W30 2025: Soybean Weekly Update

In W30 in the soybean landscape, some of the most relevant trends included:

- Brazil's soybean exports remained robust, driven by a weak currency that enhances its competitiveness. However, the country is facing a critical threat from its driest and coldest July on record, which could delay planting for the 2025/26 season. In Argentina, the market was frozen by policy volatility after the government announced, but did not formalize, export tax cuts, leading to a suspension of export declarations.

- The US soybean crop is developing ahead of schedule with the best condition ratings in five years, pointing toward a strong 2025 harvest. This positive production outlook, combined with a 46% weekly drop in export sales due to ongoing trade tensions with China, put downward pressure on domestic prices.

- While prices in Brazil, the US, and Argentina are down YoY, Uruguay's prices have remained stable and even posted a 3.66% annual gain. Strong, consistent regional demand for its quality soybeans has insulated Uruguay from the broader bearish trends affecting other major exporters.

- Canada and India have resumed trade negotiations after a two-year pause, signaling a potential new market opportunity for Canadian oilseeds if tariff barriers can be addressed. This move aligns with Canada's focus on maintaining export competitiveness.

1. Weekly News

Argentina

Policy Volatility Creates Export Market Uncertainty

Argentina's soybean export market faced significant disruption in W30 following a governmental announcement on July 26. The administration revealed a permanent cut to export taxes, setting the new rate at 26% for raw soybeans and 24.5% for processed soybean meal and oil. This decision marked a sharp reversal of a policy implemented on July 1, which had increased those same taxes to 33% for soybeans and 31% for its meal and oil derivatives.

Excessive Rainfall Threatens Crop Quality and Logistics

Argentina experienced extremely wet conditions across key provinces in W30: Córdoba received 41.57 millimeters (mm) in W30 of rain versus the 8.56 mm average (+386% anomaly), Buenos Aires logged 49.77 mm versus the 22.57mm average (+120%); and Santa Fe experienced 49.67 mm versus the 15.16 mm average (+228%), based on multi-decade historical average. The excessive moisture created waterlogging risks, increased disease pressure, and challenged machinery access for post-harvest operations. Despite 98.3% harvest completion by early July, the wet conditions threatened grain quality and logistics operations in the Paraná River.

Brazil

Export Surge Continues Despite Currency Headwinds

Brazilian soybean exports maintained strong momentum in W30, with weekly shipments rising 9.9% week-on-week (WoW) to 3.09 million metric tons (mmt) during July 20 to 26, following 2.81 mmt the previous week. The weak Brazilian real (BRL 5.4-5.6 per USD 1) continued to enhance export competitiveness, with free on board (FOB) Paranaguá prices at USD 24.75 per 60-kilogram (kg) bag offering attractive margins versus global benchmarks. Over one-third of new-crop soybeans have been pre-sold by producers seeking to lock in favorable exchange rates, supporting continued export flow momentum through Q3-2025.

Adverse Weather Threatens 2025/26 Planting Window

Brazil is experiencing its driest and coldest July on record across central producing states, raising concerns for the upcoming planting season. Mato Grosso recorded average temperatures of 21.39°C versus the 23.87°C normal, with rainfall at just 0.01 mm in July compared to 0.05 mm normal. Similar patterns emerged in Rio Grande do Sul (8.81°C vs 14.67°C normal) and Paraná (13.21°C vs 17.05°C normal), with minimal precipitation across all regions. The extreme dryness may delay critical soil moisture recharge ahead of the mid-September planting window, potentially impacting 2025/26 crop establishment.

Canada

India Trade Talks Resume After Two-Year Hiatus

Canada resumed trade negotiations with India in Jul-25 after a two-year suspension, focusing on potential tariff relief for oilseed exports. Currently, Canadian oilseed exports to India remain negligible due to high tariff barriers, while successful negotiations could open significant market opportunities. The talks coincide with Canada's 2025/26 oilseed production forecast of 22.8 mmt and export projections of 23.0 mmt, with soybean area declining 1.5%, and at the same time maintaining focus on export competitiveness through Vancouver FOB pricing around USD 360 to 362 per metric ton (mt).

United States

Crop Development Progresses on Schedule with Strong Ratings

United States (US) soybean crop development remained on track in W30, with 76% of the crop blooming (aligned with the five-year average) and 41% setting pods (versus 42% average). Crop condition ratings improved to 70% Good-to-Excellent, up from 68% the previous week and 67% last year, marking the best condition ratings in five years. The favorable development trajectory supports expectations for a strong 2025 harvest despite ongoing trade challenges with China limiting export opportunities.

Export Sales Decline Amid China Trade Tension

Weekly export sales for the week ending July 17 totaled 2.36 mmt, down 46% from the prior week, though year-to-date sales remained strong at 50.64 mmt versus 45.05 mmt last year which is an increase of 12% YoY. The export pace reached 99% of July's 51.30 mmt projection. However, China's effective 23% tariff on US soybeans, implemented on July 17, continued to limit market access, with no US cargoes booked for Q4 -2025 despite Stockholm negotiations extending the 90-day tariff truce through August.

Uruguay

Uruguay Maintained Regional Benchmark Pricing

Uruguay maintained its position as a regional pricing benchmark with Nueva Palmira FOB levels around USD 360/mt, providing producer netbacks of approximately USD 320-330/mt after freight, drying, and handling deductions. The country continued to focus on regional South American trade flows while monitoring global market developments, particularly the impact of Brazilian currency movements and Argentine policy changes on competitive positioning within the Mercosur region.

2. Weekly Pricing

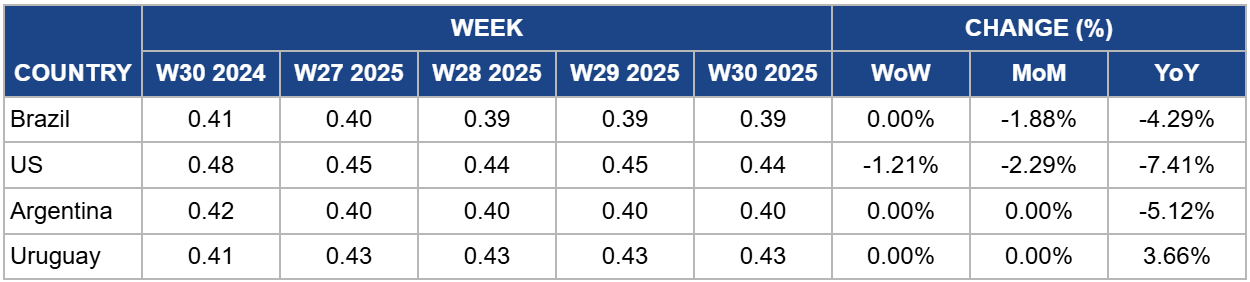

Weekly Soybean Pricing Important Exporters (USD/kg)

Yearly Change in Soybean Pricing Important Exporters (W30 2024 to W30 2025)

.png)

Brazil

In W30, Brazil's soybean price was recorded at USD 0.39/kg. The market slightly rebounded, with a 1.04% increase WoW. However prices remained lower by1.20% month-on-month (MoM) and 3.62% year-on-year (YoY). The minor weekly uptick can be attributed to a temporary strengthening in export premiums as logistics normalize after recent disruptions. The 1.88% MoM and 4.29% YoY declines are rooted in the massive global supply, primarily driven by Brazil's record-breaking harvest. With the National Supply Company (CONAB) forecasting another huge crop, projected at 147.7 mmt, international buyers have significant leverage, keeping a firm ceiling on prices. While demand from China remains a supportive factor, it is not enough to counteract the sheer volume of available soybeans in the market.

United States

In W30, US soybean prices fell 1.21% WoW to USD 0.44/kg, continuing a downward trend with a 2.29% MoM and a 7.41% YoY decrease. The weekly and monthly drop is primarily influenced by excellent weather conditions across the Midwest, which are boosting yield expectations for the upcoming harvest. This favorable outlook adds to an already bearish sentiment fueled by ample global supplies. On the other hand, the significant YoY decline highlights the market's shift over the past year. Abundant harvests from South America have intensified export competition, eroding US market share and pressuring prices. High domestic stock levels further compound the issue, leaving the market with a supply surplus that continues to weigh on values.

Argentina

In W30, Argentine soybean prices were stable at USD 0.40/kg, showing no change in WoW and MoM comparison, while remaining down 5.12% YoY. The market is in a state of balanced supply and demand. Prices are stagnant as the impact of a strong harvest is completely offset by widespread farmer hoarding. Producers are unwilling to sell their soybeans at current low prices, choosing to hold onto their stock as a hedge against economic uncertainty and in hopes of better prices in the future. This has severely restricted the flow of soybeans to the market, preventing further price drops while also stifling any potential for a significant rally. The YoY decrease reflects the reality of a well-supplied global market, which keeps prices significantly below last year's levels.

Uruguay

In W30, Uruguay's soybean prices held firm at USD 0.43/kg, unchanged both WoW and MoM, and posting a notable 3.66% gain YoY. This stability in the face of global bearishness underscores the strength of Uruguay's market fundamentals. Consistent and robust demand, particularly from its primary export partners, is effectively absorbing the available supply from its successful harvest. This balance between supply and demand is insulating Uruguayan prices from the downward trends seen in other major producing nations. The positive YoY performance is a clear indicator of sustained international confidence in Uruguayan soybeans, which have commanded a premium throughout the year due to their quality and reliable supply, allowing prices to remain elevated compared to the same period in the previous year.

4. Actionable Recommendations

Monitor Brazilian Weather Patterns Through August-September

Given Brazil’s driest and coldest July on record across central producing states, closely track soil moisture conditions and precipitation patterns through the critical August-September period ahead of mid-September planting. The extreme dryness threatens timely soil moisture recharge, potentially delaying 2025/26 crop establishment. Market participants should prepare for potential supply disruptions and price volatility if planting delays materialize, particularly given Brazil’s dominant role in global soybean exports and China’s heavy reliance on South American supplies.

Capitalize on South American Export Competitiveness

Leverage the significant cost advantages offered by South American origins, particularly Brazil’s weak real and Argentina’s policy-driven export tax reductions to 26%. Brazilian FOB prices versus Chicago levels, combined with transportation costs representing only 21-27% of landed costs, create compelling arbitrage opportunities. Focus procurement strategies on South American origins while US-China trade tensions persist, as Chinese buyers continue to avoid US cargoes despite Stockholm negotiation extensions.

Hedge Against Argentina Policy Volatility

Implement risk management strategies to address Argentina’s export policy uncertainty following the government announcement of permanent export tax cuts pending official publication. Given the suspension of export declarations and the impact of historical policy reversals on market disruption, it is advisable to establish flexible sourcing arrangements and consider premium hedging for Argentine origins. Monitor crush margin sustainability and farmer selling patterns as policy implementation progresses, as Argentina represents a critical swing supplier in global soybean trade flows with discount potential versus global benchmarks.

Sources: Tridge, ESALQ/CEPEA, CME Group/Trading Economics , GrainsPrices, BCR Rosario, USDA NASS Weekly Crop Progress, ANEC/Cargonave, USDA Weekly Export Sales, Chinese customs data, USDA FAS Country Reports, Bloomberg, Reuters, Valor International