In W24 in the orange landscape, some of the most relevant trends included:

- Egypt continues to export oranges despite tight supply and soaring prices. High local demand from juice concentrate factories is reducing export volumes and pushing prices up to USD 1,000/mt.

- Morocco is managing a difficult orange season with a 30% YoY drop in production. However, improved fruit quality and early season closures in competing countries are supporting stable demand for the Maroc Late variety.

- US orange production in Florida is forecasted to reach 12 million boxes in 2025, a 3% monthly increase. However, this remains 34% below the previous year due to ongoing challenges from citrus greening and storm damage.

- Egyptian exporters are responding to supply pressures by securing additional orchards to prepare for the next season and plan to conclude current shipments by mid-August.

1. Weekly News

Egypt

Egyptian Orange Exports Continue Despite Supply Constraints and Price Surge

Egypt continues to export oranges during a season marked by tight supply and a sharp price increase, with rates doubling compared to last year following the Eid holiday in Apr-25. The surge is largely driven by high local demand from newly established orange juice concentrate factories, which have absorbed large volumes of smaller-sized fruit, reducing availability for export. While some exporters shortened their campaigns in response, others remain active in key markets across Eastern Europe, Africa, the Gulf, and Western Europe. Current export prices range from USD 800 to 1,000 per metric ton (mt) Free On Board (FOB), a significant rise from last season’s average of USD 460/mt. Exporters plan to conclude the season by mid-August and are already securing additional orchards to stabilize supply for the next campaign.

Morocco

Morocco Navigates Challenging Orange Season with Reduced Maroc Late Volumes

Morocco’s orange season is progressing with the Maroc Late variety, which runs through August, with steady demand and pricing in markets such as Canada, Europe, and the Middle East. Early season closures in Egypt and Spain created favorable market conditions, but Morocco’s production has declined by 30% year-on-year (YoY) due to drought, pest pressures, and natural yield variation. The reduced presence of Egyptian oranges has opened up market space for Moroccan exporters, though growth remains limited by water constraints. Growers are cautiously optimistic, supported by improved fruit quality and a strong local market that values premium produce.

United States

Florida Orange Production Sees Modest Recovery but Remains Far Below Previous Season

Florida’s orange production is showing modest signs of recovery, with the United States Department of Agriculture’s (USDA)’s Jun-25 forecast increasing total output to 12 million boxes, up 3% from May-25 but still 34% YoY below the previous season. This includes 4.6 million boxes of non-Valencia and 7.4 million boxes of Valencia oranges, reflecting gains across both categories. While last season saw a rare YoY increase, the industry continues to face long-term challenges such as citrus greening and hurricane damage. Recovery efforts are ongoing, with state support aimed at helping the industry regain stability.

2. Weekly Pricing

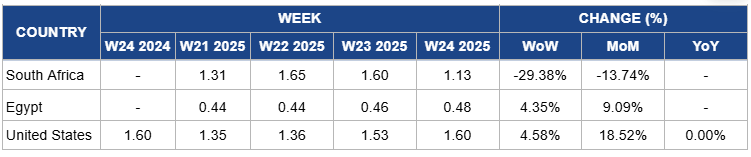

Weekly Orange Pricing Important Exporters (USD/kg)

Yearly Change in Orange Pricing Important Exporters (W24 2024 to W24 2025)

South Africa

In W24, orange prices in South Africa fell sharply by 29.38% week-on-week (WoW) and down 13.74% month-on-month (MoM) to USD 1.13 per kilogram (kg). This steep decline resulted from increased volumes being diverted to juicing rather than fresh markets. High orange juice prices made processing far more lucrative, reducing the supply of fresh oranges available. Additionally, a slight uptick in local production and steady domestic output cushioned the market, while ongoing logistical issues with port handling and European Union (EU) phytosanitary restrictions limited fresh export opportunities, further easing pressure on domestic prices.

Egypt

Egypt's orange prices rose 4.35% WoW to USD 0.48/kg and climbed 9.09% MoM in W24. This increase is due to the export season winding down. A sharp drop in fresh harvest volumes following abnormal heat during flowering slashed yields by about one-third, creating tighter domestic availability. Additionally, oranges are being redirected toward processing, driven by booming juice concentrate markets, further reducing fresh fruit supply and supporting higher prices

United States

Orange prices in the United States (US) increased by 4.58% WoW to USD 1.60/kg in W24, reflecting an 18.52% MoM increase with no YoY change. This is due to tighter supplies driven by a continued decline in Florida’s orange production, which remains historically low following hurricane damage in previous seasons and the persistent impact of citrus greening disease. At the same time, demand has remained steady, particularly from the fresh consumption and processing sectors, contributing to upward price pressure. Imports have only partially offset the local shortfall, keeping prices elevated.

3. Actionable Recommendations

Invest in Drought-Resilient Practices to Maximize Market Gaps

Orange producers should invest in water-efficient irrigation systems and drought-resilient rootstocks to sustain output during dry seasons and capitalize on reduced competition in key markets. For example, growers can adopt micro-drip systems, mulching, and deficit irrigation techniques to reduce water loss while maintaining fruit quality. Planting drought-tolerant varieties or grafting onto rootstocks like Carrizo or Cleopatra can also enhance resilience. These measures allow producers to maintain export volumes when others exit the market early, especially in regions like Europe and the Middle East, where seasonal supply gaps offer higher pricing potential.

Strengthen Disease and Weather Resilience to Stabilize Yields

Orange producers should prioritize integrated disease and climate risk management to stabilize long-term production. This includes adopting tolerant rootstocks to combat citrus greening, implementing frequent tree health monitoring, and using biocontrol methods like beneficial insects. To mitigate storm-related losses, producers can reinforce orchard infrastructure with windbreaks and drainage systems. These combined efforts help maintain a consistent supply and reduce vulnerability to yield shocks across key production regions.

Sources: Tridge, Agro Fruits Egypt, Datamarnews, Freshplaza, Portalfruticola, USDA