1. Weekly News

Belarus

Belarus Imposes Temporary Export Licensing for Onions to Secure Domestic Supply

The Belarusian government has implemented a temporary licensing requirement for onion exports,white cabbage, and apples to ensure adequate domestic supply during the off-season. The Ministry of Antimonopoly Regulation and Trade will issue export licenses on a case-by-case basis in coordination with regional authorities, following an assessment of available resources relative to national demand.

Chile

Chile Strengthens Agricultural Ties with Brazil, Focusing on Rural Development, Trade, and Climate Resilience

During his visit to Brazil, Chile's Agriculture Minister led the national representation at Chile Week in São Paulo and signed a Memorandum of Understanding (MoU) with the state of Goiás. The collaboration emphasizes rural development through initiatives that support small-scale agriculture, climate adaptation, and gender equality in agriculture, which aligns with directives from the Presidents of Chile and Brazil. Chile Week highlighted agricultural trade, noting a significant 2.5% increase in Chilean onion imports to Brazil. Other agreements included market access for Chilean products like piel de sapo melons, cut peony flowers and Brazilian hass avocados. The Minister also formalized cooperation with the Brazilian Agricultural Research Corporation (Embrapa), Brazil's leading agricultural research institution, to enhance resilience and innovation in Chilean agriculture.

Türkiye

Record Heat in Adana Triggers Severe Onion Crop Losses

Extreme heat in Adana, Türkiye, led to severe crop yield losses, including onions, as temperatures hit record highs from Jun-24 to Oct-24. Farmers reported burned crops, with onions particularly impacted, leading to the plowing of some onion fields for the first time. Local authorities urged against "wild irrigation" due to limited water resources and advised farmers to avoid planting water-intensive crops like onions, potatoes, and garlic this season. The Yüreğir Chamber of Agriculture emphasized the need for improved irrigation practices, calling for the free provision of drip irrigation systems to mitigate the effects of climate change.

Ukraine

Ukraine's Onion Prices Decline 11% WoW Due to Increased Supply of Low-Quality Produce

Onion prices in Ukraine have begun to decline, with bulk prices at USD 0.19 to 0.34 per kilogram (UAH 8 to 14/kg), a decrease of 11% week-on-week (WoW). This decrease results from increased market supply, especially of medium and low-quality onions affected by unfavorable summer weather and prolonged rains during harvest. Farmers are quickly selling these lower-quality onions, which are unsuitable for long-term storage, reducing prices. In contrast, high-quality onions are scarce, as producers hold them back, expecting future price increases. Despite recent declines, onion prices remain 15% higher than last year.

2. Weekly Pricing

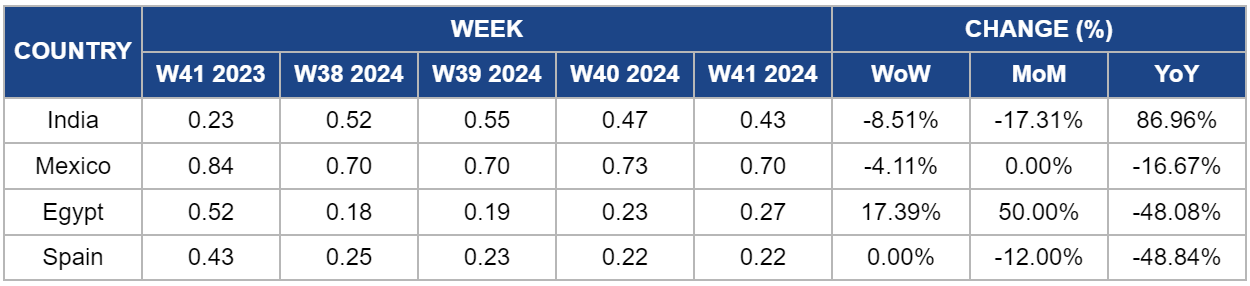

Weekly Onion Pricing Important Exporters (USD/kg)

Yearly Change in Onion Pricing Important Exporters (W41 2023 to W41 2024)

.png)

India

India's onion wholesale prices decreased to USD 0.43/kg in W41, marking an 8.51% WoW and 17.31% month-on-month (MoM) decrease from USD 0.52/kg. Despite this decline, prices remain significantly elevated, up 86.96% year-on-year (YoY) compared to USD 0.23/kg in 2023. In response to the recent spike in onion prices, the state government has implemented a strategy to stabilize prices by offering onions at USD 0.48 to 0.54/kg (INR 40 to 45/kg) through Rythu Bazaars. This initiative includes direct procurement from farmers and aims to provide consumers with essential vegetables at more affordable rates, especially as onions continue to be a critical staple in Indian diets. The immediate effect of these measures may lead to further price stabilization, particularly if the government successfully procures the planned quantities of 21,000 kg of onions for distribution.

Mexico

In W41, Mexico's onion prices decreased to USD 0.70/kg, marking a 4.11% WoW and a 16.67% YoY decrease. The current price trends can be attributed to increased production in Mexico. While the recent price drop offers relief, market experts urge policy measures to ensure long-term market stability. Recommendations include enhancing marketing reforms, expanding storage solutions, and introducing onion futures trading to improve supply chain efficiency and pricing strategies.

Egypt

Egypt's onion wholesale prices rose significantly in W41, increasing by 17.39% WoW and 50% MoM to USD 0.27/kg. However, this represents a substantial YoY decline of 48.8% from USD 0.52/kg. The price rise follows the commencement of the Egyptian onion season in Apr-24, after a three-month export ban imposed due to last season's insufficient stocks, which had led to unprecedented local prices. Unfortunately, demand remains low, with producers reporting almost nonexistent interest in Egyptian onions, particularly from key markets like Saudi Arabia. This oversupply and diminished demand have led to falling prices compared to the previous season.

Spain

In W41, Spain's onion wholesale prices remained stable at USD 22/kg, reflecting a 12% decrease MoM and a significant 48.84% YoY decline. The downward price trend can be attributed to a nearly 20% increase in onion cultivation area and significantly higher yields compared to the previous season, coupled with weak demand from export markets affected by similar high production levels across Europe. The Association of Onion Producers of Castilla-La Mancha (Procecam) Directors noted that the market was oversupplied as early as Jul-24, with expectations for equilibrium in mid-Aug-24 proving unrealistic due to persistently low prices. Spanish onion production is reportedly 30% higher than last year, while most European countries have also increased their cultivation areas, leading to ample supply. Exceptions include France, which experienced production declines due to phytosanitary issues.

3. Actionable Recommendations

Facilitate Export Diversification Strategies for Belarusian Produce

Given Belarus's temporary licensing requirements for onion, cabbage, and apple exports, Belarusian exporters should focus on diversifying their target markets to stabilize demand and minimize disruptions from licensing restrictions. Partnering with trade associations in new regions could secure alternative markets for surplus produce, helping maintain export revenues. Promoting Belarusian produce through international trade fairs and marketing campaigns would further support this diversification.

Develop Climate-Resilient Agricultural Initiatives in Türkiye

With extreme heat severely impacting crops in Adana, Türkiye, the government and local agricultural bodies should prioritize climate-resilient agricultural practices. Programs to distribute drip irrigation systems at reduced or no cost and incentives for planting less water-intensive crops would alleviate water stress. Educational initiatives on water conservation and heat-resistant crop varieties can further enhance farmers' resilience to climate shifts, helping mitigate crop losses.

Strengthen Chile-Brazil Agribusiness Collaborations

Following the MoU between Chile and Goiás, Chile should establish joint agribusiness programs with Brazilian agencies to promote rural development and market expansion. Creating training sessions on sustainable agricultural techniques and small-scale farming in Goiás would reinforce these bilateral efforts. Additionally, organizing trade events in São Paulo could bolster Chilean agricultural exports, aligning with Brazil's demand for sustainable, high-quality produce.

Sources: Portal Del Campo, IHA, Vedomosti, East Fruit, Fresh Plaza, La Nota del D