1. Weekly News

Peru

Peru's Onion Exports Reached 283,217 MT in 2024

Between Jan-24 and Nov-24, Peru exported 283,217 metric tons (mt) of fresh onions, generating a Free on Board (FOB) value of USD 132.44 million. The United States (US) was the primary market for these exports, accounting for 58% of the total value, with sales reaching USD 77.16 million. Spain followed as the second-largest market with USD 20.84 million in onion exports. Other significant destinations included Colombia with USD 14.66 million, the Dominican Republic with USD 8.21 million, Costa Rica with USD 3.37 million and Chile with USD 1.91 million. These exports highlight Peru's strong position in the global onion market, particularly in North and Latin American markets.

South Korea

South Korea to Ban Onion Distribution in String Nets Nationwide Starting Jan-25

Starting Jan-25, South Korea will expand its policy of banning onion distribution in string nets at agricultural wholesale markets, which has been in effect at Garak Market in Seoul since Jan-24. The measure will apply to local wholesale markets, such as the Seoul Gangseo and Gyeonggi Guri Wholesale Markets, as part of a nationwide effort to improve onion distribution methods. The policy mandates machine net distribution, alongside manual packaging, to replace the traditional use of string nets, which have long been a common practice in onion wholesale distribution. String nets involved sorting and packaging onions in strings for shipment after harvest, with specialized labor required to sort and package the onions according to specific weight standards, such as 12 kilograms (kg), 15 kg, or 20 kg.

Ukraine

Ukrainian Onion Prices Rose in W51 Due to Decreased Supply

In W51, Ukrainian vegetable prices continued to rise, with onions seeing a noticeable price increase. Onions rose from USD 0.36/kg in W50 to USD 0.38/kg. The higher prices are due to tightening supply and increasing seasonal demand.

2. Weekly Pricing

Weekly Onion Pricing Important Exporters (USD/kg)

Yearly Change in Onion Pricing Important Exporters (W51 2023 to W51 2024)

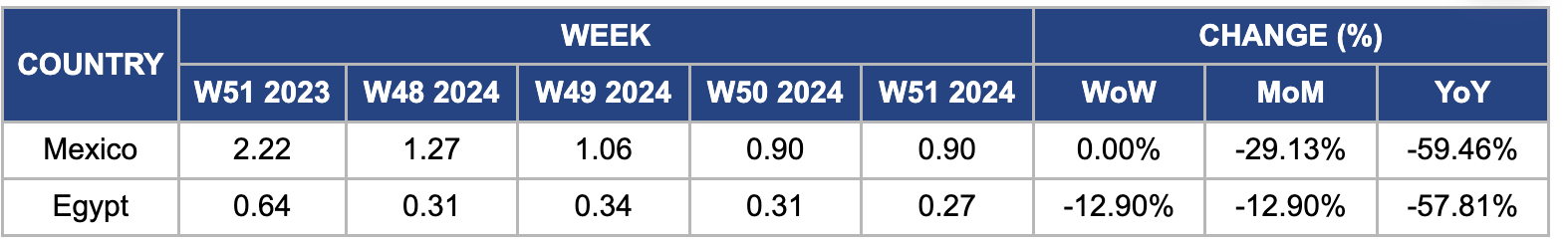

Mexico

In W51, Mexico's onion prices remained stable week-on-week (WoW) at USD 0.90/kg. However, prices significantly declined by 29.13% month-on-month (MoM) and 59.46% year-on-year (YoY). This sharp drop is primarily attributed to an increase in supply from the new harvest, particularly from key production areas like Sinaloa, which led to a market surplus. As the harvest season peaks, the higher availability of fresh onions has pressured prices downward. Moreover, reduced export demand, partly due to competition from other onion-exporting countries such as the Netherlands and India, has contributed to the growing domestic supply. Seasonal variations in domestic consumption also led sellers to lower prices to avoid excess stock accumulation.

Egypt

In W51, Egypt's onion prices dropped by 12.90% both WoW and MoM, reaching USD 0.27/kg. Prices also fell sharply by 57.81% YoY. The primary cause of this price decline is a significant increase in domestic onion production. Favorable weather conditions, particularly in key production areas like the Nile Delta and Upper Egypt, have resulted in higher yields, leading to a more stable and abundant supply. Furthermore, the Egyptian government's efforts to improve market efficiency, reduce export restrictions, and enhance logistical access have further contributed to better domestic availability. Increased production and government initiatives to stabilize the market have pressured down prices, causing a notable decline compared to the previous year.

3. Actionable Recommendations

Expand Onion Exports to Boost Global Market Presence

To combat the downward price pressure caused by surplus production and increased competition from other exporters like the Netherlands and India, Mexico should focus on diversifying its export destinations and improving its value-added products. Developing marketing strategies for high-value, niche onion products such as organic or premium varieties could attract more discerning buyers in high-end markets. In addition, Mexico could enhance its marketing efforts in regions that rely heavily on onion imports, such as the US, while exploring new markets in the Middle East and Asia. Strengthening logistics to improve the export supply chain and working with international partners to build stronger trade relations will ensure that Mexico maintains a competitive edge in the global onion market.

Improve Onion Distribution Efficiency

With South Korea’s policy shift to improve onion distribution methods by banning string nets, investing in more advanced packaging technologies and machinery that align with the new regulations is essential. Local onion suppliers should consider investing in automated packaging systems that meet the new machine net distribution requirements, which could help streamline the supply chain and reduce labor costs. Moreover, training and educating wholesale markets about these new packaging standards would ensure a smooth transition. These improvements would comply with the government’s policy and reduce post-harvest losses, provide better product quality, and potentially open up new opportunities for export to neighboring countries like Japan and China, where packaging standards are often stringent.

Diversify Export Markets

Peru's strong position in the global onion market, particularly with its export dominance in North and Latin American markets, should be leveraged by exploring new and emerging markets. Expanding exports to regions such as Asia and Africa, where demand for fresh vegetables is rising, could help mitigate the risks of over-dependence on the US and Spain. Peru could target countries like Japan and South Korea, with growing interest in high-quality, fresh produce. Developing relationships with local distributors and participating in international trade fairs could facilitate entry into these markets. Moreover, promoting Peruvian onions' specific quality and freshness, potentially through certifications and branding, could enhance their appeal to these new markets.

Sources: Tridge, Agraria, Agrinet, Unian