W22 2025: Sugar Weekly Update

.jpg)

In W22 in the sugar landscape, some of the most relevant trends included:

- Brazil has eliminated import tariffs on sugar and is expanding port infrastructure, while prices remain stable amid active futures trading.

- India expects stable sugar prices due to early monsoon rains and strong carry-forward stocks despite lower production forecasts.

- US sugar prices may edge up following a 10% tariff on Brazilian imports, with futures markets showing increased activity.

- Mexico faces downward pressure on sugar prices due to reduced exports after US tariff imposition and domestic oversupply.

- Pakistan continues to experience elevated sugar prices driven by supply shortages, prompting regulatory scrutiny and potential raw sugar imports.

1. Weekly News

Brazil

Brazil Implements Tariff Cuts and Accelerates Infrastructure Expansion

In recent weeks, Brazil has taken significant steps to address rising food prices by eliminating import tariffs on nine essential food items, including sugar. This policy shift aims to reduce consumer prices and alleviate inflationary pressures. Despite being a top global agricultural producer, Brazil's decision reflects concerns over climate-related production issues and their impact on food availability.

Additionally, Brazil's sugar industry is experiencing infrastructural growth, with China investing heavily in the construction of new megaports to facilitate agricultural exports. The state-owned agricultural conglomerate Cofco is building its largest export terminal outside China at Brazil’s Port of Santos, aiming to triple annual capacity to 14 million tons by 2026. This development is part of China's broader strategy to diversify food sources and reduce dependence on supplies from the United States (US).

India

Early Monsoon Boosts Cane Prospects Amid Market Optimism

India's sugar sector is experiencing renewed optimism as early and ample monsoon rains have commenced, marking the earliest onset in 16 years. This favorable weather is expected to enhance sugarcane yields, particularly in key producing states like Maharashtra and Karnataka, potentially stabilizing the sector after previous production declines.

Reflecting this positive sentiment, sugar stocks have seen an uptick in the Indian stock market this week, aligning with broader market gains. Investors are responding to the anticipated improvements in agricultural output and the potential for increased profitability in the sugar industry.

Pakistan

Pakistan Intensifies Regulatory Actions to Tackle Price Volatility

Pakistan's sugar industry continues to face challenges related to pricing and regulation. The Competition Commission of Pakistan (CCP) has issued warnings to sugar mills against price manipulation, following retail prices rising above USD 0.64 per kilogram (PKR 180/kg), despite the government's stipulated rate of USD 0.46/kg (PKR 130/kg). The CCP is closely monitoring the situation and has indicated that strict enforcement actions will be taken if anti-competitive activities are identified.

In response to rising domestic sugar prices and potential shortages, the government is considering the import of raw sugar. A high-level committee has been formed to assess the feasibility of such imports, aiming to stabilize the local market and address the demands of sugar millers who advocate for year-round operations. This move comes amid criticism that previous export approvals, influenced by powerful sugar industry stakeholders, have contributed to the current supply crisis.

United States

Tariff Policies Influence Sugar Import Dynamics

In the US, recent tariff policies have introduced volatility into the sugar market. Brazil, a primary supplier of sugar to the US, now faces a baseline 10% tariff, contributing to economic uncertainty and potential price increases for consumers.

Despite these trade policy shifts, sugar futures on the Intercontinental Exchange (ICE) have shown significant activity. As of June 4, 2025, open interest stood at 876,287 contracts, reflecting ongoing market engagement.

2. Weekly Pricing

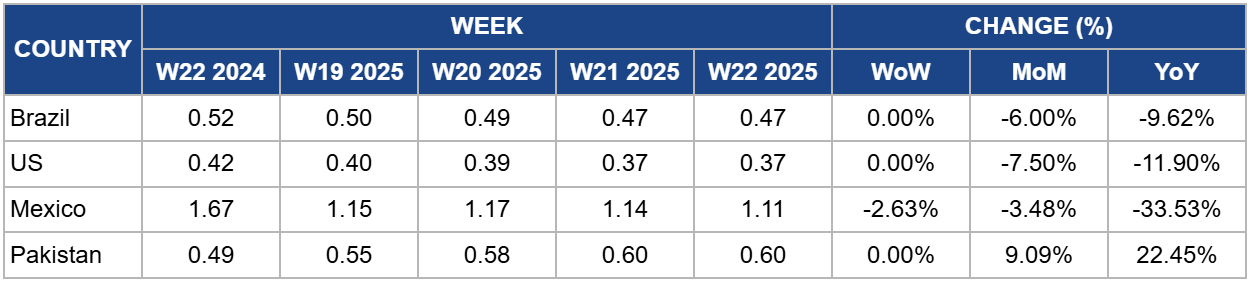

Weekly Sugar Pricing Important Producers (USD/kg)

Yearly Change in Sugar Pricing Important Producers (W22 2024 to W22 2025)

.png)

Brazil

In W22, Brazil's domestic sugar prices remained stable week-on-week (WoW) at USD 0.47/kg. However, on the global stage, sugar futures traded on the Intercontinental Exchange (ICE) exhibited notable activity. As of June 4, 2025, the trading volume reached 145,949 contracts, a decrease from the previous day's 166,609 contracts. Open interest increased to 876,287 contracts, indicating sustained investor engagement in the sugar market.

Brazilian sugar prices are expected to remain relatively stable in the coming week. While recent rainfall forecasts have alleviated some concerns about drought conditions, potentially boosting sugarcane yields, the overall market sentiment is tempered by the anticipation of increased global production. Additionally, the substantial volume of sugar already price-fixed for export in the 2025/26 season suggests that major price movements are unlikely in the short term.

United States

In the US, sugar prices remained flat WoW at USD 0.37/kg in W22 due to moderate trading activity. Recent tariff policies, including a universal 10% tariff on Brazilian sugar imports, have introduced volatility into the sugar import market, potentially impacting domestic prices

In the US, sugar prices may experience modest increases in the coming week. The implementation of a baseline 10% tariff on Brazilian sugar imports, combined with Brazil's position as a leading sugar supplier to the US, could lead to higher import costs. While some of these costs may be absorbed by exporters and buyers, consumers might still see slight price upticks.

Mexico

Mexico's sugar prices experienced a decline in W22, with prices dropping to USD 1.11/kg, reflecting a 2.63% WoW decline and a significant 33.53% year-on-year (YoY) drop. The imposition of 25% tariffs by the US on key Mexican agri-food exports, including sugarcane, presents a severe risk to the Mexican sugar market. These tariffs could disrupt exports, leading to an oversupply in the domestic market and potential price volatility.

As a result, Mexican sugar prices are anticipated to decline further in the upcoming week. This surplus is likely to exert downward pressure on prices, especially in regions heavily reliant on sugar production.

Pakistan

Despite Pakistan WoW sugar prices remaining flat at USD 0.60/kg in W22, the price trend remains upward, reflecting a 22.45% YoY increase. Despite government-imposed price ceilings and crackdowns on hoarding, retail prices have remained elevated, with reports indicating prices hovering between USD 0.58/kg (PKR 164/kg) and USD 0.64/kg (PKR 180/kg). The surge is attributed to factors such as high sugarcane procurement costs, reduced sugarcane recovery rates, and significant sugar exports in the past year. The government is considering importing raw sugar to stabilize the market.

Sugar prices are expected to remain elevated in W23 as the country is facing a looming sugar shortage of nearly 1 million metric tons (mmt). Despite government efforts to stabilize prices, including the allocation of subsidized sugar, these measures may be insufficient to counteract the prevailing supply constraints.

3. Actionable Recommendations

Diversify Export Markets to Hedge Against Trade Disruptions

Industry players in Mexico and Brazil should explore diversifying their export destinations. With US tariffs disrupting traditional trade flows, such as Mexico’s 25% duty and Brazil’s 10% universal tariff, sugar exporters should accelerate outreach to markets in Asia, the Middle East, or regional trade blocs (e.g., Mercosur). Establishing trade partnerships outside the US can mitigate dependency risks and help maintain price stability.

Utilize Futures and Hedging to Manage Price Volatility

Given the observed fluctuations in ICE sugar futures and the elevated open interest across markets, producers and traders in Brazil, the US, and India should actively employ hedging strategies to lock in favorable pricing. With global sugar prices susceptible to climatic and regulatory shifts, managing exposure through derivatives will help secure margins and plan logistics more efficiently.

Strengthen Domestic Inventory and Procurement Planning

Pakistan’s ongoing price surge highlights the need for proactive inventory management. Market participants, including processors and retailers, should conduct a detailed audit of their procurement pipelines and assess the feasibility of importing raw sugar in advance of seasonal tightness. Likewise, Indian and Brazilian millers may consider forward contracting with growers to ensure cane supply ahead of any weather-induced shortfalls.

Sources: Tridge, The Washington Post, Times of India, Investing.com, Nasdaq, Pakistan Today, Dawn, AP News, Business Recorder, The News International