In W19 in the sugar landscape, some of the most relevant trends included:

- Cuba's sugar industry is facing severe declines, with production at less than 20% of targets for the 2024/25 harvest, causing a substantial shortfall against domestic demand.

- India's sugar prices remain mostly stable amid balanced supply-demand and lower quotas, with production expected to rebound significantly in 2025/26.

- Ukraine has exported nearly 500,000 mt of sugar in 2024/25, with Türkiye, Libya, and the EU as key markets. However, EU import restrictions threaten future exports and have led to a projected 15 to 20% reduction in sugar beet cultivation.

- Brazil's sugar prices declined due to a weaker BRL, enhancing export competitiveness. Production for 2025/26 is forecast to rise, potentially increasing exports and price volatility.

- Pakistan’s sugar prices are steady WoW but elevated YoY, with regional tensions causing panic buying and potential disruption of supply chains and trade flows between Pakistan and India.

1. Weekly News

Cuba

Cuba's 2024/25 Sugar Harvest Falls Drastically Short of Targets

Cuba's sugar industry is facing a severe downturn, with national production reaching less than 20% of planned targets as the current 2024/25 harvest nears completion. As of W19, output is expected to fall below one-quarter of domestic demand, highlighting a significant shortfall and ongoing challenges within the sector.

India

Sugar Prices Hold Steady in India During W19 as Supply-Demand Stays Balanced

In W19, domestic sugar prices in India remained mostly stable for the third consecutive week in key markets such as Maharashtra and Karnataka. However, prices in Uttar Pradesh declined slightly by USD 0.12 to 20 per quintal (INR 10 to 20/quintal). Market dynamics are being influenced by need-based demand and a lower monthly quota, maintaining a balanced supply-demand scenario. S-grade sugar in Kolhapur ranged from USD 44.33 to 45.04/quintal (INR 3,790 to 3,850/quintal), and M-grade sugar in Muzaffarnagar was priced between USD 46.67 and 48.19/quintal (INR 3,990 and 4,120/quintal). Meanwhile, sugar production in India is expected to see a significant rebound in the 2025/26 season.

Ukraine

Surging Ukraine's Sugar Exports Prompts EU Pushback Amid Market Concerns

As of May 1, 2025, Ukraine exported 494,000 metric tons (mt) of sugar in the 2024/25 marketing year (MY), with 196,600 mt shipped between Jan-25 and Apr-25. The world market absorbed 90% of these exports, with Türkiye accounting for 16%, Libya 11%, and the European Union (EU) with 10% as the top destinations. The Ukrainian government has highlighted the sector's strategic value, particularly in agro-processing and renewable energy. However, the European Commission (EC) is considering curbing Ukrainian sugar imports following complaints from EU producers about market disruptions and falling prices, raising concerns of a potential trade conflict.

Ukraine Sets Higher Sugar Export Target as MAPFU Urges Agro-Processing Expansion

The Ministry of Agrarian Policy and Food of Ukraine (MAPFU) held a meeting with sugar industry stakeholders to discuss export performance and plans. MAPFU's Minister highlighted sugar as a key value-added product, noting its importance to the agricultural sector. Over 217,000 hectares (ha) of sugar beet have been sown this year, and nearly 200,000 mt of sugar have already been exported. For MY 2025/26, Ukraine aims to increase sugar exports to 700,000 mt. The Minister also urged producers to expand into agro-processing sectors such as biogas, bioethanol, biomethane, and livestock farming.

EU Quotas Prompt 15 to 20% Cut in Ukraine’s Sugar Beet Acreage for 2025

Ukraine’s sugar beet cultivation area is projected to decline by 15 to 20% in 2025 due to EU export quotas. The First Deputy Minister of Agrarian Policy and Food stated that farmers are reducing plantings from 260,000 ha to approximately 210,000 ha amid uncertainty over market access. He emphasized that this is a clear example of how restrictions under the EU’s autonomous trade preferences are directly impacting crop structure.

United Kingdom

NFU Sugar Welcomes UK Decision to Exclude Sugar Concessions in FTA with India

The National Farmers' Union Sugar (NFU Sugar) has praised the decision not to include the United Kingdom (UK) sugar market concessions in the Free Trade Agreement (FTA) with India. This decision follows NFU Sugar's campaign, which has opposed preferential access for Indian sugar, arguing it would harm UK beet growers competing with India's heavily subsidized sugar production. India's sugar subsidy regime, deemed illegal by the World Trade Organization (WTO) in 2021, remains in place due to an ongoing appeal. NFU Sugar’s chairman welcomed the government's stance, emphasizing the importance of maintaining a fair and competitive market for the UK's efficient sugar industry.

2. Weekly Pricing

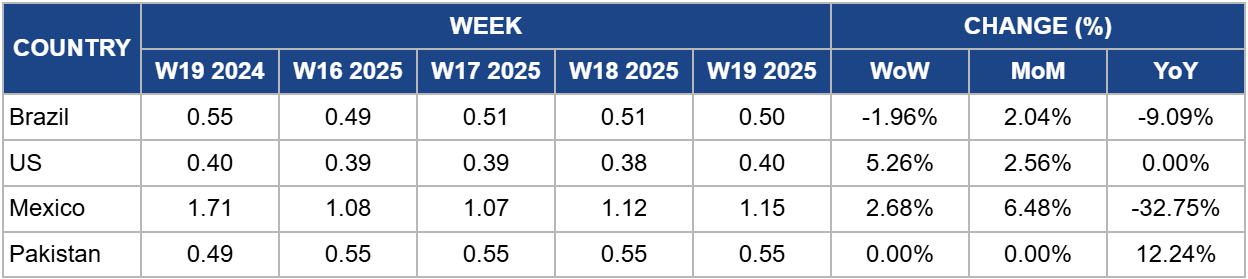

Weekly Sugar Pricing Important Producers (USD/kg)

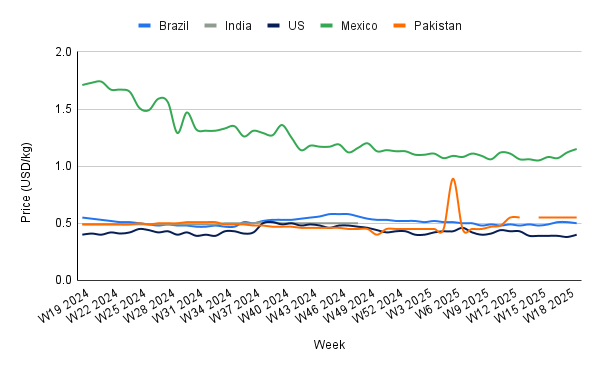

Yearly Change in Sugar Pricing Important Producers (W19 2024 to W19 2025)

Brazil

In W19, Brazil's sugar prices fell to USD 0.50 per kilogram (kg), reflecting a 1.96% week-on-week (WoW) decrease and a 9.09% year-on-year (YoY) decline from USD 0.55/kg. This weekly drop is partly due to the weakening of the Brazilian real (BRL), which fell to a two-week low against the United States dollar (USD), providing a competitive advantage for Brazil's sugar exports. The weaker currency has encouraged export sales, as Brazilian sugar becomes more affordable on the international market. Brazil's sugar outlook for the 2025/26 season is promising, with the Brazilian Sugarcane Industry Association (UNICA) reporting a 1.3% YoY increase in Center-South production for Apr-25, reaching 731,000 mt. The National Supply Company (CONAB) also forecasts a 4% YoY increase in total sugar production to 45.875 million metric tons (mmt). While higher production could boost exports and potentially lower domestic prices, ongoing currency weakness and rising global demand may drive price volatility.

United States

In W19, US sugar prices rose to USD 0.40/kg, reflecting a 5.26% WoW and a 2.56% month-on-month (MoM) increase from USD 0.39/kg. Favorable spring planting conditions in key sugar beet regions, such as Idaho, Oregon, and Washington, have enabled early sowing, with minimal replanting required. This suggests strong yield potential for the 2025 crop, despite a planned 2% decline in planted acreage. While an increase in domestic sugar production could exert downward pressure on prices later in the year, risks such as late-season frost or water shortages may disrupt yields and prevent significant price declines.

Mexico

In W19, Mexico’s sugar prices rose to USD 1.15/kg, marking a 2.68% WoW increase but remaining 32.75% below last year’s USD 1.71/kg. The 2024/25 sugar production is forecasted at 5.02 mmt, representing a 6.8% annual recovery supported by favorable rainfall mitigating previous drought impacts. Improved weather conditions are expected to enhance sugarcane yields and sucrose levels, potentially boosting output this season. Despite production progress showing a 4.2% decrease through W19 compared to last year, field and agro-industrial yields have improved by 4.8% and 7.8%, respectively. Lower national sugar consumption in 2023/24 by 4.1% is projected to moderately rebound by around 1% in 2024/25. Continued recovery in production and yields may stabilize prices, but the significant YoY decline suggests ongoing market caution influenced by recent weather-related disruptions and consumption trends.

Pakistan

In W19, Pakistan’s sugar prices remained steady at USD 0.55/kg, showing no weekly or monthly change but marking a 12.24% YoY increase from USD 0.49/kg. The price stability reflects a balanced supply situation, though the YoY rise indicates tightening fundamentals or rising costs. However, escalating military tensions between Pakistan and India have triggered panic buying and hoarding of essential goods, including sugar, in Indian border regions, which could disrupt regional supply chains and trade flows. Prolonged conflict risks increasing market uncertainty, potentially impacting sugar demand and prices in both countries.

3. Actionable Recommendations

Enhance Market Stability through Strategic Trade and Production Planning

Major sugar producers like India, Brazil, and the US should monitor currency fluctuations and geopolitical tensions (e.g., Pakistan-India) closely to adjust export strategies and manage price volatility. India's anticipated production rebound offers a timely opportunity to stabilize regional supply, while Brazil and the US must balance increased output with external demand and domestic price support.

Sources: Tridge, AgroPolit, Ukr AgroConsult, Agravery, NFU, Chini Mandi, Martí, South China Morning Post, Debate