1. Weekly News

Malaysia

Stability in Malaysian Palm Oil Futures Despite Downward Pressure

During W21, palm oil futures in Malaysia exhibited stability despite downward pressure from falling oil prices and reports of increased production and reduced exports. On May 23, 2024, Jul-24 palm oil futures on the Bursa Malaysia Exchange saw a modest uptick of 0.6% to reach USD 828 per metric ton (mt), marking a 2.3% increase for the week. This rise was attributed to the upward trajectory of soybean and sunflower oil prices, which could potentially stimulate palm oil exports, particularly in light of diminishing stock levels in major importing countries such as China and India.

Additionally, the benchmark palm oil contract for Aug-24 delivery on the Bursa Malaysia Derivatives Exchange increased by 0.62%, closing at USD 827.73/mt on May 24. This increase was supported by a weakening Malaysian ringgit and increased United States (US) soybean oil futures prices. The depreciation of Malaysian ringgit makes palm oil more attractive to foreign currency holders, contributing to the market's strength.

Malaysia’s Palm Oil Inventory Reached 1.74 mmt in Apr-24

The Malaysian Palm Oil Council (MPOC) reported that palm oil stocks in Malaysia rose to 1.74 million metric tons (mmt) in Apr-24, marking a 1.8% increase from the previous month. This increase was driven by an 8.6% year-on-year (YoY) surge in production from Jan-24 to Apr-24. Furthermore, from May 1 to 20, production continued to rise compared to the same period in Apr-24, while exports experienced a decline ranging from 8.3 to 9.6% month-on-month (MoM). Despite the current price increase, a potential decrease in palm oil prices is forecasted due to declining exports and the expected rise in production from August to October, coinciding with the soybean and sunflower harvests.

Malaysian Palm Oil Exports Decreased by 5.2% MoM in the First Half of May-24

Malaysian palm oil in the first 15 days of May-24 decreased by 5.2% MoM compared to 600.78 thousand mt in the same period of Apr-24. The estimate for the export from May 1 to 20 was at 647.35 thousand mt. This reduction can be attributed to weak exports and increased production.

United States

USDA Forecasts Increased World Oilseed Production and Processing for MY 2024/25

The United States Department of Agriculture (USDA) forecasts that world oilseed production will increase by 26 mmt YoY in the 2024/25 marketing year (MY), while processing is projected to rise by only 16 mmt. This could lead to an oversupply, especially with the increased palm oil production in Malaysia and Indonesia, which benefit from favorable weather conditions.

2.Weekly Pricing

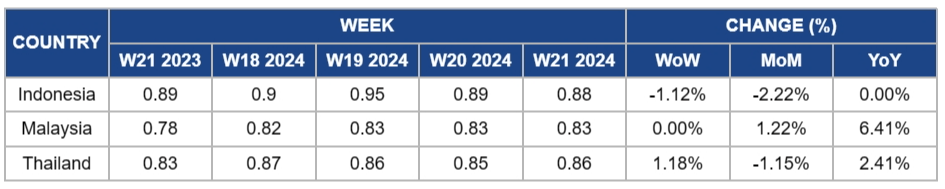

Weekly Palm Oil Pricing Important Exporters (USD/kg)

Yearly Change in Palm Oil Pricing Important Exporters (W21 2023 to W21 2024)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

Indonesia

In W21, palm oil prices in Indonesia dropped slightly by 1.12% week-on-week (WoW), reaching USD 0.88 per kilogram (kg) compared to USD 0.89/kg in W20. This decline can be attributed to concerns about increased output and decreased demand within the country. According to agriculture commodity trading company GrainTrade, Indonesia’s palm oil exports in Q1-2024 declined by 12% YoY due to strong competition from other edible oils.

Malaysia

In W21, Malaysian palm oil prices remain unchanged at USD 0.83/kg. Despite downward pressure from increased production and reduced exports, prices found support from the upward trend in soybean and sunflower oil prices. This positive movement in soybean and sunflower oil prices is expected to stimulate palm oil exports, especially considering the dwindling stock levels in China and India.

Thailand

Thailand experienced a 1.18% WoW increase in palm oil prices, reaching USD 0.86/kg in W21. This price increase followed five consecutive weeks of decline from USD USD 0.99/kg in W15. Despite the fluctuation, prices are anticipated to decline again due to ample supply and increased stock.

3.Actionable Recommendations

Promote Branding and Marketing

Investing in branding and marketing efforts can elevate the profile of Malaysian palm oil on the global stage. Developing a compelling brand narrative highlighting Malaysian palm oil’s quality, sustainability, and versatility can resonate with consumers and differentiate it from competitors. Leveraging digital marketing channels and participation in industry events can amplify brand visibility and attract new customers.

Explore Value-Added Products

Diversifying product offerings to include value-added palm oil products such as organic palm oil can open new market opportunities and command premium prices. Researching consumer preferences and trends can guide the development of innovative products such as specialty oils, biofuels, or cosmetics, catering to niche markets and expanding revenue streams.

Optimize Supply Chain Efficiency

Streamlining the palm oil supply chain to improve efficiency and reduce costs can enhance competitiveness in the global market. Implementing technology solutions and predictive analytics can optimize logistics, inventory management, and traceability, ensuring timely delivery and quality assurance.

Sources: Tridge