports Dropped 35% YoY in Volume and 57% in Value in Sep-24

Peru exported 1,868 metric tons (mt) of tomatoes in Sep-24, valued at USD 2.39 million, marking a significant year-on-year (YoY) decrease of 35% in volume and 57% in value. The average export price was USD 1.28 per kilogram (kg), a 33% decline. Peruvian tomatoes reached ten markets, primarily in Latin America. The leading destination was Colombia, accounting for 33% of Peru's tomato exports, with 542 mt worth USD 789,000 and an average price of USD 1.45/kg. Ecuador followed with a 21% share, importing 387 mt valued at USD 508,000, at an average price of USD 1.31/kg. Brazil was the third-largest market, receiving 290 mt for USD 367,000, priced at USD 1.26/kg.

Spain

Spain’s 2024/25 Winter Tomato Production and Consumption Outlook

Spain's winter tomato production for the 2024/25 season, which started in Oct-24, is projected to reach around 1.27 million metric tons (mmt), closely aligning with the previous season's 1.3 mmt output. The planted area also shows minimal change, estimated at 14,175 hectares (ha) compared to 14,320 ha in 2023, indicating stable production expectations. Moreover, household tomato consumption in Spain has recovered, with a 9.5% increase in the first half of 2024, totaling 265 thousand mt compared to 242 thousand mt in the same period in 2023.

2. Weekly Pricing

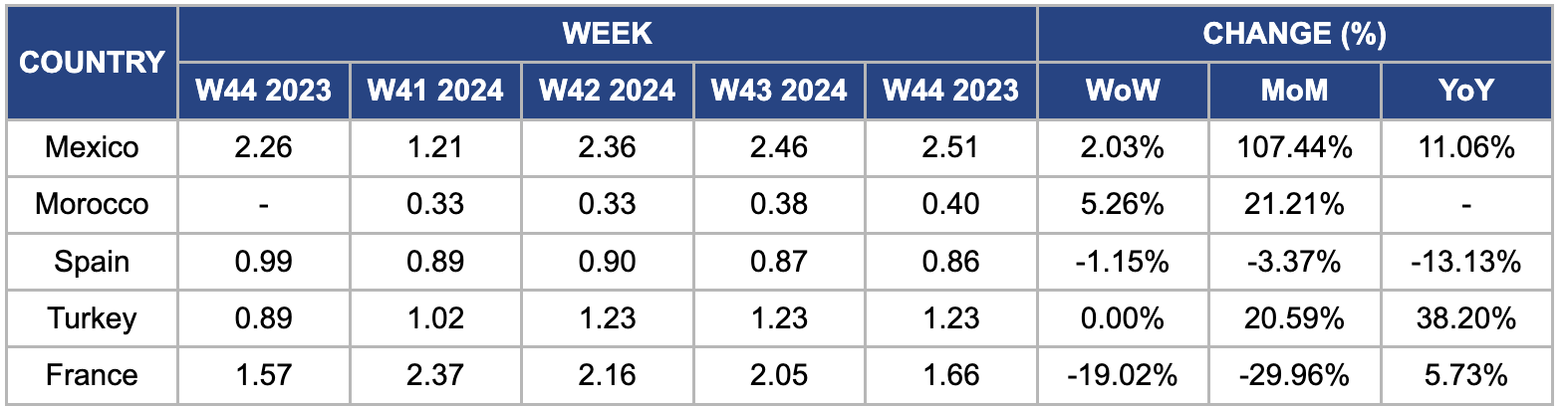

Weekly Tomato Pricing Important Exporters (USD/kg)

Yearly Change in Tomato Pricing Important Exporters (W44 2023 to W44 2024)

Mexico

In W44, Mexico's wholesale tomato prices rose to USD 2.51/kg, marking an increase of 2.03% week-on-week (WoW) and reflecting significant gains of 107.44% MoM and 11.06% YoY. The price surge is mainly due to the completion of production cycles in key growing regions, such as Sonora and Sinaloa. Despite this rise, Mexico's tomato production is forecasted to increase from 3.22 mmt in 2023 to 3.30 mmt in 2024, bringing market stabilization and a potential price decline. While some producers invest in protected cultivation methods to mitigate weather-related impacts, a large portion of tomato production still relies on open-field farming, making it more vulnerable to adverse weather and often resulting in lower yields.

Morocco

In W44, Moroccan tomato prices saw a notable 5.26% WoW increase and 21.21% MoM rise, reaching USD 0.40/kg. This upward price trend is attributed mainly to robust export demand, particularly from France, which remains a primary destination for Moroccan tomatoes, followed by other EU countries, the UK, and Sub-Saharan Africa. Germany, in particular, has shown increased interest, importing 25 thousand mt in the first seven months of 2024, up from 21 thousand mt during the same period last year. Morocco’s total export volume for 2024 will largely depend on autumn weather patterns and the residual effects of summer heatwaves, which have strained tomato production. Growers in critical regions like Agadir, Mohammedia, El Jadida, and Oualidia anticipate an overall decrease in output due to these challenging weather conditions, which may impact Morocco's ability to meet high export demand fully.

Spain

In W44, Spain's wholesale tomato prices declined by 1.15% WoW and 3.37% MoM, reaching USD 0.86/kg, influenced by delayed planting among Spanish growers and early market entry by Moroccan producers, intensifying competition. Spanish growers faced additional pressure due to concerns over the Tomato Brown Rugose Fruit Virus (ToBRFV), leading many to opt for virus-resistant tomato varieties in hopes of reducing potential crop losses. Moreover, Spanish tomato acreage has shrunk, partly due to profitability issues stemming from last year’s low prices and rising labor costs. These factors combined to apply downward pressure on Spanish tomato prices.

Türkiye

In W44, Türkiye's wholesale tomato prices remained stable WoW at USD 1.23/kg but saw a significant increase of 20.59% MoM and 38.20% YoY. This price rise is primarily driven by ongoing drought conditions and escalating costs, particularly for diesel and transportation, which have outpaced the growth in tomato prices. These financial pressures have led to dissatisfaction among producers, with protests emerging in critical agricultural regions. In addition to domestic challenges, European demand for Turkish vine tomatoes has increased as retailers seek alternatives to the strained supply from Spain and Morocco, where extreme weather and water shortages have severely impacted production. This shift in demand is further boosting Turkish tomato exports to the European market.

France

In W44, France's wholesale tomato prices decreased 19.02% WoW and 29.96% MoM, reaching USD 1.66/kg owing to an increase in production . However, prices are still 5.73% higher YoY due to a significant shortage of round tomatoes compared to 2023, influenced by seasonal factors, particularly since mid-September. Although imports from Spain and Morocco faced initial delays, they are now gradually entering the French market. Despite moderate demand, prices remain high, reflecting a production shortfall that is more substantial than last year.

3. Actionable Recommendations

Diversify Export Markets

Peru should diversify export markets to reduce reliance on specific regions and minimize the impact of market fluctuations. By targeting emerging markets in Asia, the Middle East, and Africa, exporters can spread their risk and create new revenue streams. Strengthening trade agreements with these regions and enhancing marketing strategies will help generate demand for Peruvian tomatoes, offsetting the declines in traditional markets, such as Latin America. Expanding into new territories broadens the customer base and helps stabilize income by lessening dependence on a few markets. As global demand for tomatoes continues to rise, having a more diverse export strategy will ensure long-term sustainability and growth for the industry.

Adopt Climate-Resilient Farming Practices

Morocco and Turkey should adopt climate-resilient farming practices, which is critical for sustainability. Farmers should consider using drought-resistant tomato varieties specially bred to thrive under dry conditions, ensuring more stable yields even during droughts. Additionally, investing in protected cultivation methods, such as greenhouses or shade netting, can help mitigate the risks of extreme heat and fluctuating weather patterns. These methods reduce crops' vulnerability to adverse weather and enhance overall productivity by providing more controlled growing conditions. By embracing these practices, farmers in Morocco and Turkey can reduce production volatility, maintain a steady supply of tomatoes, and stabilize market prices, ensuring their competitiveness in domestic and international markets.

Strengthen Import and Export Control Mechanisms

Greece should prioritize the enforcement of stricter import inspections, mainly due to concerns over Turkish tomatoes treated with banned chemicals. By ensuring that imports meet the EU’s stringent safety standards, authorities can level the playing field for local farmers who adhere to these regulations. Additionally, improving the enforcement of phytosanitary documentation requirements will help prevent potentially harmful agricultural practices from entering the market. Strengthening these controls will protect public health and ensure that local producers are not affected by cheaper imports that do not meet the same quality standards. This approach will bolster consumer confidence in the quality of imported produce while maintaining fair competition for domestic growers.

Sources: Tridge, Foodmate, EGmasrawy, Agroplovdiv, Agri