W19 2025: Sunflower Oil Weekly Update

In W19 in the sunflower oil landscape, some of the most relevant trends included:

- Kazakhstan's sunflower oil sector is expanding rapidly, driven by government incentives and strong production growth. In Q1-2025, output rose 23.1% YoY, exports grew 29%, and imports fell 6.8%. Kazakhstan also plans to boost acreage and trade with China.

- Russia reduced its sunflower oil export duty slightly in May-25, but a higher reference price offset most of the FOB cost relief. Prices declined slightly WoW, yet remained over 32% higher YoY due to tight seed supply, rising costs, and global price alignment.

- Türkiye increased sunflower seed imports 4.3 times YoY in Q1-2025 due to depleted stocks, mainly sourcing from Romania and Moldova. Despite higher domestic demand, the country maintained stable export volumes, especially to North Africa, the Middle East, and the EU.

- Ukraine's sunflower seed harvest is forecast to shrink by nearly 20% in MY 2024/25 due to adverse weather and smaller planting areas. Despite this, oil export volumes are expected to remain stable, supported by adequate seed stocks and processing continuity.

1. Weekly News

Kazakhstan

Kazakhstan Accelerates Sunflower Oil Growth with Strong Output

Kazakhstan's sunflower oil industry continues to expand, supported by strong policy measures and production growth. In Q1-2025, sunflower oil output rose 23.1% year-on-year (YoY) to 210.2 thousand metric tons (mt). In 2024, oilseed acreage reached 2.9 million hectares (ha), yielding 3.3 million metric tons (mmt) of oilseeds, a 53% increase from 2023.

The country operates 88 processing plants with an annual capacity of 4.7 mmt. Vegetable oil production totaled 753 thousand tons in 2024, marking a 12% YoY increase, while exports surged by 29% YoY, led by demand from China and Uzbekistan. Imports fell by 6.8%. Kazakhstan has implemented reduced value-added tax (VAT), preferential loans, and a 20% export duty on raw sunflower to boost domestic processing. Plans include expanding oilseed acreage to 3.3 million ha and enhancing trade with China through new sanitary agreements.

Russia

Russia Slightly Lowers Sunflower Oil Export Duty but Trade Impact Remains Limited

Effective May 1, 2025, Russia reduced its export duty on sunflower oil slightly to USD 55.56/mt (RUB 4,500/mt), down from USD 56.41/mt (RUB 4,568.7/mt) in Apr-25, while raising the reference price used for duty calculation to USD 1,090.5/mt. The export duty on sunflower meal increased to USD 11.65/mt (RUB 943.6/mt). These measures will remain in effect through August 31, 2026. Although the duty cut offers minor free-on-board (FOB) relief, the higher reference price offsets potential price reductions. India, a major importer, saw a 3% YoY decline in imports from Nov-24 to Mar-5 due to sustained price premiums over palm and soybean oils. The overall impact on trade is expected to be limited, with Indian imports likely to remain stable unless broader global market dynamics shift.

Türkiye

Türkiye Boosts Sunflower Seed and Oil Imports Amid Low Stocks

Between Jan-25 and Mar-25, Türkiye significantly increased sunflower seed imports by 4.3 times YoY to 396 thousand mt due to low domestic stocks. Romania and Moldova emerged as the leading suppliers, providing 201 thousand and 168 thousand mt, respectively. Sunflower oil imports also rose, reaching 308 thousand mt during the same period. Despite strong domestic demand, Türkiye maintained robust export volumes, shipping 186 thousand mt abroad, on par with Q1-2024. Key export destinations included Ethiopia, Libya, Sudan, Syria, Iraq, Saudi Arabia, and European Union (EU) member states.

Ukraine

Ukraine Maintains Sunflower Oil Export Outlook Despite 20% YoY Drop in Harvest

Ukraine's sunflower harvest for the 2024/25 marketing year (MY) is estimated at 12 mmt, nearly 20% below last year due to reduced sown areas and adverse weather, including heat and drought. Despite the smaller crop, processing and export forecasts remain stable. As of early May-25, sunflower seed stocks totaled 3.6 to 3.7 mmt, sufficient to meet processing needs and support the projected sunflower oil export volume of 4.7 mmt.

2. Weekly Pricing

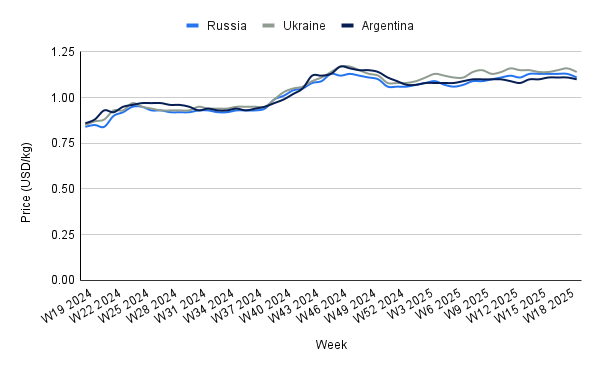

Weekly Sunflower Oil Pricing Top Producers (USD/kg)

Yearly Change in Sunflower Oil Pricing Top Producers (W19 2024 to W19 2025)

Russia

In W19, Russia’s sunflower oil prices declined to USD 1.11 per kilogram (kg), marking a 1.77% week-on-week (WoW) and month-on-month (MoM) decrease, despite remaining 32.14% higher YoY. This annual rise reflects tight sunflower seed supply due to adverse weather, increased input costs, and global price alignment with Ukrainian and Argentine offers. The recent marginal cut in Russia’s sunflower oil export duty to USD 55.56/mt offers limited FOB relief, as the concurrently raised reference price offsets most gains. As a result, prices are unlikely to fall significantly in the near term.

Ukraine

Ukraine's sunflower oil prices declined to USD 1.14/kg in W19, reflecting a 1.72% WoW drop despite a 34.12% YoY increase from USD 0.85/kg. The short-term price decrease is linked to weakening export demand, especially as Russian sunflower oil prices dropped by USD 20 to 30/mt, intensifying competition at Black Sea ports where Ukrainian prices fell to USD 1,120-1,125/mt. Additionally, lower palm oil prices and geopolitical uncertainty in South Asia are shifting some demand away from sunflower oil toward cheaper alternatives.

Domestically, processors continue to offer USD 639.13 to 651.19/mt for sunflower seeds with 50% oil content, but oversupply from farmers and limited processing margins are capping upward price movement. Strong sowing progress, at 47% completion as of W19, and favorable weather in Ukraine and Russia are expected to raise harvest and production forecasts, which could further pressure prices for the upcoming crop.

Argentina

Argentina’s sunflower oil prices slightly declined to USD 1.10/kg in W19, down 0.90% WoW and MoM, reflecting subdued short-term demand despite strong fundamentals. In addition, Argentina's sunflower production in 2025 is projected at 4.7 mmt, the highest level in 25 years and a substantial increase from 3.8 mmt in 2024. This surge, driven by favorable weather, improved yields, and expanded planting, has boosted average yields in key regions like Buenos Aires and La Pampa by 17% YoY. Processing volumes are expected to reach 4.12 mmt, up from 3.78 mmt, yet may be constrained by capacity limitations. This imbalance between supply and crushing infrastructure could cap domestic prices unless export channels absorb the surplus.

3. Actionable Recommendations

Diversify Procurement to Hedge Against Black Sea Volatility

Given weather-related production risks in Ukraine and volatile pricing from Russia, buyers should diversify sunflower oil procurement to include Argentina and Kazakhstan. This will mitigate supply chain disruptions and protect against price fluctuations driven by export duties or geopolitical uncertainty.

Advance Sales Before Global Supply Pressures Intensify

Exporters, particularly in Ukraine, should front-load sunflower oil shipments in Q2-2025 and Q3-2025 to capture current price levels before expanded global output, especially from Argentina and Kazakhstan, drives prices lower in late 2025.

Sources: Tridge, Agro Sektor, Ukr AgroConsult, Sinor, Super Agronom, Agro Spectrum, Sud Oeste