In W19 in the maize landscape, some of the most relevant trends included:

- Heavy rains in the US, Brazil, improved soil moisture and crop development, while dry weather accelerated corn harvesting in Argentina.

- Global corn prices showed mixed trends in W19. US corn prices decreased due to improved weather conditions and better crop outlooks, while Ukrainian prices surged due to supply chain issues and strong export demand. Brazilian and Argentine prices dropped due to increased supply and lower demand from the livestock and ethanol sectors.

- In Pakistan, surging domestic demand, especially from the poultry sector, caused a sharp 87% YoY decline in corn exports during Q1-2025. The poultry industry rebounded following the lifting of the GM soybean import ban, further boosting domestic consumption and squeezing export availability.

1. Weekly News

Global

Heavy Rains Boost Corn Crops in the US and Brazil, Dry Conditions in Argentina and Europe

In W19, heavy rains hit major corn-growing regions in the United States (US), delaying planting but significantly improving soil moisture to support future crop development. In Brazil, central and northern regions received substantial rainfall, which replenished moisture reserves, creating favorable conditions for pollination and grain filling of the second corn crop and for sowing winter wheat in the coming weeks. Forecasts suggest southern Brazil may also receive additional rainfall this week. In Argentina, dry weather allowed farmers to accelerate corn harvesting, while expected rains should improve conditions for sowing winter wheat. Across Europe, farmers advanced spring crop sowing under dry weather, and a rain front over the weekend replenished soil moisture in southeastern areas.

Argentina

Argentina Corn Harvest Progresses to 31.3% as of April 30

As of April 30, Argentina’s 2024/25 corn harvest progressed to 31.3%, marking a 9.3% week-on-week (WoW) increase, though progress was delayed by excessive rain and farmers prioritizing soybean harvesting. The nationwide yield currently averages 8.21 metric tons (mt) per hectare (ha), aligning with initial expectations. While yields in northern Argentina may disappoint due to earlier adverse weather, strong yields in central Argentina are expected to offset those losses. The Buenos Aires Grain Exchange (BAGE) kept the total production estimate unchanged at 49 million metric tons (mmt), maintaining a neutral to slightly bullish outlook. Crop ratings showed 38% in good to excellent condition, 42% fair, and 20% poor to very poor.

Brazil

Brazil Forecasts Record Corn Harvest in 2024/25 Season

Brazil is set to harvest one of its largest corn crops in the 2024/25 season due to favorable weather and expanded planting. The National Supply Company (CONAB) projects total production at 124.7 mmt, an 8.5% increase from the 2023/24 season, with the second crop (Safrinha) accounting for 98 mmt, or nearly 80% of the total. The United States Department of Agriculture (USDA) gives a slightly higher estimate of 126 mmt, supported by a 4% rise in planted area to 22.3 million ha. Heavy early-season rains improved yield prospects, particularly in key regions like Sinop in Mato Grosso, where rainfall reached up to 2,500 millimeters (mm). However, corn stocks fell to a record low of 2 mmt in 2023/24. They will recover to 5.5 mmt by Jan-25 and 7.5 mmt by the end of Feb-25, before potentially falling below 3 mmt later in the season. Tight stocks and strong domestic and export demand will keep prices high, potentially impacting US competitiveness. For 2025/26, the USDA expects Brazil's corn output to reach 130 mmt, reinforcing its dominance in global markets.

Pakistan

Record Poultry Demand Reduces Corn Exports by 87% YoY in Q1-2025

Surging poultry production pushed Pakistan’s corn demand to record highs, slashing exports and transforming the country’s grain market. In Q1-2025, corn exports from Pakistan plunged 87% year-on-year (YoY) as administrative hurdles and soaring demand from domestic feed manufacturers disrupted trade flows. Pakistan shipped only 53 thousand mt of corn during this period, halting deliveries to more than a dozen countries, including China, Vietnam, Saudi Arabia, and Romania. This sharp decline contrasts with 2024, when Pakistan exported 419 thousand mt of corn, driven by strong demand from Vietnam. However, this upward trend has now reversed. The USDA recently reported that growing demand from the domestic feed industry will likely keep export volumes under pressure.

A key factor behind this shift lies in the dynamics of the poultry sector. The ban on genetically modified (GM) soybean imports in Oct-22 had severely constrained the industry, dampening corn demand. But after the government lifted the ban in late 2024, the poultry sector rebounded sharply, triggering a surge in corn consumption.

2. Weekly Pricing

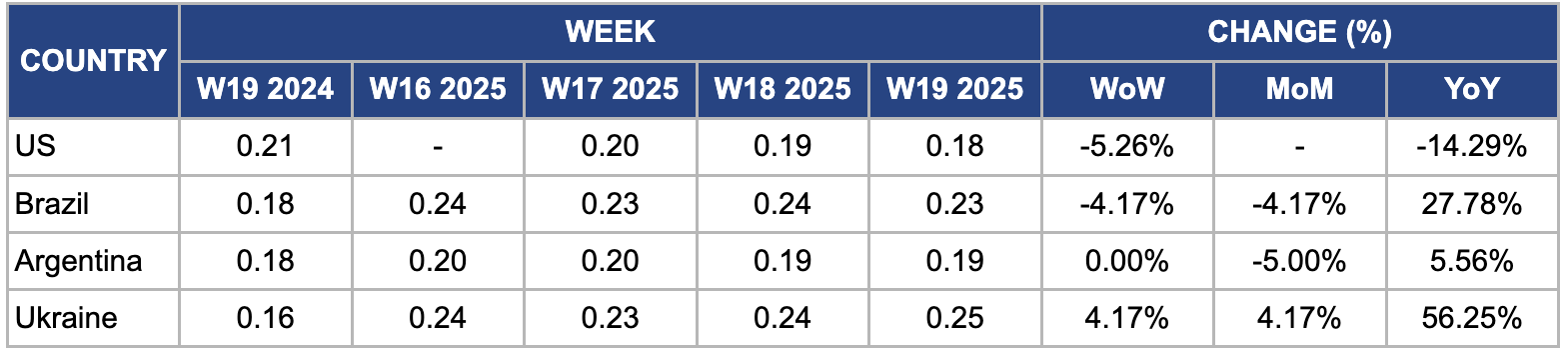

Weekly Maize Pricing Important Exporters (USD/kg)

Yearly Change in Maize Pricing Important Exporters (W19 2024 to W19 2025)

United States

In W19, US corn prices dropped to USD 0.18 per kilogram (kg), reflecting a 5.26% WoW and 14.29% YoY decline. This WoW decrease was due to favorable weather conditions in key corn-producing regions, such as the Midwest, which improved crop conditions and accelerated planting progress, alleviating previous supply concerns. As a result, the outlook for the upcoming corn harvest improved, leading to lower prices. Moreover, the strengthening US dollar made corn less competitive globally, reducing demand from international buyers. Improved harvest expectations in major corn-exporting countries like Brazil and Argentina, where weather conditions favored production, also exerted downward pressure on US corn prices.

Brazil

In W19, Brazil's wholesale maize prices decreased 4.17% WoW and month-on-month (MoM) to USD 0.23/kg. The price drop is due to improved weather conditions in key maize-producing regions, such as Mato Grosso and Paraná, which alleviated concerns over potential crop yield losses. The better weather allowed for faster harvesting and an increase in supply. Moreover, there has been a slowdown in demand from the livestock and ethanol sectors, as some industries have adjusted their consumption due to the ongoing economic situation. As the market starts to see more availability of maize from the 2024/25 Safrinha crop, pressure from higher supply has led to a price drop.

Argentina

In W19, Argentine maize prices held steady WoW at USD 0.19/kg, but declined 5% MoM. This decline was mainly due to recent weather improvements in key growing regions such as Buenos Aires, Entre Ríos, and Santa Fe, where significant rainfall helped ease supply concerns that had previously driven prices higher. The favorable weather conditions contributed to better crop yields and alleviated fears of prolonged drought, leading to a more positive outlook for the upcoming maize harvest. Furthermore, increased competition from other major maize producers like Brazil and the US, with their larger harvests and more competitive pricing, exerted further downward pressure on the market.

Ukraine

In W19, Ukrainian wholesale maize prices rose 4.17% WoW, 4.17% MoM, and 56.25% YoY, reaching USD 0.25/kg. Several key factors contributed to this price surge, including reduced global maize availability and ongoing challenges within Ukraine's domestic supply chain. The country's 2025 maize harvest will be lower, while export demand, particularly from the European Union (EU), remains high due to the global supply shortage caused by production issues in other major maize-producing regions such as Argentina and Brazil. By May 5, Ukraine had exported 255 thousand mt of maize, and May-25 will be an active month for trade. However, prices may drop in the coming weeks as Ukrainian maize becomes more expensive than US corn in certain markets. For example, in Spain, US corn is cheaper by USD 20 to 25/mt, leading Spanish importers to favor American corn.

3. Actionable Recommendations

Diversify Sourcing for Corn Imports

Given the fluctuations in corn prices across regions, particularly in the US, Brazil, and Ukraine, businesses and importers in countries like China, Vietnam, Saudi Arabia, and Romania should diversify their sourcing strategies. Relying on a single source, like the US, which is experiencing price pressure due to a stronger dollar, may limit cost-saving opportunities. Companies can mitigate risks associated with supply disruptions or price volatility by expanding imports from regions like Brazil, which will have a large harvest, and Ukraine, where a weaker hryvnia makes prices more competitive. This approach allows businesses to benefit from price differentials and secure a more stable supply chain.

Monitor Market Closely and Adjust Pricing Strategies

Given the rising prices of Ukrainian maize due to reduced availability and supply chain challenges, traders and businesses should monitor Ukraine's market closely and adjust pricing strategies accordingly. Companies exporting corn should explore alternative markets such as South Asia or North Africa, where Ukrainian maize is still competitive. In markets like Spain, where US corn is now cheaper, adjusting price points to be competitive with US exports could help maintain market share.

Focus on Long-Term Contracts

With Brazil's corn production set to hit record levels in 2024/25, businesses looking to secure a stable supply should consider negotiating long-term contracts with Brazilian suppliers. This will help mitigate the impact of any price fluctuations, especially as Brazil is likely to dominate the global market and demand may push prices up in the near term. Establishing contracts in advance could provide price stability and supply security.

Sources: Tridge, Agro Link, UkrAgroConsult