W17 2025: Banana Weekly Update

In W17 in the banana landscape, some of the most relevant trends included:

- Colombia, Ecuador, and Namibia actively promote sustainable banana production by adopting modern technologies such as precision agriculture, disease-resistant practices, and improved farming systems to strengthen industry resilience.

- Ecuador, Mexico, and Spain are benefiting from strong international and domestic demand, which is driving up banana and plantain prices amid reduced regional supply and weather-related disruptions.

- Ecuador and Colombia are enhancing global competitiveness through innovation in post-harvest handling, traceability, and value-added product development, such as banana snacks and frozen plantains.

- Namibia is exploring local banana production to reduce reliance on imports, leveraging favorable climate conditions and seeking investments to develop a structured local industry.

1. Weekly News

Colombia

Colombia Advances Sustainable Banana Production Despite Growing Challenges

In Colombia, banana cultivation is key to agricultural exports and rural employment, particularly in regions such as Urabá, Magdalena, and La Guajira. However, the industry is increasingly challenged by climate variability and diseases like Black Sigatoka, prompting a shift toward more sustainable and technologically advanced practices. Current efforts emphasize adopting environmentally responsible methods, precision agriculture tools such as drones, and innovative disease control strategies that meet international standards. These developments aim to enhance Colombia’s banana industry’s resilience, productivity, and long-term sustainability.

Ecuador

Ecuador Strengthens Banana Export Leadership with Focus on Sustainability and Innovation

Ecuador, the world’s leading banana exporter, saw a 2.43% year-on-year (YoY) increase in export volume in Jan-25, underscoring the fruit’s importance to the national economy. Despite challenges such as climate variability, disease pressures such as Black Sigatoka, and stricter global regulations, Ecuador is advancing sustainable and efficient banana production. Key initiatives include using technology like drones and virtual DemoFarms, precision farming techniques, and introducing new fungicides like Vitelyum. With support for over 8 thousand producers across nearly 80% of the country’s banana-growing regions, Ecuador is focused on innovation, traceability, and environmental responsibility to sustain its export leadership.

Ecuador Sees Growing International Demand for Plantains and Processed Banana Products

Ecuador is seeing increased international demand for its plantains in 2025, driven by growing consumption of fresh fruit and processed banana-based products like chips and frozen ripe plantains. The United States (US) remains the main export market, particularly in the Latin consumer and restaurant segments, while Ecuadorian companies are expanding into Europe with Barraganete plantain snacks. Ecuadorian bananas are known for their superior texture and flavor. Grown on certified farms with strict quality control, they stand out against competitors from Colombia, Mexico, and the Dominican Republic. Despite a pending 10% US tariff, high demand continues to support Ecuador’s plantain competitiveness, especially in Miami and New York. Producers are earning USD 14 to 15 per box, while US market prices are reaching up to USD 27 per box. Reduced supply from Central America due to weather has further strengthened Ecuador’s position in the global market.

Mexico

Banana Prices Surge in Mexico’s Central Pacific Region

In Mexico, banana prices in the Central Pacific region, particularly in Coahuayana, Michoacán, have risen sharply due to reduced harvests across Michoacán, Colima, and Jalisco. Producers are now receiving up to USD 0.46 per kilogram (MXN 9/kg) for bananas packed in wooden boxes, up from USD 0.31/kg (MXN 6/kg). Export-quality bananas packaged in new or used cardboard boxes have reached a suggested minimum price of USD 0.56/kg (MXN 11/kg). This price increase is driven by limited supply and strong market demand. Local associations are encouraging growers to uphold quality and pricing standards to ensure the profitability of banana cultivation.

Namibia

Namibia Eyes Local Banana Production to Reduce Import Reliance

Despite growing local demand for bananas, Namibia remains heavily reliant on imports, with 6.3 thousand tons valued at USD 3.7 million imported in 2022/23, primarily from South Africa. The Namibian Agronomic Board (NAB) notes that bananas are among the most consumed and traded fruits globally, yet Namibia lacks a structured local banana industry. However, favorable climatic conditions in regions like Kavango and Zambezi offer an opportunity for local cultivation. By adopting high-yield varieties, irrigation systems, and modern farming practices, Namibia could reduce its dependency on imports, create agricultural jobs, and potentially develop export capacity. The NAB emphasizes the need for investment in local banana production to meet national demand and align with global trade standards.

Spain

Canary Islands Banana Prices Reach Record High in 2025

Banana farmers in the Canary Islands have seen average prices rise to USD 1.68/kg (EUR 1.49/kg) in 2025, the highest since Jan-23. This increase is driven by a slowdown in local harvesting and disruptions in Central American banana exports, which are facing challenges due to La Niña-related impacts. These favorable market conditions allow Canarian farmers to profit, even after covering marketing costs of USD 0.45 to 0.56/kg (EUR 0.40 to 0.50/kg) and production costs of around USD 0.73/kg (EUR 0.65/kg). Additionally, they expect payments from the European Union’s (EU) Posei program, which provides USD 0.37/kg (EUR 0.33/kg) in direct aid to support agricultural production in remote and insular regions like the Canary Islands.

2. Weekly Pricing

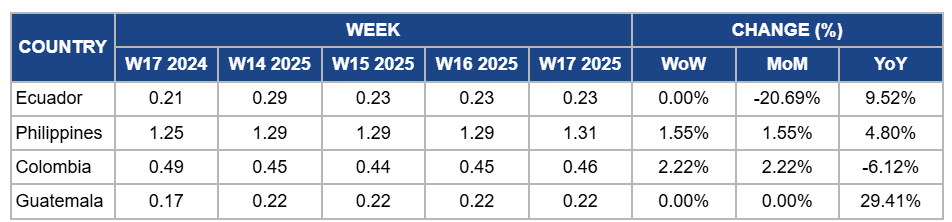

Weekly Banana Pricing Important Exporters (USD/kg)

Yearly Change in Banana Pricing Important Exporters (W17 2024 to W17 2025)

Ecuador

In W17, banana prices in Ecuador remained steady at USD 0.23/kg with no week-on-week (WoW) change, but marked a 9.52% YoY increase due to strong international demand, particularly from Europe, the US, and East Asia. This demand surge was driven by reduced banana production in Central American countries, such as Costa Rica, Guatemala, and Honduras, which faced climatic challenges, prompting buyers to turn to Ecuador for supply. Additionally, Ecuador's commitment to sustainable and high-quality banana production further strengthened its competitiveness in the global market. However, prices dropped by 20.69% month-on-month (MoM) due to favorable weather conditions that increased banana production, resulting in a temporary oversupply. This surplus, coupled with logistical challenges like disruptions in the Panama Canal and increased shipping costs, affected export dynamics. Moreover, implementing a higher minimum support price for bananas in 2025 led some European retailers to reduce their purchases, seeking more competitively priced alternatives. These combined factors contributed to the observed MoM price decline.

Philippines

Banana prices in the Philippines increased slightly by 1.55% WoW and MoM to USD 1.31/kg in W17, with a 4.80% YoY rise. This uptick is due to stronger demand from key export markets like Japan and government initiatives to boost banana production and export competitiveness. Programs by the Department of Agriculture (DA) have supported small-scale farmers and enhanced production capabilities. Despite ongoing challenges, such as Panama disease, the efforts to improve farm resilience and ensure quality have helped maintain supply, contributing to price stability in the market.

Colombia

In Colombia, banana prices rose by 2.22% WoW and MoM to USD 0.46/kg, reflecting a 6.12% YoY decrease. This price uptick is due to stronger demand in key export markets, such as the US and Europe, where there is a preference for higher-quality bananas. While favorable weather conditions contributed to improved yields, the better fruit quality and consistency in supply allowed producers to capture higher prices in these markets. However, the YoY decrease reflects ongoing challenges, including disease pressures like Fusarium Wilt (Foc TR4) and increasing competition from other banana-producing countries, which have kept prices lower than last year.

Guatemala

In W17, Guatemala's banana prices remained steady at USD 0.22/kg, with no WoW or MoM change. This stability is due to consistent export demand from key markets, particularly North America and Europe, and stable supply conditions. The 29.41% YoY price increase is due to higher input costs, such as fertilizers and labor, and ongoing efforts to enhance quality standards, which have contributed to overall price stability and gradual upward trends in the market.

3. Actionable Recommendations

Maintain Price Gains by Standardizing Post-Harvest Handling

Banana producers in Michoacán, Colima, and Jalisco should maintain current price momentum by improving post-harvest handling practices. This includes consistently using export-grade packaging like clean, ventilated cardboard boxes and maintaining uniform fruit sizing and ripeness. Producers can meet buyer expectations and justify premium pricing amid tight supply by standardizing quality across shipments and avoiding shortcuts with mixed packaging or inconsistent grading. Associations should support these efforts through on-site training and peer-led quality checks.

Capitalize on High Prices by Prioritizing Premium Grades

Canarian banana farmers should prioritize sorting and marketing premium-grade bananas to maximize profits during this price surge. Farmers can secure top-tier retail placements and justify higher pricing by focusing on consistent size, ripeness, and appearance. For example, packing only uniform, blemish-free bananas in export-ready boxes can attract supermarket buyers looking for a reliable supply amidst Central American disruptions. Cooperatives can help by streamlining packing center standards and aligning shipments with retailer specifications.

Sources: Agronegocios, Agropacífico del Ecuador, Directoalpaladar, Freshplaza, Kchcomunicacion, Market Watch, Quadratin