W43 2024: Mango Weekly Update

1. Weekly News

Peru

Peru's Mango Season Begins with Anticipation in European Markets

The Peruvian mango season started in early Oct-24, generating excitement among European importers eager to enhance their mango supplies from Latin America. Alborán Produce Services, a prominent fruit import and export company based in Malaga, reports that while receiving containers of Colombian mangoes and loading Ecuadorian varieties, Peruvian mangoes are expected to arrive soon. In the Central European market, the creamy consistency of the Peruvian Kent variety is favored over the fibrous Brazilian Palmer mango, highlighting the distinct textural preferences of consumers. Despite rising air freight costs potentially shifting most shipments to sea transport, a notable increase in production volume is anticipated this year, arriving earlier than last season. Retail promotions will be essential to stimulate demand as the Peruvian mango season runs from October to March/April. Additionally, Alborán aims to diversify its offerings, including avocados and other tropical fruits, to meet the growing European demand.

Peru’s Mango Industry Faces Crisis as Water Shortages Threaten Harvests in 2024

The Peruvian mango industry, especially in the Piura region, faces critical setbacks due to severe water shortages exacerbated by the El Niño disruptions in 2023. The San Lorenzo Valley, a key growing area, has cut irrigation supplies by 50%, drastically limiting water availability for mango plantations. As a result, approximately 90% of the current crop is unharvestable, putting fresh mango exports and the frozen mango sector at significant risk. Other crops in the valley, including lemons and avocados, are also vulnerable to the ongoing water crisis. Industry leaders are urgently hoping for rainfall in higher elevations to help mitigate these challenges.

Kenya

Kenya Concludes Avocado Export Season While Preparing for Mango Trade

Kenya's Agriculture and Food Authority (AFA) has concluded the export season for Hass, Pinkerton, Fuerte, and Jumbo avocado varieties as of October 25, 2024. Due to a decline in export-quality avocado volumes, sea shipments will be limited for the 2024/25 season. Air shipments will continue under strict compliance with clearance and traceability protocols. In preparation for the upcoming mango export season, targeting markets in the Middle East and Europe, the AFA mandates that exporters avoid combining avocado and mango shipments, per the Crops (Horticultural Crops) Regulations of 2020. This requirement ensures quality control, as both fruits have different handling and storage needs. It also helps manage pests and diseases by minimizing cross-contamination risk, enhances traceability for better quality monitoring, and meets specific market regulations. Overall, these measures protect the reputation of Kenyan avocados and mangoes in global markets. Moreover, the AFA has introduced a registration requirement for mango marketing agents to facilitate this process and address unpaid produce issues, effective October 28, 2024. Registration will be available through the AFA-Integrated Management Information System (AFA-IMIS) platform at primary locations like Nairobi, Machakos, and Mombasa to enhance regulation and protect stakeholders within the mango export chain.

2. Weekly Pricing

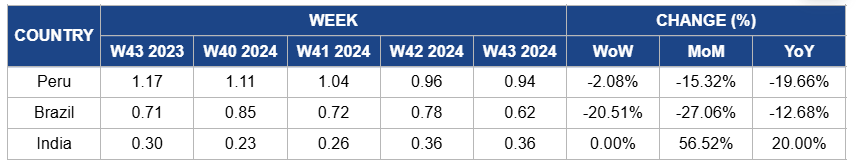

Weekly Mango Pricing Important Exporters (USD/kg)

* Varieties: Mexico (Manilla), Peru (Kent), Brazil (Tommy), and India (overall average)

Yearly Change in Mango Pricing Important Exporters (W43 2023 to W43 2024)

* Varieties: Mexico (Manilla), Peru (Kent), Brazil (Tommy), and India (overall average)

* Blank spaces on the graph signify data unavailability stemming from factors like supply unavailability, missing data or seasonality

Peru

In Peru, mango prices experienced a slight decline of 2.08% week-on-week (WoW), reaching USD 0.94 per kilogram (kg) in W43. This decrease, combined with a 15.32% month-on-month (MoM) and 19.66% year-on-year (YoY) decline, reflects ongoing competition from increased mango supplies from Colombia and Ecuador, adding downward pressure to Peruvian prices. Despite these reductions, looming water shortages in the Piura region pose a serious risk to future harvests, with approximately 90% of the current crop deemed unharvestable. This crisis may eventually tighten supply, potentially driving prices up later in the season.

Brazil

Brazil's mango prices dropped by 20.51% WoW to USD 0.62/kg in W43, reflecting a 27.06% MoM decrease and a 12.68% YoY decline. This drop is mainly due to a market oversupply driven by high local production levels as the peak harvest season continues, leading to increased inventory that surpasses current demand. Competition from neighboring suppliers like Peru and Ecuador, who have also entered the market with strong volumes, has intensified pressure on Brazilian exports. The initial recovery in demand observed in W42 softened as export opportunities weakened, with buyers opting for competitive prices from alternative sources, thus intensifying downward pressure on Brazilian mango prices.

India

Mango prices in India remained stable since last week at USD 0.36/kg in W43, with a 56.52% MoM surge and a 20% YoY increase. The increases are due to a combination of sustained demand from both domestic and international markets as consumers continue to favor mangoes during the ongoing season. Despite the stability in weekly prices, the supply remains tight as the effects of prior weather disruptions persist, limiting overall harvest volumes. The earlier oversupply has allowed prices to maintain their upward trajectory. Additionally, with the peak mango season approaching, the market anticipates continued demand, further supporting the current price levels.

3. Actionable Recommendations

Address Water Shortages in Peruvian Mango Production

Mango producers in the Piura region of Peru must implement immediate water conservation strategies to manage the severe irrigation cuts impacting crop yields. To mitigate losses, growers should prioritize using limited water supplies for the most productive mango plantations while exploring alternative irrigation methods like drip systems or rainwater harvesting. Additionally, industry leaders should collaborate with local agricultural experts to develop contingency plans for crop management and resilience against future water shortages, ensuring the sustainability of both fresh and frozen mango exports.

Optimize Mango Supply Chain Management in India

Mango producers in India should enhance their supply chain management to address the current tight supply situation and capitalize on stable prices. Growers must closely monitor weather patterns and implement risk mitigation strategies to safeguard future harvests. Additionally, producers should collaborate with logistics partners to improve transportation efficiency and reduce delays in getting mangoes to market. By establishing better forecasting and inventory management practices, they can ensure adequate supply aligns with sustained demand, maximizing profitability during the peak season.

Adjust Marketing Strategies to Address Mango Oversupply in Brazil

Mango producers in Brazil should reevaluate their marketing strategies to address the recent oversupply and declining prices. Growers must analyze consumer trends and identify niche markets to target effectively, focusing on quality differentiation to attract premium buyers. Collaborating with export agents to explore alternative markets may also help mitigate the impact of local inventory surpluses. Producers can better manage excess supply and stabilize prices in a competitive environment by adapting marketing efforts and optimizing distribution channels.

Sources: Tridge, Agraria, Alboran, Eastfruit, Freshplaza, Mxfruit, Tuko