.jpg)

1. Weekly News

Global

Global Palm Oil Market Faces Supply Challenges, Regulatory Pressure, and Price Volatility

Indonesia and Malaysia dominate global production. However, Indonesia faces tight supply due to adverse weather and high input costs, leading to an expected production drop of 200 thousand metric tons (mt) in 2024. Malaysia may see increased demand and higher exports as a result.

Regulatory pressure from the European Union's Deforestation Regulation (EUDR) poses significant industry risks, potentially sidelining developing nations' smallholders. While Indonesia and Malaysia have contested the World Trade Organization (WTO) regulation with limited success, delays in implementing the EUDR have provided some breathing room for stakeholders.

Palm oil prices remain volatile, with Sep-24's crude palm oil (CPO) futures at USD 915/mt (MYR 3,977/mt), driven by El Niño weather conditions and policy changes like India's 20% tax on imported vegetable oils. Despite these issues, Malaysia's 2023 exports totaled over USD 21 billion, contributing nearly 3% to its gross domestic product (GDP).

European Union

EU Delays Deforestation Regulation by 12 Months

The European Union (EU) has agreed to delay the implementation of the EUDR by 12 months, pending European Parliament approval. Made by the European Council (EC), the decision postpones the implementation to December 30, 2025, for large companies and to June 30, 2026, for small and micro businesses. The regulation aims to prevent importing products linked to deforestation, such as palm oil, soy, and livestock, into the EU. The delay responds to requests from global partners and industries, allowing more time for compliance. Environmental groups, like the World Wildlife Fund (WWF), have criticized the postponement as a setback for sustainability.

India

India Cuts Vegetable Oil Imports by 30% in Sep-24, but Palm Oil Demand Expected to Rebound in Oct-24

In Sep-24, India reduced its vegetable oil imports by over 30% month-on-month (MoM), totaling 1.1 million metric tons (mmt), according to the Indian Solvent Producers Association (SEA). Palm oil imports fell by more than 33% to a six-month low of 527,314 mt, driven by high prices and ample domestic reserves. Sunflower and soybean oil imports also declined significantly.

Reducing palm oil imports may increase stockpiles in major producers like Malaysia and Indonesia, pressuring prices. However, with rising demand during India's festival season, palm oil imports are expected to surpass 700,000 mt in Oct-24.

Malaysia

Malaysia Proposes Higher Windfall Profit Levy and Export Tax on Crude Palm Oil, Effective 2025

The Malaysian government has proposed raising the Windfall Profit Levy (WPL) threshold on crude palm oil (CPO) starting January 1, 2025. The new thresholds will be USD 731.85/mt in Peninsular Malaysia and USD 848.05/mt in Sabah and Sarawak, an increase of USD 34.85/mt. Reintroduced in 2008, the 3% WPL exempts smallholders and applies when CPO prices exceed the set threshold.

The CPO export tax ceiling will increase from 8% to 10% when prices surpass USD 941/mt, effective November 1, 2024. The revised tax structure introduces new brackets for intermediate price ranges. The Smallholder Oil Palm Replanting Financing Incentive Scheme (TSPKS) will continue with a USD 23.23 million allocation for 2025.

Ukraine

No Palm Oil Ban in Ukraine as New Law Targets Trans Fat Limits

The Director of the Ukroliaprom Association, a trade organization representing the country's oilseed processors, confirmed there is no palm oil ban in Ukraine, addressing concerns over recent media reports that misrepresented a law on food products. The law primarily focuses on limiting trans fats, not palm oil. Ukraine's regulations align with global standards, capping trans fats at 2 grams (g) per 100 g of product. This policy aligns with the EU's export standards, especially for confectionery.

2. Weekly Pricing

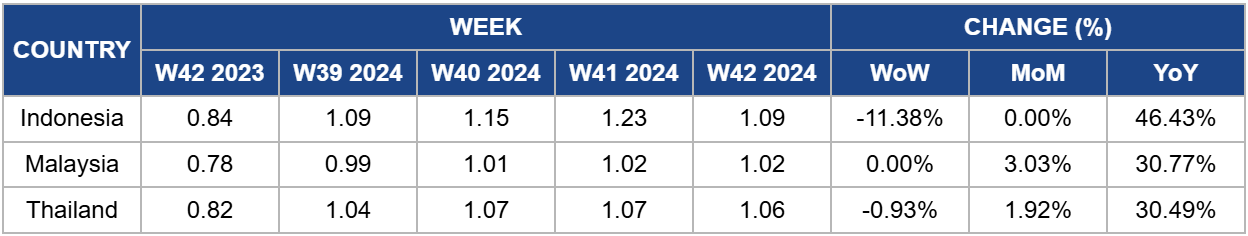

Weekly Palm Oil Pricing Important Exporters (USD/kg)

Yearly Change in Palm Oil Pricing Important Exporters (W42 2023 to W42 2024)

.png)

Indonesia

Indonesia's palm oil prices dropped to USD 1.09 per kilogram (kg) in W42, marking a notable 11.38% decrease from the previous week, though still 46.43% higher year-on-year (YoY). This decline reflects potential market instability, influenced by a corruption investigation targeting the Ministry of Environment and Forestry. The case involves the mismanagement of oil palm plantations in forest areas, which could disrupt the supply chain and potentially put downward pressure on prices due to regulatory uncertainties. Furthermore, price volatility is forecasted if fines are increased or production capacities are restricted.

Malaysia

In W42, Malaysia's CPO wholesale prices remained stable at USD 1.02/kg, showing a 30.77% YoY increase. Despite this week's stability, palm oil prices remained at 30.77% YoY higher. However, with weak energy prices and a surplus in soybean oil, palm oil prices are expected to stay above USD 929.37/mt (MYR 4,000/mt) in Oct-24. Contributing factors include declining palm oil inventories and rising exports, which grew 12.9% from Jan-24 to Sep-24. Malaysia's reduced stock levels, India's anticipated import surge, and Indonesia's B40 biodiesel mandate, are expected to keep palm oil prices elevated but with limited upward movement.

Thailand

Thailand's RBD palm oil prices decreased to USD 1.06/kg in W42, marking a slight 1.92% week-on-week (WoW) decrease from USD 1.07/kg and a notable 30.49% YoY increase. This price movement occurs alongside positive developments for smallholders in Thailand, who dominate the country's palm oil sector. The adoption of Roundtable on Sustainable Palm Oil (RSPO) certification has increased production volumes, income, and access to premium markets for certified smallholders. Despite the recent price drop, the sector remains strong, driven by sustainable practices and growing market opportunities for certified producers.

3. Actionable Recommendations

Strengthen Supply Chain Resilience

To address the anticipated supply drop in Indonesia and volatility in palm oil prices, stakeholders should diversify their supply chain by developing relationships with alternative palm oil producers, such as Thailand and emerging markets in Africa and Latin America. Long-term contracts with these producers can enhance resilience against adverse weather conditions, regulatory pressures, and political instability. Furthermore, investing in sustainable practices and certifications can improve market access and align with evolving consumer preferences, particularly in regions emphasizing sustainability.

Enhance Compliance and Sustainability Initiatives

Given the regulatory pressure from the EUDR and other sustainability concerns, stakeholders should invest in compliance programs that assist smallholders in adapting to new regulations. This could include technical support, financial incentives, and training on sustainable agricultural practices. Engaging in partnerships with non-governmental organizations (NGOs) and international organizations can also facilitate access to resources and knowledge, enabling smallholders to meet compliance standards and secure their positions in the supply chain.

Leverage Market Opportunities through Export Strategies

Palm oil producers should develop targeted marketing strategies aimed at international markets to capitalize on Malaysia's expected increase in demand and higher exports. By promoting the unique qualities of Malaysian palm oil and emphasizing sustainable production methods, businesses can differentiate their products in competitive markets. Additionally, companies should monitor changes in global trade policies and consumer preferences to adapt their export strategies effectively, ensuring they remain responsive to market dynamics and regulatory shifts.

Sources: Tridge, Ukragroconsult, the Edge Malaysia, EFE: Agro, Grain Trade, Wartaekonomi, News Mongabay,