W22 2025: Olive Oil Weekly Update

In W22 in the olive oil landscape, some of the most relevant trends included:

- The US delayed a proposed 50% tariff on EU olive oil imports to July 9, maintaining a 10% rate as of W22. This has created uncertainty in the market and prompted EU exporters to diversify into alternative markets.

- Spanish producers are shifting focus toward China to offset losses from the US market and maintain international competitiveness.

- Tunisia's olive oil prices and revenues remain under pressure despite a rise in export volumes. Bulk shipments continue to dominate, and value addition remains limited. Reforms are urged to enhance branding and strengthen the country's global presence.

- Malta's production fell 69% YoY due to extreme weather, though quality was maintained through agricultural management. Supply shortages have led to price increases for local oils.

1. Weekly News

European Union

US Delays 50% Tariff on EU Olive Oil as Exporters Face Market Uncertainty

The United States (US) has delayed a proposed 50% tariff on European Union (EU) imports, including olive oil, to July 9th, amid stalled trade negotiations. As of W22, EU olive oil faces a 10% US tariff, down from an initial 20% announced in Apr-25. The US is the EU’s largest olive oil customer, importing over 250,000 mt annually, more than 90% of its total imports. Despite a 7% rise in US olive oil imports so far in the 2024/25 crop year, uncertainty over future tariffs is prompting European exporters to seek alternative markets. Meanwhile, EU export values have fallen 32% year-on-year (YoY) due to harvest rebounds in key producing countries.

Malta

Extreme Weather Slashes Malta’s Olive Oil Output, Driving Up Local Prices

Malta's olive oil production plummeted in the 2024/25 crop year due to extreme weather, including heatwaves, strong winds, and insufficient rainfall. The country produced just 37 mt of olive oil, a 69% drop from the previous year and 48% below the four-year average. Growers reported severe damage to blossoms and disrupted pollination across multiple flowering periods. Despite the low yield, producers maintained quality through irrigation, pest control, and soil management. While domestic output fell sharply, most of Malta's olive oil is imported, and prices for local premium oils have risen amid limited supply.

Spain

Spain Shifts Olive Oil Focus to China Amid US Tariff Disruptions

Recent US tariff policies have disrupted global trade, impacting Spain’s olive oil industry, a sector that accounts for about 50% of global production and is crucial to the Spanish economy. In response, Spanish producers are intensifying efforts to expand into the Chinese market. Industry leaders view China as a strategic growth area to offset losses from the US market and ensure continued international competitiveness.

Tunisia

Tunisia Urged to Strengthen Olive Oil Strategy Following Falling Prices and Weak Global Presence

Tunisian olive oil exports have faced challenges due to declining global prices and limited marketing efforts. While exports of packaged olive oil rose by around 10% in the 2024/25 season, exports remain in bulk and are priced lower than those of Italy and Spain. Experts have emphasized the need for a clearer national promotion and marketing strategy, greater international presence, and stronger engagement in promising markets such as China, India, and Africa. Insufficient action is negatively affecting farmers and the broader economy, prompting calls for the development of a distinct Tunisian agricultural identity.

2. Weekly Pricing

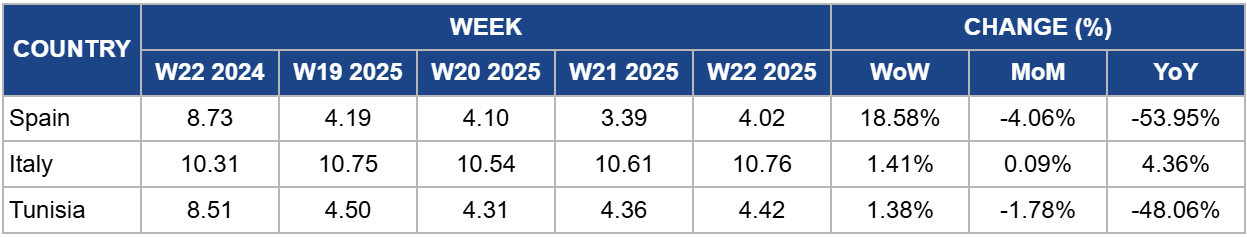

Weekly Olive Oil Pricing Important Exporters (USD/kg)

Yearly Change in Olive Oil Pricing Important Exporters (W22 2024 to W22 2025)

.png)

Spain

Spain's wholesale olive oil price rose sharply to USD 4.02 per kilogram (kg) in W22, reflecting an increase of 18.58% week-on-week (WoW) but still down 53.95% YoY from USD 8.73/kg. This rebound follows months of price correction after record highs, driven by improved domestic production and increased imports from lower-cost countries like Portugal and Tunisia. Despite the sharp YoY decline, Spain maintains a positive trade balance, exporting far more than it imports, over 778,000 mt in 2024 alone. However, the ongoing price volatility and competition from third-country imports may continue to pressure domestic producers. Unless value-added exports and branding improve, Spanish olive oil prices may remain below previous peaks despite short-term gains.

Italy

Italy's olive oil price rose to USD 10.76/kg in W22, a 1.41% WoW increase and a 4.36% YoY rise, supported by tight supply following a 32% drop in the 2024/25 harvest due to drought, heat, and pest damage. Despite resilient international demand, upward pressure on prices may intensify due to recent trade developments. A new 20% US tariff on EU olive oil adds cost burdens, though a temporary 90-day suspension offers short-term relief. If tariffs persist, Italy may face reduced competitiveness in non-EU markets, potentially shifting export flows toward intra-EU trade and sustaining elevated prices through 2025.

Tunisia

Tunisia's wholesale olive oil price reached USD 4.42/kg in W22, rising 1.38% WoW but remaining sharply down 48.06% YoY from USD 8.51/kg. Despite a 40.1% YoY increase in export volume during the first six months of the 2024/25 campaign, export revenues fell 28.9%, reflecting significant price erosion. The average price for extra virgin olive oil declined nearly 49% in Apr-25, indicating persistent oversupply and limited value addition. As bulk exports continue to dominate, accounting for 88.1% of exports, Tunisia's price recovery will likely depend on increasing packaged and organic olive oil sales, which currently contribute only modestly to total revenue. Without structural shifts, downward pressure on prices is expected to persist.

3. Actionable Recommendations

Accelerate Market Diversification with Strategic Outreach

European and North African olive oil exporters, particularly Spain, Italy, and Tunisia, should reduce reliance on the US market by expanding into high-growth regions such as China, India, and the Gulf States. This requires tailored promotional campaigns, partnerships with local distributors, and participation in international food fairs to raise brand visibility and adapt to regional consumer preferences.

Develop and Promote Value-Added and Packaged Olive Oil Products

Producers should prioritize the development of packaged, organic, and origin-certified olive oils to combat price erosion from bulk exports, especially in Tunisia. Governments and industry bodies should support this transition through marketing assistance, certification programs, and incentives for small and mid-sized producers to upgrade processing facilities.

Enhance Resilience Through Climate-Adaptive Cultivation and Quality Assurance

Producers should invest in irrigation systems, integrated pest management, and soil health monitoring in light of weather-related production volatility, notably in Malta and Italy. At the same time, implementing robust quality control systems will help maintain product standards, justify premium pricing, and build resilience against climate and trade disruptions.

Sources: Tridge, CGTN, Olive Oil Times, African Manager, Oleo, Maldita