In W21 in the coffee landscape, some of the most relevant trends included:

- Coffee prices show significant volatility across producing countries, with sharp increases in both Brazil and Colombia driven by weather and supply disruptions. Vietnam experienced a short-term price decline despite a strong YoY gain.

- Export volumes are tightening in key markets, with Brazil's Apr-25 shipments down 28% YoY and Vietnam’s volume falling despite high prices. In contrast, Ethiopia saw a surge in both volume and revenue due to improved quality and digital market access.

- Vietnam generated USD 4.2 billion in export revenue by mid-May 2025, making coffee its second-highest agricultural export, and earnings could reach USD 7 billion if high prices persist.

- Production outlooks remain mixed across major coffee producers. Colombia forecasts an 18.1% increase in 2024/25, marking its highest output since 1992. Mexico reports slight gains, though persistent structural issues such as low productivity and labor shortages constrain growth. Vietnam expects production to rise in 2025/26, but stockpiling and export uncertainty may limit short-term availability.

1. Weekly News

Global

Leading Five Coffee Producers Contribute More Than 70% of the World's Supply

According to 2024 data from Statista, global coffee production remains highly concentrated in five countries.Brazil, Vietnam, Colombia, Indonesia, and Honduras, account for over 70% of total output. Brazil leads with more than 63 million 60-kilogram (kg) bags annually, followed by Vietnam and Colombia. These nations benefit from ideal growing conditions within the coffee belt, including abundant rainfall, mild temperatures, and fertile soils. The predominance of Arabica or Robusta beans varies by country, contributing to distinct flavor profiles essential to the global market. Long-standing investment in agricultural practices further supports their leading roles in coffee production.

Brazil

Brazil's Coffee Revenue to Surpass USD 22.6 Billion in 2025

According to the Brazilian Consortium for Research and Development of Coffee (CBP&D/Café), Brazil's gross coffee revenue for the 2025 coffee year is projected at USD 22.64 billion (BRL 127.88 billion), a 59.2% year-on-year (YoY) increase over 2024 and more than double the 2023 figure. Coffea arabica accounts for USD 16.47 billion (BRL 93.05 billion), representing 72.7% of total production, driven by a 60% YoY increase. Minas Gerais is the leading producer, generating USD 11.60 billion (BRL 65.55 billion). Coffea canephora contributes USD 6.16 billion (BRL 34.82 billion), accounting for 27.3% of total production. Espírito Santo leads production, with an output of USD 4.03 billion (BRL 22.80 billion). These figures are based on producer prices collected between Jan-25 and Apr-25 and reflect robust growth across Brazil's main coffee-producing states.

Chile

Coffee Consumption in Chile Shows Strong Preferences and Emerging Premium Trends

A recent study by the Corporation for Market and Public Opinion Research (CORPA) reveals that coffee is a deeply ingrained habit in Chile, with 73% of adults consuming it at least once a week, driven primarily by enjoyment of flavor (56%) and the need for energy (33%). Instant powdered coffee remains the dominant format, preferred by 66% of consumers, particularly among middle and lower-income segments. While traditional formats prevail, premium options like whole bean and capsule coffee are gaining popularity among younger and higher-income consumers. On average, Chileans drink 10 cups per week, primarily at home and in the mornings. Conducted in collaboration with EXPO Café, the research offers strategic insights for brands and producers aiming to navigate and innovate within Chile's evolving coffee market.

Ethiopia

Ethiopia Nears Record USD 2 Billion in Coffee Exports for 2024/25 Following Strong Volume Growth

Ethiopia is poised to surpass USD 2 billion in coffee export revenue for 2024/25, with earnings already reaching USD 1.87 billion in the first ten months, a YoY increase of 87%. Export volumes rose 70% to 354,302 metric tons (mt), driven by reforms, quality control improvements, and expanded digital market access. Germany, Saudi Arabia, and the United States (US) remain key buyers.

Mexico

Mexico's Coffee Output Rises Modestly in 2024/25 Despite Low Productivity and Ongoing Structural Challenges

In Mexico, coffee production is forecast to rise slightly to 3.87 million bags in 2024/25, led by Arabica gains, though Robusta output declined due to heat stress. Productivity remains low, averaging under six bags per hectare (ha). Soluble coffee leads exports, while green coffee imports are increasing to support domestic processing. Structural issues, including limited farm renovation, labor shortages, and disease management, continue to challenge producers.

Vietnam

Vietnam Coffee Export Revenue Hits USD 4.2 Billion, Poised to Reach USD 7 Billion in 2025 Amid Soaring Prices

Vietnam earned USD 4.2 billion from coffee exports as of May 15, 2025, despite a 5.5% YoY drop in export volume to nearly 736,600 mt. This 56.7% surge in value was driven by a sharp increase in the average export price, which rose 66.3% to USD 5,709/mt. Coffee has become Vietnam's second-highest agricultural export earner, surpassing seafood and vegetables. Major buyers include Germany, Italy, Spain, the US, Japan, and Russia, all showing significant import growth. Although domestic green bean prices have softened slightly, export earnings for 2025 could reach USD 7 billion if current trends persist. The United States Department of Agriculture (USDA) forecasts a rise in Vietnam's coffee output in 2025/26, despite short-term supply constraints due to stockpiling by farmers.

2. Weekly Pricing

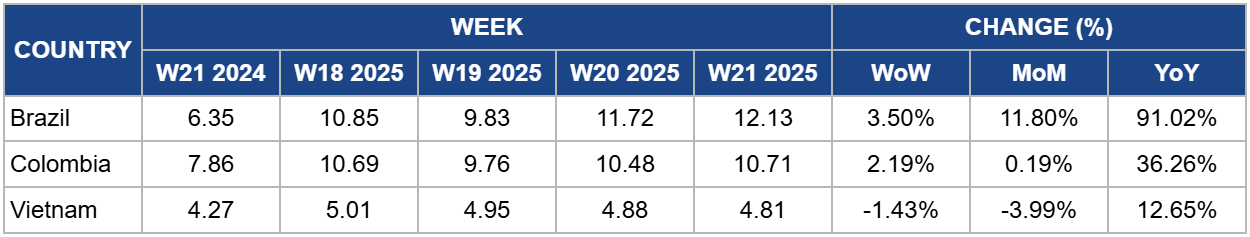

Weekly Coffee Pricing Important Exporters (USD/kg)

Yearly Change in Coffee Pricing Important Exporters (W21 2024 to W21 2025)

.png)

Brazil

In W21, Brazil's coffee price rose to USD 12.13/kg, up 3.50% week-over-week (WoW) and 91.02% YoY from USD 6.35/kg. This continued price increase reflects growing market concerns over weather-driven supply risks, particularly in Minas Gerais, which received only 2.5 millimeters (mm) of rain, or 12% of the historical average in W20. On the supply side, bullish pressure is supported by falling exports. Data from the Brazilian Coffee Exporters Council (Cecafe) shows Brazil's Apr-25 green coffee exports dropped 28% YoY to 3.05 million bags, with cumulative Jan-25 to Apr-25 exports down 15.5% YoY. This suggests tightening global availability, reinforcing upward price momentum.

Colombia

Colombia's coffee prices rose marking a 2.19% WoW to USD 10.71/kg in W21, and a 36.26% YoY gain from USD 7.86/kg. On a month-on-month (MoM) basis, prices rose by 0.19%, indicating a consistent but moderate upward trend. This increase likely reflects short-term tightening in supply due to harvest delays from unseasonal rains, alongside steady export demand. Despite these challenges, Colombia's coffee production is forecast to grow 18.1% to 15 million 60-kg bags in the 2024/25 season, according to the National Federation of Coffee Growers of Colombia (FNC). If realized, this would be Colombia's highest output since 1992, potentially easing upward price pressure in the medium term. However, persistent weather variability and supply chain disruptions may continue to influence price volatility. Given Colombia's role as the leading exporter of washed arabica, buyers may move to secure contracts in advance amid concerns of logistical uncertainty or regional competition, particularly as global demand for premium arabica remains firm.

Vietnam

In W21, Vietnam's coffee prices declined to USD 4.81/kg, marking a 1.43% WoW decrease and a 3.99% MoM drop. This represents the fourth consecutive weekly decline, suggesting a short-term easing of demand or improved supply conditions, possibly driven by ongoing harvest inflows or lower export volumes. Despite this recent softening, prices remain 12.65% higher YoY from USD 4.27/kg in W21 2024, indicating persistent structural cost pressures, such as rising input expenses or evolving trade dynamics. While the current price dip may offer buyers temporary relief, the sustained elevated YoY levels point to a relatively tight market outlook that necessitates ongoing monitoring of Vietnam’s production and export trends.

3. Actionable Recommendations

Lock in Long-Term Supply Contracts Amid Export Tightness and Price Volatility

With Brazil and Colombia experiencing sharp YoY price increases and Vietnam facing stockpiling behavior, importers should secure forward contracts now to mitigate further cost escalation. Priority should be given to Arabica from Colombia and Brazil, where robust demand and weather risks are elevating market prices. Buyers should also monitor Vietnam’s supply trends closely and consider diversifying the origin mix to ensure stability.

Invest in Premiumization Strategies in Brazil and Colombia

As Brazil's coffee revenue surges, brands should deepen partnerships with producers offering traceable, high-grade beans. Investments in origin marketing, certifications, and supply chain transparency can help tap into growing demand in North America, Europe, and emerging specialty markets like Chile. Targeting younger and affluent consumers through capsule and whole-bean offerings can further drive brand differentiation.

Expand Market Presence in High-Growth, Underserved Regions Like Chile and Ethiopia

Chile's evolving coffee habits present a strategic entry point for specialty roasters and global coffee chains. Meanwhile, Ethiopia’s near-doubling of export earnings due to quality improvements and digital access makes it an increasingly attractive origin for specialty sourcing. Firms should invest in tailored marketing campaigns in Chile and build sourcing partnerships in Ethiopia that highlight traceability, flavor diversity, and sustainability credentials.

Sources: Tridge, Agrolink, Vietstock, Comunica Café, Portal Innova, Billiken, Nasdaq