W12 2025: Avocado Weekly Update

In W12 in the avocado landscape, some of the most relevant trends included:

- Global avocado export volumes have declined, with major exporters like Mexico, Chile, and Spain reducing their shipments. Chile reduced avocado exports by 34%, shifting 74% of its shipments to Latin America as its presence in the US, Europe, and China continued to decline. Meanwhile, Colombia is expanding its presence in the US market.

- Avocado prices have surged due to lower supply, with notable increases in Spain at 44% WoW for smaller sizes. The US market also saw price hikes, particularly for larger sizes.

- Heavy rainfall and flooding have impacted avocado harvesting in Spain, delaying supply. An excessively wet spring has further reduced yields in certain Spanish regions, though some varieties are already flowering for the next season.

- Colombia is increasing avocado exports to the US, leveraging expanded certified acreage and improved packing facilities. Meanwhile, Spain’s production remains stable despite weather challenges, and Peru continues to supply global markets.

1. Weekly News

Global

Global Avocado Market Sees Supply Reductions and Price Increases

The global avocado market saw a sharp decline in export volumes alongside rising prices in W12. In the United States (US), container arrivals dropped by 26% week-on-week (WoW), with Mexico remaining the primary supplier despite a 24% WoW decrease. Uncertainty over temporary tariffs drove price increases, with larger sizes rising by up to 13%. In Europe, shipments grew by 6% WoW, led by Israel, Spain, and Peru, though Spain recorded a 44% price surge for smaller sizes. China’s avocado imports rose 47% WoW but remained 33% below last year’s levels, with Peru dominating the market despite prices standing 63% year-on-year (YoY) higher. Meanwhile, Chile reduced exports by 34%, shifting 74% of its shipments to Latin America as its presence in the US, Europe, and China continued to drop.

Colombia

Colombia Expands Hass Avocado Exports to the US

Colombia, the fourth-largest exporter of Hass avocados to the US, is expected to supply 130 million pounds (lbs) during the 2025 spring-summer harvest, with peak volumes expected in late April and early May. Colombian avocados are available year-round, with a main harvest from September to February and a secondary season from March to August. Since gaining United States Department of Agriculture (USDA) approval in 2017, the industry has expanded through increased certified acreage and packing facilities. Following a strong main season that delivered 50 million lbs to the US, Colombia aims to strengthen its market presence through Aug-25.

Spain

Avocado Harvest in Malaga Faces Delays Due to Localized Flooding

Despite severe flooding in parts of Malaga, Vélez-Malaga has largely remained unaffected, except for one village. However, heavy rainfall temporarily slowed the harvesting of Hass and Lamb Hass avocados, with further delays possible as more rain is expected over the weekend. Sunnier weather is forecast to follow, which should help resume harvesting. In the coming weeks, attention will shift to the final harvest of Spanish Lamb Hass while imports of Hass avocados from Peru and Maluma Hass continue.

Wet Spring Affected Avocado Production in Spain

Avocado production in Cabranes, Spain, declined this season due to an excessively wet spring, which has affected fruit yields across all fruit trees. However, the overall harvest remains solid, with some avocado varieties already flowering for the 2026 season. Cultivation continues to expand in the Principality, with market prices ranging from USD 6.48 to 8.63 per kilogram (kg), depending on size.

2. Weekly Pricing

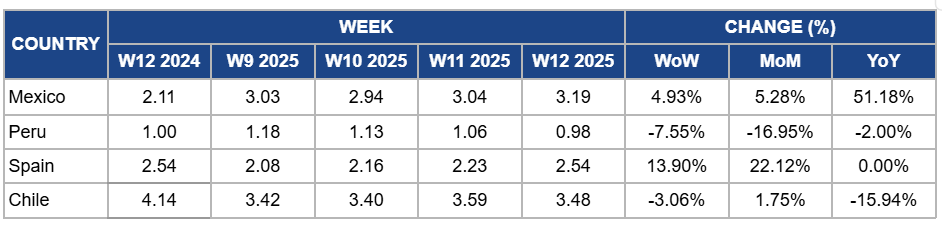

Weekly Avocado Pricing Important Exporters (USD/kg)

Yearly Change in Avocado Pricing Important Exporters (W12 2024 to W12 2025)

Mexico

Mexico's avocado prices rose by 4.93% WoW to USD 3.19/kg in W12, with a 5.28% month-on-month (MoM) increase and a 51.18% YoY surge. This price increase is due to ongoing uncertainties surrounding the potential reinstatement of a 25% tariff on Mexican avocado exports to the US. Although the tariff was temporarily suspended on March 6, 2025, after a brief enforcement period, producers and exporters remain cautious, leading to reduced shipments and tighter supply. Additionally, efforts to diversify export markets to Europe and the Middle East have introduced logistical challenges and increased costs, further contributing to the price rise. The US government's planned review of the tariff decision on April 2, 2025, continues to add to market uncertainty, influencing pricing dynamics.

Peru

In W12, Peruvian avocado prices declined by 7.55% WoW to USD 0.98/kg, marking a 16.95% MoM decrease and a 2% YoY drop. This downward trend is due to a significant increase in avocado production. Moreover, the anticipation of a 23% growth in Peruvian avocado production for the 2025 season has intensified competition in the global market, particularly from countries like Mexico and Colombia. This increased supply and heightened competition have exerted downward pressure on prices. Despite the volume increase, the value of exports has seen only modest growth, suggesting that higher supply levels are outpacing demand, thereby contributing to the observed price decline.

Spain

In W12, Spain's avocado prices surged by 13.90% WoW to USD 2.54/kg, marking a 22.12% MoM increase. This price escalation is primarily due to heavy rainfall and localized flooding in key production areas such as Málaga, which have disrupted the harvesting of Hass and Lamb Hass varieties. The adverse weather conditions have led to supply constraints, thereby driving prices upward. However, YoY prices have declined by 14.35%, due to an anticipated 20% increase in the 2024/25 Spanish avocado harvest. This expected increase in production is due to the expansion of cultivation into new regions like Cádiz, Huelva, and Valencia, which has introduced a larger supply into the market, exerting downward pressure on prices compared to the previous year.

Chile

In W12, Chile's avocado prices declined by 3.06% WoW to USD 3.48/kg, with a 15.94% YoY drop. This price decrease is primarily due to a significant increase in avocado production during the 2024/25 season, which saw a 33.3% rise to 200 thousand metric tons (mt). Consequently, exports have also surged by approximately 30%, leading to an expanded supply in international markets. Despite strong demand from European countries such as the Netherlands, Spain, and the United Kingdom (UK), the substantial increase in supply has exerted downward pressure on prices.

3. Actionable Recommendations

Optimize Harvest Timing to Prevent Quality Loss

Spanish avocado growers should resume harvesting Hass and Lamb Hass as soon as conditions allow to avoid overripening and maintain fruit quality. Coordinating with buyers to adjust delivery schedules and prioritizing well-drained orchards can help minimize delays and ensure market supply remains stable.

Adjust Sourcing Strategies to Manage Rising Prices

Avocado importers should diversify sourcing by increasing procurement from suppliers with stable volumes, such as Israel and Spain, to offset supply shortages from Mexico and Chile. Retailers can adjust promotions to focus on smaller sizes, which have seen higher price surges, while exporters should target markets with strong demand, like China, where prices remain elevated.

Sources: Tridge, Colombia Avocado Board, Freshplaza, Fruitnet, MLVVM, Portalfruticola, RTPA