1. Weekly News

Brazil

Brazilian Table Grapes Gain Access to the Chinese Market

China opened its market to Brazilian table grapes after Brazil's Ministry of Agriculture, Livestock and Food Supply (MAPA) signed phytosanitary agreements with China's General Administration of Customs China (GACC). This development strengthens trade ties between the two nations, with China already being Brazil's most prominent food export destination since 2017. In 2023, Brazil exported over 73 thousand tons of grapes, primarily from Pernambuco and Bahia. The new access to China's USD 600 million grape market offers substantial growth opportunities, with Brazilian grapes, known for their quality and sustainability, expected to meet the premium standards of Chinese consumers. Full-scale exports are anticipated to begin by 2025.

Kyrgyzstan

Grape Imports from China Surged in Kyrgyzstan

According to the GACC, Kyrgyzstan significantly increased its grape imports from China by 60% in the first ten months of 2024, importing 21.4 thousand tons. These imports rose by 72% year-on-year (YoY) to USD 25 million, with average grape prices ranging between USD 0.90 and USD 1.80 per kilogram (kg). This growth highlights the strengthening trade relationship between the two countries and Kyrgyzstan's rising demand for Chinese grapes.

Moldova

Moldova's Table Grape Exports to EU Surged in 2024

Moldova's table grape exports to the European Union (EU) reached USD 34.2 million (MDL 627 million) in the first ten months of 2024, marking a 1.9-fold increase compared to last year. The primary export markets include Romania and Poland, which have driven the EU’s share of Moldovan grape exports from 36% in 2021 to 74% in 2024. Meanwhile, Russia's share dropped significantly to just 6%. Supported by government initiatives and tariff-free access to the EU, Moldova has expanded its export reach to 33 countries, including new markets like Italy, Sweden, and the United Arab Emirates (UAE). This growth highlights the country's focus on quality and competitiveness in global markets.

Peru

Peru Set to Break Table Grape Export Record with 640 Thousand Tons in 2024/25 Season

Peru is projected to export over 78 million boxes of table grapes for the 2024/25 campaign, equivalent to 640 thousand tons, surpassing the previous season's 62.7 million boxes and setting a new record. Despite adverse weather, competitive markets, and economic fluctuations, Peruvian producers have demonstrated resilience and adaptability, incorporating high-yield varieties like Sweet Globe and Red Globe. The industry's modern infrastructure and sustainable practices have enabled it to meet international demand, with exports reaching over 50 markets, including the United States (US), Europe, Latin America, and China. The upgraded Port of Paracas has further boosted competitiveness, particularly in southern regions like Ica, which accounts for nearly half of the country's production.

Protests Disrupt Peruvian Table Grape Exports and Local Markets

Protests by informal miners in Peru, especially in Arequipa, La Libertad, and Ica, have blocked major routes, disrupting the transport of essential agricultural exports, including table grapes. Driven by dissatisfaction with the lack of expansion of the Comprehensive Registry of Mining Formalization (REINFO), the unrest has prompted authorities and agricultural organizations, such as the Association of Agricultural Producer Guilds of Peru (AGAP), to seek alternative routes and secure shipments of perishable goods. The disruptions affect grape exports, small producers, logistics, and local markets, leading to shortages and potential price increases that could negatively impact families and the national economy.

Spain

Spain Faces Grape Supply Challenges Ahead of New Year's Eve Season

Spain's grape imports from Peru and Brazil encountered significant challenges in Nov-24, including harvest delays and international transport issues, leading to supply shortages and disrupted stock planning for importers. Despite these challenges, Spanish importers anticipate that both volumes and prices will stabilize in the coming weeks, coinciding with the crucial New Year's Eve campaign, a peak period for grape consumption.

Turkey

Manisa's Sarıgöl District Continues Strong Grape Harvest Through Winter

The grape harvest in Turkey's Manisa Sarıgöl district extends into late autumn and mid-winter, focusing on the prized Seedless Sultana and Crimson varieties. These grapes are in high demand, with Crimson grapes priced at USD 1.44/kg (TRY 50/kg) due to their resilience and quality. Home to nine grape varieties, Sarıgöl continues to thrive as a hub for grape cultivation, showcasing the region's agricultural vitality even as vineyard leaves turn yellow with the changing seasons.

2. Weekly Pricing

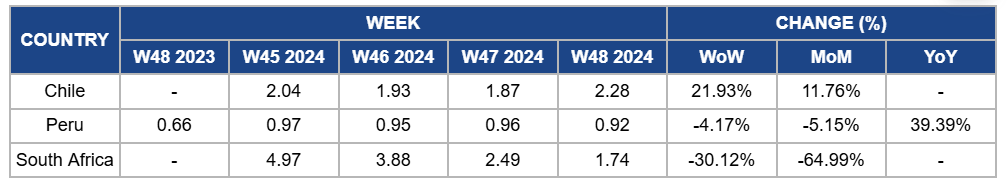

Weekly Grape Pricing Important Exporters (USD/kg)

Yearly Change in Grape Pricing Important Exporters (W48 2023 to W48 2024)

Chile

Chile's grape prices surged by 21.93% week-on-week (WoW) to USD 2.28/kg in W48, with an 11.76% month-on-month (MoM) increase due to the tightening of supply resulting from a decline in grape production. Despite competition from multiple regions, including Peru, Italy, and South Africa, Chile's reduced production levels contributed to a temporary supply shortage, boosting prices. Additionally, the transition in the market as new shipments arrived from competing origins created a window for Chilean grapes to gain price traction. The price rise also reflects the increasing demand for Chilean grapes as they compete with other countries offering similar varieties.

Peru

In Peru, grape prices dropped slightly by 4.17% WoW to USD 0.92/kg in W48, with a slight decline of 5.15% MoM as the market adjusted after the peak harvest period. This decrease was mainly due to the stable supply flow, which helped balance demand and maintain consistent market conditions despite the seasonal changes. However, there was a 39.39% surge in prices YoY due to the strong export demand and a lower base of comparison from the previous year. Despite protests disrupting logistics in primary regions like Ica and La Libertad, Peru’s ability to adapt and meet global demand, particularly from the US and Europe, supported higher prices. Additionally, the production growth and the export market expansion helped maintain a favorable price trend despite temporary disruptions in supply chains.

South Africa

Grape prices in South Africa declined significantly by 30.12% WoW to USD 1.74/kg in W48, with a 64.99% MoM decrease. The price decline is due to the continuation of the peak harvest season, which has kept supply levels elevated, compounded by delayed harvesting from earlier weather disruptions. Despite the typical post-harvest price drop, the ongoing release of stocks from late-season harvests has sustained downward pressure on prices. Competition from other regions, such as Chile, and the overall oversupply in export markets have also contributed to the sharp price decline.

3. Actionable Recommendations

Optimize Grape Import Coordination for Seasonal Demand

Spanish grape importers should secure contingency shipping plans, such as diversifying transport routes and utilizing alternative carriers, to mitigate delays caused by logistical challenges. Maintaining close communication with logistics partners ensures real-time shipment updates and facilitates swift problem-solving. These strategies will help stabilize supply and align stock levels with the high consumer demand during the New Year’s Eve campaign, preserving market confidence and sales.

Strengthen Export Capabilities and Sustain Growth

Peruvian table grape producers should continue to invest in high-yield varieties, such as Sweet Globe, Autumn Crisp, and Allison, which are well-suited to meet global demand due to their quality and market preference. Producers can maintain their competitive edge by integrating these varieties with modern infrastructure and sustainable practices. To further enhance export capacity, they should prioritize expanding partnerships with international distributors and ensure timely logistics by securing reliable shipping routes. Producers in primary regions like Ica should collaborate with local authorities and stakeholders to optimize supply chains, ensuring consistent and on-time deliveries to over 50 international markets. This strategic approach will help sustain growth, meet rising global demand, and reinforce Peru’s position as a leading exporter.

Expand Export Network and Strengthen Market Presence

Moldovan table grape producers should focus on diversifying their export destinations and strengthening their presence in emerging markets like Italy, Sweden, and the UAE. Producers can maintain growth momentum and reduce reliance on traditional markets by enhancing relationships with key international distributors and offering tailored marketing strategies for specific regions. To improve product quality and meet the increasingly demanding standards of the EU, producers should adopt advanced post-harvest handling techniques, invest in cold chain infrastructure to preserve freshness and obtain certifications such as Global Good Agricultural Practices (GAP) and ISO 22000 to assure compliance with international quality and safety requirements. These measures will further solidify Moldova's competitiveness in global grape exports, ensuring long-term stability and growth in the market.

Sources: Tridge, Agraria, Agricultural News, Iha, MXfruit, NoticiasAgricolas, Provid Connection, Tazabek