1. Weekly News

Australia

Australia’s Table Grape Production to Surge 18% YoY in 2024/25 MY

Australian table grape production is forecasted to rise by 18% year-on-year (YoY) in the 2024/25 marketing year (MY), reaching 230 thousand metric tons (mt), driven by favorable weather conditions expected to improve yield and fruit quality. This growth is anticipated to push exports to 135 thousand mt, making it the third-highest export volume on record. China remains Australia’s top export market, followed by other Asian countries such as Indonesia, South Korea, and Vietnam. Despite increasing competition, Australia’s proximity to China and its focus on popular seedless grape varieties will help maintain its strong market position.

Brazil

Stable Pricing for Peruvian and Brazilian Red Globe Grapes in Brazil

Peruvian Red Globe grapes have maintained a steady price of USD 24.51 per 8.2-kilogram (kg) box (BRL 140) in Brazil throughout the season, covering high-grade CAT1, XL, and Jumbo sizes. Brazilian-grown Red Globes, featuring higher brix levels and comparable quality, present a competitive alternative for consumers, supporting stable demand and market balance between local and imported options.

Georgia

Georgia’s 2024 Grape Harvest Hits Record High with 47% YoY Surge

As of October 7, 2024, Georgia's grape harvest reached a record 300 thousand tons, a 47% YoY increase. This generated USD 165.7 million (GEL 450 million) in revenue, marking an 82% rise. The Kakheti region led production with 296 thousand tons, with additional contributions from regions like Racha and Lechkhumi. This growth contrasts with harvest declines in European markets such as France, Germany, and Portugal. With over 500 grape varieties, including the celebrated Saperavi, Georgia continues to enhance its wine industry's global presence, aided by subsidies, certifications, and strong promotional efforts from the National Wine Agency, with a particular focus on markets like Poland.

Peru

Peruvian Grape Exports Expected to Rebound Despite Production Challenges

Despite weather disruptions affecting the 2023/24 campaign, Peru maintains its strong position in the global grape export market. The season, which begins in late Jul-24 with peak exports from Piura and continues until April, saw early-season shipments down 45% in volume and 44% in value by Sep-24, totaling 13.4 thousand tons and USD 35 million. Stabilizing weather conditions, however, are projected to boost exports, potentially exceeding last year’s totals with an anticipated 25% increase in overall volume. While grape prices have dipped by 3%, they are expected to stabilize as production normalizes. Europe remains Peru’s largest market, with substantial exports also directed to Colombia and Asia, though increased Chinese production may raise competition in the region.

Thailand

Thailand Issues Health Warning on Chemical Residues in Imported Shine Muscat Grapes

The Thai Pesticide Alert Network (Thai-PAN) has flagged significant safety concerns over imported Shine Muscat grapes from China, which are highly favored for their affordability compared to Japanese and Korean varieties. After testing 24 samples from various sources, Thai authorities discovered that 23 of them contained pesticide residues above safe limits, including chlorpyrifos, a banned pesticide in Thailand, and unapproved chemicals like triasulfuron and fludioxonil, which are challenging to wash off. Thai-PAN and the Thai Consumers Council (TCC) call on the Ministry of Public Health to enforce origin labeling on grape imports. The Ministry of Agriculture and Food Security is running further tests and may issue health warnings if contamination levels are validated.

Drop in Sales for Grape and Juice Vendors Amid Chemical Contamination Fears

Vendors in Nakhon Ratchasima are facing a sharp decline in grapes and fruit juice sales due to public concerns over chemical contamination in imported Shine Muscat grapes from China. Despite assurances from experts and the Thai FDA that the grapes are safe if adequately washed, ongoing fears about pesticide residues, particularly the banned chlorpyrifos, continue to affect consumer confidence. The Thai Pesticides Alert Network and the Foundation for Consumers have raised alarms, urging the government for more precise guidance, leading to unsold stock and financial strain for local vendors.

United States

California Table Grapes Facing Reduced Volumes in 2024 Amid Record Heat

The 2024 California table grape season is expected to produce 10 to 15% fewer volumes than initially estimated, with total shipments likely reaching around 90 million 8.6-kg cartons, down from the pre-season forecast of 94.4 million. This reduction is mainly due to intense heat in July, when temperatures exceeded 43 degrees Celsius (ºC) for several days, affecting red grape varieties and hindering color development. Despite these challenges, the harvest is nearing completion, with 70% of grapes picked and 65% shipped by late Oct-24. Late-season varieties have proven heavier than anticipated, and strong export shipments to Asia, combined with high-quality grapes, provide a positive outlook for growers.

2. Weekly Pricing

Weekly Grape Pricing Important Exporters (USD/kg)

* Varieties: Chile (Thompson Seedless), Peru (Grape Italia), and India (Green Grape)

Yearly Change in Grape Pricing Important Exporters (W44 2023 to W44 2024)

* Varieties: Chile (Thompson Seedless), Peru (Grape Italia), South Africa (White Seedless), and India (Green Grape)

* Blank spaces on the graph signify data unavailability stemming from factors like supply unavailability, missing data, or seasonality

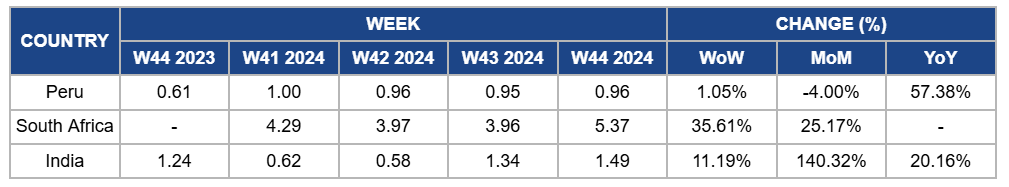

Peru

In W44, grape prices increased slightly by 1.05% week-on-week (WoW) to USD 0.96/kg, reflecting a 57.38% YoY increase. This is due to the continued strong demand for Peruvian grapes, particularly for their premium quality, which maintains its competitive edge in global markets despite fluctuations. However, month-on-month (MoM) prices decreased by 4% due to the peak harvest season, which led to an increase in domestic supply. Additionally, although stabilizing weather conditions are expected to improve export volumes in the coming weeks, the early-season export decline has impacted overall price trends.

South Africa

Grape prices surged by 35.61% WoW to USD 5.37/kg in W44, with a 25.17% MoM increase due to a combination of factors, including heightened demand as key export markets, particularly in Europe, begin to stock up for the holiday season. Additionally, supply pressures eased from the previous month, allowing producers to adjust pricing more strategically. The slight increase in the 2024/25 harvest forecast has also contributed to market optimism. South African Table Grape Industry (SATI)’s enhanced supply chain efficiency through predictive logistics has further supported the smooth movement of grapes. At the same time, favorable winter conditions and stable reservoir levels in key growing regions such as Berg and Hex Rivers have helped secure consistent production, bolstering prices despite earlier declines.

India

In India, grape prices increased by 11.19% WoW to USD 1.49/kg in W44, reflecting a 140.32% MoM increase and a 20.16% YoY increase. This is due to continued production challenges resulting from the early-season weather extremes, which have limited grape availability and affected quality, with some crops still facing challenges like mold and skin cracking. The high demand for early-harvest grapes, particularly from key export markets, has further fueled price increases. Additionally, logistical difficulties, including rising export costs and container shortages, particularly impacting shipments to Europe, have exacerbated prices, keeping prices elevated. However, as more harvests come in, there is a possibility of supply stabilizing, which could help moderate prices if weather conditions improve.

3. Actionable Recommendations

Leverage Export Markets to Mitigate Yield Losses

California table grape growers should focus on boosting export shipments, particularly to high-demand Asian markets, to compensate for the reduction in production. They should prioritize late-season varieties, which have shown stronger yields, and streamline logistics to ensure the timely delivery of high-quality grapes. Growing growers can maximize value despite domestic volume shortages by tapping into robust international demand. This strategy will help maintain revenue streams and offset the effects of the reduced harvest.

Ensure Strict Pesticide Testing and Source Transparency

Thai importers of Shine Muscat grapes should implement rigorous pesticide testing on all shipments, especially those from China, to ensure compliance with safety standards. They should also collaborate with the Thai-PAN and relevant authorities to push for more explicit origin labeling on grape imports. By improving transparency and ensuring only pesticide-free products reach the market, importers can safeguard consumer health and uphold market credibility.

Expand International Marketing for Georgian Grapes

Georgia’s grape producers should capitalize on the record harvest by intensifying marketing efforts, especially in European markets facing declines in grape production. Growers and exporters should collaborate with the National Wine Agency to enhance their promotional campaigns in regions like Poland and explore opportunities in emerging markets. By leveraging Georgia’s diverse grape varieties, including Saperavi, and highlighting the quality boost in production, they can increase global visibility and expand their export reach.

Sources: Tridge, Agraria, Bangkokpost, Farmer, Fresh Fruit, Freshplaza, Fruitnet, Portaldelcampo, Produce report, Utusanborneo, Voh, Yna