In W24 in the mango landscape, some of the most relevant trends included:

- In Bangladesh, mango cultivation in northwestern districts is boosting the rural economy and generating seasonal jobs for nearly 300 thousand people. The country is also targeting increased exports through improved quality practices.

- Mango prices in Uttar Pradesh have dropped significantly to around USD 0.48 to 0.54/kg. This is due to a production surge to 3.5 mmt in 2024, driven by favorable weather and early harvesting.

- Mexico's mango exports to the US fell by 5.33% in 2024. This decline has prompted a diversification push into European and Asian markets amid drought, pest risks, and trade tensions.

- Mango exports in Pakistan are projected to rise to 125 thousand mt in 2025 despite a 20% drop in production caused by erratic weather. The country is pursuing new markets like Japan, the US, and South Africa.

1. Weekly News

Bangladesh

Mango Industry Boosts Rural Economy in Bangladesh’s Northwest Districts

Mango cultivation has become a key driver of the local economy in Bangladesh’s northwestern districts of Rajshahi, Chapainawabganj, Naogaon, and Natore, where it has become a major commercial crop. With favorable weather and modern farming methods, the region is expected to yield around 1.255 million metric tons (mmt) of mangoes this season, valued at approximately USD 820.5 million. This growth has created seasonal employment for nearly 300 thousand people involved in harvesting, transport, marketing, and packaging. Chapainawabganj leads in production, followed by Naogaon, Rajshahi, and Natore, with popular varieties like Himsagar, Langra, and Amrapali dominating the market. Improved quality measures, including fruit-bagging and farmer training, enable increased exports to Europe and other international markets. However, experts highlight the need to further expand international market access to ensure better returns for growers and reduce pressure from local oversupply.

India

India’s Mango Prices Drop as Production Surges in Uttar Pradesh

Mango prices in India have dropped, particularly in Uttar Pradesh, the country’s largest producing state, where the Dasehri variety is now selling for USD 0.48 to 0.54 per kilogram (kg), down from 0.72/kg last year. This decline is driven by a significant production increase, with output estimated at 3.5 mmt in 2024, up from 2.5 mmt in 2023. Favorable flowering conditions and early harvesting, undertaken to avoid losses from forecasted early monsoon rains, contributed to the surge. As India produces nearly half of the world’s 25 mmt of mangoes, the abundance of local supply is expected to keep prices low in the short term.

Mexico

Mexico Diversifies Mango Exports as Climate and Trade Pressures Mount

Mexico, the world’s top mango exporter with USD 660 million in exports in 2024, is adjusting its export strategy following a 5.33% decline in United States (US)-bound shipments, affected by trade tensions and drought-related challenges. Traditionally dependent on the US for over 85% of its mango exports, Mexico is now targeting European and Asian markets to reduce reliance and promote varieties like Ataúlfo through trade missions.

In other news, climate volatility, including excessive rainfall in Chiapas that disrupted flowering and increased pest risks, is pushing a shift toward more resilient farming practices. With small-scale growers managing 70% of mango farms but earning less than 10% of retail prices, the industry is also facing challenges such as youth migration and the growing role of women in agriculture. To remain competitive, Mexico focuses on export diversification, climate adaptation, and greater support for smallholder farmers.

Pakistan

Pakistan Targets Higher Mango Exports Despite Climate and Trade Challenges

Pakistan aims to increase mango exports to 125 thousand metric tons (mt) in the 2025 season. This marks a 25 thousand mt increase from the previous year, with potential earnings of up to USD 100 million despite facing climate-related obstacles. Production is expected to fall by 20%, from 1.8 mmt to 1.4 mmt, due to water shortages and erratic weather in Punjab and Sindh. To offset the decline, Pakistan is expanding into non-traditional markets such as Japan, the US, South Korea, and Australia, and anticipates new access to South Africa. Exporters are also dealing with higher shipping costs, worsened by geopolitical tensions with India, and are calling for support to maintain competitiveness. While risks remain, industry optimism is driven by market diversification and the potential for favorable weather during the remainder of the season.

Philippines

Philippines Targets Egypt for Mango Export Expansion

The Philippines is working to expand mango exports to Egypt as part of a broader strategy to grow agricultural trade. This follows Egypt’s recent approval of durian imports. After nearly two years of regulatory coordination, Egypt has expressed confidence in the Philippines’ plant health systems, and discussions are underway to include mangoes in the next round of approved products. Agricultural trade between the two countries currently totals around USD 7.5 million annually, with the Philippines primarily exporting desiccated coconut and carrageenan. The initiative also includes exploring reciprocal imports of Egyptian grapes, potatoes, garlic, and onions. This effort aligns with the Philippines’ push to open new markets, as shown by recent mango shipments to Italy and ongoing durian access talks with New Zealand.

Senegal

Senegal Expects Strong Mango Season as Conditions Improve

Senegal’s 2025 mango season began in late May with encouraging early harvests in Casamance and Fatick, signaling a rebound after several difficult years. Favorable weather has supported strong flowering and fruiting, while efficient logistics are enabling active exports to European markets. The main harvest is expected from the Niayes region, where most orchards are located, although ripening has been slightly delayed due to a colder-than-usual winter. Farm-gate pricing agreements between producers and exporters, combined with support for pest control, including the deployment of over one million fruit fly traps, are helping stabilize the sector. With improved coordination and steady demand, Senegal is aiming to meet its export target of 30 thousand mt this season.

2. Weekly Pricing

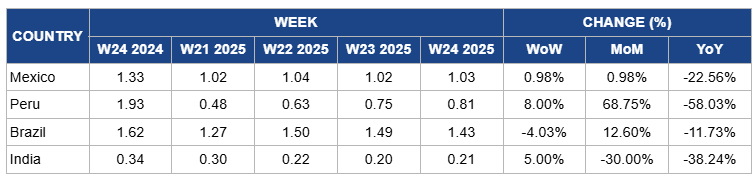

Weekly Mango Pricing Important Exporters (USD/kg)

Yearly Change in Mango Pricing Important Exporters (W24 2024 to W24 2025)

Mexico

In W24, Mexico’s mango prices rose slightly by 0.98% week-on-week (WoW) and month-on-month (MoM) to USD 1.03/kg. However, prices remain down 22.56% year-on-year (YoY), due to the end of last season's deficit. Heavy drought in 2024 slowed flowering and reduced yields, so last year’s low base pushed baseline prices higher. This year, improved weather conditions and a stronger crop harvest, particularly from Sinaloa and Chiapas, restored volumes and normalized pricing compared to last year’s shortage-inflated levels.

Peru

Peru’s mango prices rose 8% WoW to USD 0.81/kg and surged 68.75% MoM due to a significant drop in available supply. The main 2024/25 campaign has closed, and fresh fruit is in short supply, while exports remained strong, especially to Europe and North America. However, prices are still down 58.03% YoY, reflecting the massive oversupply in the previous season when exports grew by around 267%, flooding markets and collapsing prices.

Brazil

In Brazil, mango prices dropped 4.03% WoW to USD 1.43/kg in W24, due to an influx of mature Palmer and Tommy Atkins fruit hitting local markets, especially from the São Francisco Valley, boosting short-term supply availability. However, prices remain 11.73% lower YoY as Brazil continues to recover from last season’s record exports. Export value rose 46% in 2024, but current volumes exceed demand, easing local pricing pressure compared to a year ago. Meanwhile, the 12.60% MoM price rise reflects strong international demand: Brazilian mango shipments to destinations like the European Union (EU), South Korea, and South Africa have surged, drawing on limited global supply windows and powering a short-term rebound in export-driven pricing.

India

India's mango prices inched up 5% WoW to USD 0.21/kg in W24, driven by ongoing pest outbreaks and fungal infections, particularly sooty mold and fruit fly damage, in Andhra Pradesh’s Totapuri orchards, prompting farmers to harvest selectively and limit supply. However, prices remain subdued in MoM and YoY terms, down by 30% and 38.24%, respectively. This is due to a nationwide bumper crop, with record harvests across states like Uttar Pradesh and early picking ahead of the monsoon flooding markets, triggering oversupply and keeping prices consistently low.

3. Actionable Recommendations

Expand Market Reach Through Bilateral Export Trials

Mango producers should proactively coordinate with exporters to initiate trial shipments to non-traditional markets, using recent access approvals as entry points. For example, growers in India, Mexico, and the Philippines can collaborate with handlers to send pilot volumes to countries like Egypt, Italy, or New Zealand, accompanied by clear quality and phytosanitary documentation. These trials help build importer confidence and open long-term demand channels. Exporters should also adjust varieties and post-harvest treatments to meet market-specific preferences, such as favoring yellow-skinned varieties for the Middle East or smaller sizes for Europe, to maximize acceptance and competitiveness.

Prioritize High-Return Markets Through Selective Export Planning

Mango producers should work closely with exporters to prioritize shipments to premium markets offering higher returns per unit, especially during low-yield seasons. Focus should be placed on countries like Japan, South Korea, and the US, where consumers value quality, food safety, and traceability. Producers can align harvest timing, post-harvest treatment, and packaging standards to meet these market requirements. For example, using vapor heat treatment for Japan or hot water treatment for Australia can secure entry and fetch better prices. Selective export planning helps maximize earnings despite reduced volumes and high logistics costs.

Sources: Tridge, BSS News, Freshfruit Portal, Manila Bulletin, MSN, Senegalese Interprofessional Mango Association, Times of India