W36 2025: Sunflower Oil Weekly Update

In W36 in the sunflower oil landscape, some of the most relevant trends included:

- Global supply constraints are driving sunflower oil prices higher, with production projected to decline by 2.3 mmt in 2024/25 and exports falling by 2 mmt YoY. Beginning stocks for 2025/26 are also lower, supporting Aug-25 prices at a 33-month high.

- EU sunflower seed output is forecast down 1.1 mmt due to adverse weather in Bulgaria and Romania, prompting processors to substitute with rapeseed while maintaining strong processing margins.

- Russia expects a record sunflower harvest of 17.8–18 mmt despite an 11% decline in production and exports in MY 2024/25.

- Ukraine’s Aug-25 exports fell to 150,000 mt, the lowest in over three years, while shipments to India, Spain, and Italy increased. Argentina achieved its highest monthly exports in four years at 218,000 mt, supported by robust crushing volumes.

1. Weekly News

Global

Global Sunflower Oil Market Tightens as Output Falls and Stocks Decline

Global sunflower oil markets are facing a tightening supply as production is projected to decline by 2.3 million metric tons (mmt) in 2024/25, pushing Aug-25 prices to a 33-month high. Exports are expected to decline by 2 mmt year-on-year (YoY), though higher shipments from Ukraine and Argentina partially offset Russian reductions. Consumption growth is expected to remain limited at 22.5 mmt, below the previous season’s record, while beginning stocks for 2025/26 are forecast 1–1.1 mmt lower, further curbing availability. Russian sunflower oil prices eased to USD 1,135 per metric ton (mt) free-on-board (FOB) Black Sea for Sep-25 to Oct-25 delivery, undercutting Ukrainian offers of USD 1,180–1,200/mt.

European Union

EU Sunflower Seed Production Falls Following Weather Challenges

European Union (EU) sunflower seed production is forecast to drop by 1.1 mt to 8.3 mmt due to adverse weather in Bulgaria and Romania, creating a supply deficit that processors are expected to offset with increased rapeseed supplies. Aug-25 sunflower oil prices at northern European ports reached USD 1,280–1,300/mt, rising to USD 1,335/mt delivered to buyers, while Ukrainian sunseed prices initially peaked at USD 665.62–677.72/mt (UAH 27,500–28,000/mt) before easing slightly with the start of harvest. High demand for rapeseed, supported by EU and Ukrainian production, is maintaining strong processing margins despite falling prices on the Paris exchange. Exporters are securing Ukrainian non-genetically modified (GM) rapeseed for EU delivery amid limited Canadian and Australian supply options.

Kazakhstan

Kazakhstan Launches Pilot Sunflower Oil Exports to China Under 2026/28 Roadmap

Kazakhstan shipped its first batch of 156 mt of sunflower oil from East Kazakhstan to China’s Jiangsu Province using flexitanks in 40-foot containers, marking a pilot project under the 2026/28 export development roadmap. Organized by Kazakhstan Railways and the National Oilseed Processing Association (NOPA), with Altyn Shyghys Oil Refinery, an oilseed processing plant in East Kazakhstan, handling the shipment. The initiative aims to expand exports to China, the Middle East, and the South Caucasus. The project is expected to boost foreign exchange earnings to over USD 1 billion by 2028, leveraging modern logistics to enhance competitiveness in global sunflower oil markets.

Russia

Indian Importers Seek Sunflower Oil Trade Expansion with Russia

Indian importers of edible oils visited Russian enterprises as part of a reverse business mission, holding talks with EFKO Group, the largest supplier of sunflower oil to India, and Sodruzhestvo Group, the country’s leading oilseed processor. The delegation inspected production facilities, logistics operations, and bulk terminals, while negotiations focused on expanding sunflower oil supplies to India and exploring joint projects to strengthen trade cooperation.

Russia’s Sunflower Oil Sector Set for Growth Despite Agricultural Challenges

Russia’s sunflower oil sector shows resilience amid broader agricultural challenges. In the marketing year (MY) 2024/25, sunflower oil production and exports fell by 11% to 9.5 mmt and 6.75 mmt, respectively, following a difficult year for oilseed producers. For the upcoming season, a record sunflower harvest of 17.8–18 mmt is expected, supporting potential growth in production and exports. Despite low carryover stocks and weather-related risks, rising demand positions sunflower oil as a key segment with strong market prospects.

Türkiye

Türkiye Cuts Sunflower Oil and Seed Import Duties to Support Domestic Processing and Exports

Türkiye is reducing import duties on sunflower seeds from 10% to 12% and on crude sunflower oil from 36% to 30% starting October 1, aiming to boost domestic processing, stabilize local prices, and expand refined sunflower oil exports to the Black Sea and Mediterranean regions. The move comes amid high Black Sea harvest prices, with Ukraine’s sunflower oil demand reaching USD 1,170–1,200/mt FOB and Cost, Insurance, and Freight (CIF) India prices rising to USD 1,300–1,310/mt, driven by supply shortages and higher palm oil costs.

Ukraine

Ukraine’s Sunflower Oil Exports Drop to Three-Year Low Despite Strong Deliveries to Key Markets

In Aug-25, Ukraine’s sunflower oil exports fell to 150,000 mt, marking the lowest monthly volume in over three years, driven by a reduced sunflower harvest, lower processing volumes, and seasonal demand shifts. Total exports in MY 2024/25 reached 4.73 mmt, down 24% from the previous season. Deliveries to key markets increased, with India up 44% to 767,000 mt, Spain up 11% to 656,000 mt, and Italy up 28% to 504,000 mt. Export prices remain high at USD 1,170–1,200/mt FOB, although seasonal supply growth from the Black Sea and rising Asian palm oil availability may put downward pressure on prices in Oct-25 and Nov-25.

2. Weekly Pricing

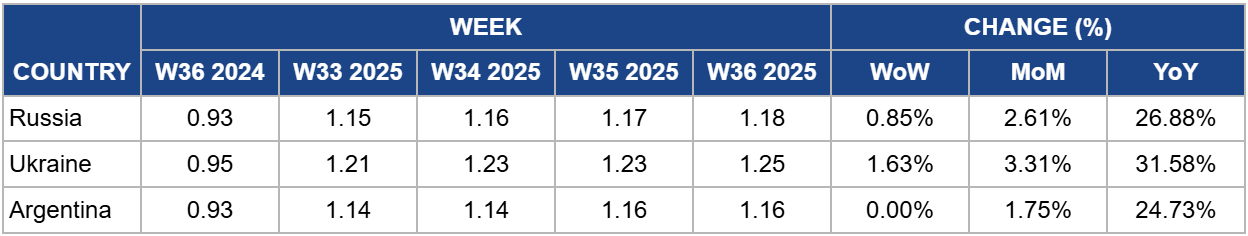

Weekly Sunflower Oil Pricing Top Producers (USD/kg)

Yearly Change in Sunflower Oil Pricing Top Producers (W36 2024 to W36 2025)

.png)

Russia

In W36, Russia’s sunflower oil prices rose 0.85% week-on-week (WoW) to USD 1.18 per kilogram (kg), marking a 26.88% increase YoY from USD 0.93/kg. Despite broader crisis trends in Russian agriculture, the oilseeds sector remains relatively stable, though MY 2024/25 saw a decline in sunflower oil production and exports by 11% amid margin pressures. A record sunflower harvest of 17.8–18 mmt is expected, which, combined with rising demand, could support further price stability or moderate growth. However, low carryover stocks and risks from drought and uncertain weather may sustain market volatility, potentially keeping prices elevated in the short term while positioning sunflower oil as a leading export segment in Russia.

Ukraine

In W36, Ukraine’s sunflower oil prices rose 1.63% WoW to USD 1.25/kg, representing a 31.58% increase YoY. Exports in the 2024/25 agricultural year totaled 4.73 mmt, down 24% from the previous season, with Aug-25 shipments falling to 150,000 mt—the lowest monthly volume in over three years. The decline reflects reduced domestic sunflower supplies, lower processing margins, and seasonal demand shifts, although deliveries to major markets such as India, Spain, and Italy increased. The tight supply and strong demand are maintaining elevated prices, but the start of the new harvest and expected increase in domestic sunflower availability could moderate prices in the coming months, while export policies on alternative oilseeds may continue to influence market dynamics.

Argentina

Argentina’s sunflower oil prices remained stable at USD 1.16/kg in W36, higher 24.73% YoY, supported by a record sunflower crushing in Jul-25 that contributed to strong foreign currency inflows. Sunflower oil exports reached 218,000 mt in Jul-25, the highest monthly volume in four years, reflecting strong demand and consolidating Argentina’s position in global markets. While soybean processing declined due to lower domestic supply, sunflower oil production maintained high capacity utilization, sustaining price stability. Going forward, continued strong crushing volumes and export demand are likely to support sunflower oil prices, although fluctuations in input availability and competing oilseed markets could moderate future gains.

3. Actionable Recommendations

Enhance Export and Processing Coordination Across Key Producers

Industry stakeholders in Ukraine, Russia, and Argentina should focus on aligning harvest, crushing, and export schedules to maximize supply availability amid tight global markets. Investments in logistics, storage, and processing capacity can help convert high sunflower yields—such as Russia’s record 17.8–18 mmt harvest and Argentina’s robust crushing volumes—into stable export flows, supporting price stability and maintaining market share in key destinations like India, Spain, and Italy.

Monitor and Strategically Respond to Policy and Duty Changes

Exporters, importers, and traders should actively track changes in import duties and trade policies, such as Türkiye’s reduced sunflower seed and crude oil tariffs, as well as Russia’s evolving export conditions. Flexible sourcing strategies, forward contracts, and hedging instruments can mitigate risks from policy-driven price volatility while capitalizing on emerging opportunities for refined oil exports to the Black Sea, Mediterranean, and Asian markets.

Promote Climate-Resilient and Diversified Production

Producers in the EU, Black Sea region, and Argentina should prioritize climate-resilient sunflower varieties, improved irrigation systems, and regional diversification to offset yield risks from adverse weather and drought. Strengthening adaptive practices will help sustain global supply, support processing margins, and protect against sharp price fluctuations caused by weather-induced production shortfalls.

Sources: Tridge, Oil World, Grain Trade, Ukr Agroconsult, Sinor, Data Portuaria