W27 2024: Wheat Weekly Update

.jpg)

1. Weekly News

Europe

EU Wheat Harvest Forecast Adjusted Downwards; Argentina and Russia Updates for 2024/25 MY

The European Commission (EC) has adjusted its forecast for the European Union’s (EU) wheat harvest in the 2024/25 marketing year (MY) to 121.9 million metric tons (mmt), slightly below the previous year's 125.6 mmt. Meanwhile, exports for the 2023/24 MY are projected at 33 mmt. In France, the proportion of wheat crops rated in good or excellent condition decreased by 2% to 60%. Meanwhile, in Argentina, as of June 26, 81% of the planned 6.3 million hectares (ha) of wheat had been planted for the 2024/25 MY, as the Buenos Aires Grains Exchange (BAGE) reported. Its forecast for Russia's wheat exports were reduced in the 2024/25 MY by 1.7 mmt to 46.1 mmt, due to severe heat in key spring wheat regions like Siberia and the Volga region.

Brazil

Rio Grande do Sul Expects 55.27% Increase in Wheat Production Despite Reduced Planted Area

Brazil's southern state of Rio Grande do Sul is expected to produce 4.07 mmt of wheat this season, a 55.27% year-on-year (YoY) increase from the previous cycle, despite a 12.84% reduction in the planted area to 1.3 million ha. This significant increase in production comes after heavy rains in early 2024. If this projection holds, Brazil's role in the global wheat market could shift. The country, which imported 2.76 mmt of wheat from Argentina, the United States (US), and Canada in May-24, may reduce its overall wheat purchases due to increased domestic supply. Additionally, Brazil could seize more export opportunities, with 2.17 mmt of wheat exported through Jun-24. The reduced wheat area reflects the impact of recent flooding, price factors, and challenges related to rural insurance accessibility.

Paraná's Wheat Planting Reaches 96% Completion with 19% Decrease in Area for 2024 Harvest

Wheat planting in Paraná, Brazil, has reached 96%, with the coldest areas still pending completion. This winter, the wheat planting area in Paraná will be 1.15 million ha, a 19% YoY decrease of 1.415 million ha. Despite the reduced planting area, the decision to plant was revised in Jun-24, increasing to 1.12 million ha. This change was driven by late price reactions by producers, although further expansion was limited by seed availability.

India

India's FCI Procures 26.6 MMT of Wheat in Rabi Season 2024/25

The Food Corporation of India (FCI) has procured 26.6 mmt of wheat during the current Rabi Marketing Season 2024/25, surpassing last year's 26.2 mmt. Farmers have received approximately USD 73,045.37 credited to their bank accounts at the Minimum Support Price (MSP) of USD 27.24 per quintal. Notable improvements in wheat procurement were observed in Uttar Pradesh and Rajasthan. The procurement process, which began later than usual in 2024, ensures a steady supply of food grains to the Public Distribution System (PDS) and supports various welfare schemes. Additionally, paddy procurement during the Kharif Marketing Season 2023/24 exceeded 77.5 mmt, benefiting over one crore farmers.

Iran

Iran's Domestic Wheat Purchases Reach 5.6 MMT Worth USD 1.647 Billion Since Apr-24

Iran has purchased approximately 5.6 mmt of wheat worth over USD 1.647 billion from domestic producers since Apr-24 as part of a national plan guaranteeing the purchase of domestic wheat. This marks an 8% YoY increase compared to the 5.125 mmt previously purchased by the government. The Agriculture Ministry reported that the government has paid over USD 692 million to farmers, nearly half of the total amount owed. Khuzestan province leads in wheat supply with 1.6 mmt, followed by Golestan, Fars, and Ilam provinces. The total wheat harvest from irrigated and rainfed fields is estimated to be between 14.5 and 15.5 mmt.

Serbia

Serbia’s Wheat Harvest Expected to Drop 16% YoY in 2024

According to Serbia’s statistics office, the country is projected to harvest 2.9 mmt wheat in 2024, marking a 16% YoY decline. The harvested area is expected to decrease to 549,032 ha from 682,246 ha in 2023, while the yield is anticipated to increase to 5.3 metric ton (mt)/ha from 5.1 mt/ha last year. In 2023, Serbia had harvested 3.449 mmt of wheat, an 11% YoY increase compared to 2022.

2. Weekly Pricing

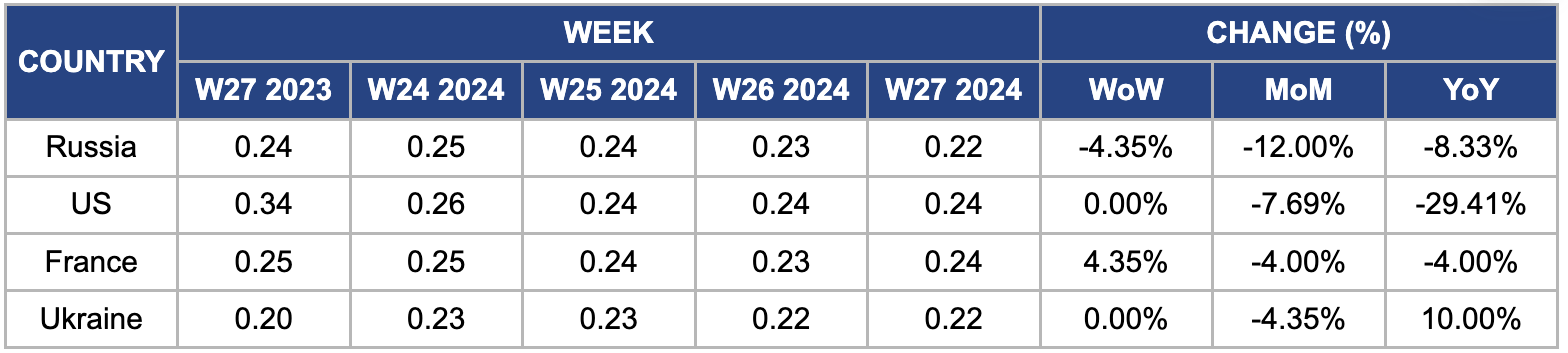

Weekly Wheat Pricing Important Exporters (USD/kg)

Yearly Change in Wheat Pricing Important Exporters (W27 2023 to W27 2024)

Russia

In W27, Russia's wheat prices decreased by 4.35% week-on-week (WoW) to USD 0.22 per kilogram (kg). This decline comes amid forecasts of tighter global wheat supplies due to production challenges in Russia, where weather issues are expected to reduce the 2024 crop size. Estimates vary, with the USDA predicting 83 mmt and other private sources in Russia suggesting even lower figures, possibly below 80 mmt. Experts caution that a smaller Russian wheat crop could lead to significant market volatility once harvest pressures ease, affecting prices.

United States

US wheat prices remained stable at USD 0.24/kg despite a 7.69% month-on-month (MoM) decline. The steady prices can be due to improved wheat crop conditions. As of June 23, approximately 40% of the winter wheat crop had been harvested, with crop conditions improving to 52% rated good or excellent, up from 40% in the previous year. Similarly, spring wheat conditions also showed improvement, with 71% rated good or excellent, marking a substantial 21% increase compared to last year. These improved crop conditions have likely mitigated downward pressure on prices.

France

French wheat prices surged by 4.35% WoW to USD 0.24/kg in W27, reversing previous trends. This increase comes amidst concerns over France's wheat production, affected by the fourth wettest spring on record. Excessive rains have worsened crop forecasts, with the Ministry of Agriculture predicting a 15.4% YoY decline in wheat production to 29.7 mmt, significantly below the five-year average and comparable to levels last seen in 2020. The cultivated area for soft wheat has also decreased by 10.8% compared to 2023, totaling 4.2 million ha, reflecting the challenging agricultural conditions faced this season.

Ukraine

In W27, Ukrainian free-on-board (FOB) wheat prices remained unchanged WoW at USD 0.22/kg but showed a significant 10% YoY increase. This price trend reflects Ukraine's current challenges with a record drought affecting southern regions, leading to anticipated decreases in wheat and barley yields by 5 to 7% YoY. Despite these weather-related setbacks, Ukraine's grain harvest is forecasted to reach around 56 mmt.

3. Actionable Recommendations

Capacity Building and Sustainable Practices

Strengthen procurement systems and infrastructure to support wheat farmers in India and Iran. Enhance MSP mechanisms and streamline procurement processes to ensure fair pricing and timely payments to farmers. Invest in sustainable farming practices and agricultural extension services to promote soil health, water conservation, and productivity improvement. These initiatives will bolster food security initiatives and support rural livelihoods amidst evolving market dynamics.

Technology Adoption for Yield Enhancement

The US and Ukraine should accelerate the adoption of precision agriculture technologies in wheat farming to optimize yields and enhance resilience against climate change impacts. Promote digital farming solutions for precision irrigation, soil management, and pest control to improve crop health and productivity. This technological advancement will empower farmers in the US and Ukraine to maintain high-quality standards and competitiveness in global wheat markets.

Investing in Climate-Resilient Agriculture and Infrastructure

Given the fluctuating weather patterns impacting wheat production in Brazil's Rio Grande do Sul and Argentina, prioritize investments in climate-resilient agriculture. Enhance irrigation infrastructure and promote the adoption of drought-tolerant wheat varieties to mitigate risks associated with weather variability. This strategic approach will bolster production capabilities despite environmental challenges, ensuring stable domestic supply and potentially reducing dependence on imports.

Sources: Hellenic Shipping News, NoticiasAgricolas, Theprint, UkrAgroConsult, Epravda