.jpg)

In W18 in the rice landscape, some of the most relevant trends included:

- Indonesia reached a 23-year high in rice reserves at 3.18 mmt, credited to coordinated efforts across government, military, and state-owned enterprises. This surge reflects a significant increase in production from 50% to 62% between Jan-25 and Apr-25 following strong presidential directives.

- India introduced two new high-yield, climate-resilient genome-edited rice varieties. Meanwhile, domestic rice prices remained firm at USD 0.65/kg due to tight supply from delayed monsoons and strong export demand. At the same time, Vietnam’s prices fell MoM and YoY due to harvest peaks, and US prices stayed flat despite rising output and weaker export demand.

- Thailand reaffirmed its 7.5 mmt export target for 2025 despite a 30% YoY drop in Q1 exports, planning to rely on G2G deals and new markets to offset competition from India’s export resurgence.

1. Weekly News

India

India Unveils Genome-Edited Rice Varieties to Boost Yields and Climate Adaptability

On April 4, India’s Agriculture Minister unveiled the country’s first genome-edited rice varieties, DRR Dhan 100 (Kamala) and Pusa DST Rice 1, developed by the Indian Council of Agricultural Research (ICAR). These varieties promise to boost yields by 20 to 30%, conserve water, and cut greenhouse gas emissions, key steps in adapting rice farming to climate change. Developed by enhancing popular varieties Samba Mahsuri (BPT5204) and MTU1010, the new lines retain the original grain quality while offering improved stress tolerance and adaptability. They are recommended for cultivation across key rice-producing states like Andhra Pradesh, Bihar, Karnataka, Odisha, Tamil Nadu, West Bengal, and others.

Indonesia

Indonesia's Government Rice Reserves Hit 23-Year High at 3.18 MMT Due to Surge in Production

The Indonesian Minister of Agriculture announced that the national government's rice reserves reached 3.18 million metric tons (mmt), its highest level in 23 years, potentially even since independence. Attributed to the coordinated efforts of agricultural stakeholders, including local authorities, agricultural extension workers, the military and police, and state-owned enterprises like Bulog and Pupuk Indonesia, this milestone marks a significant achievement in national food security. Moreover, official data from the Central Statistics Agency (BPS) show that rice production surged from 50% to 62% from Jan-25 to Apr-25. This sharp increase follows strong directives from the President, including Presidential Instruction and Regulations aimed at boosting national agricultural output.

South Korea

South Korea to Launch Voluntary Rice Self-Help Fund via RPCs After 20 Years of Stalled Debate

The South Korean government has announced plans to establish a voluntary rice self-help fund centered on Rice Processing Complexes (RPCs), aiming to counter declining rice consumption and stalled reform efforts over the past two decades. Despite ongoing discussions since 2006, when per capita rice intake dropped below 80 kilograms (kg) and imported rice from the United States (US), China, and Thailand gained market presence, industry disagreements have hindered progress on a mandatory fund. At the 2025 Nonghyup National Integrated RPC Operation Council meeting in Jeju, the Ministry of Agriculture, Food and Rural Affairs (MAFRA) confirmed it will proceed with a voluntary model. However, farmer groups remain divided over the initiative, with producer participation essential to the fund's success.

Thailand

Thailand Sticks to 7.5 MMT Rice Export Goal for 2025 Despite Q1 Slump

According to the head of the Commerce Ministry’s foreign trade department, Thailand remains committed to achieving its 2025 rice export target of 7.5 mmt, despite a sharp 30% year-on-year (YoY) decline in Q1 shipments due to India’s return to the export market. Fragrant jasmine rice exports to the US have increased ahead of upcoming steep tariffs, helping offset the downturn. The ministry plans to support export volumes through government-to-government deals, including with China, and by expanding into African markets.

2. Weekly Pricing

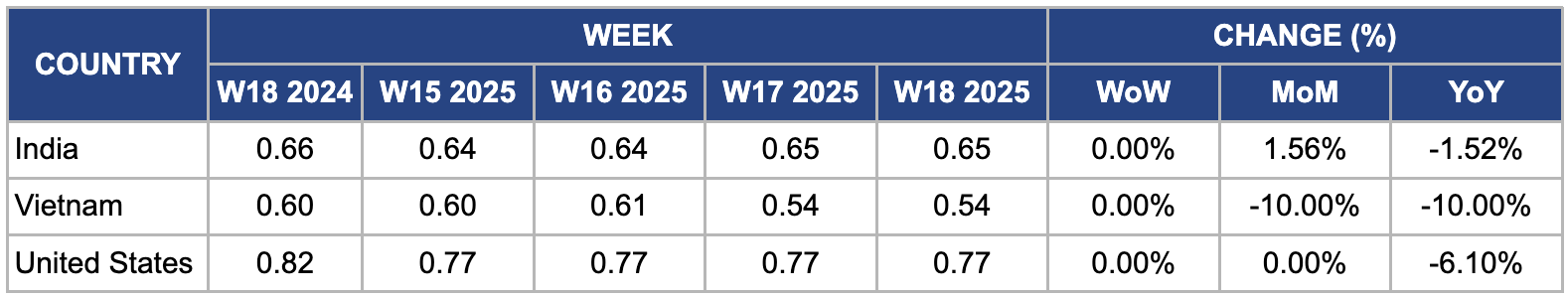

Weekly Rice Pricing Important Exporters (USD/kg)

Yearly Change in Rice Pricing Important Exporters (W18 2024 to W18 2025)

India

In W18, India's wholesale rice prices held steady at USD 0.65/kg, showing no week-on-week (WoW) change but registering a 1.56% month-on-month (MoM) increase. This price stability comes amid tightening domestic supply caused by delayed monsoons and drought conditions in key producing states such as Uttar Pradesh and Punjab, which have raised concerns about reduced yields. Export demand remains strong, particularly from Bangladesh and Sri Lanka, where local supply shortages have kept import needs high. India's rice shipments to Bangladesh rose by 15% YoY in Q1-25, contributing to upward pressure on prices. Meanwhile, global supply constraints driven by weaker harvests in other major exporters like Vietnam and Thailand have increased India's importance in the international market, further supporting price firmness.

Vietnam

In W18, Vietnamese rice prices declined significantly to USD 0.54/kg, marking a 10% drop in both MoM and YoY. This sharp decline is mainly due to peak harvest activity in areas like Trà Vinh, which caused a temporary glut in the domestic market. However, fresh rice supply started to dwindle in key regions such as An Giang, Kiên Giang, and Bạc Liêu, where harvesting has slowed. Despite the overall low transaction volumes, demand for specific high-quality rice varieties, such as ST fragrant rice in Bạc Liêu and OM 5451 rice in other provinces, has remained strong, supporting localized price stability. Moreover, Vietnamese rice exports have held steady due to consistent demand from African and Asian buyers, particularly as global rice supply remains constrained by production challenges in Thailand and Myanmar.

United States

In W18, US rice prices held steady WoW and MoM at USD 0.77/kg, but were down 6.10% YoY. The decline is due to a notable increase in production for the 2024/25 crop year, with total output estimated at around 8.6 mmt, representing a 3% rise from the previous year. This boost in supply has eased upward pressure on prices. Moreover, the global rice market has seen a broad price decline, especially from major exporters like India and Thailand, making US rice less competitive internationally. As a result, export demand has weakened, further weighing on US rice prices despite stable domestic consumption. The combined effect of higher domestic production and reduced international competitiveness due to lower global benchmarks has been the main driver of the annual price drop.

3. Actionable Recommendations

Strengthen Collaboration for National Rice Security

With Indonesia’s rice reserve reaching its highest level in 23 years, stakeholders in rice production must continue strengthening collaborations across all levels, the government, military, agricultural extension services, and state-owned enterprises. Encouraging cooperation between local authorities and farmers will further stabilize the domestic rice supply chain and ensure consistent stockpiling, particularly during peak harvest periods. Moreover, fostering public-private partnerships can create long-term strategies for enhancing the resilience of the rice sector, enabling better management of rice reserves for food security.

Adopt and Scale Up Genome-Edited Rice Varieties

The introduction of genome-edited rice varieties in India, such as DRR Dhan 100 (Kamala) and Pusa DST Rice 1 presents a model for other rice-producing nations to follow in enhancing yields, water efficiency, and climate resilience. Countries like China, Vietnam, Thailand, Bangladesh, Indonesia, and the Philippines, all of which face increasing climate-related challenges, could benefit significantly from investing in similar genome-editing technologies. By developing stress-tolerant rice strains tailored to local conditions, these nations can ensure stable or increased rice production, reduce resource usage, and improve food security. Large-scale adoption of such innovations can support sustainability and competitiveness in global rice markets while helping farmers adapt to environmental uncertainties.

Enhance Global Rice Export Strategies Amid Price Fluctuations

Given the significant fluctuations in rice prices, countries like Thailand, India, and the US should refine their export strategies to manage global competition effectively. For instance, Thailand must focus on diversifying its rice export destinations to mitigate the impact of a shrinking market share in traditional regions due to competition from India. Developing government-to-government deals, such as those planned with China and expanding into African markets, can help maintain export volumes. Similarly, in the US, addressing the competitive pricing challenge and expanding promotional efforts in new markets would support price stabilization and continued demand for US rice abroad.

Sources: Tridge, Agrinet, Bangkok Post, Republika, Ukr Agro Consult.