In W19 in the tomato landscape, some of the most relevant trends included:

- Tomato farmers in Kolar, India, face severe price crashes despite a good harvest, leading to financial losses and calls for minimum support prices.

- Mexico and Uzbekistan experienced significant declines in tomato exports due to trade barriers, adverse weather, and logistical challenges.

- Tomato prices show mixed regional trends in W19, with sharp declines in Mexico and Spain, strong increases in Morocco and France, and Turkey facing rising costs and steady demand.

1. Weekly News

India

Tomato Glut in Kolar Triggers Price Crash and Farmer Distress in 2025 Season

In Kolar district, India, tomato farmers experienced plummeting market prices despite a promising start to the 2025 season, thanks to favorable weather. Historically burdened by viral diseases like the tomato yellow leaf curl virus (TYLCV) and the tomato brown rugose fruit virus (ToBRFV), many growers have endured repeated crop failures and financial losses, even during strong market demand. 2025's successful harvest has overwhelmed the Kolar Agricultural Produce Market Committees (APMC) market, causing a price crash, with tomatoes selling for just USD 0.60 to 1.20 per box, far below production costs. As a result, some farmers left their crops unharvested or discarded tomatoes by the roadside. Farmers' associations called for a minimum support price of at least USD 0.12 per kilogram (kg) in protest, to help cover losses and sustain livelihoods. Without timely intervention, many farmers may abandon tomato farming altogether.

Mexico

US Tariffs Trigger Decline in Mexico’s Agri-Food Exports in Mar-25

The Mexican agri-food sector is facing mounting pressure from a trade conflict sparked by the United States (US) imposing tariffs, leading to notable declines in exports of key products. According to the Agricultural Markets Consulting Group (GCMA), Mexico’s agri-food exports in Mar-25 fell by 3.2% year-on-year (YoY), translating to a loss of USD 160 million in export value due to heightened trade barriers and market uncertainty. Among the hardest-hit commodities were tomatoes, with exports dropping by 7.8% YoY, a decline of approximately USD 72 million, bringing the total export value for tomatoes to USD 859 million.

Uzbekistan

Uzbekistan’s Q1-2025 Tomato Exports Drop Sharply Amid Weather and Market Challenges

In Q1-25, Uzbekistan exported over 2,100 metric tons (mt) and USD 1.9 million less in tomatoes YoY, marking a sharp drop in volume and revenue. Despite this decline, Russia continued to import the largest share of Uzbek tomatoes, while countries like Kyrgyzstan, Kazakhstan, and the United Arab Emirates (UAE) received smaller shipments. Several factors drove this downturn, including unfavorable weather, which reduced domestic yields, regional suppliers increased market share, and logistical or trade issues created further obstacles. Moreover, shifting demand patterns and tighter import regulations in key markets like Russia likely worsened the decline.

2. Weekly Pricing

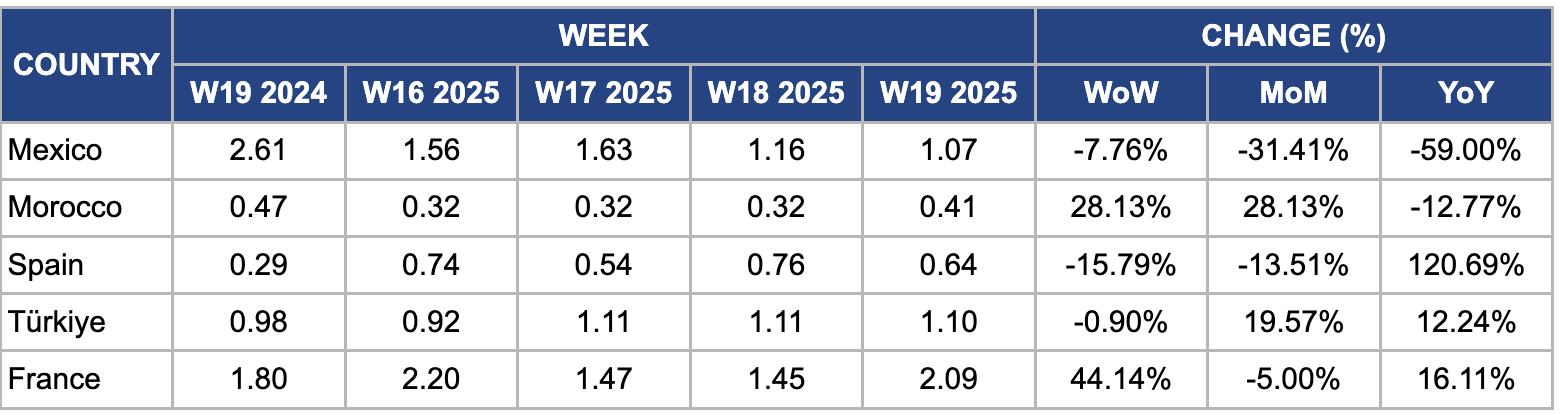

Weekly Tomato Pricing Important Exporters (USD/kg)

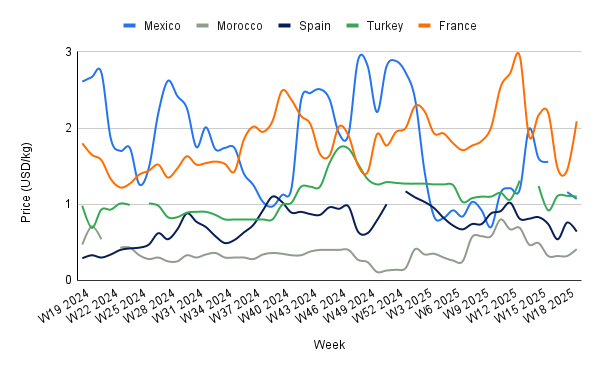

Yearly Change in Tomato Pricing Important Exporters (W19 2024 to W19 2025)

Mexico

Mexican tomato prices declined 7.76% week-on-week (WoW), 31.41% month-on-month (MoM), and 59% YoY, to USD 1.07/kg in W19. The decline is primarily due to a seasonal surge in supply from key producing states such as Sinaloa and Baja California, where the peak harvest period has significantly boosted market availability. Moreover, favorable weather conditions in Apr-25 across northwestern Mexico supported higher yields, leading to oversupply and downward pressure on prices. Weak export demand to the US and rising domestic inventories have also contributed to the sharp price drop.

Morocco

In W19, Morocco's tomato prices experienced a significant increase, rising by 28.13% both WoW and MoM to USD 0.41/kg. This surge was primarily due to adverse weather conditions, including cold temperatures and irregular rainfall in key producing regions such as Souss-Massa and Agadir. This led to lower yields and delayed harvests, tightening domestic supply. Moreover, strong export demand from European markets, particularly France and Spain, intensified competition for available produce, further pushing prices higher.

Spain

In W19, Spain's wholesale tomato prices declined 15.79% WoW and 13.51% MoM, to USD 0.64/kg. Despite that, Spain's tomato production is projected to drop by approximately 22.5% YoY, from nearly 3.1 million metric tons (mmt) in 2024 to an estimated 2.4 mmt in 2025. This downturn is due to several factors, including adverse weather conditions such as cold temperatures and excessive rainfall in key producing regions like Andalusia and Extremadura, which have delayed planting and affected crop yields. Moreover, increased competition from countries like Morocco and Turkey, which offer lower-priced tomatoes, has pressured Spain's market share.

Türkiye

In W19, Türkiye’s wholesale tomato prices declined slightly by 0.90% WoW, dropping from USD 1.11/kg to USD 1.10/kg. This slight decrease was mainly due to the seasonal increase in supply as the spring harvest gained momentum, especially in major producing regions like Antalya and Mersin. The fresh influx of tomatoes eased earlier supply tightness, leading to a modest price correction despite steady domestic demand. However, prices still surged 19.57% MoM and 12.24% YoY. Over the past year, rising production costs, including higher fertilizers, labor, and energy prices, forced growers to raise prices to maintain profitability. On the demand side, growing domestic consumption and steady export demand, particularly to nearby markets, continued to put upward pressure on prices.

France

In W19, France’s wholesale tomato prices surged sharply by 44.14% WoW, reaching USD 2.09/kg. This steep increase was due to limited domestic supply due to delayed spring harvests caused by cooler-than-average temperatures and intermittent rainfall. Moreover, rising input costs and strong demand from local markets and neighboring countries contributed to the price spike. The supply constraints and heightened demand created a tight market, pushing prices significantly higher during this period.

3. Actionable Recommendations

Implement Price Stabilization Mechanisms and MSP

The steep price decline in the Kolar district highlights the urgent need for a robust Minimum Support Price (MSP) system tailored for tomato farmers. The Indian government, local agricultural bodies, and farmers’ associations should set and enforce an MSP around USD 0.12/kg, ensuring farmers receive a fair price that covers production costs. This MSP can be complemented by a price stabilization fund or buffer stock program to buy excess tomatoes during market oversupply. By purchasing surplus produce directly from farmers or mandis, the system can prevent prices from crashing and protect farmers’ incomes. Moreover, improving market transparency and strengthening the APMCs can help farmers better negotiate prices and reduce exploitation by intermediaries. These measures will reduce financial stress on farmers, discourage crop abandonment, and sustain long-term tomato cultivation in regions prone to price volatility.

Promote Value-Added Processing and Diversification

To reduce the vulnerability caused by volatile fresh tomato prices, India should invest in expanding local tomato processing infrastructure, such as facilities for making tomato paste, puree, sauces, and dried tomatoes. This will allow farmers and cooperatives to convert surplus fresh tomatoes into value-added products, extending shelf life and tapping into higher-value markets. Government subsidies, technical training, and partnerships with food processing companies can facilitate this shift. Simultaneously, encouraging farmers to diversify by integrating other complementary crops, such as vegetables less susceptible to price crashes or pest outbreaks, will help spread risk. Crop diversification also supports soil health and improves resilience against adverse weather events.

Enhance Export Market Access and Trade Negotiations

Mexico and Uzbekistan are facing export challenges due to trade conflicts, tariffs, and regulatory barriers impacting their tomato shipments. Both countries should prioritize diplomatic efforts to resolve these trade disputes by engaging in bilateral talks, trade negotiations, and regional cooperation frameworks to reduce tariffs and streamline import procedures. Furthermore, they should explore and develop alternative markets beyond traditional buyers, such as expanding into emerging markets in Asia, the Middle East, and Africa. Improving export infrastructure, including cold storage, logistics, and transport connectivity, will help reduce transit times and post-harvest losses, making exports more competitive. Public-private partnerships could support exporters in meeting quality standards and certification requirements demanded by international markets. By diversifying markets and easing trade frictions, Mexico and Uzbekistan can stabilize export volumes and revenues, sustaining their tomato sectors despite current global trade tensions.

Sources: Tridge, 3 Trend, Fresh Plaza