W45 2024: Sugar Weekly Update

1. Weekly News

Brazil

Brazil's Sugar Exports Hit Record High Due to Strong Demand and Indian Supply Constraints

Brazil's sugar exports reached 31.7 million metric tons (mmt) from Jan-24 to Oct-24, surpassing last year's record of 31.3 mmt. Strong demand amid Indian export restrictions drove this increase. Brazil now holds an estimated 70% share of the global sugar market.

Indonesia emerged as the top buyer of Brazilian sugar, overtaking China, while Egypt and the United Arab Emirates (UAE) also significantly increased imports. Despite a projected decline in the 2024 sugarcane crop, Brazil's record-high stocks from the previous season support significant export volumes. Exports to India, Indonesia, the UAE, and Egypt rose sharply, with shipments to Indonesia alone tripling to 2.6 mmt compared to the same period in 2023.

Brazilian Millers Cautious on New Sugar Plant Investments Due to Tight Market and Limited Production Capacity

Brazilian millers are cautious about investing in new sugar plants, citing that current raw sugar prices are insufficient to justify such investments. Marginal gains from improvements at existing mills are nearing their limits. While sugar demand grows by about 2% annually, production is constrained by climate change and biofuel blending policies, particularly in India, which maintains a tight market balance between supply and demand.

The Chief Financial Officer (CFO) of Jalles Machado, one of the world's largest producers and exporters of organic sugar, stated that the internal rate of return for new mills with a 50% sugar blend is only 9%, which is not attractive enough for investment. Other executives of Adecoagro, an agro-industrial company that produces and manufactures food and renewable energy, noted that Brazil's production capacity is nearing its limit despite recent adjustments that have added 2.6 mmt of sugar capacity. Tereos Brazil, a cooperative conglomerate, emphasized that any further production increases would likely come from sugarcane, as India's blending policy limits its output. Despite these challenges, experts remain optimistic about future sugar prices, forecasting a positive market outlook.

Kazakhstan

Kazakhstan's Imports of Sugar, Tea, and Sweets from Russia Reach Record High in 2024

Kazakhstan's imports of sugar, tea, and sweets from Russia rose from Jan-24 to Aug-24, reaching a record high of USD 338 million, a 2.6% increase over the same period in 2023, according to Kazakhstan's statistical service. Cane sugar imports saw the most significant growth, up 16.6% year-on-year (YoY) to USD 162.5 million. In addition, chocolate and other cocoa-based product imports rose by 5.2% YoY to USD 118.8 million, while non-cocoa sweets increased by 2.1% YoY to USD 46.9 million.

Philippines

Philippines Delays Sugar Import Decision Due to Stable Supply and El Niño-Impacted Production

The Philippine Department of Agriculture (DA) and the Sugar Regulatory Administration (SRA) have postponed their decision on sugar importation due to stable domestic supplies and the beginning of the harvest season. The Secretary of Agriculture and SRA Administrator agreed to review importation needs after May-25, when the current harvest season concludes.

While sugar stocks are stable in W45, the season’s slow start, affected by the recent El Niño, has impacted production. The El Niño phenomenon, lasting from Jul-23 to Jun-24, delayed cane maturity and reduced sugar content by 16% per ton of cane. Consequently, despite a slight increase in planted areas from 388,378 to 389,461 hectares (ha), the SRA forecasts a 7.2% drop in domestic sugar production to 1.782 mmt. The United States Agriculture Department (USDA) has similarly projected a 3.6% decrease, estimating Philippine output at 1.85 mmt. The current crop year will end in Aug-25.

Russia

Lipetsk Oblast Farmers Achieve Record Sugar Beet Harvest Despite Climate Challenges, Securing Top Rankings in Sugar Production

According to the Governor of Lipetsk Oblast, farmers successfully harvested almost the entire sugar beet crop before the first frosts. Despite challenges in agriculture this year, including intensified droughts and floods due to climate change, farmers have harvested 4 mmt of beets from 115.7 thousand ha, with only 3,000 ha remaining. Over 3 mmt of the new crop has already been processed at six regional plants, producing 490,000 metric tons (mt) of sugar. The region ranks second in Russia for sugar production and is among the top five for sugar content and yield. This ensures sufficient sugar for domestic consumption and export.

Türkiye

Türkiye's Sugar Beet Production Hits Record 25.25 Million Tons in 2023, but 2024 Forecasts 8.9% Decline

In 2023, Türkiye's sugar beet production reached a record 25.25 mmt, grown on 3.6 million acres. However, the Turkish Statistical Institute (TurkStat) forecasts an 8.9% decrease in 2024, with production expected to fall to 23 mmt. The President of the Union of Chambers of Agriculture of Türkiye (TZOB) highlighted Türkiye's global position as the fifth largest sugar beet producer, accounting for 6.6% of global production, and emphasized the need for increased sugar beet and output to meet domestic demand, calling for better prices for producers to incentivize higher yields and urging investments in factory technology and employment.

2. Weekly Pricing

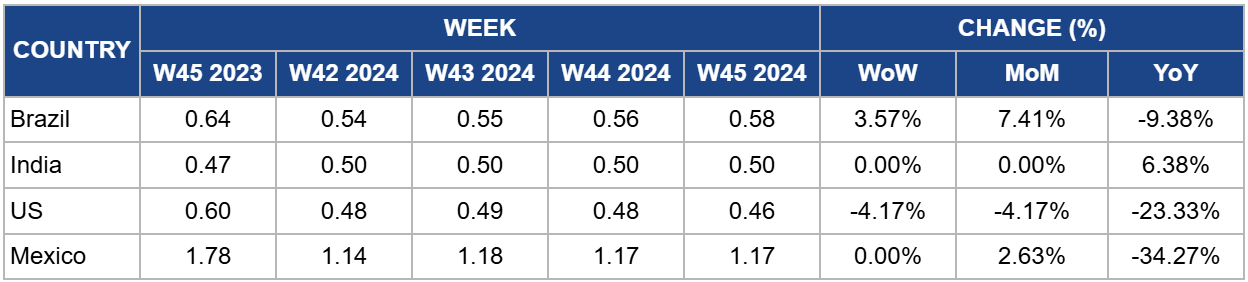

Weekly Sugar Pricing Important Producers (USD/kg)

Yearly Change in Sugar Pricing Important Producers (W45 2023 to W45 2024)

.png)

Brazil

In W45, Brazil's sugar prices rose to USD 0.58 per kilogram (kg), marking a 3.57% increase week-on-week (WoW) and a 7.41% rise month-on-month (MoM) from USD 0.54/kg. The price surge is due to persistent rains in Brazil's key sugar-producing Center-South region, which have hindered sugarcane harvesting and delayed the final phase of the season. This weather disruption has raised concerns about potential crop losses. Analysts anticipate continued rainfall will further affect crop conditions, potentially maintaining upward price pressure in the short term.

India

India's sugar prices have remained steady at USD 0.50/kg in W45, marking a 6.38% YoY increase. However, production is expected to decline by 2.24% to 33.3 mmt in 2024/25, largely due to drought in Maharashtra. The Indian Sugar and Bioenergy Manufacturers' Association (ISMA) has called for a 26.25% increase in the minimum selling price (MSP) to USD 0.46/kg (INR 39.14/kg), citing rising costs and lower revenues due to export restrictions and reduced ethanol diversion. ISMA has also requested permission to export 2 mmt, which could help alleviate financial pressures on mills and ensure timely cane payments to farmers. With surplus stocks, India's sugar prices may increase depending on export opportunities and MSP adjustments.

United States

Sugar prices in the United States (US) decreased to USD 0.46/kg in W45, a decrease of 4.17% WoW and a decrease of 23.33% YoY from USD 0.60/kg. This decline is attributed to several macroeconomic factors, including the impact of the US presidential election, which led to a stronger dollar and lower oil prices, negatively influencing the global sugar market.

Mexico

Mexico's sugar prices fell to USD 0.46/kg in W45, a significant 4.17% weekly drop and a 23.33% decrease YoY from USD 1.78/kg. This decline is partly driven by domestic supply and production fluctuations as Mexico remains a key global sugar producer. Sugarcane is mainly produced in Veracruz, Jalisco, and San Luis Potosí. However, the price drop could be influenced by global market pressures, including changes in demand from key importers, as well as regional production variations due to climate impacts. With the country ranking eighth globally in sugarcane production, any shifts in price could impact both the local agricultural sector and the broader sweetener market, especially given sugar’s integral role in Mexican food and beverages. Additionally, a continued drop in sugar prices could affect the financial stability of sugarcane producers, potentially leading to shifts in production strategies or increased reliance on alternative markets for exports.

3. Actionable Recommendations

Leverage Brazil's Sugar Export Leadership

Given Brazil's dominant position in the global sugar market, with a 70% share, stakeholders should explore strategic partnerships and long-term contracts with Brazilian exporters, particularly focusing on high-growth markets such as Indonesia and the UAE. By securing stable supply agreements, businesses can mitigate risks posed by potential production declines in other regions, such as India, and position themselves to benefit from Brazil's consistent export volumes, even amidst climate-related production constraints. Companies can also consider diversifying their sourcing from Brazil to other emerging exporters to reduce market volatility exposure further.

Monitor Weather-Driven Price Fluctuations

Driven by adverse weather conditions, the recent surge in Brazilian sugar prices highlights the need for businesses to implement adaptive pricing strategies. Companies should closely monitor weather patterns in key sugar-producing regions and integrate this data into their procurement strategies. In the short term, businesses should hedge against price fluctuations, especially in Brazil, by securing fixed-price contracts or exploring alternative suppliers from regions with more stable climates, such as India and Russia. This proactive approach can help manage rising costs and ensure a more predictable supply chain.

Sources: GMA Network, Ukragroconsult, RG RU, Portal Do Agronegócio, Kvedomosti, DHA, Economic Times India, MX Gob