W22 2024: Mango Weekly Update

1. Weekly News

Dominican Republic

Dominican Republic Expects 30% YoY Increase in Mango Exports in 2024

The Dominican Republic anticipates a significant boost in mango exports, with producers expecting a 30% year-over-year (YoY) increase in 2024, reaching 3 million 4-kilogram (kg) boxes. Dominican producers are focusing on promoting local mango varieties in the United States (US) due to increased shipments to this important trading partner for the Dominican fruit industry. In 2023, Mingolo accounted for 32% of Dominican mango exports to Europe and 95% of shipments to the US. The Dominican Mango Cluster PROMANGO has invested in six hydro-technical plants and advanced technology to cultivate the native Mingolo variety, enhancing export growth. PROMANGO is also preparing for Expo Mango 2024, which will gather local producers and international industry experts. The long-term goal is to continue promoting local mango varieties on the global stage.

India

Uttar Pradesh Leads India's Mango Production Despite Weather Challenges

India's largest mango producer, Uttar Pradesh accounts for 40% of the country's total yield, cultivating primary varieties such as Dussehri, Langda, and Chausa. Despite challenging hot weather conditions, these climates promote natural fruit maturity without damaging crops. Agricultural experts highlight the resilience of mangoes to high temperatures during ripening. However, the mango industry has faced challenges due to warmer weather anomalies and pest infestations.

Mexico

NMB's Rebranding of Ataúlfo Mango to "Honey" Sparks Controversy

The National Mango Board (NMB) has rebranded the Ataúlfo mango variety as "Honey" to enhance its acceptance in the US market. Intended as a designation of origin, the name change has been met with opposition from the Mexican mango industry, which has been trying to implement it for seven or eight years. The Michoacán Mango Packers Association (EMEX) of Mexico argues that the NMB should have focused on teaching pronunciation rather than erasing a part of their culture. The Mexican mango industry is also experiencing a production drop due to the effects of El Niño, creating a delicate balance between fruit availability in the North American market and the region. The US remains the primary market for Mexican mangoes, making the proposed name change both significant and symbolic for the industry.

Myanmar

Myanmar Mango Exporters Face Losses Due to Low Prices in China

Myanmar's fruit traders report losses due to low prices for mangoes exported to China. In early May, Saint Delong mangoes were legally exported through the Mongla-Daluo port, with prices in the Chinese market at USD 13.81/16 kg to 16.57/16 kg (RMB 100/16 kg to 120/16 kg) and USD 8.28 to 9.66/16 kg (RMB 60/16 kg to 70/16 kg) of Eagle's Beak mangoes. However, high export trade costs, including the fare for one vehicle at around USD 7.6 thousand (MMK 16 million), have led to significant losses for exporters. Consequently, most mangoes are not exported and are primarily sold in Myanmar's domestic market. The Muse border route, used during the mango season, has been suspended due to the ongoing conflict, impacting 100% of the trade in the Muse and Qingshuihe border trade zones.

Pakistan

Climate Change Severely Impacts Pakistan's Mango Production and Export Targets

Pakistan produces approximately 1.8 million metric tons (mt) of mangoes annually, with the Punjab province contributing 70% and Sindh province accounting for 29% of the total production. In 2024, Punjab's production decreased by 30% to 35%, while Sindh saw a 20% decline. Pakistani mangoes are a primary export, renowned for their variety, high quality, and flavor. The All Pakistan Fruit and Vegetable Exporters, Importers, and Merchants Association (PFVA) set a mango export target of 100 thousand metric tons (mt), but concerns arose about meeting this goal. Climate change, increased rainfall, thunderstorms, and flash floods have decreased production and diminished foreign exchange earnings. Additionally, the industry faces rising electricity, natural gas, transportation, and orchard maintenance costs.

Peru

Peruvian Mango Producers Optimistic for 2024/25 Season After El Niño Disruptions

Peruvian mango producers and exporters are optimistic for the 2023/24 season despite the flooding caused by El Niño. Since the second half of Apr-24, daily minimum temperatures have been close to or below historic averages, creating ideal conditions for successful flowering development in Piura, Motupe, and Casma. While it's too early to estimate precise volumes, this positive development in the phenological cycle is crucial to achieving standard production yields for the 2024/25 season despite the atypically high temperatures that persisted until late Mar-24.

2. Weekly Pricing

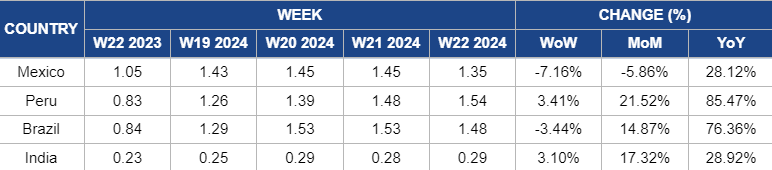

Weekly Mango Pricing Important Exporters (USD/kg)

Yearly Change in Mango Pricing Important Exporters (W22 2023 to W22 2024)

Mexico

Mango prices decreased by 7.16% week-over-week (WoW) in W22 due to the transition of mango supply from Southern Mexico to Central Mexico. Additionally, mango production moved from areas like Nayarit and Sinaloa due to weather issues in South Mexico. Pricing fluctuations are expected due to varying supply volumes of different mango sizes, with shortages in larger fruit sizes and more supply in smaller sizes.

Peru

The continued increase in mango prices in W22 in Peru, with a 3.41% WoW rise to USD 1.54/kg, is directly linked to ongoing supply shortages caused by adverse weather conditions. This contrasts with the USD 1.48/kg price recorded in W21. The challenges such as high temperatures, heavy rains, and insufficient flowering, previously mentioned, have significantly impacted mango production. Consequently, the limited availability of mangoes has likely intensified pricing pressure, resulting in further price hikes.

Brazil

The recent challenges fruit producers face such as flooding, damaged orchards, and reduced local production, particularly in Brazil's primary cultivation areas like the São Francisco Valley, have led to a notable increase in mango prices. Despite a slight decrease in W22 from USD 1.53/kg in W21 to USD 1.48/kg, mango prices have shown resilience, especially considering the significant 14.87% month-on-month (MoM) increase compared to Apr-24. These fluctuations reflect the dynamic nature of mango pricing influenced by supply disruptions and increased demand due to reduced yields and compromised fruit quality resulting from adverse weather conditions and heightened pest infestations.

India

Indian mango prices saw a slight 3.10% WoW increase in W22 to USD 0.29/kg, returning to the price seen in W20. Additionally, there was a significant 17.32% MoM increase compared to USD 0.25/kg in Apr-24. This price surge is due to adverse weather conditions, particularly unseasonal rains, prematurely ending the Alphonso mango season and disrupting market dynamics. Consequently, there has been a decrease in supply, leading to subsequent price hikes. Moreover, consumer concerns regarding fruit quality and affordability have further fueled the price increase.

3. Actionable Recommendations

Strengthening Mango Export Resilience in Myanmar

Amidst low prices and high export costs, Myanmar's mango industry can enhance resilience by diversifying its export destinations. Exploring new markets beyond China, such as neighboring countries in Southeast Asia or emerging markets in the Middle East, could provide alternative avenues for mango exports, reducing reliance on a single market and mitigating risks associated with price fluctuations. Additionally, negotiating for more favorable transportation costs and exploring alternative routes or modes of transport can help alleviate the financial burden on exporters. Collaborating with the government to secure subsidies or support to offset high export trade costs could further improve profitability and sustainability for the industry.

Mitigating Climate Change Impact on Pakistan's Mango Production

To address the severe impact of climate change on mango production and meet export targets, Pakistan's mango industry should invest in climate-resilient agricultural practices. This includes adopting advanced irrigation systems like drip irrigation to conserve water, implementing integrated pest management to reduce crop losses, and using climate-tolerant mango varieties. Enhancing weather forecasting and early warning systems can help farmers prepare for and mitigate adverse weather conditions. Government and industry stakeholders should collaborate to provide financial support and subsidies for small-scale farmers to adopt these technologies and improve infrastructure to reduce transportation and maintenance costs. This multi-faceted approach will help stabilize production, ensure quality, and maintain Pakistan's position in the global mango market.

Strategic Steps to Enhance Dominican Mango Export Growth

To capitalize on the anticipated 30% YoY increase in mango exports in 2024, Dominican producers should focus on expanding and diversifying their marketing efforts in the US. This can be achieved by leveraging the popularity of the Mingolo variety and promoting its unique qualities through targeted marketing campaigns. Investing in advanced supply chain management and cold storage facilities will ensure the quality and freshness of mangoes during transit. Collaborating with US retailers and distributors to secure shelf space and conducting consumer awareness programs about Dominican mangoes' health benefits and taste can further boost demand. Additionally, participation in Expo Mango 2024 will provide a platform to showcase innovations and forge international partnerships, reinforcing the Dominican Republic's position in the global mango market.

Source: Tridge, Freshplaza, MXfruit, Foodmate,Producereport