W26 2025: Tomato Weekly Update

In W26 in the tomato landscape, some of the most relevant trends included:

- South Korean agricultural services, the Chungnam Agricultural Research and Extension Services and Geumsan-gun, are set to distribute new high-brix, disease-resistant tomato varieties to local farmers. They will also provide farmers with pheromone traps to combat the invasive tomato hornworm.

- Producer crises are affecting key regions, with farm-gate prices in Adana, Turkey, collapsing below production costs due to a lack of industrial demand. Meanwhile, Spanish farmers are facing a devastating season, marked by a 20% acreage drop and conflicts with processors.

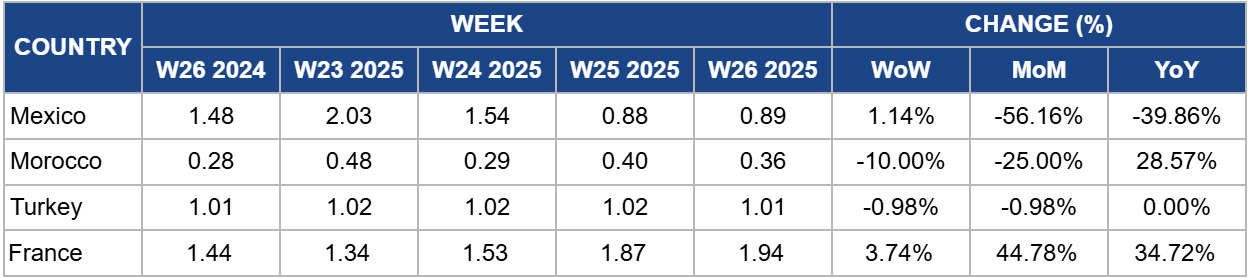

- Prices diverged sharply across major exporters: France saw a 44.78% MoM surge to USD 1.94/kg amid supply shortages, while Morocco's prices fell 10% WoW to USD 0.36/kg. In contrast, Turkey maintained stable export pricing at USD 1.01/kg, gaining market share in Germany.

- Mexico's market faces significant uncertainty, with a potential ~21% US tariff looming as the Tomato Suspension Agreement nears its end. Meanwhile, Peru is thriving in a high-value niche segment, exporting USD 14.6 million in tomato seeds in early 2025.

1. Weekly News

Korea

Chungnam Agricultural Service to Distribute New High-Brix, Disease-Resistant Tomatoes to Farmers

In partnership with the Rural Development Administration, the Chungnam Agricultural Research and Extension Services, a South Korean agricultural organization focused on research and development, held a market evaluation meeting in Seoul to assess two new varieties of jujube-shaped cherry tomatoes.

The two new varieties, T.Y.Mighty and T.Y.Mashito, were presented to wholesale distributors for quality verification. For instance, the T.Y. Mighty is a red cherry tomato noted for its exceptional consumer appeal, boasting a high sugar content of 8.3 Brix. Its value to growers is reinforced by its heat resistance and strong resilience to several common tomato viruses, making it a very stable variety for cultivation. Complementing this, the T.Y. Mashito offers a slightly larger fruit and is also praised for its yield and sugar content. This variety is particularly well-adapted to various challenges, as it is resistant to a broader range of diseases and grows well in lower temperatures, providing a robust option for cooler climates or seasons.

Based on the positive evaluation, the research service company plans to create an artificial crossbreed of the two varieties and begin distributing them to farmers by the end of the year. The organization stated its commitment to developing high-quality tomatoes that meet consumer demand, using feedback from these wholesale market evaluations to guide its efforts.

Geumsan Ag Center Arms Farmers Against Invasive Tomato Pest

The Geumsan-gun Agricultural Technology Center (Ag Center) in South Korea is distributing a second round of control supplies to help local farmers manage the invasive tomato hornworm. The support package includes pheromone traps, mating disruption agents, and specific medicines to minimize crop damage. The tomato hornworm poses a significant threat because it reproduces rapidly, with up to 12 generations per year, and can overwinter in greenhouses, thereby increasing the risk of developing pesticide resistance. The pest causes damage by boring into the leaves, stems, and even the mature fruit of tomato plants. Officials are emphasizing the need for early and active control, as the pest's habit of tunneling inside the plant makes it difficult to manage once an infestation takes hold, posing a significant risk to farmers' income.

Turkey

Adana Tomato Prices Plummet Below Production Cost

In Adana, a key agricultural region in Turkey, the farm gate price of tomatoes has dropped significantly, causing financial hardship for farmers. Farm gate prices have fallen to USD 0.075 to 0.13 per kilogram (TRY 3 to 5/kg), down from USD 0.15 to 0.18/kg (TRY 6 to 7/kg) last year. Producers state that these low prices do not cover their cultivation costs of approximately USD 1003.98 per acre (TRY 40,000/acre), pressuring profit margins for the 2024/25 season. In response, the head of a local agricultural chamber is calling for government support for the struggling farmers. Additionally, farmers report that a lack of market demand for industrial tomatoes is a primary cause of the price collapse, which has seen prices for tomato paste varieties hit a low of USD 0.075/kg (TRY 3/kg). This issue is part of a wider problem, as agricultural leaders note that Adana farmers have been unable to make a profit from any of their products this year.

Spain

Corteva Launches New Fungicide in Spain to Protect Key Potato and Tomato Crops

Corteva has launched a new fungicide in Spain called Zorvec™ Entecta®, designed to protect potato and tomato crops. The product specifically targets downy mildew, a significant disease that thrives in humid conditions and significantly reduces crop yield and quality in Spain's important potato and tomato industries.

Zorvec™ Entecta® features the active ingredient fluthiazolinone and combines two modes of action to provide preventive, curative, and anti-spore effects. It is noted for its ability to protect new plant growth, remain effective even after rain, and offer long-lasting protection. Additionally, the fungicide can be used in conjunction with other products to effectively manage resistance issues, helping farmers improve profitability and sustainability while meeting stringent regulations.

Extremadura Farmers Warn of Acreage Drop

The Farmers' Union of Small Farmers and Livestock Producers of Extremadura (UPA-UCE) is warning of a "ruinous" tomato season, which will be late and have 20% less planted acreage than last year. They blame the low prices offered by processing industries and delays from earlier rains for the situation. This late start pushes the main harvest into the riskier months of September and October, creating concerns about the impact of high temperatures on crops and leading to higher insurance costs for growers. Due to the inactivity of the Regional Government of Extremadura, the union has reported the situation to Spain's Food Information and Control Agency (AICA) for alleged violations of the Food Chain Law.

Peru

Peru's Tomato Seed Exports Reach USD 14.6 Million in Early 2025

Between Jan-25 and Apr-25, Peru exported USD 14.6 million worth of tomato seeds, according to a report by the consulting firm Agrodata. The Netherlands was the primary destination, purchasing 76% of the total shipments. The leading exporting company was Natucultura SA, which accounted for 72% of the total value. The total export value of tomato seeds from Natucultura SA amounted to nearly USD 11 million.

2. Weekly Pricing

Weekly Tomato Pricing Important Exporters (USD/kg)

Yearly Change in Tomato Pricing Important Exporters (W26 2023 to W18 2024)

Mexico

In W26, Mexico’s wholesale tomato price reached USD 0.89/kg, representing a 1.14% increase week-on-week (WoW). However, this small gain contrasts with a sharp 56.16% drop month-on-month (MoM) and a 39.86% decline year-on-year (YoY). The pricing environment reflects broader instability in the Mexican tomato sector, driven in part by the looming expiration of the Tomato Suspension Agreement on July 14, 2025, which threatens to impose a ~21% tariff on fresh tomato exports to the US. Given that Mexico supplies nearly 90% of US fresh tomato imports, the end of this agreement could significantly reshape the trade landscape.

Morocco

In W26, Morocco’s tomato prices dropped to USD 0.36/kg, down 10% WoW and 25% MoM, though still 28.57% higher YoY. The declines are attributed to production constraints caused by persistent drought in the Souss-Massa region and labor shortages as workers shift to more lucrative crops like blueberries and raspberries. Nonetheless, Moroccan tomato exports remain stable overall, particularly in the European Union (EU), where they continue to capture market share.

Turkey

In W26, Turkey’s wholesale tomato price was USD 1.01/kg, reflecting a slight 0.98% decline WoW and MoM, while showing no change YoY. The stable annual pricing suggests relative consistency in Turkey’s export position, even as domestic farmers in Adana face significant stress due to farm-gate prices falling below production costs. On the export front, Turkish tomatoes continue performing well, with growing demand in Germany, where beef tomato varieties have helped Turkey strengthen its market share amid supply gaps from other exporters.

France

In W26, France’s tomato price rose to USD 1.94/kg in W26, marking a 3.74% increase WoW, a 44.78% increase MoM, and a 34.72% rise YoY. These sharp comparative gains are largely due to supply constraints, including a 2% YoY decline in national production, driven by acreage reductions and adverse weather in southern regions. While demand for larger-caliber tomatoes remains strong in the domestic market, producers of smaller tomatoes continue to face pricing pressure from lower-cost Moroccan imports.

3. Actionable Recommendations

Adopt New Varieties and Implement Proactive Pest Control

Growers should proactively seek to acquire and cultivate the new tomato varieties once they are distributed, as seen in the example from Korea. Their high-brix content can command better consumer prices, while their strong resistance to heat, disease, and pests will lower cultivation risks and potentially increase stable yields. Additionally, farmers must immediately deploy the control supplies provided by the local agricultural advisory service. As seen in Korea, the tomato hornworm's rapid reproduction and ability to overwinter necessitate the early and aggressive implementation of pheromone traps and mating disruption agents to prevent devastating crop and income losses.

Pivot to Export Markets and Diversify Crop Varieties

With domestic prices for industrial tomatoes collapsing below production costs, producers must aggressively shift their focus to export markets. Tridge data shows Turkish tomatoes are gaining market share in Europe at a stable price of around USD 1.01/kg, offering a vital lifeline compared to the volatile domestic market. Farmers in regions like Adana should evaluate shifting acreage away from industrial tomatoes, which are facing a demand crisis. Instead, they should plant varieties in high demand in export markets, such as the Turkish beef tomatoes that are performing well in Germany, to align production with profitable market opportunities.

Prepare for Tariff Impact

This is a critical and urgent recommendation, not just for Mexican traders, although Mexican tomatoes account for 90% of the market share in the US. All parties involved in the US-Mexico tomato trade must prepare for the termination of the Tomato Suspension Agreement on July 14, 2025. Mexican exporters should be negotiating contract terms with US buyers to address how the ~21% duty will be handled. US importers should budget for significantly higher costs and secure supply chains to avoid disruption.

Sources: Tridge, Agrinet-KR, Kamu3, Afl News, Foodmate, Agraria, Agrodiario