W10 2025: Mango Weekly Update

In W10 in the mango landscape, some of the most relevant trends included:

- Guatemala and India expect strong mango harvests in 2025 due to favorable weather conditions. Meanwhile, Peru faces losses from overproduction.

- Droughts impacted Guatemala's 2024 exports, while atypical rains in Mexico and climate variations in Peru caused early flowering, overproduction, and price declines.

- Rising freight costs challenge India’s mango exports. Mexican producers face potential US tariffs that could disrupt market access.

- While India sees strong global demand, Peru’s oversupply led to a sharp price drop, forcing farmers to take drastic measures to manage excess fruit.

1. Weekly News

Guatemala

Strong Recovery Expected in 2025 for Guatemala’s Mango Industry

Following a drought-induced decline in 2024, Guatemala’s mango industry is expected to recover in 2025, with production and exports returning to average levels. In 2024, Guatemala exported 3.5 million 4 kilogram (kg) boxes of mangoes, representing a 19.9% year-on-year (YoY) drop from the 4.3 million 4-kg boxes exported in 2023. The exports were valued at approximately USD 9 million. However, projections for 2025 estimate exports will reach 4.6 million boxes, a 31% YoY increase, driven by favorable weather conditions and improved rainfall stabilizing production cycles. The harvest season runs from March to May, peaking in April, with the Tommy Atkins variety dominating exports at 90%, followed by Keitt at 8%, while Kent and Ataulfo hold smaller shares. With mango trees capable of producing fruit for up to 50 years, Guatemala’s mango sector remains well-positioned for long-term growth.

India

India Expects Strong Mango Harvest with Rising Global Demand

India anticipates higher mango production this season, driven by increased farmer engagement and favorable weather conditions, with temperatures between 24 to 30 degrees Celsius (°C). High-quality varieties like Alphonso, Kesar, and Badami continue to see strong export demand, while international interest in Langra and Dasheri is rising. Logistics has improved compared to last year, though rising freight rates remain a concern, particularly for shipments to the United States (US) and Europe. Key export destinations include the US, United Kingdom (UK), and European markets such as the Netherlands, Germany, and Italy. There is also strong demand from the Middle East and growing interest from Asia-Pacific regions, including Singapore, Australia, and New Zealand.

Mexico

Mexican Mango Producers Face Tariff Concerns Despite Export Challenges

Mango producers in Soconusco, Mexico, particularly Ataulfo growers, are concerned about potential US tariff updates that could impose a 25% duty, impacting exports. The US remains their primary market, importing around 35 thousand tons annually, followed by Canada with 10 thousand tons and Europe with 1 thousand tons. To mitigate risks, producers are exploring diversification into European and Asian markets while strengthening domestic sales. Additionally, atypical rains late last year triggered early flowering, reducing the expected 2025 harvest and delaying the peak marketing season. However, despite lower production, exports to key markets are expected to rise in Mar-25, Apr-25, and May-25, with improved mango quality helping maintain competitive prices.

Peru

Peru’s Mango Industry Faces Major Losses Due to Overproduction

The mango harvest in Lambayeque, Peru, which began in Nov-24 and runs until Mar-25, has been severely affected by climate variations that accelerated ripening, leading to overproduction and a sharp price decline. Prices fell from USD 0.27/kg (SOL 1/kg) to just USD 0.027 to 0.055/kg (SOL 0.10 to 0.20/kg), resulting in losses of up to 10 thousand tons valued at USD 712.1 thousand (SOL 2.6 million). Some farmers have resorted to burying mangoes to prevent fruit fly infestations, which could threaten exports and other key crops. While local trade agreements enabled the sale of 420 tons of Kent mangoes, overall production losses could reach 80%. To prevent future crises, experts stress the need for climate monitoring systems, crop diversification, improved irrigation infrastructure, and preservation technologies like dehydration to enhance value and expand agribusiness opportunities.

2. Weekly Pricing

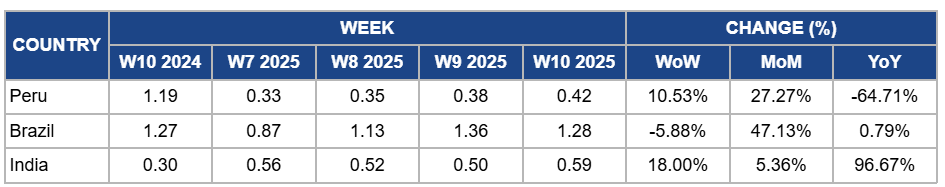

Weekly Mango Pricing Important Exporters (USD/kg)

Yearly Change in Mango Pricing Important Exporters (W10 2024 to W10 2025)

Peru

In W10, Peruvian mango prices increased by 10.53% week-on-week (WoW) to USD 0.42/kg, with a 27.27% month-on-month (MoM) surge. This rise is due to a recovery in export volumes following the previous season's downturn and improved demand in key markets such as the US and Europe. However, prices have dropped by 64.71% YoY, primarily due to an overproduction crisis earlier in the season, which led to market saturation and a sharp decline in prices. The accelerated ripening of mangoes, caused by climatic variations, resulted in an overlap with competing exporters like Brazil and Ecuador, further exacerbating the price decline.

Brazil

Mango prices in Brazil dropped slightly by 5.88% WoW to USD 1.28/kg in W10 due to weaker export demand, leading to higher domestic availability, resulting from reduced export demand. Despite the recent weekly decrease, prices have surged by 47.13% MoM, reflecting seasonal supply fluctuations and increased domestic consumption. Meanwhile, YoY prices have risen slightly by 0.79%, indicating a stabilization in the market compared to the previous year's volatility.

India

India's mango prices surged by 18% WoW in W10 to USD 0.59/kg, reflecting a 5.35% MoM increase and a substantial 96.67% YoY rise. This price escalation is primarily due to heightened export demand for premium mango varieties such as Alphonso, Kesar, and Badami, particularly from key markets including the US, UK, and European countries like the Netherlands, Germany, and Italy. Additionally, growing interest from the Asia-Pacific region, encompassing Singapore, Australia, and New Zealand, has further bolstered demand. Despite an anticipated increase in production driven by favorable weather conditions and increased farmer engagement, the surge in international demand has exerted upward pressure on prices. However, rising freight rates, especially for exports to the US and Europe, have contributed to increased costs, influencing the overall price structure.

3. Actionable Recommendations

Optimize Export Logistics for Cost Efficiency

Indian mango exporters should secure cost-effective logistics solutions to maintain competitiveness in key markets. Negotiating bulk freight contracts, using multi-modal transport options, and optimizing cold chain management can help offset rising shipping costs. Exploring direct shipping routes to high-demand regions like the Middle East and Europe can also reduce transit times and preserve fruit quality.

Expand Partnerships with Processors to Reduce Losses

Peruvian mango farmers should collaborate with processors to convert surplus fruit into dried mango, pulp, and juices, creating alternative revenue streams without requiring large individual investments. Partnering with local processing facilities can help stabilize incomes and reduce waste during peak production. Establishing agreements with buyers in advance can further ensure consistent demand and price stability.

Strengthen Export Readiness for Market Recovery

Guatemalan mango exporters should secure early contracts with key buyers in the US and Europe to capitalize on the projected production rebound. Strengthening post-harvest handling, including cold chain logistics and quality sorting, will help maintain fruit integrity during peak exports. Expanding promotional efforts for Keitt and Kent varieties can diversify market opportunities beyond Tommy Atkins.

Sources: Tridge, Cuartopoder, Freshplaza, M.K. Exports, Oem, Prensalibre, Prensa-latina