W51 2024: Potato Weekly Update

.jpg)

1. Weekly News

Belarus

Belarus Introduces Licensing for Potato Exports to Ensure Domestic Supply

On December 12, the Belarusian government introduced a licensing system for potato exports to ensure sufficient domestic supply during the off-season. This move aims to meet the country's demand for agricultural products, particularly potatoes. In coordination with the Ministry of Agriculture and Food, regional administrations, and the Minsk Executive Committee, the Ministry of Antimonopoly Regulation and Trade will issue one-time licenses for potato exports. The decision to grant licenses will be based on the availability of domestic stocks and the current need for potatoes in Belarus.

Netherlands

Dutch Potato Processing Hits 10-Year Low in Nov-24

Dutch potato processing dropped to its lowest level in a decade in Nov-24, with a 10% year-on-year (YoY) decrease, totaling 300,600 metric tons (mt). The supply of domestically sourced potatoes fell by 44,700 mt, while imported potatoes also saw a reduction of 9,800 mt compared to Oct-24. Despite the decline, imported potato processing increased by 4% YoY. Furthermore, the backlog in potato processing grew by 91,500 mt compared to the previous season. This was mainly due to a reduced supply of domestically grown potatoes, which was 149,400 mt lower than the prior year.

Spain

Spanish Potato Exports Rise in 2024 Despite Production Challenges

Spanish potato exports in 2024 increased by 1.7% YoY in volume, reaching 298,594 mt, and 5.8% YoY in value to USD 184.17 million. Despite relatively low production levels, these growth figures are significantly higher than the five-year average. Spanish potato production for 2024 is expected to be around 1.93 million metric tons (mmt), 0.6% higher than the previous year but 5.2% below the average from 2019 to 2023. The export increase is due to rising potato prices, with a substantial 60.4% jump in value compared to the five-year average. Notably, the bulk of export revenue, USD 169.83 million, was generated from the European market. Despite production challenges, Spanish exporters have continued to benefit from favorable pricing and demand.

Ukraine

Ukraine's Potato Prices Surge Significantly Due to Rising Demand

In W51, Ukraine's potato market saw a notable uptick in trading activity, with prices increasing by 22% week-on-week (WoW), now ranging from USD 0.53 to 0.72 per kilogram (kg). This price rise is due to growing demand as wholesale companies and retail chains begin stocking up for the New Year holidays. Market experts suggest that while further price increases are possible, a sharp rise is unlikely. The significant price hike is also 85% higher than last year's period, mainly attributed to reduced potato production due to a summer drought that impacted major potato-growing regions across Ukraine.

2. Weekly Pricing

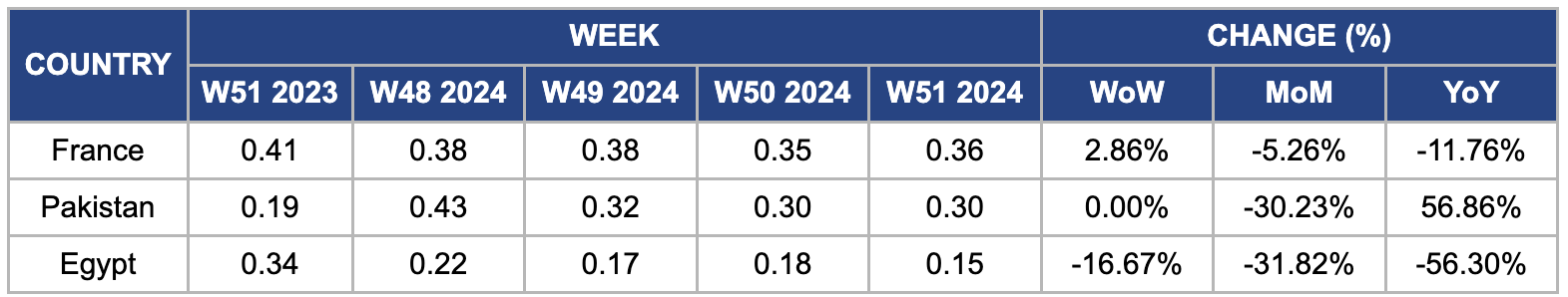

Weekly Potato Pricing Important Exporters (USD/kg)

Yearly Change in Potato Pricing Important Exporters (W51 2023 to W51 2024)

France

In W51, wholesale potato prices in France increased by 2.86% WoW, reaching USD 0.36/kg from USD 0.35/kg in W50. This rise was driven by seasonal demand during the holiday period, particularly Christmas and New Year celebrations when potatoes are a staple in festive meals. Moreover, the tightening supply caused by adverse weather earlier in the season, including heavy rains during the harvest in Oct-24 and Nov-24, impacted yields and quality. These factors and increased production costs placed upward pressure on prices despite stable market conditions in prior weeks. However, prices declined 11.76% YoY, attributed to a forecasted 10% YoY increase in the 2024 potato production volumes, supported by expanded cultivation areas. Furthermore, subdued export demand, particularly from key markets like Spain and Italy, which rely on domestic production or alternative suppliers with surplus stocks, has further contributed to the YoY price decline.

Pakistan

In W51, potato prices in Pakistan remained stable WoW at USD 0.30/kg. Still, they experienced a sharp month-on-month (MoM) decline of 30.23%, primarily due to a significant surge in supply from Punjab, which produces approximately 85% of the country’s potatoes. Favorable weather conditions, including optimal temperatures and sufficient rainfall, created ideal growing conditions, resulting in a bumper harvest. While this increase in supply should have positively impacted exports, logistical challenges severely limited Pakistan’s ability to capitalize on the surplus. Transportation bottlenecks at critical border crossings, rising export costs, and a depreciating currency hindered shipments to key markets such as Afghanistan, the Middle East, and Central Asia. These logistical barriers coincided with a weakening domestic market, as high inflation and reduced consumer purchasing power dampened local demand. The confluence of abundant supply and constrained export opportunities, alongside diminished domestic consumption, exerted significant downward pressure on prices.

Egypt

In W51, Egypt's wholesale potato prices dropped by 16.67% WoW, 31.82% MoM, and 56.30% YoY to USD 0.15/kg, driven by an increase in supply from the winter harvest and new crop arrivals compared to the previous season. However, this price decline comes against the backdrop of significant economic challenges. High inflation, currency depreciation, and a persistent US dollar shortage have disrupted the import of essential potato seeds, negatively impacting production. Yields have fallen sharply, from 14 to 16 mt per acre in 2023 to just 9 to 12 mt per acre in 2024. This combination of increased supply in the short term and structural issues affecting productivity underscores the complex dynamics in Egypt's potato market.

3. Actionable Recommendations

Expand Potato Processing Capacity

Belarus should prioritize expanding its potato processing infrastructure to address the recurring supply gaps during the off-season by establishing new processing plants in key potato-producing regions, such as Minsk, Gomel, and Brest, closer to the central farming areas. By increasing the processing capacity for products like potato chips, frozen fries, and potato flour, Belarus could reduce its reliance on imports, ensure a more consistent supply of processed potatoes year-round, and strengthen its domestic market. Moreover, modernizing existing plants with more efficient technology could help reduce processing costs and increase output while creating more jobs and boosting the agricultural sector’s competitiveness. With this enhanced processing capacity, Belarus can also explore opportunities to export more processed potato products to neighboring countries, further supporting economic growth.

Enhance Potato Export Logistics

Despite the bumper harvest of potatoes in Pakistan’s key producing region, Punjab, logistical challenges such as transportation bottlenecks and inefficient border procedures limit the country’s ability to capitalize on the surplus. To address these issues, Pakistan should invest in improving its transport infrastructure, especially around critical border crossings like Torkham and Chaman, by facilitating smoother customs processes and expanding road networks. Improving cold storage facilities along key transport routes would help maintain potato quality during transit, mainly for export to neighboring countries like Afghanistan and the Middle East. Furthermore, working with logistics partners to negotiate lower shipping costs would help reduce the price pressure caused by high export costs. By tackling these logistical challenges, Pakistan could increase its exports and stabilize the domestic market, helping to avoid price declines during periods of surplus.

Diversify Potato Export Markets

While Spain’s potato exports to Europe have grown, it should diversify its export markets to reduce dependency on European demand. Targeting emerging markets in North America, Asia, and the Middle East, where demand for high-quality potatoes is increasing, could help Spanish producers balance the risk of market fluctuations. For instance, Spain could promote specific potato varieties with unique attributes, such as those with higher nutritional value or specialized uses (e.g., for the processing industry). Moreover, creating strategic marketing partnerships with importers in these regions and participating in international trade.

Sources: Tridge, Agrotimes, Farmer.pl, Nieuwe Oogst, UkrAgroConsult