In W18 in the tomato landscape, some of the most relevant trends included:

- Azerbaijan banned tomato imports from Turkmenistan after detecting ToBRFV, highlighting growing phytosanitary concerns in global trade.

- Nigeria faced devastating crop losses due to an outbreak of Tuta absoluta, also known as Tomato Ebola. Meanwhile, Ukraine’s tomato production suffered from unexpected frosts damaging blooming crops.

- The US imposed a 17.09% levy on Mexican tomato imports, sparking debate across the industry. Florida growers welcomed the move to protect domestic production, while importers and retailers warned of reduced variety and higher prices.

- In parallel, Morocco’s strict export restrictions led to a surge in local supply and a sharp domestic price drop.

- On the pricing front, Mexican tomatoes saw a steep WoW decline due to seasonal oversupply and weak US demand. In contrast, prices in Nigeria and Spain surged, driven by pest-induced shortages and cross-border trade imbalances, respectively.

1. Weekly News

Azerbaijan

Azerbaijan Bans Turkmen Tomato Imports After Virus Detection

Azerbaijan’s Food Safety Agency (FSAA) has imposed a temporary import ban on tomatoes from Turkmenistan after detecting the Tomato brown rugose fruit virus (ToBRFV) in 11 imported batches. Following laboratory analysis, the authorities destroyed or removed the affected shipments from the customs territory. The FSAA also alerted Turkmenistan’s relevant authority to implement corrective measures at the source farms. This highly contagious virus, which spreads through seeds, fruits, and mechanical contact, affects crops such as tomatoes, eggplants, peppers, and tobacco, potentially causing 30 to 70% yield losses and reducing produce quality and shelf life.

Nigeria

Nigeria's Tomato Prices Surged Due to Pest Outbreak

Tomato prices surged across Nigeria in May-25 as a devastating outbreak of Tuta absoluta, known as Tomato Ebola, has caused over USD 807,558 in losses in Kano, Katsina, and Kaduna. The Minister of Agriculture and Food Security disclosed during a workshop in Abuja that the pest can wipe out tomato crops within 48 hours, causing the price of a 50-kilogram (kg) basket to jump from USD 3.11 to 18.64. This sharp increase is fueling food inflation and straining household budgets nationwide. Kyari stressed the importance of tomatoes and peppers in Nigerian cuisine and warned that rising costs impact food vendors, restaurants, and families. According to the National Bureau of Statistics (NBS), tomato prices increased 320% year-on-year (YoY), making them the top contributor to food inflation. The minister urged urgent investment in pest control, resilient crop varieties, and farmer support, highlighting horticulture's role in nutrition, trade, job creation, and rural development.

Ukraine

Unexpected Frosts Devastate Tomato Crops in W18

Unexpected frosts have struck Ukraine again in W18, severely damaging tomatoes and strawberries. Farmers expressed frustration, reporting that forecasts had predicted +3°C, yet temperatures dropped to -1°C, devastating uncovered, blooming crops. While some growers hope for partial recovery if roots remain intact, many experienced total yield loss due to the widespread frost damage.

United States

US Imposes 17.09% Tariff on Mexican Tomatoes, Sparking Industry Division

A new 17.09% levy on Mexican tomato imports, set to take effect in mid-July-25, has divided Florida tomato growers and other stakeholders in the United States (US) tomato industry, including restaurateurs, importers, and fans of specialty varieties like cherry tomatoes. The US administration withdrew from a decades-old trade agreement and imposed tariffs to protect Florida's domestic tomato industry, which has struggled with rising imports. Florida growers support the levy, claiming it levels the playing field and asserting that US farms can match Mexico in variety and quality. However, critics argue the tariff could backfire, noting that Mexico supplies about 65% of tomatoes consumed in the US, including most sweet, vine-ripened, and small varieties that consumers prefer. Retail and restaurant associations oppose the move, warning it could reduce year-round access and limit variety on store shelves. Mexico continues to serve as the largest tomato supplier to the US market.

2. Weekly Pricing

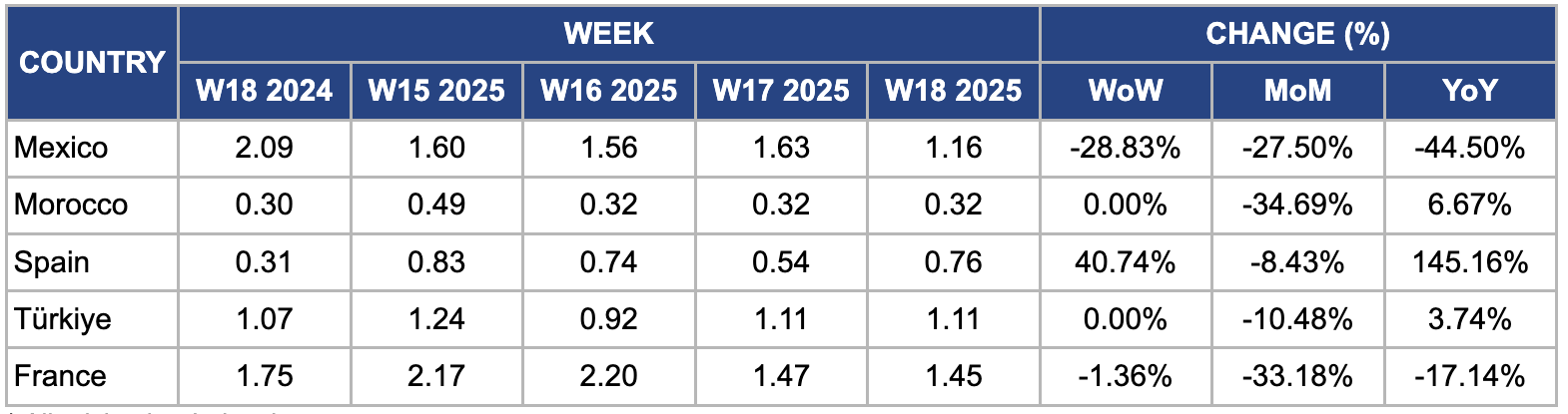

Weekly Tomato Pricing Important Exporters (USD/kg)

Yearly Change in Tomato Pricing Important Exporters (W18 2024 to W18 2025)

Mexico

Mexican tomato prices declined 28.83% week-on-week (WoW), 27.50% month-on-month (MoM), and 44.50% YoY to USD 1.16/kg in W18. The decline is primarily due to a seasonal surge in supply from key producing states such as Sinaloa and Baja California, where the peak harvest period has significantly boosted market availability. Moreover, favorable weather conditions in Apr-25 across northwestern Mexico supported higher yields, leading to oversupply and downward pressure on prices. Weak export demand to the US and rising domestic inventories have also contributed to the sharp price drop.

Morocco

In W18, Morocco's tomato prices held steady WoW but experienced a significant MoM drop of 34.69%, falling to USD 0.32/kg. This decline was largely attributed to the government's decision to impose strict export quotas, reducing daily tomato shipments to Europe by 90% for round and grape varieties. The measure was intended to increase domestic availability and control price inflation, ahead of the holiday period when food demand typically spikes. Consequently, the surge in local supply led to a sharp price reduction, demonstrating the immediate impact of policy interventions on market dynamics.

Spain

In W18, Spain's wholesale tomato prices surged by 40.74% WoW, rising to USD 0.76/kg from USD 0.54/kg. This price increase is mainly due to the influx of Moroccan tomatoes, which exceeded the 32 thousand metric tons (mt) allowed. The agricultural associations in Almería province explained that these imports arrived in Europe without an established price. Moreover, the Spanish Federation of Associations of Producers and Exporters of Fruits, Vegetables, Flowers, and Live Plants (FEPEX) believes the European Commission's (EC) daily import value estimates do not accurately reflect the market situation. Transactions are reportedly occurring at much lower prices, with some tomatoes being sold on consignment without a set price. FEPEX further highlights that the situation worsened as the EC does not permit producer organizations to implement crisis prevention and management measures until they meet the Commission’s regulations published in Dec-24.

Türkiye

In W18, Türkiye's wholesale tomato prices remained unchanged WoW at USD 1.11/kg. However, prices showed a notable MoM decline of 10.48% from USD 1.24/kg in W15. This drop is due to the seasonal increase in supply as the spring harvest gained momentum, particularly from major producing regions such as Antalya and Mersin. The influx of fresh tomatoes into the market eased previous supply tightness, leading to a price correction despite steady domestic demand.

France

In W18, France's wholesale tomato prices fell by 1.36% WoW and 33.18% MoM to USD 1.45/kg. The sharp decline stemmed primarily from a surge in domestic supply as growers in key regions like Provence-Alpes-Côte d’Azur and Brittany hit peak spring production. Favorable weather accelerated harvests, temporarily flooding the market. At the same time, post-Easter demand slowed, and steady imports from neighboring EU countries such as Spain and Morocco further pressured prices downward. This price drop reflects seasonal trends typical during abundant supply and weakened consumer demand.

3. Actionable Recommendations

Invest in Climate-Smart and Pest-Resilient Horticulture Systems Using IPM

Nigeria’s catastrophic Tuta absoluta infestation wiped out crops within 48 hours and triggered a YoY price surge, underscoring the urgent need for pest-resilient practices. Governments must subsidize farmers’ access to insect-proof netting, biopesticides, early warning systems, and training in Integrated Pest Management (IPM) techniques. Local seed companies should develop and distribute pest-resistant tomato varieties, such as Tropic King, Roma VF, UC82B, and Padma F1, which have shown tolerance to common tomato pests and diseases. These actions can reduce crop losses, stabilize food prices, and strengthen resilience against future invasive pest outbreaks.

Develop Buffer Stocks and Domestic Supply Chain Incentives to Stabilize Prices during Surpluses and Trade Shocks

Mexico’s WoW price crash due to overproduction and weak exports, coupled with the upcoming US levy on Mexican tomatoes, demonstrates the vulnerability of growers to both seasonal gluts and trade barriers. Governments in major tomato-producing countries should create public-private buffer stock systems to absorb excess supply during peak harvests. Moreover, domestic value chain investments, such as support for local processors and cold chain expansion, can reduce dependency on export markets, stabilize farmgate prices, and extend product shelf life.

Establish a Regional Biosecurity Framework to Prevent Virus Spread and Strengthen Cross-Border Disease Monitoring

The outbreak of ToBRFV in Turkmenistan highlights the need for coordinated regional biosecurity measures. Azerbaijan and neighboring countries should form a task force under a shared framework to enhance real-time pest and disease monitoring, standardized testing protocols at borders, and transparent information sharing. Such a framework could help detect outbreaks early, limit trade disruptions, and protect regional tomato industries from economic and reputational damage caused by uncontained plant diseases.

Sources: Tridge, Fresh Plaza, FructiDor, Horti Daily, Point Blank News, Washington Post