South African Citrus Producers to Benefit from UK Citrus Deregulation

UK post-Brexit Deregulation on Citrus

The UK government has announced that imports of citrus fruits to South Africa will be deregulated post-Brexit, which means that the original EU phytosanitary restrictions will no longer be in place. This deregulation means that exporting countries such as South Africa will no longer have to comply with EU regulations when exporting fruits to the UK.

Producers in South Africa and Latin America will be able to export citrus fruits without the need for a phytosanitary certificate, which reduces bureaucracy and allows producers to respond more quickly to changes in UK market demand. The South African citrus industry is currently awaiting further clarification of phytosanitary and other regulations.

Imports of Oranges and Mandarins: More than 50% from Non-EU Countries

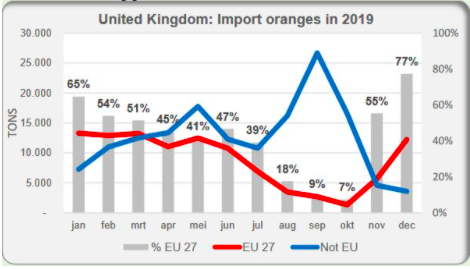

In 2019, 58% of the oranges in the United Kingdom came from countries outside of the European Union. The UK imported a total of about 265K tons of oranges annually, and with more than 90K tons, Spain is the leading supplier. In terms of mandarins, non-EU imports accounted for 51% of the total imported volume.

South Africa already sends a 1/4 of its mandarins to the UK. Exports from South Africa totaled 295K tons. Of this 26% - 76K tons went to Britain.

The UK deregulation is of extreme importance for orange and mandarin suppliers outside the EU, as the UK market represents USD 580 million for both of the products. The EU mandarin import value from the UK in 2019 was USD 373 million while oranges accounted for USD 206 million.

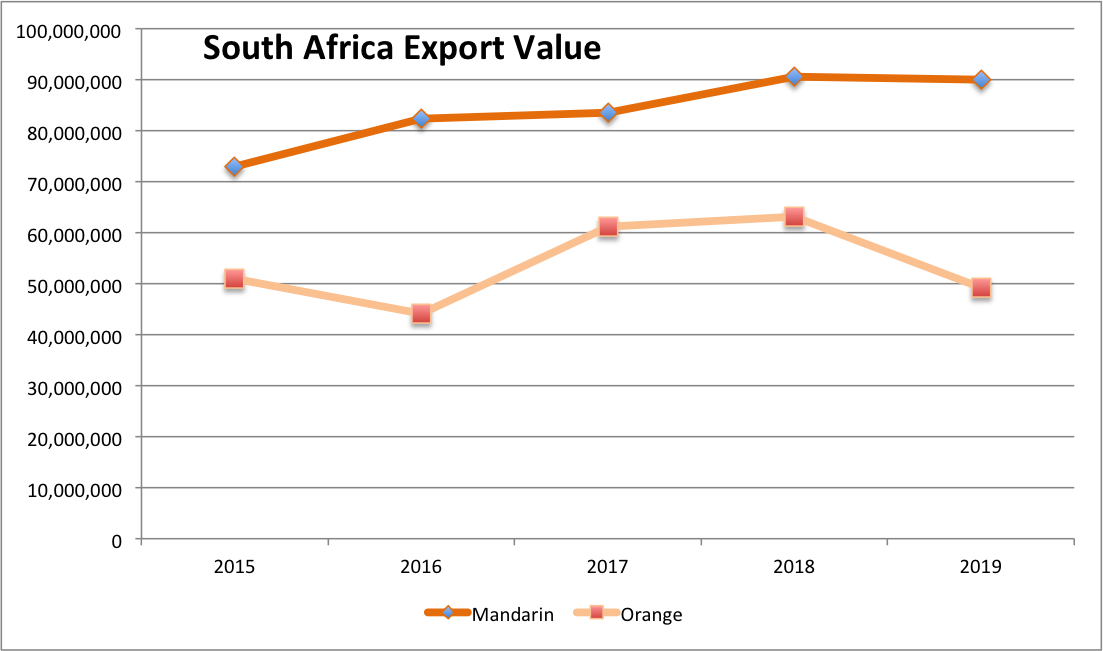

In both of the products, South Africa is the second largest exporter behind Spain, a EU country which is the main re-exporter in Europe for both of the fruits, making South Africa the main non European supplier in both cases. South Africa exports value in 2019 for both products was USD 102.2 million in 2019, compared to the USD 245 million re-exported from Spain.

For the UK mandarin market, Spanish oranges have a strong lead with 43% of the share and South Africans follow with 24%. which makes it a market with bigger opportunities for non-EU exporters to take some of that share led by spanish mandarin re-exports.

As for the UK orange market, Spain leads the share with 36.6% (2019), followed by South Africa with 24% and then Egypt (18.3%), Germany (5.7%). South Africa has been notably increasing its participation in the UK market in recent years, having a very successful 2018 and gaining a 32% share that year.

Source: Tridge

Source: Tridge

Source: Tridge

Source: Tridge

Positive Production Forecast for 2021

South African production is expected to increase by 3% to 1.7 million tonnes due to anticipation of good weather conditions, an increase in harvested area due to new plantings of high yielding varieties with late ripening, and better water management.

Exports are expected to increase slightly to 1.3 million tonnes and represent more than a quarter of world trade. The EU is expected to remain South Africa's largest sales market, accounting for more than a third of exports.

South African citrus Celebrates Record-breaking Export Season

The Citrus Grower's Association in South Africa announced a record-breaking 2020 export season that delivered 146 million cartons of South African citrus to the rest of the world.

These figures indicate phenomenal growth within the South African citrus industry, which remains the second largest exporter of fresh citrus in the world after Spain.

The citrus industry is expected to increase its exports by another 300K tons over the next three years. The growth projections for mandarins, lemons and Valencia oranges alone indicate an expected additional ZAR 6.8 billion (USD 456 million) in foreign exchange earnings and the creation of 22,250 sustainable jobs over the next three years.

South African citrus exporters now face no quota restrictions in exporting their produce to the UK, which had been the case when the country had been a member of the EU.

A New Market Dynamics for Citrus in Europe

The UK citrus deregulation will bring a more direct and wider competition for the UK market, as non-European suppliers will gain direct access to the British market. Spain and other European re-exporters, such as the Netherlands, are in for more competition for the European market as they will have to compete with lower prices and a not restricted access to the market.

It will also bring a direct channel for South African producers that are interested in diversifying their Northern European distribution directly through the UK without the need of dealing with current EU phytosanitary procedures as the ones they have today when shipping to Spain or any other country in the EU.

Sources:

Fresh Plaza. ¨The UK opens up to citrus exporters¨

Farmers Weekly. "Clarification wanted on relaxation of UK citrus export rules"

Fresh Fruit Portal. "Global orange and soft citrus production to rise in 2021, with lemons and limes set to fall"

El Heraldo. "Gran Bretaña se abre a los exportadores de cítricos"

Fresh Plaza. OVERVIEW GLOBAL ORANGE MARKET