1. Weekly News

Argentina

Argentina’s Onion Market Faces Record Imports from Brazil

Onion imports from Brazil into Argentina surged in Nov-24, reaching a record high as nearly 1,000 trucks transported over 30 thousand metric tons (mt) of onions across the border. Historically, Brazil has relied on Argentina for onions. Argentina exported 231 thousand mt tons in 2024, over 80% of which went to Brazil between Mar-24 and Jun-24 when local availability was a lot. However, as Argentina's high costs made Brazilian onions more competitively priced, exports halted and the trade flow reversed. According to the National Food Safety and Quality Service (SENASA), Argentina imported 32,227 mt of fresh onions in 2024, mainly from Brazil. Unlike the 2022 import surge driven by drought, this year's increase highlights a competitiveness issue, with Brazilian onions being significantly cheaper than their Argentine counterparts.

Poland

Polish Onion Prices Declined Amid Oversupply

Polish onion prices remain subdued, ranging from USD 0.23 to 0.33 per kilogram (kg) in W48, well below the five-year average. An abundant domestic supply and increased imports drive these price drops. Despite a modest 4% week-on-week (WoW) decline in late Nov-24, prices continue to fall due to the oversupply of Polish onions, particularly early varieties. However, late varieties are less abundant compared to last year. Notably, imports from Germany and the Netherlands, especially low-quality onions for industrial use, have added to the market pressure. Interestingly, occasional imports from Central Asia and Portugal have also contributed to the surplus. Across Europe, onion prices remain lower than last year, though Germany, the Netherlands, and France have experienced slight price increases in recent weeks.

Ukraine

Ukrainian Onion Prices Surged in W48 Due to Limited Supply and Strong Demand

As of November 28, Ukrainian onion prices have surged from USD 0.29 to 0.41/kg, marking a 35% WoW increase and a 16% rise year-on-year (YoY). This sharp price increase is driven by heightened demand and a limited supply of high-quality onions, as many farms withheld stock from the market. Notably, the price rise is concentrated in the premium segment, while the availability of medium and low-quality onions has dwindled. Analysts suggest the current price spike is artificial, as farmers' reluctance to sell at prevailing rates aggravates the shortage. If this trend persists, Ukraine could lead the region in onion prices, potentially prompting earlier-than-usual imports to meet domestic demand.

2. Weekly Pricing

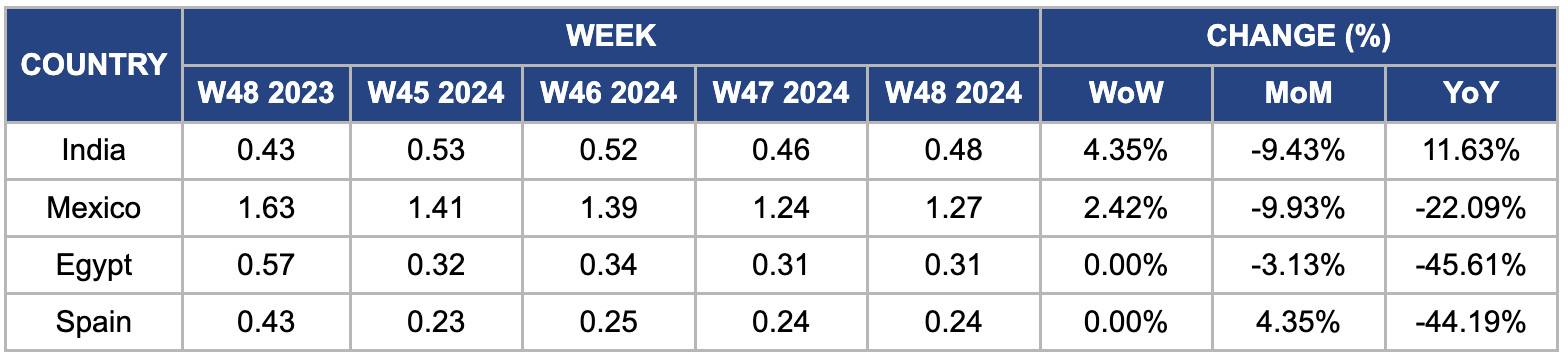

Weekly Onion Pricing Important Exporters (USD/kg)

Yearly Change in Onion Pricing Important Exporters (W48 2023 to W48 2024)

India

In W48, India's onion prices rose to USD 0.48/kg, reflecting a 4.35% WoW increase from USD 0.46/kg in W47. Despite some relief in vegetable prices in Nov-24, onion prices remain elevated, continuing to contribute to inflationary pressures in the country. The price surge is due to heavy rains in Aug-24 and Sep-24, which disrupted supply chains and led to a 28% drop in mandi arrivals over the past two months. This has resulted in higher consumer costs, significantly impacting households, especially in North India, where onions are a key ingredient in cooking and salads. As a result, sales have declined, and local hawkers face losses due to higher prices and reduced consumer demand, leading to unsold stock piling up.

Mexico

In W48, Mexico's onion prices rose to USD 1.27/kg, reflecting a 2.42% WoW increase. This increase comes as the National Institute of Statistics and Geography (INEGI) reported a rise in the National Consumer Price Index (INPC), with inflation reaching 4.56% in the first half of Nov-24. The non-core price index, which includes fruits and vegetables, rose 1.44% biweekly and 7.64% annually. Onion prices increased 14.88% during this period, aligning with broader inflationary pressures in Mexico, particularly in food prices. However, onion prices decreased 9.93% month-on-month (MoM) and 22.09% YoY, mainly due to seasonal factors such as the post-harvest period when supply typically increases, leading to lower prices.

Egypt

In W48, Egypt's onion prices remained steady at USD 0.31/kg, reflecting a 3.13% MoM decrease and a significant 45.61% YoY drop from USD 0.57/kg in W48 2023. This price reduction is due to seasonal shifts in supply and demand and an increase in domestic consumption in anticipation of a short-term supply gap. Despite a projected 1 million metric ton (mmt) rise in Egypt's onion production for 2024, fluctuations in harvest timing and supply chain disruptions have temporarily tightened available stock, contributing to the current price drop. These factors suggest that while prices are lower now, short-term volatility may persist due to ongoing supply chain challenges.

Spain

In W48, Spain's onion prices reached USD 0.24/kg, reflecting a 4.35% MoM increase but a 44.19% YoY drop. The Spanish onion sector is facing an oversupply due to increased acreage and lower prices in previous years, leading to production outpacing demand. While some industries, like Agorreta, are experiencing high demand, especially for high-quality onions, the overall market needs help with an oversupply, particularly of open-ground onions priced as low as USD 0.10/kg. The lack of demand from the industrial sector, including frozen food producers, who have already secured supplies, has aggravated this situation. Despite the price drop, high-quality onions from regions like Navarre are seeing strong demand within the EU and in non-EU markets. Modernization efforts in sorting and packaging are helping meet this demand, but the market is still adjusting to the supply-demand imbalance.

3. Actionable Recommendations

Increase Storage and Distribution Efficiency

In Ukraine, where onion prices have spiked due to the limited availability of high-quality onions, there is a pressing need for better storage and distribution strategies. Ukrainian producers in the northern regions, who grow onions with thicker skins that can be stored longer, should invest in modern storage technologies such as refrigerated storage and active ventilation systems. This would help preserve their onions longer and reduce market volatility by ensuring a consistent supply throughout the year. Moreover, by enhancing distribution networks and collaborating with local retailers and wholesalers, Ukrainian producers can expand their market reach and ensure that premium onions are available during high-demand periods, helping to stabilize prices while maximizing revenue potential. This approach can also prevent unnecessary stock withholding, contributing to artificial price spikes.

Diversify Supplier Networks in Poland and Eastern Europe

Polish importers must diversify their supplier networks to manage price fluctuations effectively. Sourcing onions from regions such as the Netherlands, Germany, and Central Asia will allow Polish importers to maintain price stability and reduce reliance on any single supplier. Furthermore, targeting low-quality onions for industrial use, which have become increasingly available due to imports from countries like Germany and the Netherlands, presents a strategic opportunity. Polish buyers can secure a more stable supply chain by negotiating bulk deals with these countries, helping them better manage the market pressures caused by domestic oversupply and price depressions.

Leverage Regional Trade Opportunities

Brazilian onion exporters can take advantage of the current surge in demand from Argentina, where high local production costs make Brazilian onions more competitively priced. To strengthen their position, exporters should focus on securing long-term contracts with Argentine importers, ensuring a stable and consistent demand for Brazilian onions, especially during Argentina's off-season when local production is low. Furthermore, Brazilian exporters can offer customized packaging and promotional deals to attract Argentine consumers, making Brazilian onions more attractive than higher-priced domestic options. By capitalizing on this opportunity, Brazil can solidify its role as a key supplier to Argentina and diversify its export market beyond traditional European destinations.

Sources: Agrotimes, Bichos de campo, Agronaplo, Agrobusiness, Economic Times