In W18 in the soybean landscape, some of the most relevant trends included:

- Argentina's coarse-grain harvest is progressing well, supported by stable weather. Meanwhile, Brazil has nearly completed its soybean harvest, reaching 91.8% as of mid-Apr-25. In Brazil, harvests in key states like Mato Grosso, Goiás, and São Paulo are almost finished, with progress in the South improving ahead of 2024 levels.

- China is diversifying its grain sources and expects a record 30 mmt of soybeans from South America in Q2-25, mitigating potential feed shortages due to reduced US imports. This shift is driving stability in China's domestic soymeal prices, which had surged earlier, as Brazil's export demand remains strong despite logistical challenges and tariff issues.

- Brazil's soybean prices rose WoW in W18 driven by strong export demand, especially from China, and a favorable exchange rate. In contrast, US soybean prices dropped YoY due to slow farmer sales and wet field conditions in the Midwest. Argentina's soybean prices also fell WoW due to steady harvest progress, though global demand remained subdued. Uruguay’s soybean prices stayed stable as domestic production recovered following a drought in 2023.

1. Weekly News

Argentina

Argentina's Soybean Harvest Progresses with Favorable Weather Conditions

Argentina’s coarse-grain harvest is progressing well, supported by favorable weather conditions. Dry and stable weather will continue for the next few days. While rains are not forecasted until W19, fog banks may form in central and northern Buenos Aires mid-week. However, by the end of W19, some rainfall is expected in regions like western Río Negro, Neuquén, Chubut, and Northern Argentina. The lack of rain and high humidity will help facilitate machinery entry into the fields, accelerating the pace of harvest.

Brazil

Brazil’s Soybean Harvest Nears Completion, Slightly Ahead of Historical Pace

Brazilian soybean harvest moved steadily toward completion, with 91.8% of the total cultivated area reaped as of April 17, well above 2024’s pace of 88.9% at the same time. Harvesting was finalized across the Midwest states, Mato Grosso do Sul, Goiás, Minas Gerais, and São Paulo, leaving only minor areas without impacting national progress. Paraná has also completed harvesting, while activity in the Northeast continues at a slower but seasonally typical pace. The pace has improved in the south. Santa Catarina has completed 80% of its planting, covering 664 thousand hectares (ha), surpassing last year’s 67% and the five-year average of 78.8%. Rio Grande do Sul has harvested 63% of its 6.87 million ha, up from 50% in 2024. Overall, the harvest remains on track and slightly ahead of historical trends, ensuring a stable national supply.

China

China's Grain Supply Unaffected by US Import Decline

Due to abundant global substitutes and ample domestic reserves, China's grain supply is poised to remain stable despite reduced United States (US) feed grain and oilseed imports. The country will receive a record volume of over 30 million metric tons (mmt) of soybeans from South America in the second quarter, helping to alleviate potential shortages and lower animal feed prices. This shift is part of China's broader strategy to diversify its grain sources, increasingly relying on Brazilian soybeans due to the trade tensions, which made US crop purchases less viable. This move should help stabilize domestic soymeal prices, which had spiked to their highest levels since Dec-23, due to delayed Brazilian shipments and ongoing logistical challenges.

Paraguay

Paraguay Eyes Soybean Production Growth Amid Global Tariff Uncertainty and EU Regulatory Challenges

Paraguay, the third-largest global soybean exporter, is navigating a challenging environment due to the ongoing global tariff tensions, which have created uncertainty regarding Chinese demand for its soybeans. Despite these challenges, Paraguay is hopeful that improved weather conditions will bolster its soybean production, which will exceed 10 mmt in the 2025/26 season. This growth is contingent on meeting new European Union (EU) regulations that mandate a deforestation-free supply chain by Dec-25. While exporters are concerned about potential market volatility and the long-term effects of tariffs, farmers remain optimistic. They see the possibility of gaining a competitive advantage and accessing new markets, despite the unpredictability of the global trade situation.

2. Weekly Pricing

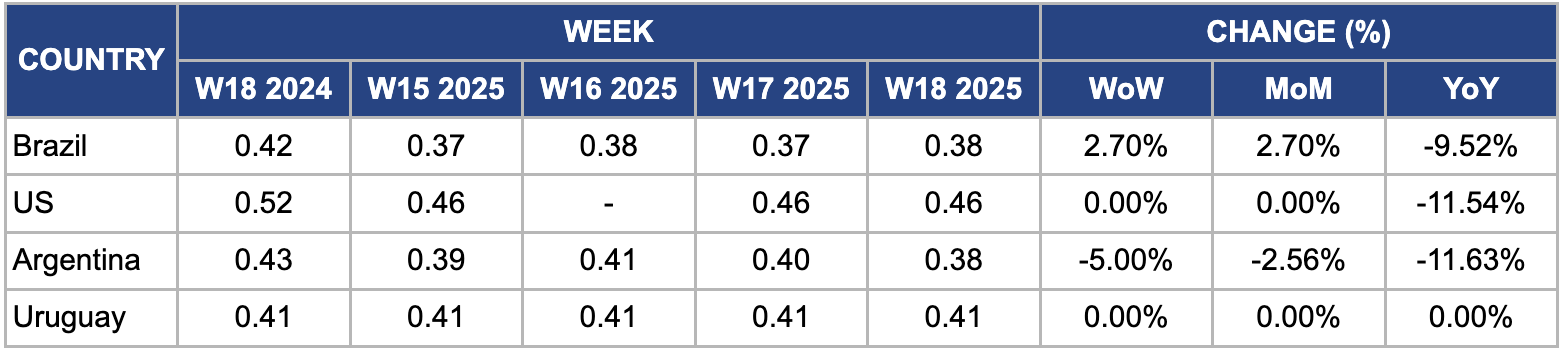

Weekly Soybean Pricing Important Exporters (USD/kg)

Yearly Change in Soybean Pricing Important Exporters (W18 2024 to W18 2025)

Brazil

In W18, Brazil's soybean prices increased by 2.70% week-on-week (WoW) and month-on-month (MoM) to USD 0.38 per kilogram (kg) due to strong export demand. A key factor driving this demand was continued high imports from China, the world's largest importer of soybeans. Despite global supply concerns, Brazil’s soybean exports have remained robust, with steady export volumes. This consistent demand, coupled with the high 2024/25 production estimate of 169 mmt, provided confidence in the market and supported price growth. Moreover, the weaker Brazilian real has made Brazilian soybeans more price-competitive on the global market, further bolstering exports and contributing to the upward price trend.

United States

In W18, US soybean prices remained unchanged WoW, but decreased 11.54% year-on-year (YoY) to USD 0.46/kg. This price decline was due to a slow pace of farmer sales, as cash prices for soybeans remain below growers' desired levels. Dealers noted that marketing activity was sluggish, with farmers less inclined to sell their crop at current price levels. Many growers are prioritizing spring fieldwork and planting over marketing their grain. Moreover, rainy weather and wet field conditions in the Midwest have caused delays. However, improving weather in the central Midwest is expected to speed up planting in the coming days, which could influence future supply dynamics.

Argentina

In W18, Argentina's soybean prices declined 5% WoW, 2.56% MoM, and 11.63% YoY to USD 0.38/kg. This decrease is due to steady progress of the coarse grain harvest, impacted by a prolonged period of stable weather across much of the country. According to a meteorology specialist, favorable weather conditions will continue, with no rain forecasted until at least Monday or Tuesday of the W19 in the core region. Although southeastern Buenos Aires may experience some coastal clouds, the central region will remain dry, further supporting the harvesting process. Despite favorable weather, the slower pace of harvest, combined with reduced global demand for soybeans, contributed to the price decline.

Uruguay

In W18, Uruguay's soybean prices remained steady WoW at USD 0.41/kg, reflecting a balance between recovering domestic production and subdued global market conditions. Following a severe drought in 2023 that slashed output to 700 thousand metric tons (mt), Uruguay's 2024/25 soybean harvest rebounded significantly, with production estimated at 3.1 mmt. This recovery was supported by favorable weather conditions and improved yields, bringing production levels closer to the five-year average. Despite the production rebound, international soybean prices have been under pressure due to record harvests across South America, particularly in Brazil, leading to an oversupply internationally.

3. Actionable Recommendations

Leverage Export Markets for Price Stability

Brazil and Paraguay should continue strengthening relationships with key soybean importers, particularly China, which remains the world’s largest importer of soybeans. In addition to solidifying existing trade agreements, these nations should explore the possibility of long-term, government-to-government deals and focus on emerging markets in Africa and Southeast Asia where demand for soybeans is growing. By diversifying export destinations, countries can reduce their dependence on a single market, mitigating risks associated with trade disruptions, tariff wars, or fluctuations in demand from major buyers. This approach can help ensure price stability and secure consistent export volumes, even in global market volatility.

Enhance Supply Chain Efficiency

Soybean-producing countries, particularly Brazil, should prioritize investments in their transportation and logistics infrastructure to mitigate delays and reduce the impact of price volatility. They must upgrade road networks, enhance port capacity, and improve storage facilities to accommodate increased soybean volumes. With a weaker Brazilian real making exports more competitive, a more efficient supply chain can facilitate quicker exports, reduce bottlenecks, and prevent overstocking or understocking. Enhanced logistics will ensure a steady flow of soybeans to meet international demand, maintain price competitiveness in the global market, and boost the overall marketability of South American soybeans.

Support Sustainable Farming Practices

As global regulations become stricter on sustainability, especially with the EU's deforestation-free supply chain mandate, South American soybean producers, particularly in Brazil and Paraguay, should invest in sustainable farming practices to meet international standards. This could involve adopting precision agriculture technologies that reduce resource consumption, such as water and fertilizer, and improve crop yield efficiency. Furthermore, implementing traceability systems to monitor and verify sustainable production practices will ensure compliance with growing environmental regulations and enhance market access, particularly to environmentally-conscious consumers and traders. By adopting these practices, producers can secure access to global markets that prioritize sustainability, which could give them a competitive edge in the long run.

Sources: Tridge, Hellenic Shipping News, UkrAgroConsult