In W18 in the sugar landscape, some of the most relevant trends included:

- Brazil is expected to lead global sugar production in 2025/26 with a record 45.9 mmt. This growth is driven by improved processing efficiency despite a 2% decline in sugarcane output, highlighting strong export competitiveness.

- India faces declining sugar output, projected at 26.4 mmt for 2024/25, prompting a 4.41% increase in the sugarcane FRP to support farmers and ensure continued cultivation amid lower yields.

- Russia's sugar beet area is expanding, with spring sowing progressing faster than last year, supporting the country’s broader push for increased agricultural output and food security.

- California's sugar beet industry is collapsing, following the announced closure of the Spreckels Sugar plant, which will end sugar processing in the Imperial Valley. This marks a major shift in the US domestic sugar landscape.

- Pakistan’s sugar prices rose 12.24% YoY, driven by inflation and supply shortages. Political tensions and trade disruptions with India have exacerbated these challenges, pointing to potential further volatility.

1. Weekly News

Brazil

Brazil Forecasts Record Sugar Output in 2025/26 Despite Lower Sugarcane Harvest

Despite a projected 2% YoY decline in sugarcane output, estimated at 663.4 mmt, Brazil is expected to produce a record 45.9 million metric tons (mmt) of sugar in the 2025/26 season. This reflects a 4% year-on-year (YoY) increase, according to the National Supply Company (Conab). . The rise in sugar output demonstrates Brazil's strong processing efficiency and competitiveness in global markets, particularly Arab countries, which are key export destinations. While sugar production grows, ethanol output is expected to decline by 1%, reaching 36.82 billion liters (L).

India

India Raises Sugarcane FRP Amid Declining Sugar Output

Amid a projected decline in sugar production, the Indian government has raised the fair and remunerative price (FRP) of sugarcane by 4.41% to USD 4.19 per quintal (INR 355/quintal) for the 2025/26 season, effective from October 1, 2025. Based on a 10.25% recovery, this new rate represents a 105.2% margin over the estimated production cost of USD 2.04/quintal (INR 173/quintal). Sugar output for the 2024/25 season is expected to fall to 26.40 mmt, down from 31.90 mmt last year. The FRP revision aims to support farmers and incentivize continued cultivation, with guaranteed payments even for lower recovery rates, ensuring a minimum of USD 3.88/quintal (INR 329.05/quintal) for recovery below 9.5%.

Russia

Russia Accelerates Spring Sowing, Including Sugar Beet Expansion

Russia's 2025 spring sowing campaign is progressing ahead of schedule, with 10.5 million hectares (ha) sown across 56 regions as of W18, 1.3 million ha more than last year. Sugar beets have been planted on 0.8 million ha, contributing to the country’s broader agricultural expansion. The total sown area for the year is expected to reach 84 million ha, including 56 million ha for spring crops. Authorities report that farmers are fully equipped with the necessary resources, supporting strong momentum in crop development and food production.

United States

Closure of California’s Last Sugar Beet Plant Marks Major Blow to Industry and Local Economy

The impending closure of the Spreckels Sugar Company plant in Brawley, California, the state’s last sugar beet processing facility, will end sugar beet production in the Imperial Valley, impacting over 20,000 acres of cropland and potentially displacing more than 1,000 jobs. Citing unsustainable operating costs and required capital improvements exceeding USD 100 million, the Southern Minnesota Beet Sugar Cooperative (SMBSC) has deemed the plant financially unviable. Growers are now facing uncertainty over crop alternatives and water allocation, with no clear path to maintain sugar beet cultivation. The closure, coupled with the likely loss of United States Department of Agriculture (USDA) sugar production quotas, may effectively end California’s role in the domestic sugar beet industry, which once produced over 1 mmt annually in Imperial County alone.

2. Weekly Pricing

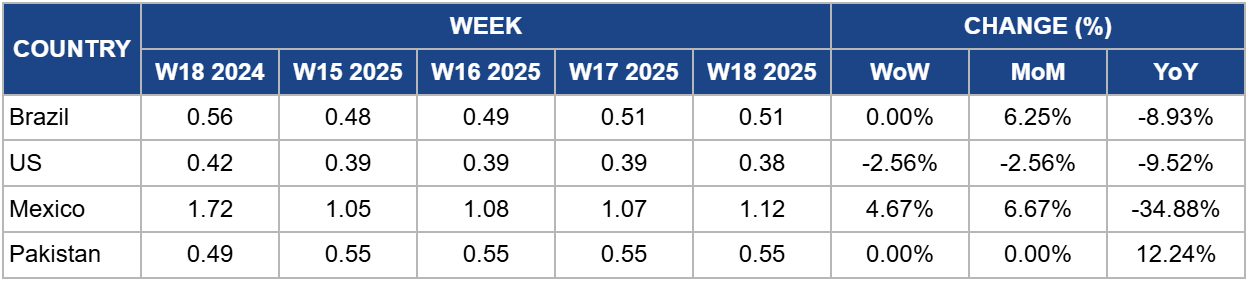

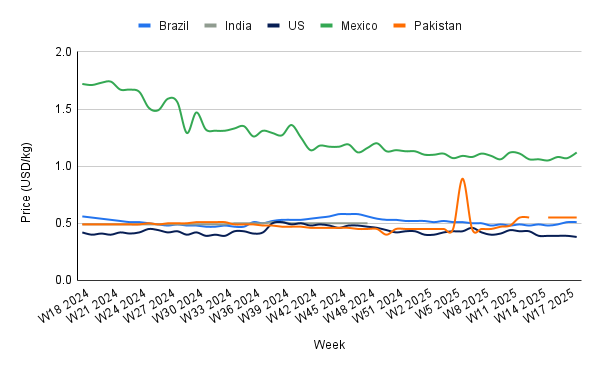

Weekly Sugar Pricing Important Producers (USD/kg)

Yearly Change in Sugar Pricing Important Producers (W18 2024 to W18 2025)

Brazil

In W18, Brazil's wholesale sugar prices remained stable week-on-week (WoW) at USD 0.51 per kilogram (kg), marking a 6.25% increase month-on-month (MoM) from USD 0.48/kg. This moderate upward trend reflects tightening global supply dynamics and expectations of strong export demand.

Despite a slight decline in sugarcane output due to adverse weather in Southeast Brazil, sugar production in 2025/26 is projected to reach a record high, supported by improved processing efficiency and a strategic shift from ethanol to sugar production. Stable prices despite a smaller harvest suggest that increased sugar production is already factored into the market. However, further weather-related disruptions or reduced output from other key producers such as India and Thailand could drive prices higher. Brazil’s low production costs and export competitiveness are expected to support firm sugar prices in the months ahead.

United States

The United States (US) sugar prices declined to USD 0.38/kg in W18, down 2.56% both WoW and MoM from USD 0.39/kg. This price easing signals a retreat from the elevated levels observed in 2024, aligning with improved market expectations. Favorable spring planting conditions across major sugar beet regions, including Idaho, Oregon, and Washington, have enabled early sowing, in some areas up to two weeks ahead of schedule. With minimal replanting required and sufficient water availability projected, early indicators point to strong yield potential for the 2025 crop. Although planted acreage is set to decline slightly by 2%, this is a strategic adjustment in line with processing capacity rather than environmental constraints.

If current growing conditions persist, an increase in domestic sugar output could place additional downward pressure on prices later in the year. However, risks remain, such as late-season frost or unexpected water shortages could disrupt yields and limit price declines. Continued monitoring of weather and crop progress will be key to gauging future price movements.

Mexico

In W18, Mexico's sugar prices rose to USD 1.12/kg, reflecting a 4.67% increase WoW but remaining 34.88% lower YoY. This short-term rebound comes amid ongoing supply and policy challenges in the domestic market. As several sugar mills conclude their harvest operations, attention has turned to setting reference prices for sugarcane liquidation payments. With the current market indicator below the pre-settlement level of USD 892.71 per metric ton (MXN 17,500/mt), pressure is mounting for a negotiated pricing solution, adding uncertainty to producer returns.

Recent export blockades by sugarcane organizations, lasting 19 days, temporarily constrained supply and lifted prices. However, as exports resumed and warehouse inventories flowed into the market, prices corrected downward compared to the previous year due to increased availability. Further compounding this is a reduction in the Manufacturing, Maquiladora, and Export Services Industry (IMMEX) program sugar sales, as industrial users imported US sugar under tariff exemptions, decreasing domestic demand and adding to supply surpluses. The upcoming US–Mexico sugar trade renegotiation adds uncertainty, especially amid recent US trade actions in other sectors. As oversupply persists, price rebounds may be limited, keeping market volatility elevated.

Pakistan

In W18, Pakistan's wholesale sugar prices held steady WoW and MoM at USD 0.55/kg, marking an increase of 12.24% YoY, amid broader inflation in essential goods. Heightened political tensions with India, including trade disruptions and border closures, have worsened supply constraints, contributing to sharp local price spikes, up to USD 0.64/kg (PKR 180/kg) in some cities. If cross-border restrictions persist and domestic supply remains tight, upward pressure on sugar prices may intensify in the coming weeks.

3. Actionable Recommendations

Expand Strategic Sugar Export Initiatives

Brazilian exporters should strengthen trade relations with high-demand markets such as the Middle East and North Africa, leveraging their record-high output and low production costs. Trade missions, bilateral agreements, and export credit mechanisms can enhance competitiveness and secure long-term contracts amid tightening global supplies and declining Indian output.

Establish Risk Management Mechanisms to Address Volatility

Given ongoing policy uncertainty and oversupply pressures, Mexican sugar stakeholders should implement forward pricing tools and explore regional export diversification. Reinforcing inventory management systems and stabilizing producer payments through indexed contracts would help buffer volatility and restore confidence among growers.

Sources: Tridge, Oil World, Brazil-Arab News Agency, Indian Express, ANBA, Farm Progress, GCMA