In W12 in the soybean landscape, some of the most relevant trends included:

- Argentina’s 2024/25 soybean crop is projected at 49 mmt, as it recovers from drought.

- Meanwhile, Brazil’s harvest reached 58.7% as of W12, with production estimates at 170 mmt. Mato Grosso leads with record yields, though wet conditions delayed harvest in the north.

- US soybean processing slowed in Feb-25, with weaker-than-expected crush volumes and rising soybean oil stocks pressuring prices. South Korea’s soybean production reached a 20-year high, but crush demand remained weak, keeping imports below historical levels.

- Brazilian soybean prices dropped WoW due to increased supply and weaker Chinese demand, while US prices fell YoY due to high stocks and low export sales. Due to dry weather and supply concerns, Argentina’s soybean prices increased WoW.

1. Weekly News

Argentina

Argentina’s 2024/25 Soybean Forecast Raised to 49 MMT Amid Recovery From Drought

The forecast for Argentina's 2024/25 soybean crop is projected at 49 million metric tons (mmt), reflecting a recovery from severe drought. Although the drought initially lowered yield expectations, recent rainfall has improved crop conditions. The Foreign Agricultural Service (FAS) also expects soybean processing and exports to increase in the coming years.

Brazil

Brazil’s Soybean Harvest Advances with Strong Output and Buyer Activity

Brazilian farmers harvested 58.7% of the 2024/25 soybean crop as of late W12, surpassing 2024's 52.6% and the five-year average of 56.2%. The harvest advanced 8.7% during the week, with favorable weather accelerating progress in most regions. However, wet conditions in northern areas, particularly Tocantins, delayed operations and raised quality concerns. Despite these challenges, estimates for national production remain at 170 mmt. In Mato Grosso, farmers harvested 91.8% of their soybean crop, exceeding 2024’s 90.4% and the 86.8% average, with a 9.5% weekly advance, according to Mato Grosso Institute of Agricultural Economics (IMEA). The harvest is on track to conclude in W12. Mato Grosso farmers expanded their soybean planting to 12.66 million hectares (ha), a 1.47% YoY increase while achieving a record average yield of 65.32 sacks per ha. The state's total production estimate rose to 49.62 mmt, reflecting a 5.22% increase from Feb-24.

South Korea

South Korea’s Soybean Production Hits 20-Year High Due to Paddy Conversion Efforts

The United States Department of Agriculture (USDA) FAS states that South Korea's efforts to replace rice paddies with other crops have driven soybean production to a 20-year high and soybean acreage to a 12-year high. Despite importing 89% of its annual soybean supply, South Korea has steadily increased domestic production, reaching 160 thousand metric tons (mt) in the 2025/26 marketing year (MY). Soybean acreage has expanded for five consecutive years, demonstrating sustained growth. To further support domestic production, the South Korean government plans to introduce initiatives that promote local soybean consumption, potentially driving additional expansion. Meanwhile, stagnant crush demand and soybean imports reflect market conditions that have forced crush facilities to operate at 15% to 20% below capacity in 2024/25 and into 2025/26. As a result, total soybean imports will likely remain below 1.1 mmt, about 100 thousand mt lower than the historical average.

United States

US Soybean Crushing Falls Short in February, Oil Stocks Exceed Expectations

The latest National Oilseed Processors Association (NOPA) report revealed weaker-than-expected soybean crushing numbers for Feb-25, while soybean oil stocks exceeded market forecasts. This data pressured the soybean market and heightened concerns about United States (US) domestic demand. Soybean processing in the US reached 177.87 million bushels in Feb-25, falling short of the projected 185.229 million bushels. Compared to Feb-24, when crushing totaled 186.194 million bushels, the slower processing pace points to a decline this year. Meanwhile, soybean oil stockpiles surged to 1.503 billion pounds (lbs), surpassing market expectations of 1.386 billion lbs. This figure exceeded Jan-25’s 1.274 billion lbs, easing near-term supply concerns.

2. Weekly Pricing

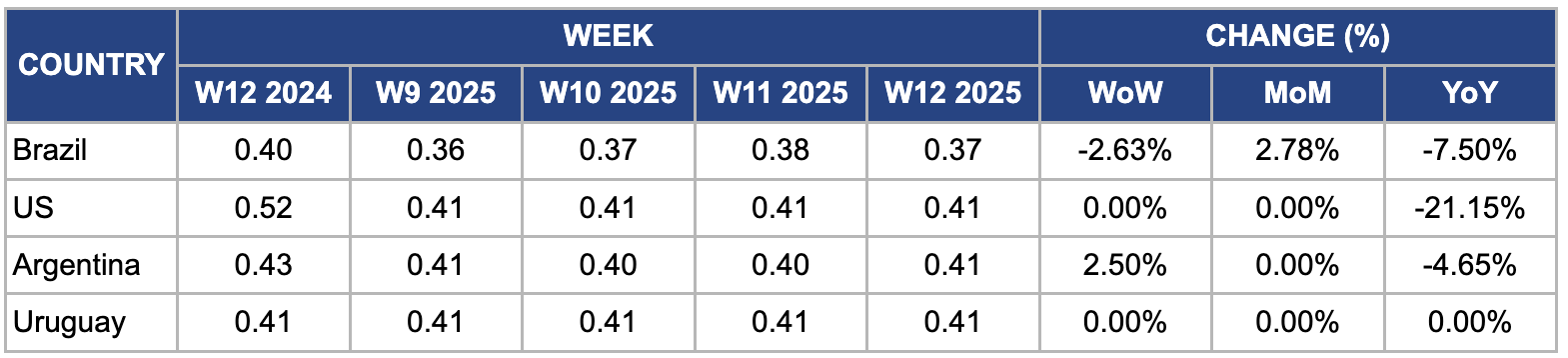

Weekly Soybean Pricing Important Exporters (USD/kg)

Yearly Change in Soybean Pricing Important Exporters (W25 2024 to W25 2025)

Brazil

In W12, Brazilian soybean prices decreased by 2.63% week-on-week (WoW) and 7.50% YoY to USD 0.37 per kilogram (kg), primarily due to increased supply from the ongoing 2024/25 harvest. As of mid-Mar-25, soybean harvesting progress in Brazil reached approximately 65%, up from 57% in the previous week, leading to higher market availability. Moreover, weaker Chinese demand and lower export premiums at Brazilian ports contributed to downward price pressure. The strong Brazilian real (BRL) against the US dollar also made Brazilian soybeans less competitive in global markets, further influencing the price decline.

United States

In W12, US soybean prices remained stable WoW but dropped sharply by 21.15% YoY to USD 0.41/kg due to higher production forecasts and weaker demand. The 2024/25 US soybean crop will reach 118.82 mmt, with ending stocks at 10.34 mmt, slightly below market expectations of 10.39 mmt. Soybean export sales have also underperformed, with sales to China for MY 2024/25 hitting a 17-year low. Market sentiment weakened further as trade tensions escalated, with the US imposing tariffs on Mexico, Canada, and China. In response, Canada and China announced retaliatory measures, adding pressure to the market. As a result, soybean prices have fallen to their lowest level since early Jan-25.

Argentina

In W12, Argentine soybean prices rose 2.50% WoW to USD 0.41//kg as dry weather persisted, with slight rainfall expected in the west and northwest in the coming days. Despite these conditions, the soybean crop has improved for the fourth consecutive week, with 2024/25 production estimates ranging from 44.5 to 49.6 mmt. Farmers expect to begin the early harvest in W13, though heat and moisture stress in the north and flooding in central areas have affected production. Soybean crops remain in various stages of pod filling and maturation.

Uruguay

Uruguay's soybean prices remained stable at USD 0.41/kg in W12, supported by favorable market conditions and an expansion in planting area. For the 2024/25 season, Uruguay increased its soybean planted area to approximately 1.3 million ha, up from 1.2 million ha in the previous year, boosting production expectations. Moreover, strong demand from key export markets, particularly China, provided price stability despite global soybean price fluctuations. Favorable weather conditions, including adequate rainfall and moderate temperatures, further supported yield potential, ensuring steady market supply without significant price volatility.

3. Actionable Recommendations

Strengthen Risk Management Strategies

Soybean producers in Brazil and the US should hedge against price declines by securing forward contracts and utilizing options in the futures market. Given the weakening demand from China and increasing global soybean stocks, prices will remain under pressure. Farmers in Brazil should consider structured pricing mechanisms, such as minimum price guarantees or staggered sales, to mitigate losses from currency fluctuations and weaker export premiums. Moreover, cooperatives can assist members in securing financing for storage facilities, enabling them to hold inventory and sell at more favorable prices.

Capitalize on South Korea’s Rising Domestic Soybean Production

South Korean agribusinesses and food manufacturers should increase domestic soybean sourcing by establishing long-term purchase agreements with local farmers. Given the expansion in soybean acreage and government support for domestic production, companies in the tofu, soy milk, and soybean oil industries can reduce dependency on imports while benefiting from potential subsidies for local procurement. Furthermore, exporters of soy-based products should monitor policy shifts that may create new opportunities for processed soybean exports. Enhancing local sourcing will improve supply chain resilience, reduce import costs, and align with government incentives for promoting local agriculture.

Expand Market Diversification to Reduce Dependence on China

US and Brazilian soybean exporters should diversify their buyer base beyond China, targeting alternative markets such as the European Union (EU), Egypt, and Southeast Asia, where demand for soybean meal and oil remains strong. Given the 17-year low in US soybean sales to China and trade tensions between major economies, traders should focus on marketing high-protein soybeans to regions with strong livestock industries. Moreover, logistics optimization and lower freight costs can help secure competitive export pricing for emerging markets. Reducing dependence on China will enhance market stability, mitigate geopolitical risks, and create new trade opportunities, ensuring steady demand for US and Brazilian soybeans.

Sources: Tridge, Graintrade, NoticiasAgricolas, UkrAgroConsult