1. Weekly News

Global

ISO Forecasts Global Sugar Deficit for 2024/25 Season

The International Sugar Organization (ISO) announced on August 30, 2024, a global sugar deficit forecast of 3.58 million metric tons (mmt) for the 2024/25 season. The ISO also revised its forecast for the 2023/24 season, lowering the expected deficit to 200 thousand metric tons (mt) from the 2.95 mmt projected in its Jun-24 update. This adjustment is primarily due to increased sugar production in Brazil’s central-south region. For the 2024/25 season, global sugar production is anticipated to decline by 1.1% year-on-year (YoY) to 179.29 mmt, while consumption is expected to grow by 0.8% YoY to reach 182.87 mmt.

Brazil

Brazil's Sugar Production Declined in the Central-South Region

According to the Brazilian Sugarcane and Bioenergy Industry Association (NUICA), sugar production in Brazil's center-south region experienced a 10.2% YoY decline in the first half of Aug-24. During this period, the total sugarcane crushing also saw an 8.6% YoY decrease to 43.83 mmt. Additionally, the total ethanol output fell by 2.19% YoY to 2.30 billion liters (L), both falling short of analysts' expectations. The average sugarcane yields in the first half of Aug-24 fell by 12.2% YoY to 86.6 mt per hectare (ha). NUICA also emphasized that the reduction is unrelated to recent regional fires.

Moldova

Moldovan Sugar Industry Faces Crisis as Drought Devastates Sugar Beet Harvest

Moldova's largest sugar producer, Sudzucker Moldova, has announced that the country's 2024 sugar beet yield is expected to be 42mt/ha, only a third of the planned amount due to extreme drought. In 2024, Sudzucker Moldova had sown more than 8 thousand ha of land with sugar beets. However, the severe drought has led to a decrease of over 60% compared to the initial yield forecast. This lower harvest is expected to have a negative impact on the Moldovan sugar industry and place additional pressure on the entire agricultural sector. The company is currently negotiating with partners to find solutions to mitigate the consequences of this crisis and is working on developing support measures for farmers.

Russia

Russia Lifted Sugar Export Ban

Russia lifted the export ban on sugar, which lasted until August 31, 2024. The Ministry of Agriculture of the Russian Federation (MARF) announced this decision in Aug-24, stating that any future decisions regarding sugar exports will depend on the upcoming sugar beet harvest and coordination with the Eurasian Economic Union (EAEU) partners. The Russian government initially imposed a temporary ban in May-24 to maintain stability in the domestic food market.

Ukraine

2024/25 Sugar Production Season Begins in Ukraine

The 2024/25 sugar production season has commenced in Ukraine, with three plants in the Vinnytsia, Ternopil, and Lviv regions starting to process sugar beets as of August 30, 2024. However, expectations for a widespread early launch of sugar processing plants this year have yet to be met. Due to dry weather conditions complicating the sugar beet harvest, several factories have postponed the start of processing to a later date.

2. Weekly Pricing

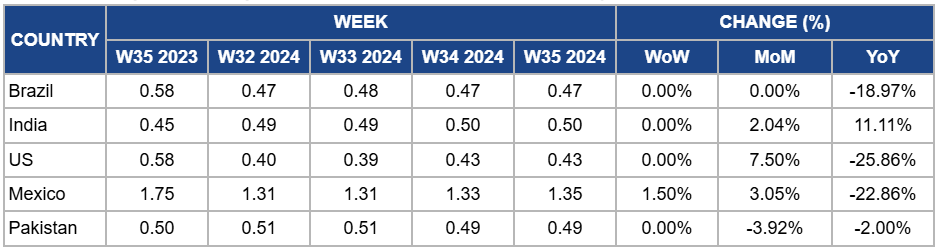

Weekly Sugar Pricing Important Producers (USD/kg)

Yearly Change in Sugar Pricing Important Producers (W35 2023 to W35 2024)

Brazil

In W35, Brazil’s sugar price remained unchanged week-on-week (WoW) and month-on-month (MoM) at USD 0.47 per kilogram (kg). However, the YoY prices dropped 18.97% from USD 0.58/kg in W35 2023. Brazil’s sugar production in the central and southern regions is under pressure due to persistent drought and fires on sugar plantations. These fires have damaged around 80 thousand ha of sugarcane, potentially resulting in a loss of up to 5 mmt. The supply uncertainty has caused price fluctuations in the futures market.

India

Sugar prices in India stood at USD 0.50/kg in W35, reflecting a 2.04% MoM and an 11.11% YoY increase due to global supply uncertainty. India has removed restrictions on sugar mills and distilleries using cane juice to produce ethanol, which is expected to ease tight global supply. Ethanol producers will now be permitted to utilize sugarcane juice and molasses during the 2024/25 season, which commences in Nov-24. This change is likely to increase demand from the sector and impact prices.

Unites States

In W35, sugar prices in the United States (US) reached USD 0.43/kg, marking a 7.5% MoM increase and a 25.86% YoY decline. The global sugar market experienced price fluctuations during this week due to supply uncertainty in Brazil. Despite this challenge, the US has expanded its sourcing channels, with the Philippines shipping 25.3 thousand mt of raw sugar in Sep-24. The previous shipment from the Philippines was in the 2020/2021 season when the country shipped 112 thousand mt of raw sugar to the US. This increased sourcing is expected to help stabilize the US sugar market.

Mexico

In W35, Mexico’s sugar prices increased by 1.50% WoW to USD 1.35/kg compared to 1.33/kg in W34 due to currency fluctuation. The MoM prices increased by 3.05%, but the YoY prices declined by 22.86%. The country’s sugar production faces challenges from reduced outputs driven by climate issues, negatively affecting exports, especially to the US market. The government aims to enhance plantation productivity and resilience by introducing new sugarcane varieties and replanting vines in the 2024/25 season.

Pakistan

In W35, Pakistan’s sugar remained unchanged at USD 0.49/kg, marking a 3.92% MoM and a 2% YoY decline. Pakistan’s decision to halt sugar exports in the 2024/25 season has alleviated some of the financial issues that sugarcane farmers and sugar mills face. Additionally, the Pakistan Sugar Advisory Board (PSAB) announced a reduction of USD 0.072/kg in the retail price of sugar after reviewing current sugar stock levels and pricing nationwide. The federal minister emphasized the country’s sugar surplus and stated that any sugar price rise would be unacceptable.

3.Actionable Recommendations

Stabilize Domestic Sugar Prices and Support Producers

The PSAB should continue to monitor sugar stock levels and adjust retail prices to reflect the country's surplus, avoiding unnecessary price hikes. Sugar mills should work closely with the government to address financial challenges and ensure fair prices for farmers, promoting long-term stability in the sugar sector. Additionally, exploring export opportunities once domestic needs are met could provide a new revenue stream for the industry.

Capitalize on Ethanol Production Opportunities

Indian sugar mills should capitalize on the government's decision to allow the use of sugarcane juice for ethanol production. By expanding ethanol production, mills can diversify their revenue streams and mitigate the impact of fluctuating global sugar prices. Ethanol producers should prepare for increased demand and ensure the infrastructure and supply chains to meet 2024/25 season production targets.

Strengthen Support for Sugar Beet Farmers

In collaboration with Sudzucker Moldova, the Moldovan government should implement immediate support measures for sugar beet farmers affected by the severe drought. These include financial aid, access to drought-resistant seeds, and technical assistance for improving water management practices. Long-term strategies should enhance the agricultural sector's resilience to climate change.

Sources: Tridge, NoticiasAgricolas, Hellenic Shipping News, Interfax, AgroPortal.ua, ChiniMandi