1. Weekly News

Global

Extreme Weather Disrupts Global Orange Supply and Spurs Industry Changes

Extreme weather, including severe flooding in multiple regions and prolonged droughts worldwide, have severely impacted global orange crops. Spain, the world's largest exporter of oranges in 2022, has been particularly affected. Causing an estimated USD 205 million in damages, the flooding has led to the lowest global orange juice availability in nearly 50 years. Spain's USD 3.65 billion orange industry faces significant challenges, with rising prices impacting global costs. In response to the challenges, farmers are diversifying into crops like mandarins and seeking alternative suppliers from countries such as Egypt, Greece, Morocco, Argentina, and Peru.

Spain

Vega del Guadalquivir Region Faces Challenges with Smaller Citrus Yield and Market Competition

In Spain's Vega del Guadalquivir region, 20 to 30% of the 2024/25 citrus crop has been harvested. The Navelina variety leads the harvest, with producers now starting the harvest of the Salustiana variety. While production for the 2024/25 season has increased compared to 2023, the final yield is expected to be lower due to smaller fruit sizes, complicating sales, especially with slow market activity during the Christmas season. Despite the expected lower yield due to smaller fruit sizes, orange prices have risen slightly to USD 0.26 per kilogram (EUR 0.25/kg), raising expectations that the post-Christmas market will recover. Producers are also concerned about competition from Egyptian oranges, which impacted last year's marketing campaign.

Turkey

Turkey's Orange Production Declines in 2024/25 Due to Heat and Drought

Turkey's orange production is forecasted to decrease by 36% year-on-year (YoY) in marketing year (MY) 2024/25, reaching approximately 5 million metric tons (mmt). This decline is mainly due to excessive heat during the blooming period and drought conditions during the harvest.

As a result, citrus prices in supermarkets are expected to rise, while orange exports will decline. However, reduced output from competing countries may lead to higher revenue. The yield is projected to fall by 30%, with early varieties like Navelina and Fukumoto being hit hardest. Despite higher farmgate prices, their price gap with supermarket prices remains wide, primarily due to increased transportation and storage costs. Consequently, orange consumption is anticipated to fall to 1.2 mmt in MY 2024/25.

The Antalya province, Turkey's main orange-producing region, is also facing challenges from the Mediterranean fruit fly, which threatens fruit quality.

United States

Florida's Citrus Industry Struggles as Orange Production Declines

Florida's orange production has fallen by 92% since the 2003/04 season, primarily due to natural disasters, diseases, and broader issues such as climate change, anti-science politics, and unchecked development. This dramatic decline has not only disrupted the local supply of fresh oranges but also weakened Florida’s once-thriving citrus identity. The state now imports oranges from California, further reducing its citrus industry's prominence. These challenges raise concerns about the future of Florida's agricultural landscape and its ability to maintain a competitive position in the global market.

Mexico

Orange Production in Mexico Recovers After Drought Impact

Despite a three-month drought in early 2024 affecting the Martínez de la Torre region, Mexico’s orange production is expected to normalize next year. The drought, which lasted from April to June, caused a temporary decline in citrus fruit production. The Secretary of Agricultural, Rural, and Fisheries Development has confirmed that the situation has improved, and no current drought conditions are present. This assurance indicates that production will recover for 2025.

2. Weekly Pricing

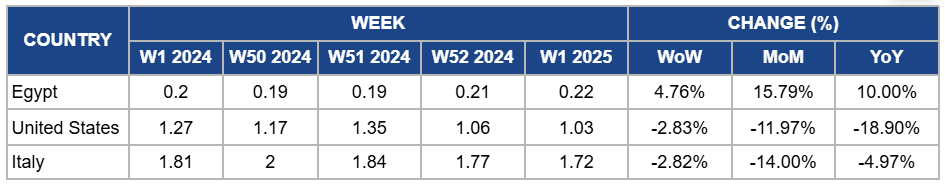

Weekly Orange Pricing Important Exporters (USD/kg)

Yearly Change in Orange Pricing Important Exporters (W1 2024 to W1 2025)

Egypt

Egypt's orange prices rose by 4.76% week-on-week (WoW) to USD 0.22/kg in W1, with a 15.79% month-on-month (MoM) increase and a 10% YoY increase. The price increase is due to the continued seasonal peak of orange production during winter, which has driven higher market activity and supported increased pricing. Additionally, strong domestic demand and favorable export opportunities have contributed to the upward trend, as Egypt remains competitive in the global orange market. While supply levels remain robust, steady demand has kept prices elevated compared to earlier months.

United States

Orange prices in the US dropped by 2.83% WoW to USD 1.03/kg in W1, reflecting an 11.97% MoM drop and an 18.90% YoY decline. This is due to reduced consumer demand during the post-holiday period and increased reliance on imports, particularly from California, as Florida's orange production continues to face significant challenges. While production in Florida remains historically low due to the lingering effects of hurricanes, diseases like citrus greening, and broader issues such as climate change, the supply from other regions has helped stabilize market availability, exerting downward pressure on prices. Additionally, ongoing efforts by growers to improve yields through plant growth regulators and other scientific advancements may have slightly alleviated supply constraints, contributing to the price decline.

Italy

In Italy, orange prices dropped by 2.82% WoW to USD 1.72/kg in W1, reflecting a 14% MoM decline and a 4.97% YoY decline. The price drop is due to the continued oversupply from the conclusion of the Sicilian Navelina orange campaign, which has placed downward pressure on prices. Additionally, the market shift towards Tarocco oranges, now in full production, has increased supply levels further, exacerbating the decline. These combined factors, along with stable domestic demand, have contributed to the ongoing reduction in orange prices in Italy.

3. Actionable Recommendations

Revitalize Florida’s Citrus Industry

Florida citrus growers should adopt disease-resistant orange varieties and modern agricultural techniques, such as advanced irrigation systems and precision farming, to mitigate the impacts of climate change and diseases. Collaborating with research institutions to develop innovative solutions and investing in local branding initiatives will help restore the state’s citrus prominence and reduce dependency on imported oranges.

Enhance Crop Resilience and Diversify Supply Chains

Orange producers in Spain should focus on adopting climate-resilient farming methods, such as flood-resistant rootstocks and advanced water management systems, to mitigate the effects of extreme weather. Simultaneously, exporters and industry players should strengthen partnerships with alternative suppliers, including Egypt, Greece, and Morocco, to ensure a stable orange supply and maintain market competitiveness amid global disruptions.

Sources: Tridge, Asaja Córdoba, Flying penguin, Jornadaveracruz, Pulsoslp, TCD, USDA