W52 2024: Rice Weekly Update

.jpg)

1. Weekly News

Brazil

Brazil's Rice Planting Progressed to 90.7% Despite El Niño Challenges

Brazil's National Supply Company (CONAB) reported that rice planting for the 2024/25 season reached 90.7% in W52, up from 88.6% in W51. Most of the planting has occurred in Tocantins, Maranhão, Mato Grosso, Goiás, Santa Catarina, and Rio Grande do Sul, collectively accounting for 88% of Brazil's total estimated planting area. Despite challenges posed by the El Niño phenomenon, including drought and excessive rains in various regions, this progress marks a notable increase from last year when planting stood at 87.7%.. However, heavy rains have delayed planting in Rio Grande do Sul, and efforts to develop new cultivation areas are underway as part of the Federal Government's strategic plan.

India

India's Record Rice Harvest Opened Export Opportunities

Indian farmers achieved a record-breaking rice harvest of 120 million metric tons (mmt) during the 2024 summer season, accounting for approximately 85% of the country's total rice production. This achievement is mainly due to abundant monsoon rains, which facilitated an expansion in the cultivated area. India's rice inventories have reached unprecedented levels, with stocks at the beginning of Dec-24 exceeding five times the government’s target. Data from the Food Corporation of India (FCI) shows that state granaries held 44.1 mmt of rice reserves, including unmilled paddy, well above the target of 7.6 mmt.

This surplus positions India, the world’s largest rice exporter, to boost its overseas shipments without jeopardizing domestic supply. Although the government imposed export restrictions on all grades of rice last year due to erratic monsoon rains, the expectation of a bumper harvest has led to the relaxation of most curbs, with restrictions now only applied to broken rice.

Pakistan

Pakistani Rice Exports Surge Amid Growing Demand and Competitive Edge in 2024/25 Season

Pakistan is poised to see a 10% year-on-year (YoY) increase in rice exports during the first half of the 2024/25 season, driven by strong demand for high-quality and aromatic rice. In Nov-24, rice exports grew by 17% YoY in quantity and 5.6% YoY in value, with non-Basmati rice exports rising to 781,882 metric tons (mt) from 665,851 mt during Nov-23 This growth comes amid intense competition from India, which lifted its export ban on various rice varieties earlier in the year. To enhance its export competitiveness, India reduced its minimum export price for Basmati rice, devalued its currency by 2.2%, and redirected subsidized rice from its Public Distribution System (PDS) to export markets.

In contrast, Pakistan has leveraged increased demand from Far Eastern countries such as Indonesia, Malaysia, Singapore, and the Philippines, where El Niño-induced agricultural shortfalls have boosted rice imports. During the first five months of the 2024/25 season, Pakistan's rice exports were valued at USD 1.515 billion, marking a 35% YoY increase.

Russia

Russia Extended Rice Export Ban Until Jun-25 to Secure Domestic Supply

The Russian Prime Minister signed a decree extending the temporary ban on the export of raw rice and rice groats until June 30, 2025. According to the Cabinet of Ministers' website, the restriction excludes deliveries to the Eurasian Economic Union (EAEU), Abkhazia, and South Ossetia and exports for humanitarian aid and international transit shipments. Moreover, rice intended for sowing has been exempted from the ban following requests from partner states. The decision aims to ensure a stable supply of rice and rice groats in the domestic market.

2. Weekly Pricing

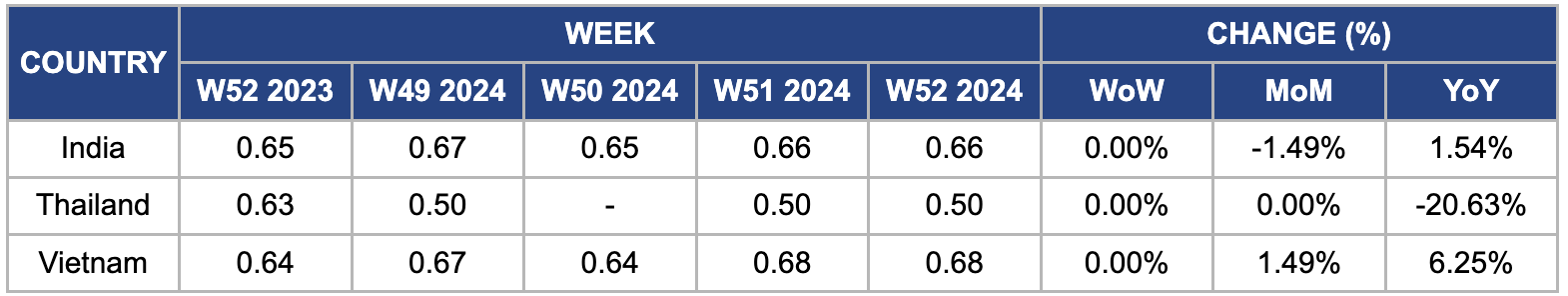

Weekly Rice Pricing Important Exporters (USD/kg)

Yearly Change in Rice Pricing Important Exporters (W52 2023 to W52 2024)

India

In W52 2024, India's wholesale rice prices remained stable WoW but decreased by 1.49% MoM to USD 0.66/kg. This decline is primarily due to India's record-breaking rice production, which reached 120 mmt during summer, contributing approximately 85% to the nation's total rice output. The substantial harvest has led to an increase in rice inventories. At the beginning of Dec-24, state granaries held 44.1 mmt of rice reserves, exceeding the government's target by more than five times. This surplus supply has exerted downward pressure on domestic rice prices, contributing to the observed MoM price decrease.

Thailand

In W52 2024, Thailand's wholesale rice prices remained stable WoW but decreased by 20.63% YoY to USD 0.50/kg. This significant YoY decline is primarily due to increased rice production in Thailand, which has led to a surplus in the market, exerting downward pressure on prices. The USDA Foreign Agricultural Service reported that Thailand's 2024/25 rice production estimate was revised to 9.5 mmt due to slight reductions in area and yield. Moreover, strengthening the Thai baht (THB) and demand for new-crop rice supplies ahead of the holidays have influenced export prices.

Vietnam

In W52, Vietnamese rice prices remained unchanged week-on-week (WoW) but rose by 1.49% month-on-month (MoM) and 6.25% YoY. Several factors contributed to this increase. The supply of rice in the market was limited, with only small quantities arriving, prompting market warehouses to purchase rice at higher prices based on quality. In regions like Lấp Vò and Vàm Cống (Đồng Tháp), where rice availability was scarce, prices were higher for better-quality rice. Similarly, in Sa Đéc (Đồng Tháp), large warehouses sought smaller quantities, with prices determined by quality. This combination of constrained supply and steady demand drove the price increase. Vietnam's rice exports are projected to set a record of 9 mmt in 2024, supported by production and business strategies aligned with market demand. Farmers focus on high-quality rice varieties such as Dai Thom 8, OM 18, and ST, which are internationally popular and offer high economic efficiency.

3. Actionable Recommendations

Expand Export Partnerships in Southeast Asia and the Middle East

Given the increased demand for rice, Pakistan and India should focus on strengthening trade relations with Indonesia, Malaysia, Singapore, the Philippines, and Middle Eastern countries like Saudi Arabia and the United Arab Emirates (UAE). This includes signing bilateral trade agreements, participating in regional trade exhibitions, and enhancing logistics to ensure efficient delivery to these regions. Expanding into emerging markets will help diversify their export portfolios and mitigate the risks of reliance on traditional markets.

Invest in Rice Quality Control and Certification

India and Vietnam should enhance their focus on quality control and certification processes as demand for high-quality rice increases, particularly in Southeast Asian markets. This includes investing in modern milling technology and obtaining internationally recognized certifications for rice quality (e.g., ISO 22000 or Global Good Agricultural Practices (GAP)). By improving the quality of rice and securing certifications, exporters can command higher prices and strengthen their competitive edge in international markets, particularly in premium markets like Europe and the Middle East.

Leverage Technology for Enhanced Productivity and Sustainability

To address potential future supply challenges, especially with climate uncertainties, countries like India and Brazil should invest in innovative irrigation systems, drought-resistant seed varieties, such as IR64, Swarna Sub1, Basmati 370, and MTU1010 (in India), as well as BRSMG 66, BR 1, and Pampa varieties (in Brazil). These varieties are known for their resilience to drought conditions and irregular rainfall patterns, ensuring more stable yields. Precision farming technologies can also help optimize resource use and enhance crop management. Promoting sustainable farming practices, such as integrated pest management and reduced chemical usage, will improve environmental and economic sustainability in the long term.

Sources: Tridge, Kvedomosti, AgroInfo.vn, Planetaarroz, UkrAgroConsult