1. Weekly News

Europe

European Tomato Market Faces Declining Production and Rising Prices

Tomato production in Europe has dropped to 700 thousand metric tons (mt), while imports have risen by 400 thousand mt. In Germany, prices have increased by 65% over the past decade, with inflation accounting for 30% of the rise. Prices continue to climb as supply from various countries declines. The Netherlands and Belgium have resumed winter greenhouse cultivation, while in Italy, high prices persist due to shortages caused by heat and drought in Sicily. France’s tomato consumption sharply declined with the onset of cold winter temperatures. Spain experienced stable demand and prices earlier in the season, supported by favorable weather. In contrast, production costs are rising in Morocco due to a European Union (EU) pesticide ban and high temperatures.

Australia

Australia Allocates USD 5 Million to Combat ToBRFV

Australia is allocating USD 5 million towards a plan to eradicate the tomato brown rugose fruit virus (ToBRFV), a highly transmissible virus threatening the country’s USD 2.78 billion production nursery sector. First detected in Aug-24, ToBRFV affects tomatoes, capsicums, and chilies. The ToBRFV National Management Group, comprising all Australian governments and affected industries, coordinates the response. The virus has been contained to three linked properties so far, and the government emphasizes the importance of proactive biosecurity measures and hygiene to prevent further spread.

Hungary

Hungary's Industrial Tomato Production Set to Grow by 9% YoY in 2024

The World Tomato Processors Association (WPTC) reported that Hungary will increase its industrial tomato production by 9% year-on-year (YoY) in 2024, reaching 120 thousand mt. Globally, producers are set to raise industrial tomato output by 3 to 4% to 45.7 million metric tons (mmt) in 2024, with China driving the growth. The European Commission (EC) projects a 3% rise in the EU's yearly tomato production, even as fresh tomato market prices decline. In Hungary, traders have boosted tomato imports and exports, primarily to the Czech Republic and Slovakia, alongside higher domestic producer prices.

Türkiye

Mersin's Open-Field Tomato Harvest Thrives with Strong Prices

In Mersin, Türkiye, the open-field tomato harvest thrives well into winter, benefiting producers from favorable prices ranging between USD 0.86 and 1.29 per kilogram (kg). Mersin, especially the Erdemli district, is a key hub for Türkiye's fresh produce, significantly supplying the domestic market and exporting to Balkan countries. The region is expected to produce around 1.2 mmt of tomatoes this season. Local growers have expressed satisfaction with the strong demand and profitable prices. The harvest, which began in autumn, is projected to continue through Dec-24, showcasing the resilience and productivity of Mersin's agricultural sector.

Ukraine

Greenhouse Tomato Prices in Ukraine Reach Seven-Year Highs

Ukrainian greenhouse tomato prices surged from USD 1.92 to 2.16/kg, marking a 13% week-on-week increase (WoW) and reaching their highest level in seven years. The rise is driven by a seasonal decline in local greenhouse supply, with limited harvest volumes, while imports have yet to fill the gap. Compared to Nov-23, prices are 49% higher, reflecting ongoing supply constraints. Analysts attribute the sharp increase to insufficient domestic production and delayed imports, which have created opportunities for sellers to raise prices amidst strong demand.

2. Weekly Pricing

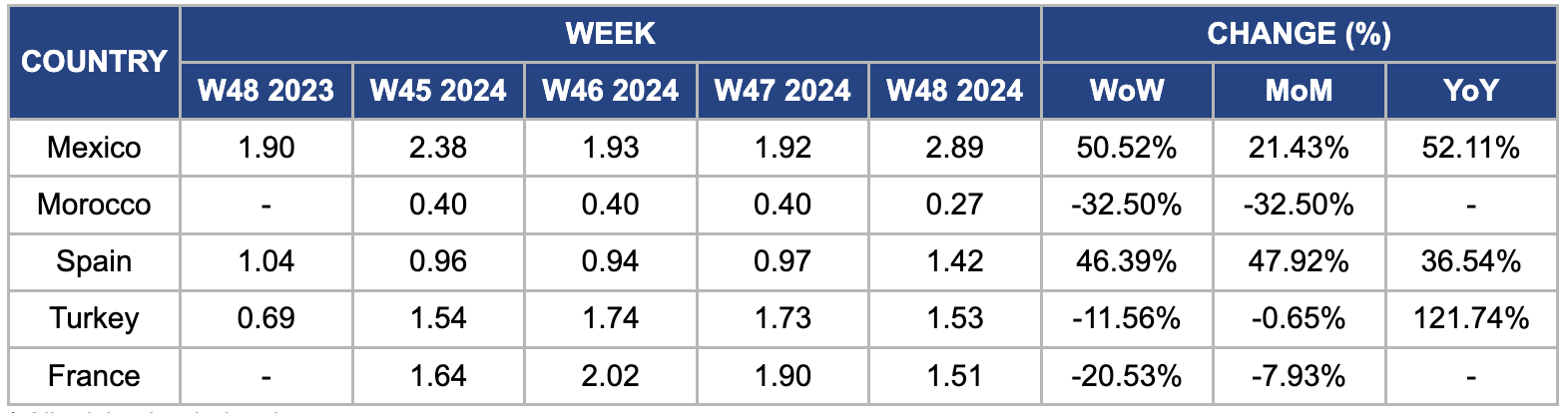

Weekly Tomato Pricing Important Exporters (USD/kg)

Yearly Change in Tomato Pricing Important Exporters (W48 2023 to W48 2024)

Mexico

In W48, Mexico's tomato prices surged by 50.52% WoW, 21.43% month-on-month (MoM), and 52.11% YoY, reaching USD 2.89/kg. This sharp increase is due to several key factors. First, a seasonal decline in production during the winter months, aggravated by adverse weather conditions such as frosts and excessive rainfall in key tomato-producing regions like Sinaloa, reduced the available supply. Moreover, strong export demand, particularly from the United States (US), which continues to experience supply shortages, further tightened the domestic market. The higher production costs, including increased expenses for labor, fuel, and fertilizers, contributed to price hikes as producers transferred these additional costs onto consumers. Furthermore, logistical challenges, including transportation delays and fuel price hikes, added to the cost of moving tomatoes from farms to markets, amplifying the price increase.

Morocco

In W48, Morocco's tomato prices decreased significantly by 32.50% WoW and 32.50% MoM, dropping to USD 0.27/kg. This decline is because Morocco's tomato production typically peaks in the fall and early winter, leading to a seasonal increase in supply, which outpaced demand and caused prices to drop. Moreover, improved harvest yields, particularly in key producing regions like Souss-Massa, contributed to a higher volume of tomatoes entering the market, further driving down prices. The decrease in demand, possibly due to seasonal shifts or reduced export activity, also played a role in the price drop. Furthermore, logistical efficiencies and lower transportation costs may have reduced the overall market cost, contributing to the price decline.

Spain

In W48, Spain's tomato prices surged to USD 1.42/kg, reflecting a 46.39% WoW rise and a 47.92% MoM increase. This surge is due to the strong start of the tomato season in Murcia, where favorable weather conditions, including moderate rains and lower temperatures compared to previous years, contributed to high fruit quality and a smooth transition between crops. Production currently operates at 80 to 85% capacity, supporting stable crop yields. Adopting new disease-resistant tomato varieties has also bolstered production, further improving the outlook for the season. However, competition from Morocco, especially in the early part of the season, may exert downward pressure on prices, potentially influencing Spain's ability to maintain high prices. Spain's favorable crop conditions and strategic agricultural practices indicate a favorable pricing environment, barring any major supply disruptions or weather-related issues.

Türkiye

Türkiye's tomato prices dropped to USD 1.53/kg, marking an 11.56% WoW decrease but a significant 121.74% YoY increase from USD 0.60/kg. The sharp price rise over the past year is primarily due to ongoing drought conditions, severely reducing tomato yields. Moreover, rising operational costs, particularly for diesel and transportation, have outpaced the price growth of tomatoes, putting financial strain on producers and leading to protests from farmers in key agricultural regions. Despite the recent price drop, demand for Turkish vine tomatoes has surged, particularly in European markets, as supply constraints from Spain and Morocco, caused by extreme weather and water shortages, have led to increased reliance on Turkish exports. This heightened demand and production challenges from major suppliers have contributed to Türkiye's substantial price increase over the past year.

France

In W48, France's tomato prices decreased to USD 1.51/kg, reflecting a 20.53% WoW drop and a 7.93% MoM decrease. This price decline is due to the French tomato season nearing its end, with producers wrapping up their harvest. While prices for grape and fleshy tomatoes remain around USD 1.90/kg and round tomatoes at USD 1.58/kg, overall market conditions prevent significant price increases. Sufficient domestic supply and quality inconsistencies at this late stage of the season have led to price variations across batches. Despite these fluctuations, French prices are relatively low compared to neighboring markets, where Dutch and Belgian tomatoes stood at USD 2.32/kg. The French market remains balanced with stable domestic stock levels, helped by the absence of significant imports, such as Spanish grape tomatoes, due to strong local demand in Spain.

3. Actionable Recommendations

Strengthen Tomato Supply Chain Resilience

Enhance infrastructure and storage capacities to handle fluctuations in supply and demand. Spain and Morocco are key tomato producers, but both face challenges from weather variability and seasonal fluctuations. Expanding storage and developing cold chain logistics would help smooth out supply issues during periods of excess production and ensure availability during peak demand. Spain could focus on increasing disease-resistant tomato varieties like Roma and Cherry, which are more resilient to environmental stress, improving yield consistency. Conversely, Morocco should invest in better storage facilities to handle surplus production, mitigating price volatility during peak seasons and ensuring stable market prices year-round.

Diversify Supply Sources for the EU to Mitigate Production Shortages

The EU should expand sourcing from emerging tomato-producing countries in Africa and Eastern Europe to reduce dependency on traditional suppliers like Spain, Morocco, and Italy. Rising production costs, environmental challenges such as droughts, extreme weather, and high input costs have pressured traditional suppliers. The EU could look to Tunisia, Egypt, and Romania, which offer significant potential due to their favorable climates, lower production costs, and relatively untapped markets. By diversifying sourcing, the EU can mitigate the risks associated with price volatility, production shortages, and supply chain disruptions in major tomato-producing regions. Furthermore, establishing trade partnerships with these emerging producers could lead to more stable prices throughout the year. The EU could benefit from more consistent tomato supplies during off-seasons while reducing reliance on overexploited traditional markets, providing an opportunity to spread risk across different countries. This approach would also support global agricultural sustainability by fostering the development of agriculture in regions with lower environmental impact, thus ensuring the long-term stability of the EU tomato market.

Develop Strategic Partnerships for Export Expansion

Türkiye and Ukraine should foster long-term agreements with importers in the EU and other key markets to secure stable demand for their tomatoes. Given the ongoing supply constraints in regions like Spain and Morocco, Turkish and Ukrainian tomato producers are seeing strong demand from European markets and are facing production shortages. By securing export deals with long-term contracts, these countries can ensure stable pricing and consistent market access, benefiting producers and importers. These agreements should include provisions for quality assurance, ensuring that the tomatoes meet the required standards in key markets. Moreover, both countries could enhance their logistics infrastructure, improving transportation networks, cold storage facilities, and delivery systems to meet the growing demand. Investing in such improvements will help maintain product quality, reduce lead times, and minimize disruptions.

Sources: Agrotimes, Sondakika, Farmweekly, Agronaplo