W24 2025: Rice Weekly Update

.jpg)

In W24 in the rice landscape, some of the most relevant trends included:

- Global rice prices rose in May-25, led by a 4.6% surge in aromatic varieties due to strong pre-Eid al-Adha demand and Thai exports to the US. This pushed the FAO Rice Price Index up 1.4% MoM in May-25 to 106.3.

- India's government rice stocks soared 18% YoY to 59.5 mmt, bolstering its export potential.

- Brazil’s May-25 rice imports jumped 26.53% MoM to 126.12 thousand mt, outpacing exports amid higher international prices.

- Despite being a major producer, Indonesia is strengthening its rice trade with Cambodia to meet domestic needs.

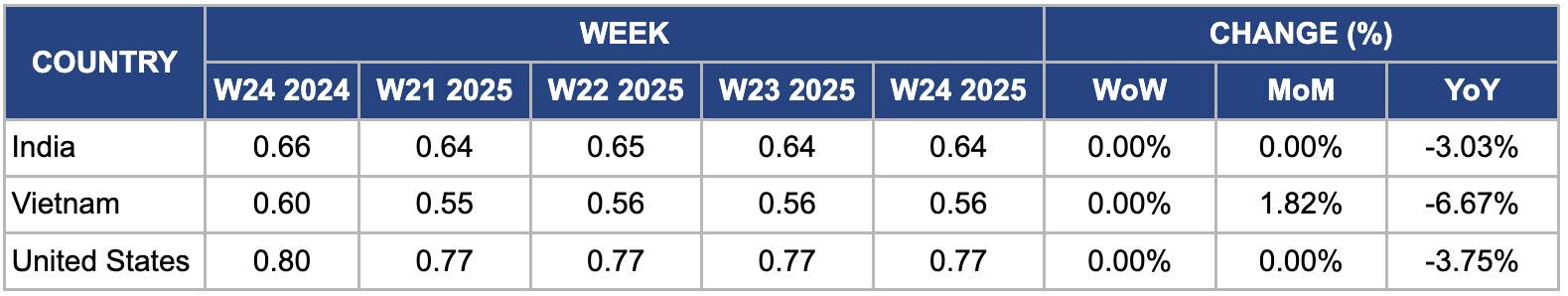

- US rice prices remained unchanged WoW but fell YoY in W24 due to improved domestic supply and tough competition from Asian exporters. India's rice prices were unchanged WoW but declined 3.03% YoY, pressured by a weaker rupee and subdued export demand.

- Vietnam’s rice prices held steady WoW but rose 1.82% MoM due to tightening supply.

1. Weekly News

Global

Fragrant Rice Drives Global Price Surge in May-25

According to the Food and Agriculture Organization (FAO), global rice prices rose in May-25, primarily driven by higher prices for aromatic varieties and robust international demand. The FAO Rice Price Index climbed to 106.3 points, up 1.4% month-on-month (MoM) from Apr-25's 104.9, marking continued market firmness. Fragrant rice was the main contributor to the increase, with the FAO Aromatic Rice Index rising 4.6%, fueled by strong pre-Eid al-Adha demand for Basmati and large Thai Hom Mali shipments to the United States (US) following a temporary suspension of reciprocal tariffs. Japonica prices rose by 1% MoM, supported by strong Calrose sales to Japan and persistent high domestic prices, which may lead to increased imports. Indica prices edged up 0.7% MoM, while glutinous rice prices remained stable. Currency fluctuations and demand dynamics continued exerting upward pressure on global rice markets.

Brazil

Brazil’s Rice Imports Hit Three-Month High in May-25 Surpassing Exports

In May-25, Brazil's rice imports surged to their highest level since Feb-25, exceeding the volume of rice exported that month. According to data from the Secretariat of Foreign Trade (SECEX), analyzed by the Center for Advanced Studies in Applied Economics (CEPEA), Brazil imported 126.12 thousand metric tons (mt) of paddy rice, a 26.53% MoM increase from Apr-25, though still 10.06% year-on-year (YoY) lower. Both import and export prices averaged higher than domestic market rates, indicating stronger international market dynamics.

India

India’s Rice Stocks Surged 18% YoY, Strengthening Export and Market Control Capacity

India's rice stocks in government warehouses soared 18% YoY to 59.5 million metric tons (mmt) as of June 1, 2025, significantly exceeding the July 1 target of 13.5 mmt. This surge strengthens the position of the world’s largest rice exporter to boost shipments in the coming months. The improved inventory will support government efforts to curb potential price spikes through increased open market sales later this year.

Indonesia

Indonesia Eyes More Rice Imports from Cambodia, but Price and Quality Remain Key Hurdles

Indonesia is strengthening its rice trade with Cambodia to help meet domestic consumption needs despite being a major rice producer with substantial reserves. With a population nearing 300 million, Indonesia relies on imports, especially from regional partners. Indonesian officials view Cambodian rice as a potential supply source, given Cambodia’s growing role as a key exporter in Southeast Asia. However, they have raised concerns about Cambodia’s competitiveness in price and quality compared to other regional exporters. Indonesia bases its import decisions on both of these factors. Despite the challenges, the Indonesian Chamber of Commerce in Cambodia continues to report progress in strengthening bilateral trade relations and investment cooperation.

2. Weekly Pricing

Weekly Rice Pricing Important Exporters (USD/kg)

Yearly Change in Rice Pricing Important Exporters (W24 2024 to W24 2025)

India

In W24, India’s wholesale rice prices held steady week-on-week (WoW) at USD 0.64 per kilogram (kg) but declined 3.03% YoY. A weaker Indian rupee (INR) drove the YoY drop by making exports cheaper while reducing demand, particularly from African markets. Additionally, India’s large stockpiles from its 2024 bumper harvest and the government’s decision to lift export restrictions on broken rice in Mar-25 boosted domestic supply, exerting further downward pressure on prices. Although global rice prices have generally increased due to increased demand, India’s specific price drop YoY in W24 stemmed from currency depreciation and subdued export activity.

Vietnam

In W24, Vietnamese rice prices remained stable WoW but increased by 1.82% MoM to USD 0.56/kg. This upward trend stemmed primarily from tightening supply conditions, as delayed harvesting and lower-than-expected yields in several key rice-growing regions reduced immediate availability. Exporters reported consistent or slightly rising demand from major international buyers, particularly in Southeast Asia and parts of Africa, supporting price gains. In addition, rising input costs, especially for fuel and fertilizer, added financial pressure on farmers and traders, while ongoing transportation and logistical bottlenecks hindered efficient distribution.

United States

In W24, US rice prices remained unchanged WoW and MoM at USD 0.77/kg but registered a 3.75% YoY decline. This decrease primarily reflects improved production conditions in key rice-producing states like Arkansas and California, which boosted domestic output and eased upward price pressure. Unlike the 2024 season, when droughts and disruptions along the Mississippi River strained logistics and elevated costs, the 2025 season has seen more favorable weather and smoother supply chain operations. Furthermore, the US has faced tough competition from leading exporters such as Vietnam and India, whose more competitively priced rice has reduced demand for US shipments. Despite stable domestic consumption, increased supply and reduced export demand drove prices lower than the previous year.

3. Actionable Recommendations

Expand India’s Rice Exports Using Strategic Stock Release

India should proactively utilize its high government rice stocks by releasing a portion for targeted export expansion, especially to markets with strong demand, such as the Middle East and Africa. This could involve coordinated export tenders or government-to-government sales. Releasing stocks will help prevent domestic oversupply, generate export revenue, and stabilize local market prices, all while supporting global food security amid international demand.

Establish a Regional Rice Trade Framework between Indonesia and Cambodia

Indonesia should establish a bilateral rice trade agreement with Cambodia that defines clear quality benchmarks, pricing formulas, and delivery commitments. Both countries can launch joint technical assistance programs to enhance Cambodian rice standards and better align them with Indonesian consumer preferences. By doing so, Indonesia secures a reliable and politically stable rice import channel, while Cambodia improves rice quality and consistency, strengthening regional food resilience.

Introduce Risk-Based Import Controls in Brazil to Manage Supply Volatility

Brazil should implement a dynamic import control mechanism that ties rice import volumes to real-time domestic price and stock level indicators. This system would reduce imports when domestic prices are low or supply is sufficient and activate during tight domestic conditions. This strategy would help stabilize Brazil’s rice market, prevent unnecessary import surges like in May-25, and support local producers by ensuring imports do not undercut domestic pricing during harvest periods.

Sources: Tridge, Canal Rural, Economic Times, UkrAgroConsult, Vietstock