W47 2024: Grape Weekly Update

1. Weekly News

Italy

Italy's 2024 Table Grape Season Faces Record Prices and Weather Challenges

Italy's 2024 table grape season, primarily in Puglia and Sicily, was marked by prolonged rainfall that reduced production volumes and pushed prices to record highs. Early-season varieties like White Vittoria saw prices soar to USD 4.19 per kilogram (EUR 4/kg), while seedless grapes reached USD 5.24 to 6.29/kg (EUR 5 to 6/kg). Initially priced lower, Red Globe rose to nearly USD 3.14/kg (EUR 3/kg) as the season progressed. Although production slightly exceeded 2023 levels, adverse weather continued to limit yields. Exports to primary markets such as Germany and France remain vital, but climate instability poses ongoing risks to domestic and international supply.

Peru

Peru's 2024 Table Grape Season Targets Global Markets with Rising Production

The Peruvian table grape season for 2024 began in late Aug-24, aiming to fill supply gaps in Europe and Southeast Asia caused by early season closures in Europe and California. Northern Peru faced water shortages that affected fruit quality and shortened the harvest, while Southern Peru's Ica region experienced favorable conditions, with cooler temperatures delaying harvests but promising higher volumes and excellent quality. Vanguard forecasts a rise in production to 4.5 million 8.2-kg boxes, led by popular varieties like Ivory and Autumn Crisp. As global shortages persist until Chile's peak harvest in February, Peru's diverse export strategy targets the United States (US) and over 25 other markets.

Spain

Spain Implements Flexibility for Vineyard Planting Amid Challenges

Spain introduced a Royal Decree to address challenges in its wine sector, including adverse weather conditions in early 2024 and market disruptions from declining domestic consumption and weaker exports. Aligned with European Union (EU) measures, the decree extends vineyard planting permits expiring in 2024 by one year in regions affected by drought or excessive rainfall and by three years in areas experiencing market uncertainties. Grape growers opting not to use their permits will avoid sanctions if they notify authorities by December 31, 2024. These measures aim to provide flexibility and stability for Spain's winegrowers amid ongoing challenges.

Turkey

Turkey's 2024/25 Grape Production Increases with Focus on Sustainable Growth

Turkey's 2024/25 grape production rose to 1.9 million metric tons (mmt), recovering from mildew disease but remaining below the long-term average. Table grape exports are projected to grow modestly to 150 thousand metric tons (mt), up from 142 thousand mt in the 2023/24 season, with Russia, Ukraine, and Poland as primary markets. To address climate challenges, the government introduced measures such as restricting water-intensive crops and promoting sustainable agriculture, aiming to balance production growth with environmental conservation.

United States

California Table Grape Industry Sees Strong Recovery in 2024

California's table grape industry is rebounding in 2024, with shipments reaching 71 million 18.14-kg boxes by early Nov-24, marking a 12-million 18.14-kg box increase from the previous year. The San Joaquin Valley leads production, with shipments expected to hit 90 million 18.14-kg boxes by Dec-24. Protective measures like plastic covers have safeguarded fruit quality, particularly for late-season varieties like Allison. This recovery follows a challenging 2023 season, which concluded with 69.7 million 18.14-kg boxes shipped, impacted by Tropical Storm Hilary.

2. Weekly Pricing

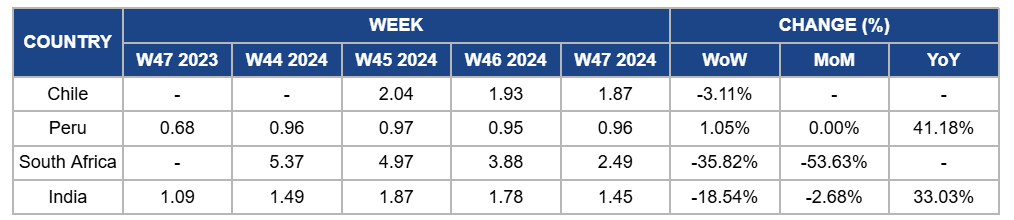

Weekly Grape Pricing Important Exporters (USD/kg)

Yearly Change in Grape Pricing Important Exporters (W47 2023 to W47 2024)

Chile

Chilean grape prices in W47 decreased by 3.11% week-on-week (WoW) to USD 1.87/kg in W47 due to continued market oversupply as Chile ramps up its grape export season. While the early end of table grape availability from Europe, California, and Northern Peru created a temporary supply gap, Chile’s increased volumes are entering the market and contributing to a more competitive environment. This influx of early-season supply, combined with stable shipments from other key competitors like Peru and South Africa, put downward pressure on prices. As Chile prepares for late-season arrivals in Feb-24, the market adjusts to the growing supply, leading to further price declines.

Peru

In Peru, grape prices increased slightly by 1.05% WoW to USD 0.96/kg, with no month-on-month (MoM) change but a 41.18% year-on-year (YoY) increase. This is due to continued strong demand in primary export markets, particularly the US and Southeast Asia. Peruvian grapes have been filling supply gaps caused by early-season closures in Europe and California. Despite competitive pressure from the start of the Chilean grape season, Peru’s ability to supply high-quality fruit, particularly from the Ica region, supported stable prices. Additionally, the growth in production to 4.5 million boxes and the variety mix, including popular options like Ivory and Autumn Crisp, helped ease upward price pressures, ensuring a competitive position without significant price spikes. These factors contributed to the notable YoY increase while maintaining market stability.

South Africa

Grape prices in South Africa declined by 35.82% WoW to USD 2.49/kg in W47, with a significant 53.63% MoM decrease. This sharp decline reflects the lingering effects of the peak harvest season, during which supply levels remained elevated due to delayed harvesting from earlier weather disruptions. Although peak harvest typically means lower prices due to high availability, the continued release of stocks from late harvests has sustained downward pressure on prices. The YoY price drop reflects the higher base prices seen last year when supply was tighter due to unfavorable conditions. Additionally, competition from other producing regions, such as Chile, has added to the oversupply in export markets, further heightening price declines.

India

India's grape prices declined by 18.54% WoW to USD 1.45/kg in W47, with a decrease of 2.68% MoM. This decline reflects the continued high supply levels as the harvest season progresses, keeping prices under pressure. While peak harvest typically results in lower prices due to an influx of supply, prices may stabilize or increase as supply tapers off toward the end of the season. The YoY price increase of 33.03% is due to sustained strong export demand, particularly in Europe, and earlier-season weather disruptions that constrained production. Despite the weekly and monthly drops, the market shows resilience, supported by strong export demand and lingering supply challenges from earlier in the season.

3. Actionable Recommendations

Strengthen Table Grape Supply Chain Resilience

Table grape producers in Italy should focus on enhancing supply chain resilience by diversifying export markets and improving climate adaptation strategies. Given the weather-related challenges affecting production in Puglia and Sicily, producers can mitigate risks by investing in protective measures such as hail nets, greenhouse structures, and advanced irrigation systems to safeguard crops against extreme weather. Exploring alternative markets, including Eastern Europe, the Middle East, and Asia, can reduce dependency on traditional markets like Germany and France, spreading risk across diverse demand bases. Additionally, implementing more precise weather forecasting and flexible pricing strategies can help them respond quickly to market shifts caused by climate instability. This approach will safeguard profitability and ensure a consistent supply of quality grapes.

Optimize Export Strategy Amid Increased Grape Supply

Chilean grape exporters should optimize export strategies by diversifying destinations and targeting premium markets. This can include exploring emerging Asian markets, such as Japan and China, where demand for high-quality grapes grows. Expanding into European countries with strong demand for premium varieties, such as the UK and Germany, can offer further opportunities. Leveraging flexible pricing strategies and adjusting shipment volumes according to market trends will help mitigate the downward pressure on prices. By doing so, exporters can better navigate the oversupply challenges and maintain profitability through strategic market positioning.

Leverage Recovery to Strengthen California's Grape Market Position

California grape producers should capitalize on the recovery from the 2023 season by focusing on quality assurance and efficient logistics. To maintain momentum throughout the 2024 season, growers should continue implementing protective measures like plastic covers to safeguard late-season varieties. Furthermore, producers can enhance market positioning by targeting premium markets with high demand for quality grapes, ensuring consistent exports to key destinations. Streamlining packaging, transportation, and storage processes will also help minimize losses and maximize returns as the industry rebounds.

Sources: Tridge, Freshplaza, Fresh Point Magazine, Fruitnet, InfoAgro, MXfruit, Portaldelcampo