W38 2024: Orange Weekly Update

1. Weekly News

New Zealand

Peru Expands Citrus Exports to New Zealand

Peruvian producers of fresh citrus fruits are set to benefit from new trade opportunities following the signing of a phytosanitary protocol that allows the export of oranges, mandarins, tangelos, and limes to New Zealand. The agreement was formalized during a bilateral technical meeting between New Zealand's Ministry of Primary Industries and Peru's National Agrarian Health Service (SENASA). This milestone enables producers from regions including Ica, Lima, Piura, La Libertad, Junín, Arequipa, Ancash, and Lambayeque to access the New Zealand market, complementing existing exports to countries such as the United States (US), the Netherlands, and Canada. The initiative underscores the importance of diversifying market access to enhance commercial opportunities for Peruvian agricultural producers.

Spain

Spain's Citrus Production Forecast for 2024/25 Campaign

The Ministry of Agriculture, Fisheries and Food (MAPA) in Spain has projected a total citrus production of 5.84 million tons for the 2024/25 campaign, which started on September 1. This initial estimate shows a slight decrease of 1% from last season's provisional figures and an 8.6% drop compared to the average of the last five campaigns. Drought, excessive heat, and alternate bearing have negatively affected production volumes. In particular, orange production is expected to reach 2.97 million tons, marking an 8.8% increase from last season but still 8.2% below the average. Oranges will continue dominating the market, making up 51% of total citrus output, with 72% of the harvest consisting of navel varieties.

Andalusia's Orange Production Expected to Surge in 2024/25 Campaign

Andalusia is anticipating a significant recovery in citrus production for the 2024/25 campaign, estimating a yield of over 2.26 million tons, nearly a 20% year-on-year (YoY) increase. This growth is due to favorable spring rainfall and improved irrigation, which enhanced the health of the plantations. Andalusia’s orange production is expected to represent 52.8% of Spain's total, contributing to the region's overall citrus harvest, which accounts for 38.8% of national output. The region dedicates approximately 61 thousand hectares (ha) to sweet orange cultivation.

Córdoba’s Orange Production Significantly Increased in the 2023/34

Córdoba's orange production is expected to reach 347 thousand metric tons (mt) this season, a substantial increase from 187.7 thousand mt in 2023. This growth is mainly due to improved climatic conditions, including increased rainfall and better irrigation practices, which have enhanced the health of the plantations.

Brazil

São Paulo’s 2024/25 Orange Harvest Forecasts 30% YoY Decline Due to High Temperatures

In early Sep-24, São Paulo state experienced high temperatures, raising concerns among citrus growers about the potential impact of prolonged heat waves. According to data released by Fundecitrus on September 10, 2024, São Paulo state and Triângulo Mineiro are expected to harvest 215.78 million 40.8-kg boxes of oranges in the 2024/25 season. This projected volume is 30% lower than the previous season, which saw average production and falls short of the initial forecast of 232.38 million boxes. This decline is due to smaller fruit size resulting from dry and warm weather, which has also accelerated the harvesting process. While rainfall is forecasted for late Sep-24, the southwestern region of São Paulo is expected to see a 19% YoY increase in harvest compared to the 2023/24 season, while other areas may experience production declines of 28% to 60%.

United States

USDA Forecasts 2% YoY Rise in California's 2024/25 Navel Orange Production Despite Record Heat

In California, the United States Department of Agriculture (USDA) forecasts a rise in orange yield for the 2024/25 season, projecting the navel orange production at 78 million 40-pound (lb) cartons, a 2% YoY increase despite record-breaking temperatures. This estimate includes conventional, organic, specialty varieties such as Cara Cara and blood oranges. The extreme heat has led to smaller fruit sizes, marking the smallest average diameter in two decades. The Cara Cara variety is expected to reach 9 million 40-lb cartons, reflecting a 10% increase in fruit set per tree, although its average diameter has decreased slightly. Additionally, the Tango and W. Murcott Afourer mandarin varieties are anticipated to produce 29 million 40-lb cartons, indicating a positive trend in the easy-peel tangerine market. Overall, mandarin acreage in California has increased, particularly in Tulare County, which continues to expand its production capacity. However, from the 2023/24 crop year, forecasts will only be published at the state level, ending specific projections for the Central Valley.

2. Weekly Pricing

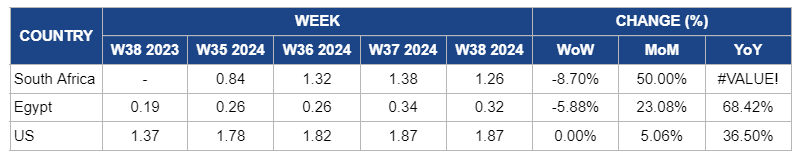

Weekly Orange Pricing Important Exporters (USD/kg)

* Varieties: Spain, South Africa, and the US (Navel), Italy (Tarocco), and Egypt (overall orange average)

Yearly Change in Orange Pricing Important Exporters (W38 2023 to W38 2024)

* Varieties: Spain, South Africa, and the US (Navel), Italy (Tarocco), and Egypt (overall orange)

* Blank spaces on the graph signify data unavailability stemming from factors like missing data, supply unavailability, or seasonality

South Africa

In W38, South Africa's orange prices decreased by 8.70% week-on-week (WoW) to USD 1.26/kg. This is due to an increase in domestic supply, as a significant portion of oranges could not be exported to the European Union (EU) due to stringent pest control regulations, leading to surplus volumes in the local market. Additionally, logistical challenges related to the mandated cooling treatments further disrupted export flows, intensifying the supply glut. However, month-on-month (MoM) prices increased by 50%, reflecting the lingering effects of earlier supply shortages and the impact of adverse weather conditions, which had previously constrained production and limited market availability.

Egypt

In W38, orange prices in Egypt decreased by 5.88% WoW to USD 0.32/kg due to cooler temperatures and the onset of rain, which improved growing conditions and led to a slight increase in supply, easing the recent market tightness. The drop in demand following the price spike in W37 also contributed to the decline. However, MoM and YoY prices surged by 23.08% and 68.42%, respectively, as ongoing supply challenges from earlier in the season and reduced harvest levels continue to drive long-term price increases compared to previous periods.

United States

Orange prices in the US remained stable at USD 1.87/kg since last week due to the coastal flood warning in W38, which limited harvesting activities and offset potential supply increases. The market also remains influenced by ongoing challenges related to the huanglongbing (HLB) disease and elevated production costs. There is also a 5.06% MoM increase and a 36.50% YoY surge, reflecting the broader impact of disease-related production disruptions and rising production expenses over time.

3. Actionable Recommendations

Strengthen HLB Disease Management with Targeted Solutions

US orange producers should implement frequent monitoring for HLB disease through regular field inspections and the use of diagnostic tools like Polymerase Chain Reaction (PCR) testing, which detects the disease's early symptoms. For effective management, integrating strategies such as applying insecticides to control psyllid populations and introducing biological controls, like parasitic wasps, can help curb the spread. Additionally, removing infected trees and replanting disease-resistant varieties will further reduce the impact of HLB on production and help stabilize long-term costs.

Promote Drought-Resistant Orange Varieties and Advanced Irrigation

MAPA should encourage citrus producers in Spain to adopt drought-resistant orange varieties such as Valencia and Delta that can better withstand dry conditions. Additionally, producers should implement advanced irrigation technologies like drip irrigation and soil moisture sensors to optimize water usage and ensure efficient water delivery to crops. Implementing these measures will reduce the impact of drought, ensuring consistent orange production in future seasons.

Implement Strategic Irrigation and Post-Harvest Cooling Solutions

Citrus growers in São Paulo and Triângulo Mineiro should prioritize strategic irrigation and water management practices to counteract the effects of high temperatures and dry weather. Additionally, they should invest in post-harvest cooling solutions such as forced-air cooling systems, hydro-cooling, and refrigerated storage to quickly reduce fruit temperatures after harvest. These methods help preserve fruit quality during transportation and storage, minimizing losses caused by heat stress and ensuring better market prices despite lower production levels.

Sources: Tridge, Valencia Fruits, MXfruit, Portalfruticola, USDA, Mid Valley Times, Top Buzz Times, CEPEA, Apnoticias